FOMC December Meeting and China Monthly Economic Data

After a weaker than expected November CPI print, the FOMC chose to downshift its rate hike to 50bps to 4.25%-4.5%, as expected. The good news stopped there. Even though there were minimal changes to the Fed’s policy and economic outlook, Chair Powell doubled down on a hawkish message.

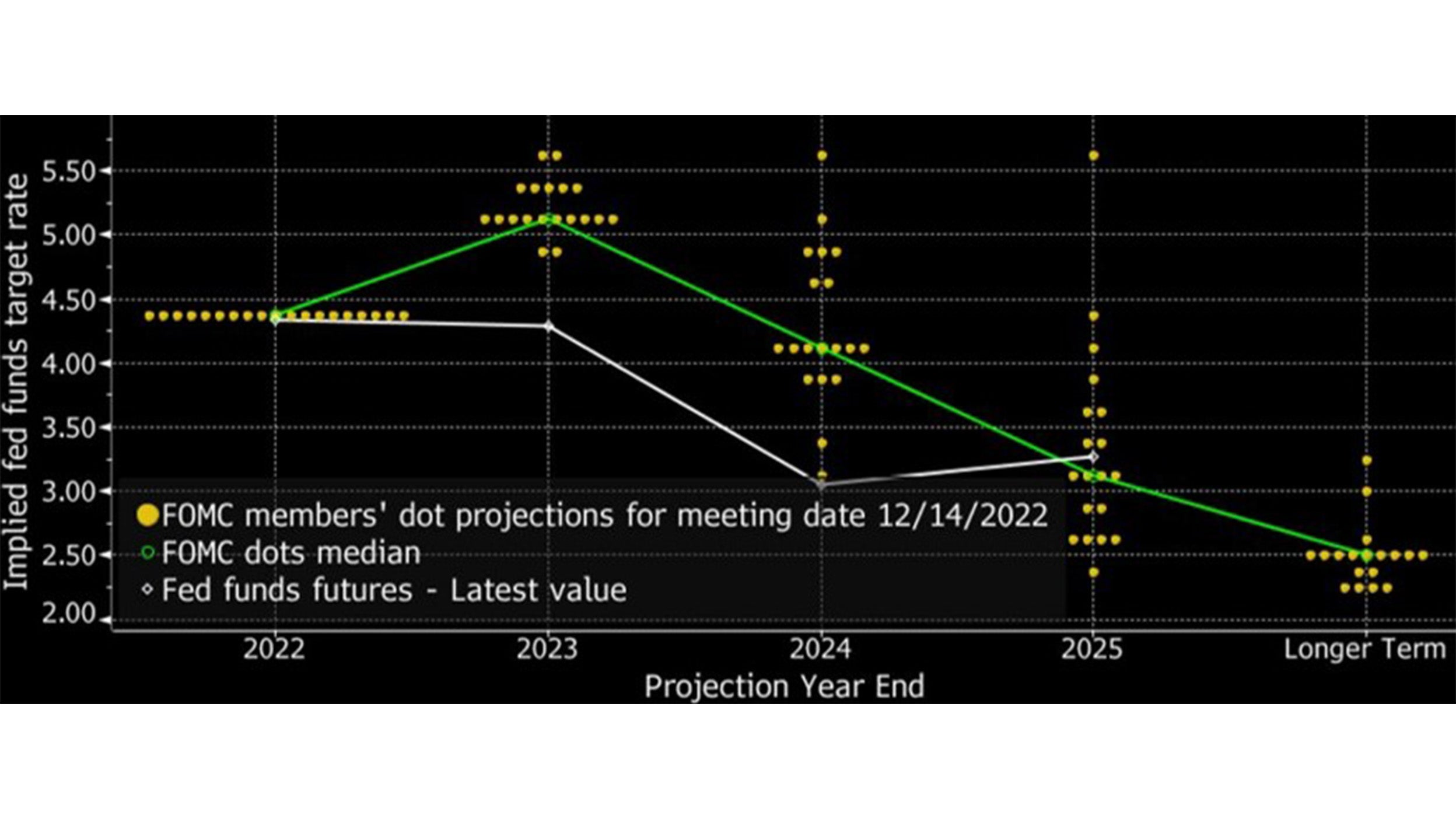

The FOMC raised the midpoint of their end-of-2023 funds rate target to 5.125% compared to 4.625% in September which amounts to an additional 75bps of rate hikes to go in 2023. Notably, the median dot plot shows a net 200bps cut in the Fed funds rate between 2023 and 2025.1

Source: Bloomberg. Data as of 14 December 2022.

The Summary of Economic Projections (SEP) also updated its 2023 projections: the unemployment rate creeps up to 4.6% (vs. 3.7% currently) slight decrease in GDP growth to +0.5% and increase in core inflation to 3.5%.

The recent weaker CPI print and downshift in the FOMC’s rate hike confirm the main tenets of our 2023 investment outlook. We expect the upcoming year to be a pivotal one as we move from a contraction to a recovery phase in the global economic cycle. Much of this is contingent on the Fed hitting the pause button on interest rate hikes sometime in mid-2023.

The big question remains on whether the US will hit a recession during the contractionary phase and whether core inflation will continue to fall towards the Fed’s targeted range. While there continues to be glidepath for the Fed to orchestrate a soft landing, this may be increasingly difficult to achieve.

Despite significant interest rate hikes, the US economy remains surprisingly resilient. The US economy appears somewhat insensitive to a higher interest rate environment, for now. The labor and property market remain strong. Real wage growth and mortgage applications are turning positive again as financial conditions have eased. That said, the current economic resilience is a double-edged sword as the Fed is likely to push back – perhaps with another 50bps hike in the next FOMC meeting in February.

