AI series – How AI remains a dominant investment theme

Recent market volatility with one of the world’s largest AI chipmakers has called into question whether the investment boom for all things AI has ended.

Seeds of doubt have grown over the economic benefits from the AI revolution as several recent reports have highlighted the limits and shortcomings of the technology.

Instead, I believe that we have already reached the peak of inflated expectations for all things AI – though these hopes haven’t been matched by conclusive evidence that this technology has transformed productivity gains.

More so, we could be entering a period of investor disillusionment though once the macroeconomic benefits start becoming more visible, this skepticism is likely to fade away.

AI – an investment theme that has much more room to run

From a markets perspective this initial step-back could be a healthy breather after the recent investment euphoria. Conclusively, I don’t believe that AI is another hype-driven tech bubble.

In our analysis, we believe that the AI investment theme has a multi-year tail and that there is much more room to run – though the upwards trajectory for AI-related stocks is likely to be uneven.

True, the hype around new technologies makes them prone to skepticism due to their bubble-like characteristics – just think about the dot com boom in the late 1990s.

While there could be day that the AI bubble may burst, I don’t believe that it’s anytime soon. There is still much more air for the current AI bubble to be filled with.

Current valuations for US AI-related stocks remain elevated though reasonable and can rise further. I believe that AI optimism is likely to return and give US stocks another boost up well into next year.

An industrial revolution led by digitization, big data and AI

From a bigger picture point of view, we argue that AI technology will lead to substantial improvements in total factor productivity gains in almost every economy around the world though the timing and impact could vary from country to country.

Even bolder, we believe that the world is undergoing another industrial revolution led by digitization, big data, automation and AI.

Of course, there are lags between technological developments and their impact to overall productivity as the benefits take time to seep through to the economy.

More so, each country’s infrastructure – including regulatory and legal frameworks – must adapt in order to make way to harness each new technology’s potential.

Looking back, it took around 10 years for key technologies to take hold during the late 1980s and 1990s’ information and communication technology (ICT) revolution and it wasn’t until the mid-1990s that the effects were broadly felt.

