Insight

Asian equities growth backed by young population and digitalization

Digitalization is one of the major economic trends, it drives productivity, entrepreneurship and changes the way we work. Asia has more young population than other economies and therefore infused the market with new energy and possibilities. We believe that Asia will continue to grow given the demographic advantage of a young population and competitive edges in technologies. These will become the structural drivers of Asia’s long-term growth.

Inflation surprised positively

- Compared to developed markets, Asia faces much less inflation and interest rate pressure.

- Asia's headline CPI was at 2.3% in May 2023, lower than that of the US and Europe.1

- The labor market supply also holds up well, and wage pressure is more benign.

- Asia's headline inflation has continuously surprised on the downside. Asia’s headline CPI was lower than Bloomberg consensus in nine out of the last ten months.2

- It is expected that inflation in most of the Asian economies would move back to the central banks' comfort zone this year.

Young population in India and ASEAN driving growth

- India has the youngest population in the world with over half of the 1.4 billion population under the age of 30.3 The large and young population will continue to drive domestic demand for many years to come.

- One of the many opportunities we see on the ground is the increase in wedding market and higher discretionary spending during festivals.

- It is estimated that around US$125 to $250 billion is spent on Indian weddings per year and around 9.5 to 10 million weddings occur annually across the country.4

- There has been increasing demand in gold, jewelry, and discretionary spending, with significant growth of weddings supporting this demand.

- Wedding and wedding-related jewelry constitute 60% of India’s total jewelry demand.5

- The share of discretionary items that makes up consumption has increased from 53.4% of total consumption expenditure in 2012 to 59.6% in 2020.6

- ASEAN is another bright spot of domestic consumption.

- Over 60% of the population are young people under the age 35, and their disposable incomes have been rising.7

- For instance, healthy household and corporate balance sheets and decent credit growth signal the willingness of the population to spend.

- We are of the view that retail demand, including department stores, convenience stores and food production in ASEAN, particularly Indonesia, will keep rising and the outlook for the region remains robust.

Digitalization, AI and smart trends drive further growth

- Asia is well positioned to benefit from digitalization, AI and smart trends.

- China has put dedicated efforts into building its digital infrastructure in the last few years. Its digital infrastructure is now well-developed. For example, China’s mobile payment adoption is close to 90%, one of the highest in the world.

- China’s strong digital capability is well-positioned to benefit from next-generation technology, including automation, new materials, blockchain, the Internet of Things and 5G network.

- Korea and Taiwan have renowned technology capabilities in various technological segments including memory, semi-conductor, DRAM components and IoTs. The leading edge these two countries have in technology will enable them to benefit from the latest technological advancements.

- India’s digital economy is transforming quickly and has grown at more than twice the rate of the country’s economy.8

