ECB Surprise September Rate Hike

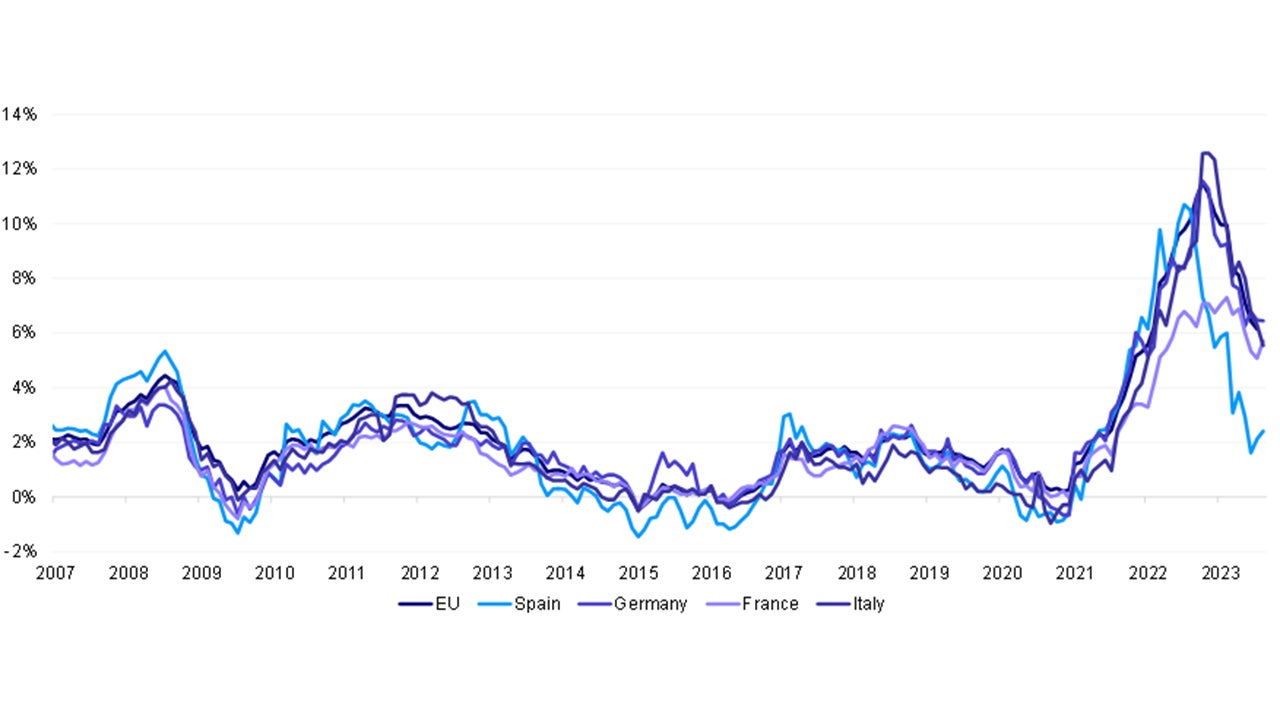

In a surprise move, the European Central Bank (ECB) raised its deposit rate by 25bps to 4.0%, the 10th consecutive hike.1

This dovish hike is likely the end of its tightening cycle, having increased its deposit rate 450bps since July 2022 when the deposit rate was at -0.5%.

Against the USD the Euro initially spiked on the announcement before settling about 0.65% lower than on the morning’s opening. The Eurostoxx 600 was up 1.2% from the open.2

We learned that ECB staff increased their outlook for headline inflation for this year and next on the back of higher energy prices, with 2023 inflation projected to be 5.6% rather than the June estimate of 5.4%, and 2024 inflation projected to be 3.2%, rather than the June estimate of 3%.3

Data dependency suggests that the ECB still awaits more consistency in the signals from growth and inflation numbers.

Outlook

In our view, slowing growth should put downward pressure on core inflation, even if energy prices hold or push headline up.

Excess savings in the Euro area have essentially been depleted now, in contrast to the US and Japan where some still remain.

With monetary policy this tight, inflation is likely to fall faster than projected by the ECB (with leading indicators such as money growth and factory prices confirming), which might cause them to cut prior to current market pricing.

Source: Eurostat. Data as at 15 September 2023.

Risks to Our Views

While we expect economic headwinds to have a dampening effect on inflationary pressures, another energy supply shock stemming from the Ukraine war, could be a key risk to our views – it could push headline inflation back up again and depress growth.

If there were new energy price controls or budgetary subsidies once again, as in the 2022-23 winter, it might push up not just headline inflation but also support non-energy spending and thereby slow or reverse the decline in core inflation.

Investors should keep this geoeconomic risk on their radar.

Investment Implications

With interest rates the highest in the Euro area in recent history, investors might find the risk / reward in Euro area fixed income attractive if the economy and inflation continue to decelerate, necessitating rate cuts sooner rather than later.

Germany, the region’s largest economy, is already in recession and PMI surveys are suggesting France is to follow. This would likely be negative for European equities, especially cyclical sectors.