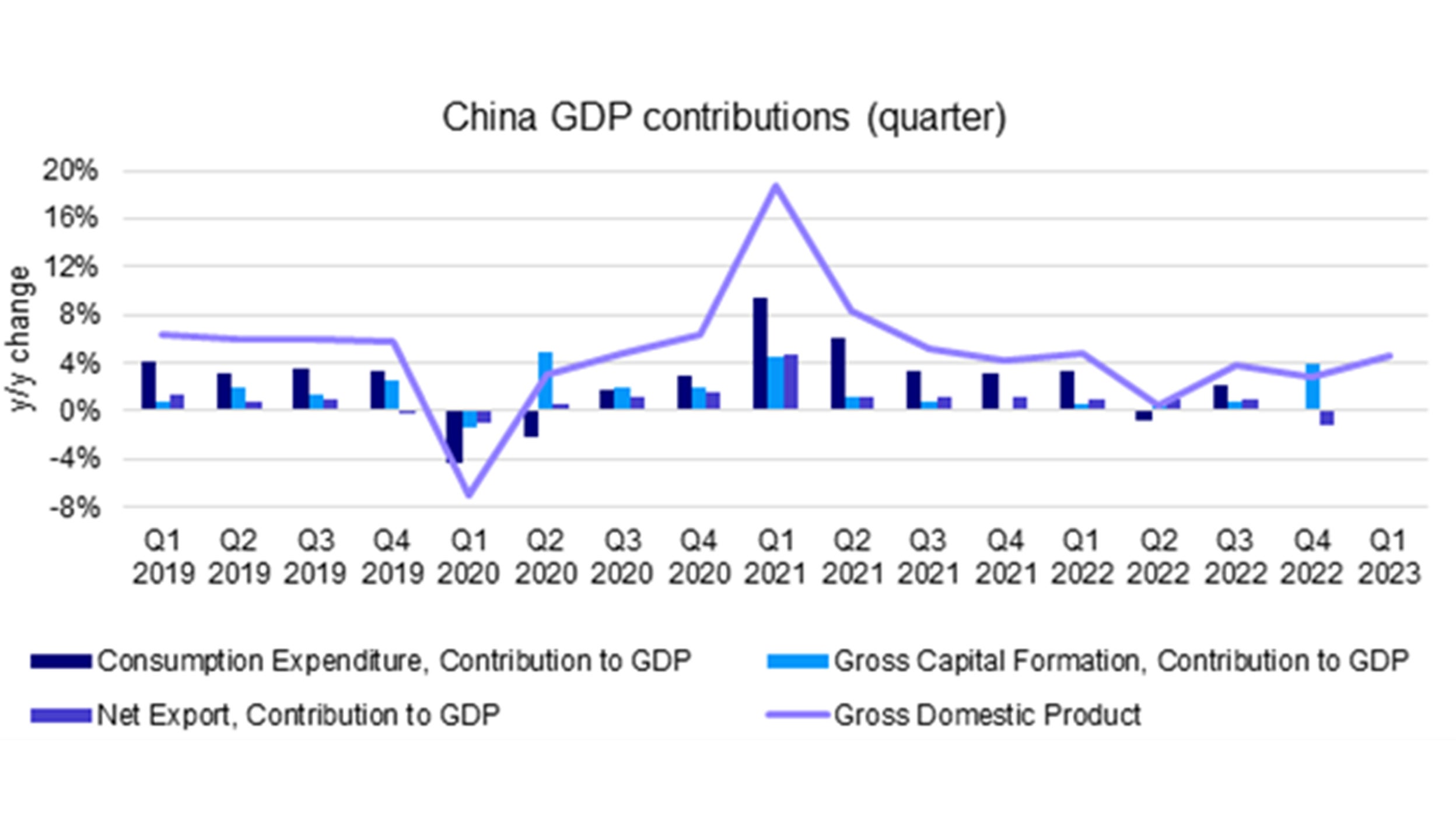

China Q1 GDP data confirms that economic recovery continues to be on track

China’s National Bureau of Statistics (NBS) data release confirms that the economic recovery continues to be on track, as Q1 GDP growth of +4.5% beat consensus estimates of 4.0%.1

While this growth rate has yet to meet the ‘around 5%’ official target for 2023, we expect it to pick up pace as the year progresses and the post pandemic rebound gains momentum translating into a broader based recovery.

Source: China National Bureau of Statistics (NBS). Data as of March 2023.

Our China investment thesis remains intact – growth and corporate earnings this year are likely to be driven by domestic household consumption.

