A dual lens on India’s growth story: Insights from equity and fixed income markets

India stands at a pivotal juncture in its economic evolution, marked by robust domestic growth, progressive reforms, and increasing global integration. This white paper presents a comprehensive view of India’s investment landscape from both equity and fixed income perspectives, highlighting the structural and cyclical drivers that underpin its attractiveness to global investors.

Macroeconomic landscape: A foundation of resilience

India’s economy continues to exhibit strong and resilient growth, supported by solid domestic fundamentals and proactive policy measures. In Q2 2025, GDP expanded by 7.8% year-on-year1, exceeding market expectations. This momentum was largely driven by robust private consumption and a thriving services sector, signaling broad-based economic strength.

Manufacturing growth persists as inflation remains well-contained

Manufacturing activity remains buoyant, with the Purchasing Managers' Index (PMI) climbing to 57,7 in September2, reflecting sustained expansion in output and new orders. Meanwhile, inflationary pressures have eased significantly. Consumer Price Index (CPI) inflation fell to 1.5% in September3, an eight-year low, primarily due to declining food and commodity prices.

Sovereign credit upgrade: A milestone for market confidence

In September 2025, Standard & Poor’s upgraded India’s long-term sovereign credit rating from ‘BBB-’ to ‘BBB’, marking the country’s first upgrade in 18 years4. This milestone underscores India’s progress in fiscal consolidation, monetary discipline, and structural reform. The improved credit profile is expected to reduce borrowing costs, boost investor confidence, and attract foreign capital inflows across both equity and fixed income markets, reinforcing India’s position as a key destination for global investment.

Equity perspective: Consumption-led growth and structural tailwinds

Goods and Services Tax (GST) reform: A game-changer for domestic demand

Indian Prime Minister Modi announced the rationalization of the GST structure in September 2025, simplifying it to three slabs: 5%, 18%, and 40%, effective October 2025. Most items currently taxed at the 12% and 28% will be lowered to 5% and 18% respectively5. This reform is expected to reduce tax burden on both mass-consumption goods and luxury items, with the government estimating an INR 2 trillion6 boost to the economy.

Key sectoral beneficiaries include:

- Automobiles: Lower GST rates on small cars, two-wheelers, and commercial vehicles are expected to enhance affordability, drive volume growth and attract first-time buyers, particularly in urban, semi-urban, and rural markets.

- Consumer discretionary & staples: Items such as processed foods, garments, and household goods will be shifted to lower tax brackets, thereby increasing disposable income and stimulating domestic consumption.

A more streamlined GST structure may also help ease inflationary pressures. This aligns with India’s broader strategy to stimulate consumption and support economic growth, particularly among middle-class households benefiting from personal income tax cuts announced in the February 2025 Union Budget.