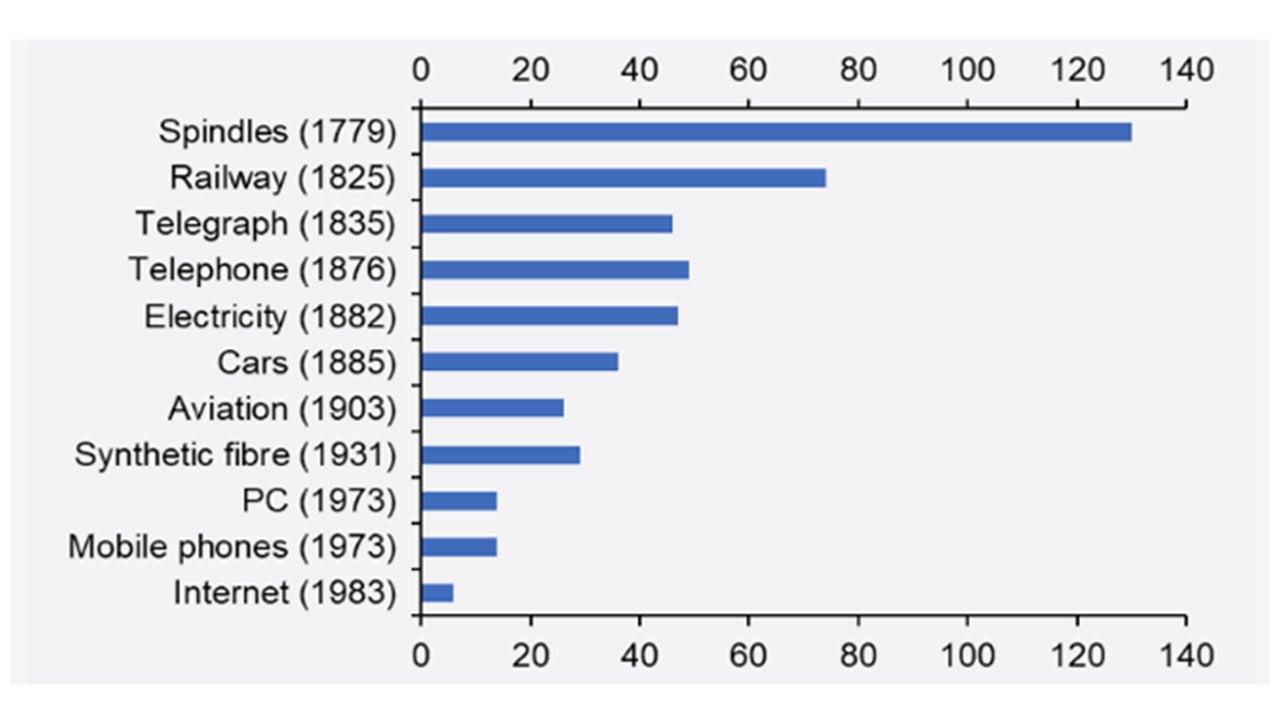

In the mid-1990s the US economy accelerated at twice the speed when compared to the 1980s because of the productivity gains from the ICT1. But as the chart below shows, each of these lags are becoming shorter.

Source: Comin & Mestieri, 2018

Thus it may have taken around 70 years for the steam engine to be broadly adopted after its invention, history has shown that the adoption rate for AI will be much faster.

