Fixed Income A proven approach

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexibility of the Invesco Global Total Return (EUR) Bond Fund’s mandate, and the fund managers’ willingness to use it, can be seen in the historical asset allocation and duration positioning.

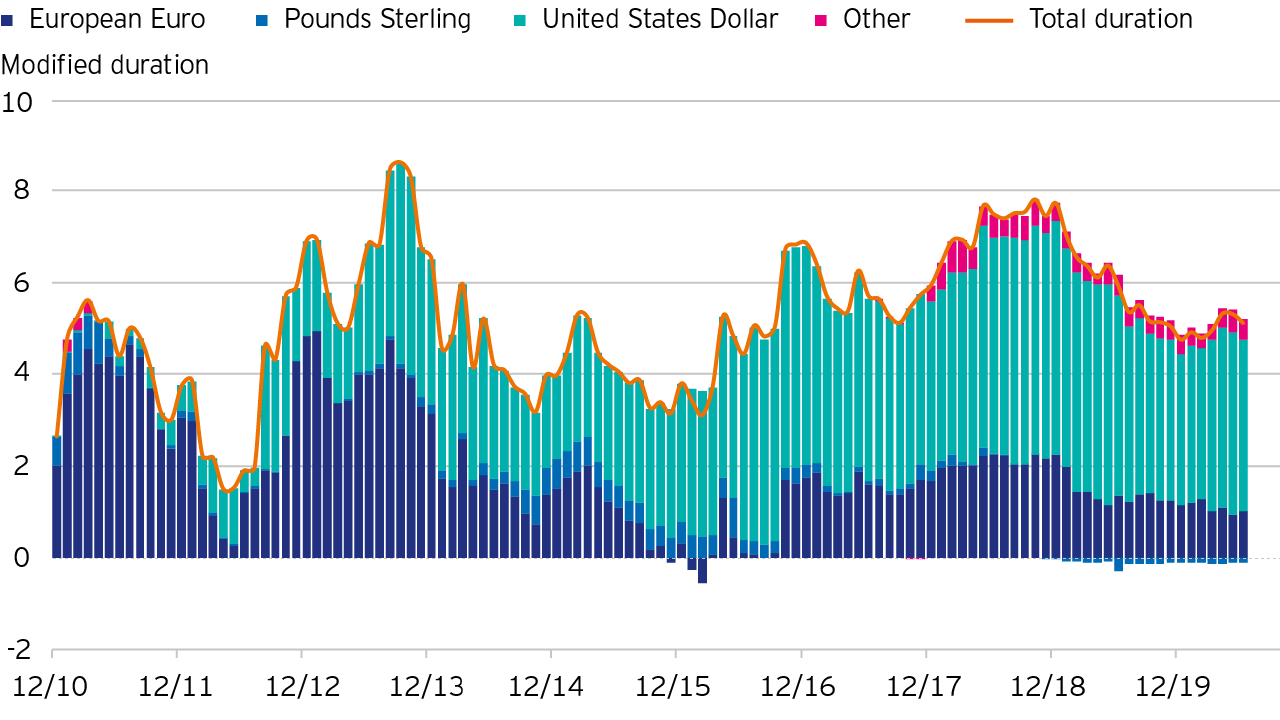

One of the biggest drivers of bond returns over the past 10 years has been duration. As figure 1 illustrates, duration is actively managed in the fund and has ranged from a low of 1.75 in 2012 to a high of 8.5 in 2013.

During the first few years of the fund, duration was biased toward the European market. As the eurozone sovereign debt crisis intensified this was increased to include peripheral European sovereigns along with core holdings in the German Bund market. In more recent years, Treasuries have offered more yield than European counterparts and duration exposure has become more US focused.