Festive and wedding season: A consumption surge

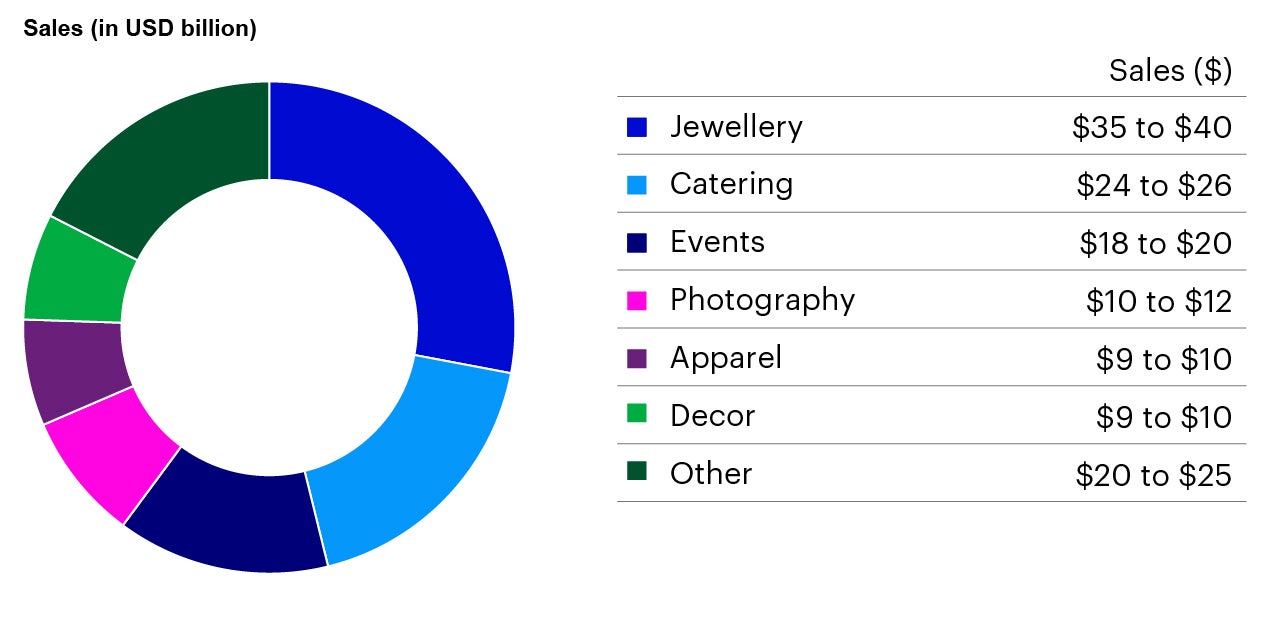

The timing of the GST reform coincides with India’s festive and wedding seasons (October to December), traditionally peak periods for discretionary spending. With 8–10 million weddings held annually and an average spend of USD 15,000 per wedding7, sectors such as jewellery, apparel, catering, and events are poised for a significant uplift.

The Indian wedding industry, valued at USD 130 billion8, is expected to grow further, driven by rising disposable incomes and growing optimism around employment prospects.

Source: RBZ Jewellers DRHP, Jefferies, June 2024 (latest available). CRISIL Research, December 2022 (latest available).

Rising US H-1B visa costs prompt expansion of India-based operations

The US has imposed a new USD100,000 application fee for new H-1B visas petitions, effective from March 2026. The H-1B visa, established in 1990, allows temporary employment-based entry, into the US for up to six years. The program has long served as a crucial pathway for skilled Indian professionals seeking employment in the US and a tool for US employers to address labor shortage.

Historically, US companies have typically paid between USD5,000 to USD10,000 in government fee for each visa holder, excluding the legal costs associated with preparing the application9. The newly introduced USD100,000 fee represents a dramatic increase in the cost of hiring foreign workers, significantly altering the economies of international staffing.

Indian nationals dominate the H-1B program, accounting for over 70% of the recipients in recent years10. The sharp rise in hiring costs may accelerate offshoring of jobs, with US firms relocating IT and business process operations to India. Many are expected to expand Global Capability Centers (GCCs) in India to leverage cost efficiencies, a deep talent pool and mature infrastructure, reinforcing long-term growth in tech services and back-office ecosystem.

Fixed income perspective: Sovereign strength and index inclusion momentum

Sovereign rating upgrade: Reinforcing investor confidence

The S&P’s upgrade of India’s long-term sovereign credit rating reflects the country’s macroeconomic stability, commitment to fiscal consolidation and improvements in public sector spending. The immediate market reaction included:

- 10-year India government bonds (IGBs) yield tightening by 10 basis points11

- Indian rupee (INR) appreciation against USD12

- Increased foreign interest in IGBs13

This upgrade enhances India’s credit profile and supports a bullish outlook for INR-denominated debt, reinforcing its appeal to global fixed income investors.

Potential inclusion of IGBs in Bloomberg Global Aggregate Index

Bloomberg is currently consulting on the inclusion of 41 Indian government bonds issued under the Fully Accessible Route (FAR), with a combined market value of USD 488 billion as of August 29, 2025, into its flagship Global Aggregate Index, with a proposed 0.7% weight14. If approved, this move could trigger approximately USD 21 billion in passive inflows, making Indian bonds the nineth largest by market value in the index15.