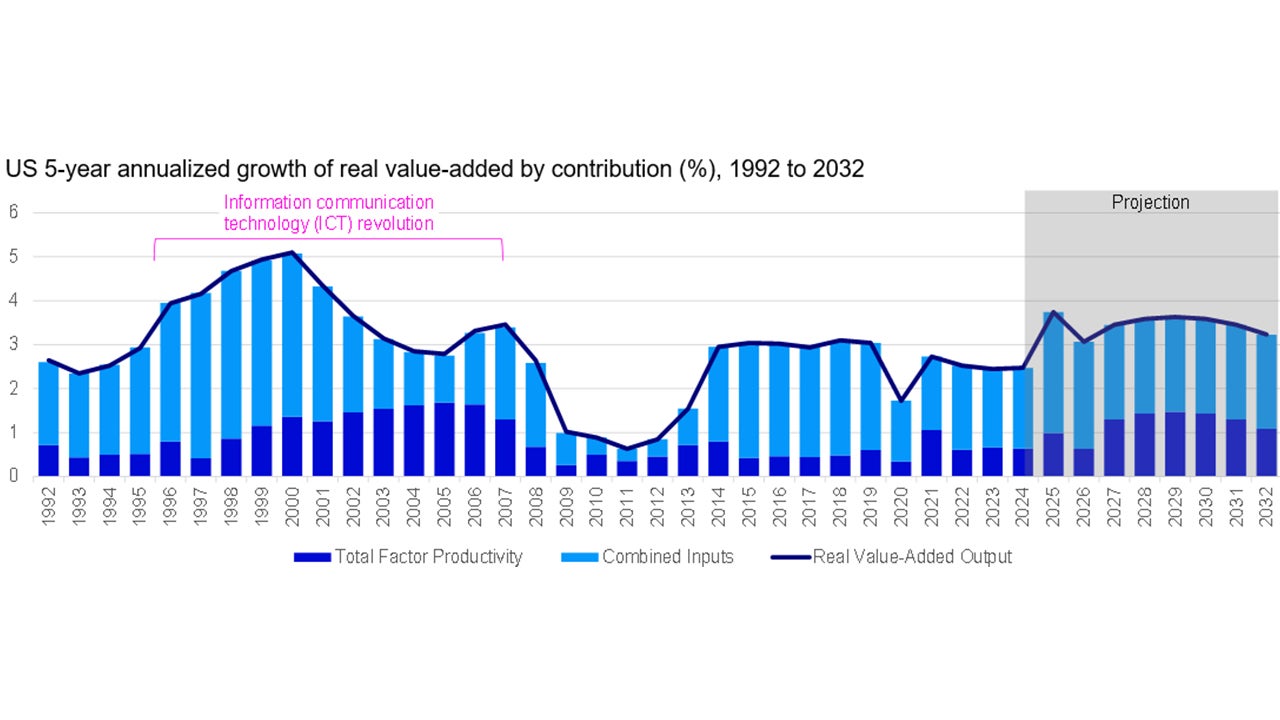

Already, there are signs that AI has started to boost business capex investment and estimates abound that AI can increase the US GDP by 1.5% a year due to productivity gains later on in this decade2.

Notes: annual data from 1992 to 2032. Values from 2023 to 2032 are projections, where combined inputs grow at the average growth rate observed from 2010 to 2022 and total factor productivity grows at an annualized growth rate of 1.6% (the growth rate observed from 2010 to 2022 plus an additional 1.1% that is assumed to derive from the effect of artificial intelligence). The rate of total productivity growth glides upward to 1.6%, peaking in 2007 and then falling back to the 2010-2022 trend thereafter. Because of this glide path, the total productivity effect is assumed to be lower than the ICT revolution experience from 1995-2005. As of 31 December 2023. Source: Macrobond, US Bureau of Labor Statistics Productivity Database and Invesco Global Market Strategy Office

Global Impact of AI

The US remains a clear world leader, while Europe may not be further in the lead unlike in the first two revolutions. Many EMs are at the forefront of adopting the technological frontier.