China’s November Monthly Economic Data

China reported November monthly economic data that broadly missed market expectations, as COVID disruptions continue to hamper growth despite loosening pandemic restrictions.

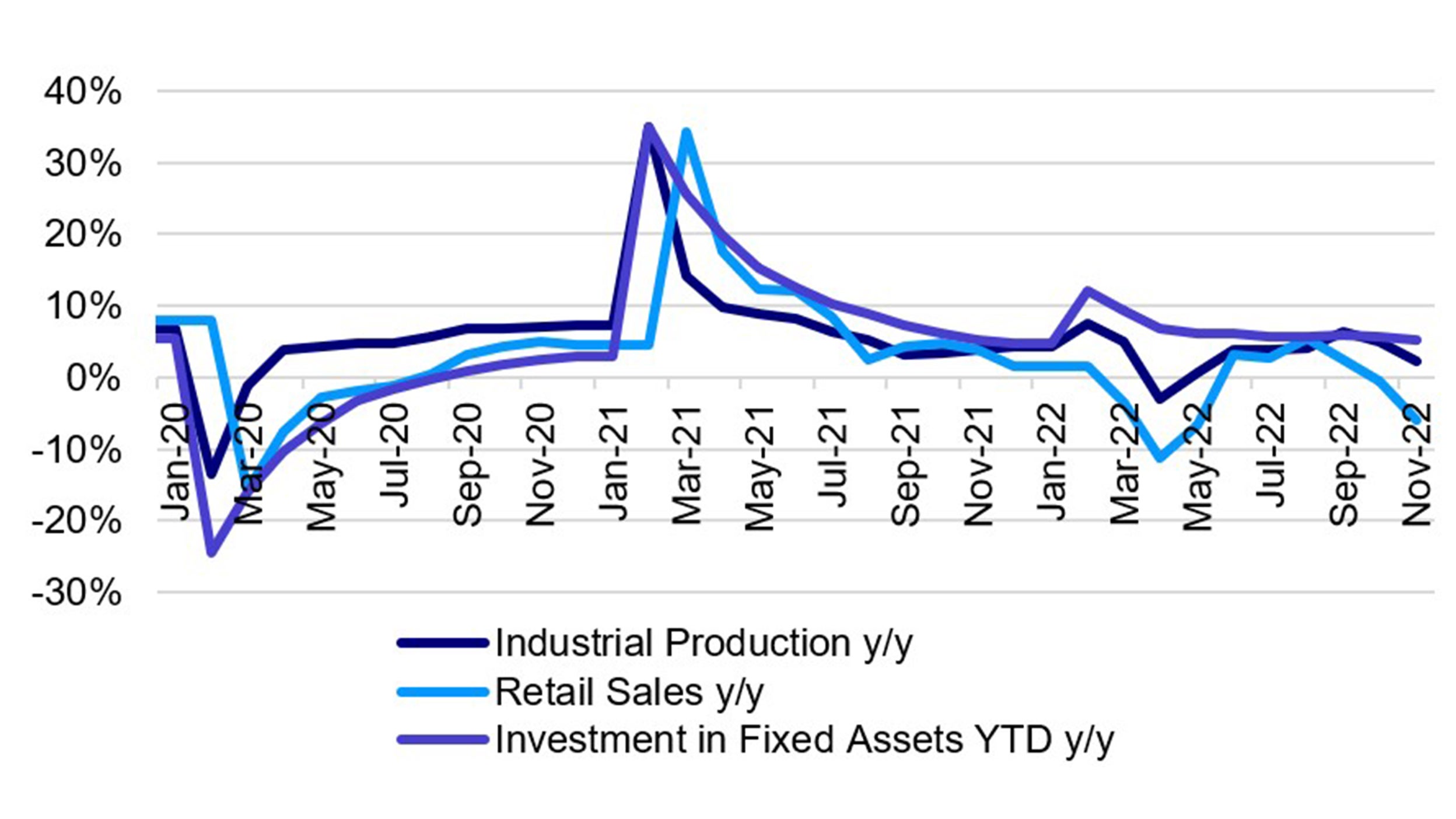

Industrial production decelerated to 2.2% year-on-year (vs. 5.0% in October) due to supply chain disruptions. For example, automobile production growth fell from 8.6% y/y growth in October to -9.9% y/y in November.2

It’s no surprise that retail sales fell -5.9% y/y (vs. -0.5% in October). The services sector has been hit especially hard and catering services deteriorated sequentially. Fixed asset investments grew 1.0% single month y/y (vs. 5.0% in October). The unemployment rate in 31 major cities ticked up to 6.7% from 6.0% in October.2

Source: National Bureau of Statistics (NBS). Data as of November 2022.

As it exits a zero-COVID regime, the Chinese economy is facing the same headwinds that every major economy has faced when reopening. It’s feasible to expect a sizable wave of new infections, hospitalizations and mortalities over the coming months, which could test the resolve of the central government’s commitment to reopening the country. Much of this will be dependent on how quickly local governments enforce these relaxations as around 25mn people over the age of 60 haven’t had a single vaccine dose and the country’s ICU bed/capita is comparatively low to developed economies.

Coupled with a softening global demand backdrop, the next few months could be a stiff challenge for policymakers trying to stabilize growth. I expect further monetary easing, possibly with additional rate cuts and loosening property market measures.

Despite possible reopening bumps, I think market participants could see through some of the near-term economic headwinds and that it makes sense to embrace the reopening. Chinese consumer cyclicals – both discretionary and staples – are likely to benefit the most.