April economic data suggest growth is slowing in the US

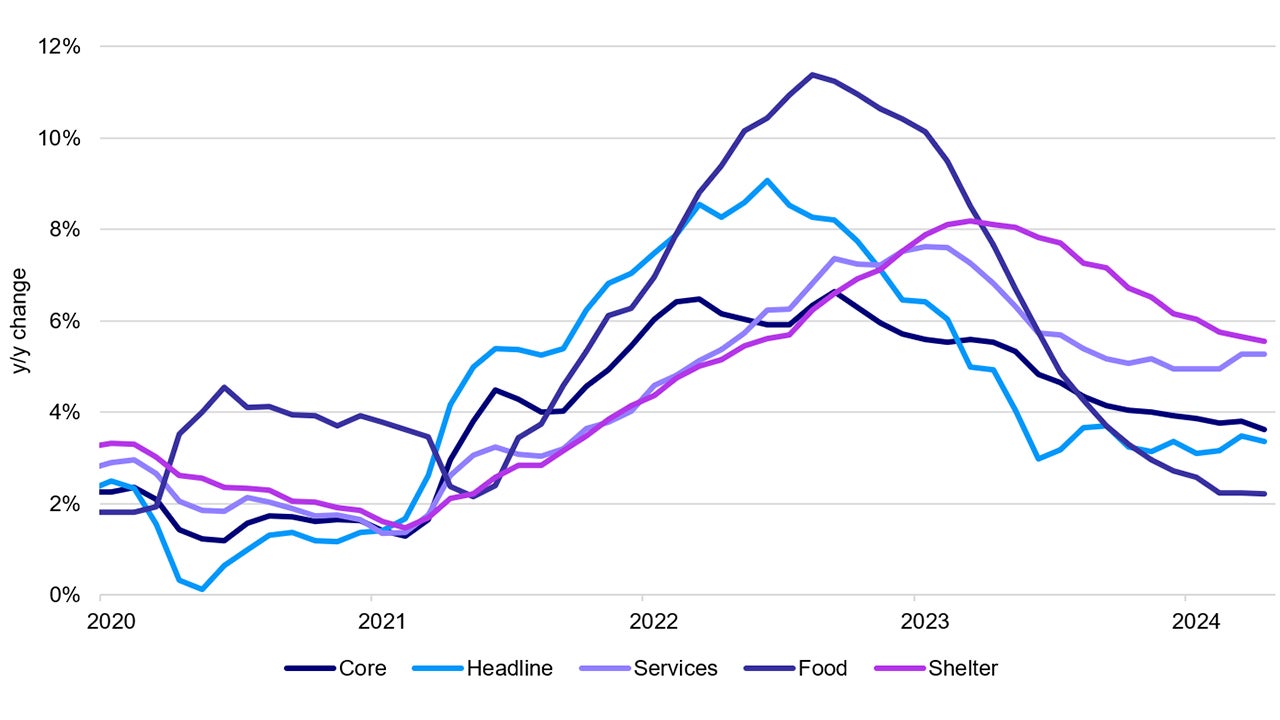

The April CPI data in the US was largely in-line with consensus expectations with no upside surprises - certainly a welcomed relief after a few months of above-consensus inflation prints.

Both April core and headline CPI eased on a sequential basis, putting to bed fears that inflation has been re-accelerating in the US. This, coupled with a weaker than expected monthly retail sales number, confirms that the disinflationary process has largely come back to the fold and that growth is starting to downshift. Needless to say, April’s inflation and growth data points are the first ones we’ve seen so far this year that could goad the Fed in cutting rates sooner rather than later.

Notably in April, shelter inflation - which is the biggest component of the CPI basket at around 42%1, has finally reflected a bit of softness, and core goods prices such as automobiles, have declined as well.

This, coupled with the disappointing April retail sales data of 0.0% m/m (versus consensus of +0.4% m/m)2 and downward revisions in previous months, suggest that consumption in the US is softer than previously expected. The negative revisions could possibly ratchet down an already weak Q1 GDP print.

Based on Chair Powell’s most recent comments, I still think the first rate cut is likely to come in September. However, if these disinflationary dynamics continue into May and June, it’s feasible to assume a Fed rate cut could come as soon as July, much earlier than the market’s forecast.

Source: U.S. Bureau of Labor Statistics (BLS). Data as of April 2024.

Investment implications

For APAC investors, I expect US yields to lower and for the USD to weaken in the coming months. This means that EM assets, particularly EM Asian assets such as currencies and equities, could start to rally in the middle of this year.

In the US, cyclicals and small-medium cap companies are likely to outperform as inflation expectations start to decline, especially with dovish CPI prints.

I’m fundamentally more bullish on EM and EM Asia stocks compared to the US, because I think US equities have capped out at these levels. For US stocks to gain further, I think that core CPI inflation has to come down much lower than April’s print – which could then open the door for the Fed to cut rates more aggressively this year.