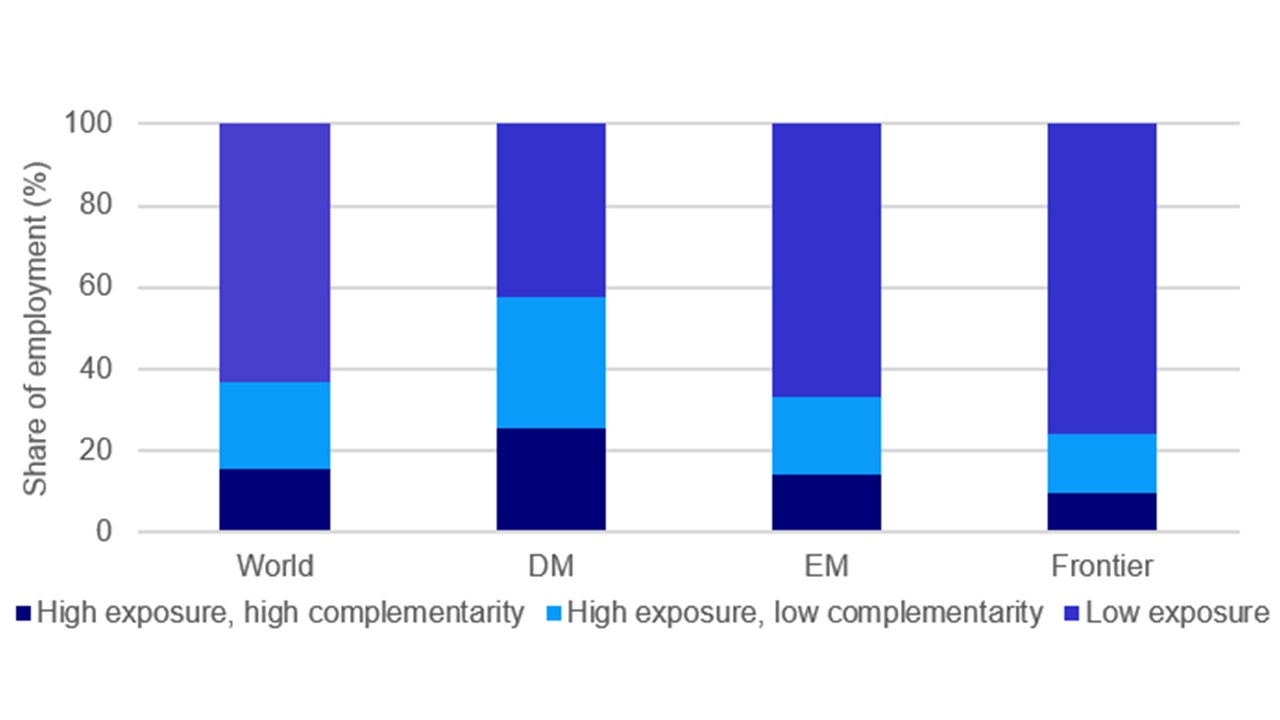

Although the trend of actively deploying AI is emerging all across the globe, its effects, especially on the labor market, can be less pronounced in EMs (Emerging Markets) rather than in DMs (Developed Markets).

This is due to the emerging market profile of younger demographics, greater labor supply, less capital intensity, less developed human capital & more manufacturing-centric economies.

There is evidence to such conclusions too – the IMF expects 60% of advanced economy jobs to be impacted by AI in contrast to 40% and 26% of EMs and low-income countries’ jobs respectively3.

Note: High complementarity – roles where job functions may be aided by AI with a meaningful boost to worker productivity with less concern for outright automation. Low complementarity but high exposure indicates job roles where job functions are likely to be significantly replaced by AI tools and services and therefore see job displacement. Low exposure indicates job roles where AI will have little effect. Note that share of employment is calculated as the working-age-population-weighted average, as per IMF methodology. Source: IMF, ILO as of 16 January 2024.