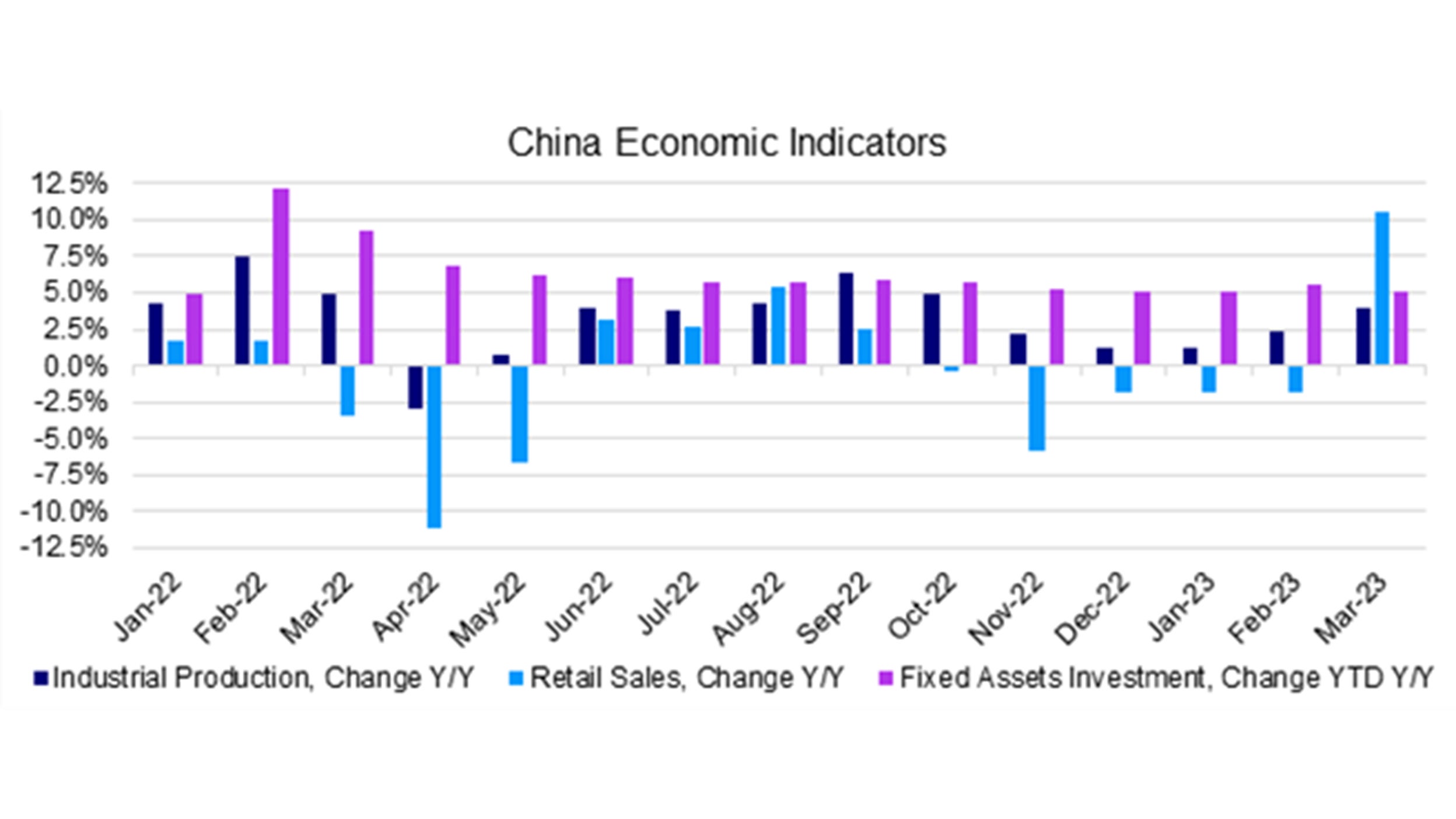

The strong retail sales data point of +10.6% y/y in March was driven by jewelry, restaurant and auto sales.2 This initially confirms that the reopening growth driver is still in play.

That said, it’s debatable how robust this driver actually is because of very low base effects from last year and some conflicting data points, such as low PPI and CPI monthly readings.

Domestic demand and sentiment are improving

We believe that domestic demand and sentiment are improving but still have a ways to go before reaching pre-COVID levels.

We are watching the consumption side closely given the government plans to hand over the economic growth baton from production to consumption this year.

The NBS has warned that inadequate domestic demand remains prominent, and consumers remain fairly prudent with their spending.

New household deposits hit RMB 9.9 trillion in Q1 jumping 27% y/y reflecting a high propensity to save, though we expect this to normalize as confidence builds through the year.2

Source: China National Bureau of Statistics (NBS). Data as of March 2023.

Other datapoints in the March release were more of a mixed bag. Industrial production missed expectations, albeit not by much.

The numbers were likely held up to some degree by both accumulated orders from the pandemic lockdown period as well as near-term strength in global demand conditions.

This is reflected in China’s March exports which soared by 14.8% y/y in dollar terms against expectations for a -7% fall3. The sustainability of these drivers are yet to be seen.

Fixed asset investments also came in slightly below consensus. Furthering our view that confidence will take time to rebuild was the divergence in private and public sector investments.

State owned investment grew by 10% while private sector investments registered a minute 0.6% growth in Q1.4

Even though the March property sales number and pricing in Tier 1 cities have improved recently, property investments fell -5.8% YTD y/y.4

This could mean that some property sales volumes that we saw in the prior quarter might have been pushed back to Q1. Overall, we believe the China property market has turned a corner, but the road ahead could be a long one filled with bumps.

It’s important to remember that sales and prices are good leading indicators, while property investment is a lagging indicator.

Property investment is a meaningful contributor to GDP and so the crux to whether growth handily beats the official 5% y/y target is contingent on how quickly property investments stabilize.

Outlook

Given the GDP beat and recent hold by the PBOC on the 1-year medium term loan financing rate and liquidity injection, we believe policymakers are likely to remain in a holding pattern.

We don’t expect any meaningful fiscal or monetary stimulus to propel the economy forward this year as the priority has now shifted to boosting business and household confidence.

Market reaction to the data was inconsistent. Equities jumped on the GDP beat and pared gains as the full set of data was digested.

We don’t believe there was anything particularly bullish or bearish in this dataset. The hold on policy rates means that Chinese bonds are likely to stay rangebound for a while. Chinese commodity markets reacted more positively.

Other data points we are watching out for include the fiscal income and spending figures which should give us some clues about the health of the government’s balance sheets.