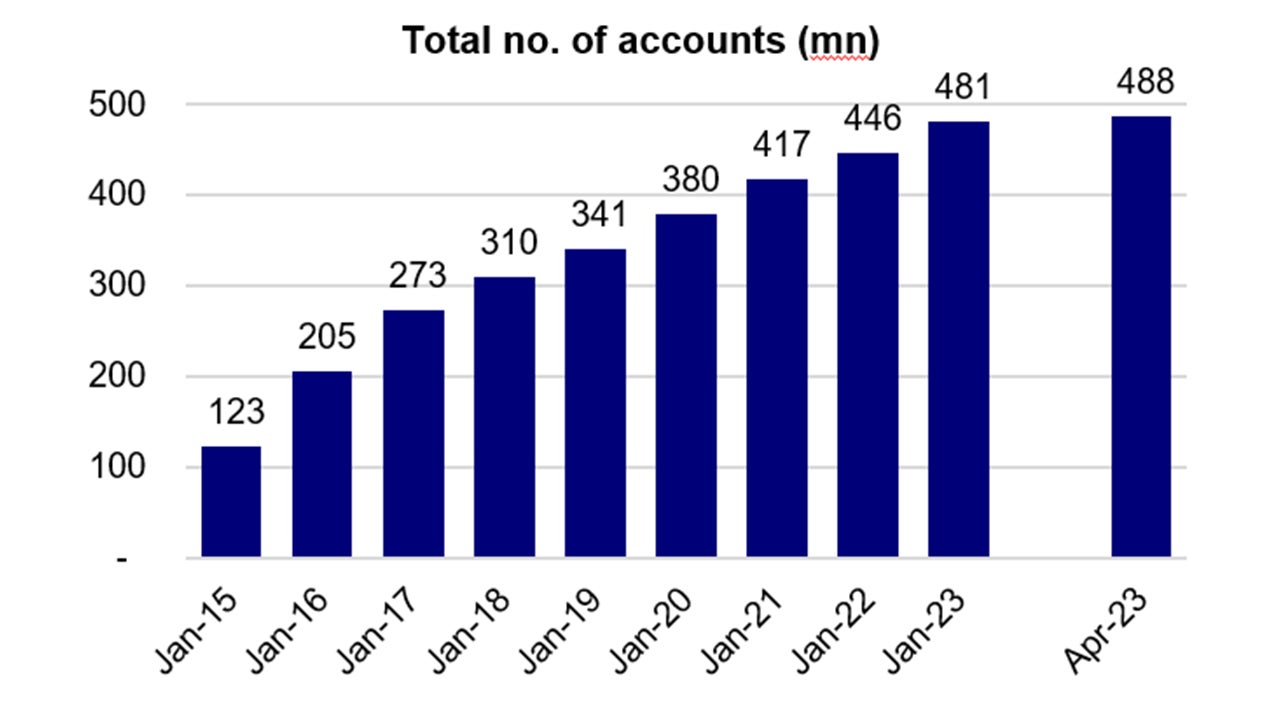

- Financial services have been shifted to digital adoption and the digital market share in payments, lending, investments and insurance have all shown robust growth. For example, under India’s financial inclusion scheme, the number of bank accounts opened have risen from 100 million in 2015 to 480 million in 2023.9

- Consumer trends in the ASEAN region are also evolving and retailers are shifting toward more online and e-commerce sales. E-commerce market size has grown by at least 35% in the past few years with Indonesia and Thailand having the highest e-commerce market share in the region.10

Bank accounts opened since Financial Inclusion Scheme

Source: Morgan Stanley, March 2023.

Slowing global growth needs monitoring

- The slowing of global growth and the potential for a developed markets slowdown are risks that we are monitoring.

- A slowdown in developed markets may affect export demand and cross-border supply chains in Asia.

- However, we believe Asia’s strong fundamentals and growing domestic demand will help offset some of these negative external impacts.

Valuation is at a comfortable level

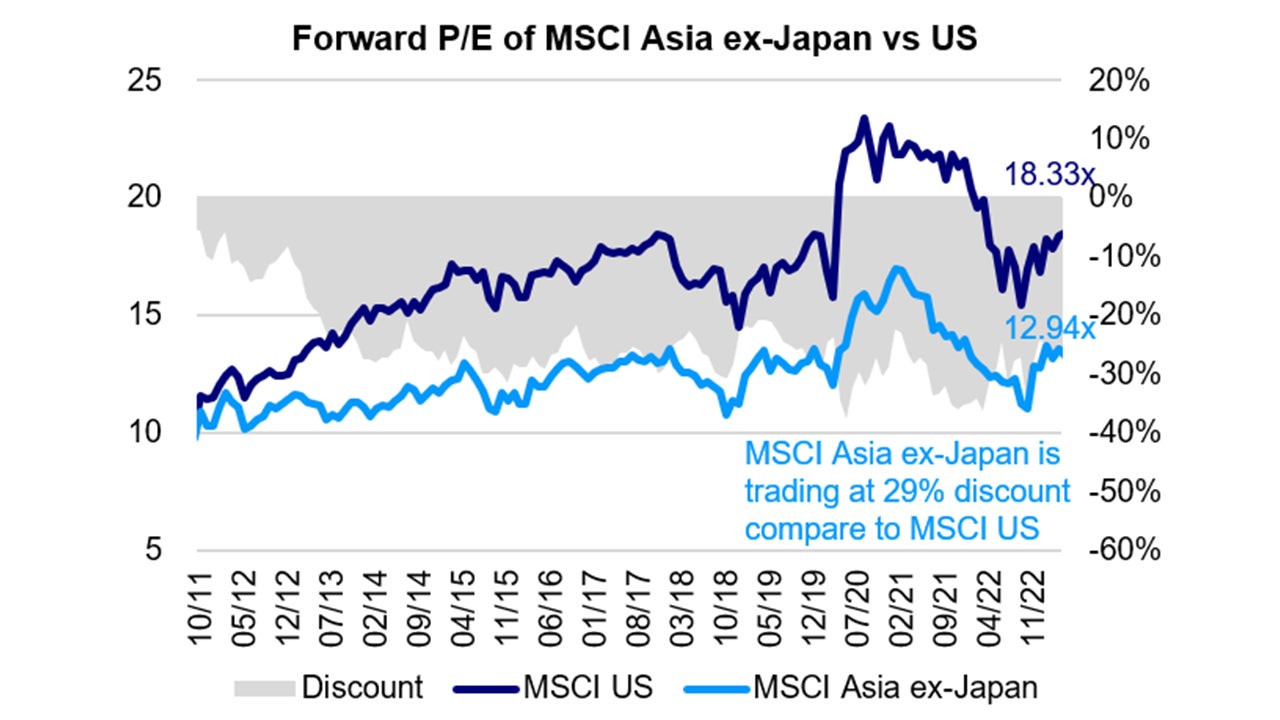

- MSCI Asia ex-Japan was trading at around a 29% discount in May as compared to the US market.

- The current P/E ratio stands slightly below the average MSCI Asia ex-Japan’s five-year, 12-month forward P/E average.11

- We believe valuations of Asian equities are at a comfortable range and are trading at a discount relative to developed markets.

Significant valuation discount against developed markets

Source: Factset, Invesco, May 2023