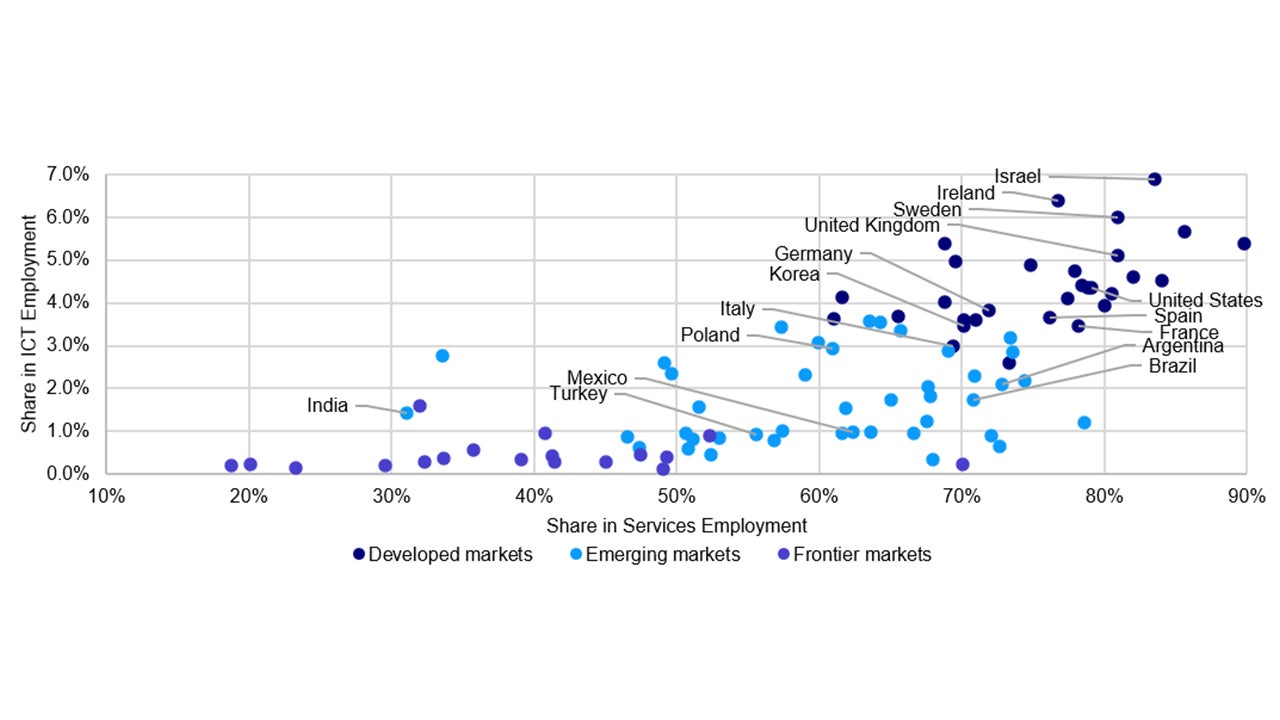

Note: In our assessment, progression on the x-axis indicates greater exposure to AI impacts, and progression on the y-axis indicates potential to benefit under current economic structure. The upper-right quadrant is more exposed to AI but also stands to benefit more. The upper-left quadrant would indicate an economy with concentrated exposure to AI that stands to benefit (e.g. India). ICT = Information communication technology. As per the International Standard Industrial Classification of all Economic Activities revision 4, the definition of ICT here includes activities involving production and distribution of information and cultural products, provision of the means to transmit or distribute these products, as well as data or communications, information technology activities and the processing of data and other information service activities. Source: IMF, ILO as of 16 January 2024.

However, a weaker magnitude of the AI influence on EMs does not necessarily make it less meaningful.

A significant portion of the human capital and R&D expenses associated with AI development are borne by DM economies.

This represents an opportunity for emerging markets to embrace AI as a leapfrogging tool, adopting cutting-edge solutions while foregoing large costs. India, Israel, Korea, and China are among those who already started using this strategy.

The timely take-up of AI coupled with limited exposure to job displacement risks have a potential to better place EM economies on the global technology scene and significantly disrupt the existing investment outlook.

That said, adopters of AI have the highest value-capture opportunities. We divide the AI value chain into 3 components: enabling infrastructure, AI architecture & adopters of AI.

Enabling infrastructure represents specialized hardware and platforms, AI architecture describes tools and systems for the training and deployment, and AI adopters stand for businesses and functions who primarily use AI-integrated software applications.

Now that the world is likely in a state between the first 2 components, we have yet to see in what ways AI is going to be embraced and how it will transform the economic landscape in the long-term.

Investment Implications – Tech sector

As mentioned, we are currently at the wake of the AI era, where the main drivers of this thematic market are in the enabling infrastructure and AI architecture components.

Hence, the recent rally in semiconductor, semiconductor equipment, hyperscalers, and data infrastructure equities.

We believe that these sectors will continue to be the catalysts of the AI market across both DM and EM economies in the near term.

Despite the speculation that the potential tech bubble might be occurring with the largest US tech stocks surging to their record levels, we believe such a scenario is unlikely, at least in the short-term.