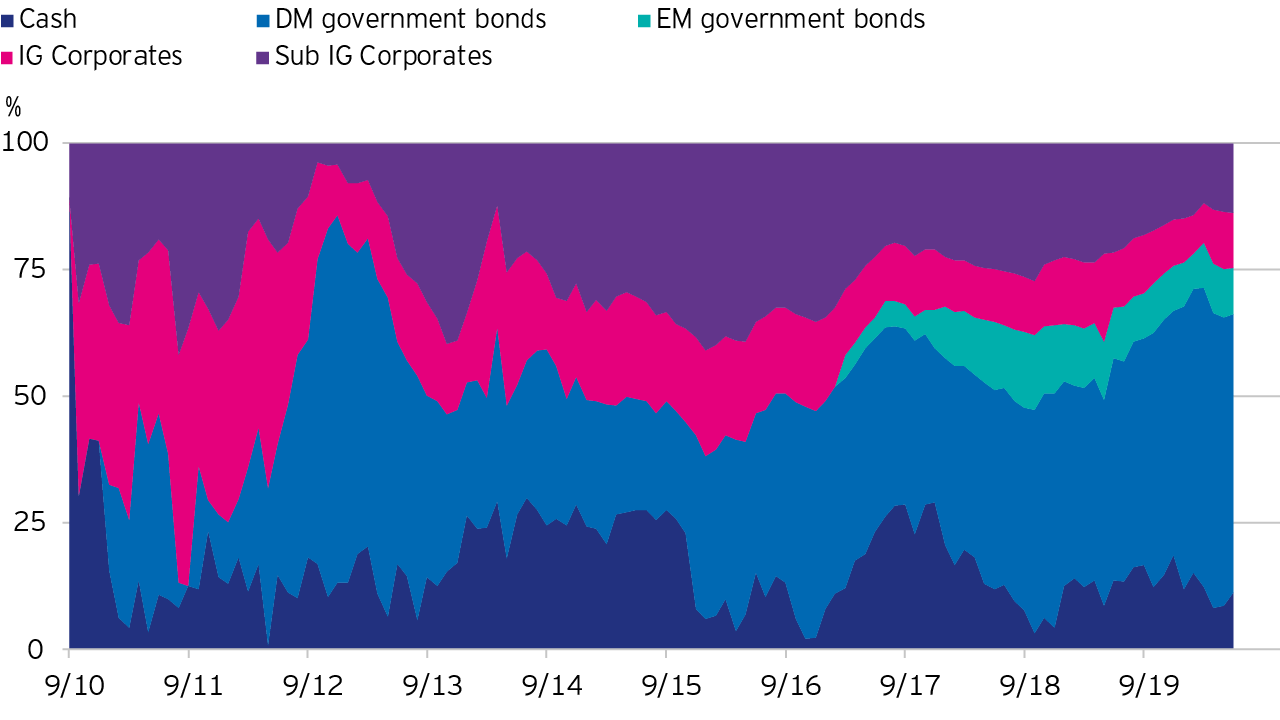

Figure 2 shows that since launch, the fund has had 4 distinct periods of asset allocation. The following section provides an overview of each of these periods.

Following the launch of the strategy in September 2010, a high allocation was held in cash. The eurozone sovereign debt crisis erupted in 2011 and against this backdrop, credit spreads widened significantly. This provided the opportunity to build exposure and lock in attractive yields. One area of particular interest was subordinated financials. Credit risk remained the dominant allocation until late 2012. This allocation benefitted from the strong central bank support, in particular, ECB President Mario Draghi’s now famous proclamation “to do whatever it takes” to save the euro.

As credit spreads tightened the fund managers took profits on the credit exposure and positioned the fund more defensively. 2013 was the year of the ‘taper tantrum’ in which US Treasury yields rose in response to more hawkish rhetoric from the US Treasury. In response, the fund managers increased both US and German bund duration. Government bond yields subsequently fell back again, and the fund managers took profits and held the proceeds in cash. This high cash allocation helped to offset the fund’s rising allocation to sub investment grade bonds. The financial sector remained an important allocation, in particular Additional Tier 1 bank capital.

The fund’s bias in this period was toward credit risk. A relatively large allocation was maintained in government bonds; however, this was held alongside cash as a counter-balance to the fund’s higher yielding credit allocations. Derivatives were used to reduce duration risk.

As yields in developed market credit fell to ever lower levels, the fund managers added exposure to emerging market issuers. Positions were, and continue to be, held in both hard and local currency sovereigns with a small allocation to corporate high yield issuers. In 2018, US government bond yields were once again rising, and credit spreads were widening. The fund gradually increased both duration and credit risk which led to strong returns in 2019 and another phase of profit taking.

The market dislocation that occurred in March 2020 as a result of concerns over the economic impact of Covid-19 provided the opportunity to build exposure. This included adding investment grade corporate bonds as well as local currency Mexican and South African bonds. These purchases enabled the fund to benefit from the subsequent strong bounce back in financial markets.

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexible approach of the Invesco Global Total Return (EUR) Bond fund has helped it to outperform its sector during this challenging period.