Potential inclusion of India FAR bonds among global currency segments in Bloomberg’s Global Bond Index

Currency |

Bond Count |

Amount Outstanding (USD bn) |

Market Value I (USD bn) |

Yield to Maturity |

Weight% |

United States Dollar |

17,271 |

34,873 |

32,822 |

4.47 |

44.40% |

European Euro |

7,677 |

18,017 |

17,095 |

2.86 |

23.10% |

Chinese Renminbi |

328 |

6,660 |

7,160 |

l.71 |

9.70% |

Japanese Yen |

957 |

7,163 |

6,546 |

l.55 |

8.90% |

Pound Sterling |

1,272 |

3,414 |

2,902 |

4.73 |

3.90% |

Canadian Dollar |

1,729 |

2,046 |

1,976 |

3.57 |

2.70% |

Australian Dollar |

609 |

1,105 |

1,042 |

4.1 |

1.40% |

South Korean Won |

181 |

863 |

856 |

2.66 |

1.20% |

Indian Rupee (Proposed inclusion) |

41 |

488 |

502 |

6.63 |

0.70% |

|---|---|---|---|---|---|

Swiss Franc |

493 |

402 |

421 |

0.53 |

0.60% |

Indonesian Rupiah |

74 |

287 |

306 |

6.16 |

0.40% |

Source: Bloomberg, data as of August 29, 2025.

This follows the phased inclusion of IGBs in JPMorgan’s JPGBI-EM Index, which brought USD 20-25 billion in inflows16 between June 2024 and March 2025. The technical impact of Bloomberg’s inclusion in the Global Aggregate Index is expected to be similarly positive, reinforcing demand and liquidity in India’s onshore bond market.

Monetary policy outlook: Easing ahead

With inflation easing and real interest rates rising, the Reserve Bank of India (RBI) is expected to consider rate cuts of 25 to 50 basis points in FY2026. The deflationary impact of the GST reform, combined with subdued export growth due to US tariffs of up to 50%, may prompt accommodative policy action.

Current market pricing suggests limited scope rate cuts over the next three to six months, but the December meeting could mark a shift if growth begins to decelerate. A dovish pivot would likely support bond yields and enhance the appeal of IGBs.

External headwinds and policy responses

US tariffs: Limited macro impact

The US has imposed a 50% tariff on Indian exports, combining reciprocal and penalty measures related to Russian oil imports. While 55% of exports to the US are affected, the macroeconomic impact is estimated at approximately 0.5% of GDP, given exports to the US account for only 2% of India’s GDP17.

India’s response includes the GST reform to offset export headwinds by stimulating domestic consumption. The fiscal impact of the reform is modest - 0.13–0.14% of GDP for FY202618 - providing reassurance to markets concerned about fiscal deterioration.

There is no guarantee that the estimate will be reached.

Current market pricing of future policy rates in India

| Market-implied policy rate | ||

| Current Policy Rate | 3-month forward | 6-month forward |

| 5.50% | 5.54% | 5.44% |

Source: Bloomberg, Invesco, data as of September 3, 2025

Recent headlines suggest that India may significantly reduce—or potentially halt—its purchases of Russian oil. This development increases the likelihood of a substantial reduction in import tariffs. Should this scenario materialize, it could trigger a wave of positive market sentiment toward India, both in the near term and over the longer horizon.

Investment implications and strategic outlook

India’s diverse growth drivers underpin a resilient and optimistic macroeconomic outlook, enhancing its investment appeal across both equity and fixed income markets. The ongoing growth momentum presents a compelling case for strategic, diversified portfolio positioning.

- Equities: India continues to benefit from three major themes - financialization of savings, consumption expansion and manufacturing renaissance. Sectors such as automobiles and discretionary goods are well positioned for strong earnings growth in Q4 2025, supported by GST restructuring, resilient consumer demand and favorable seasonal dynamics.

- Fixed Income: IGBs are poised to benefit from sovereign upgrades, potential global index inclusion and a dovish monetary policy stance. These factors enhance their attractiveness through competitive yields and strengthening credit quality.

India’s policy agility, demographic advantage and reform-driven growth trajectory reinforce its role as a strategic allocation for global investors seeking diversified exposure to growth and yield opportunities in Asia.

Conclusion

India’s investment case is underpinned by a confluence of favorable macroeconomic indicators, progressive structural reforms and deepening integration with global markets. The economy continues to demonstrate agility and resilience amid external challenges while leveraging its domestic strengths.

As India enters a phase marked by accelerating consumption and supportive policy tailwinds, investors are presented with a distinct opportunity to participate in its growth story through multi-asset strategies spanning both equity and fixed income. A balanced and actively managed approach offers the potential to generate alpha while capturing the breadth and dynamism of India’s evolving market landscape.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.