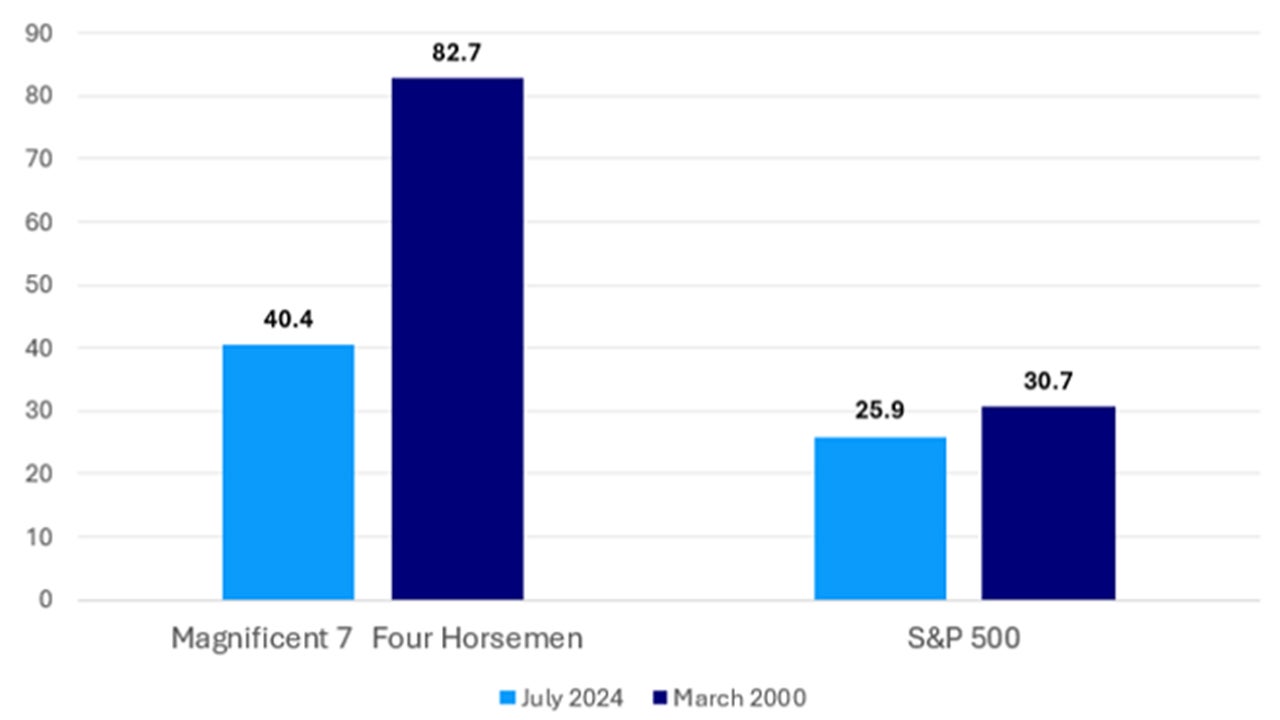

Developed Markets tech sector is hot, but not too hot – Magnificent 7 trades at the P/E ratio of nearly 40x, half of that of the Four Horsemen (Dell, Microsoft, Intel, Cisco) which traded at more than 80x trailing earnings during the peak of 2000s tech bubble4. The top 6 by market cap companies used to trade at 64x P/E at the peak5.

Source: Bloomberg as of 4 July 2024

In addition, a prolonged AI bull has been supported by tech’s strong earnings.

The recent market correction is a healthy breather as investors re-calibrate the longer-term impact of the innovative technology, but we do not believe that it is the reason to turn away from the AI theme.

Rather, it should pave the way for more sustainable growth in the tech sector.

Given the measures which suggest the improvement of domestic demand for AI infrastructure parts in the US and other DM countries, we remain overweight in the respective sectors.

Investment Implications – Emerging Markets

In EM, we find Taiwanese and South Korean stocks as particularly favorable in the 2H of this year. Both indexes are disproportionately weighted towards the technology sector.

Taiwanese AI-related stock valuations are not cheap, though earnings are improving, and we would be looking for buying opportunities on a meaningful dip to the market.

There has recently been a wide divergence in Taiwanese and South Korean markets. TAIEX (Taiwan Stock Exchange Capitalization Weighted Stock Index) has surged by 30% to date while the KOSPI (Korean Composite Stock Price Index) has lagged6.

Although both countries are leading the global chip supply, Korean semiconductor companies have not enjoyed the AI premium that their Taiwanese peers have. This might be a palatable entry point into the Korean stocks.

Investment Implications – Long-term fund flows and risk factors

From a long-term perspective, we are anticipating the direction of fund flows to shift from the equipment and infrastructure to AI-integrated software applications sector.

As the proliferation holds, similar to when 4G was introduced, we believe that there will be a rise of the new era of app-based economies with AI as a centerpiece.

It is important to keep in mind that any new technology comes with risks too. Given how powerful of a tool AI is, unprecedented cybersecurity cases might unfold soon.

For this reason, we see prospects in cybersecurity as well as IT consulting services.

With contributions from Nuray Smatova

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.