How will Moody’s US sovereign rating downgrade affect markets?

Summary: We view the recent downgrade of US government debt by Moody’s to have little impact on investor positioning as most investment guidelines were rewritten in 2013 to hold US Treasuries as a distinct asset class instead of part of the AAA rated bucket. All three rating agencies still classify US government debt as investment grade.

Instead, we are more focused on the reasons for the downgrade and thus closely watching the Congressional negotiations over the US domestic budget. We are also keeping a close eye on the overall impact from the tariffs - which should reduce the deficit as the Treasury collects more revenues - and from the domestic tax cuts - which should increase the deficit.

US real yields are attractive, though could remain elevated until more details are released. We favor being broadly diversified and believe that this could be an attractive entry point for AAA sovereign debt in the APAC region.

Reasons for Moody’s downgrade of US government debt

On May 16, Moody’s downgraded the US sovereign rating from AAA to AA1 bringing it in line with Fitch and S&P (downgrades on 1 August 2023 and 5 August 2011, respectively). This is the first time that Moody’s has had the US below triple-A since it first rated the US sovereign in 1917.

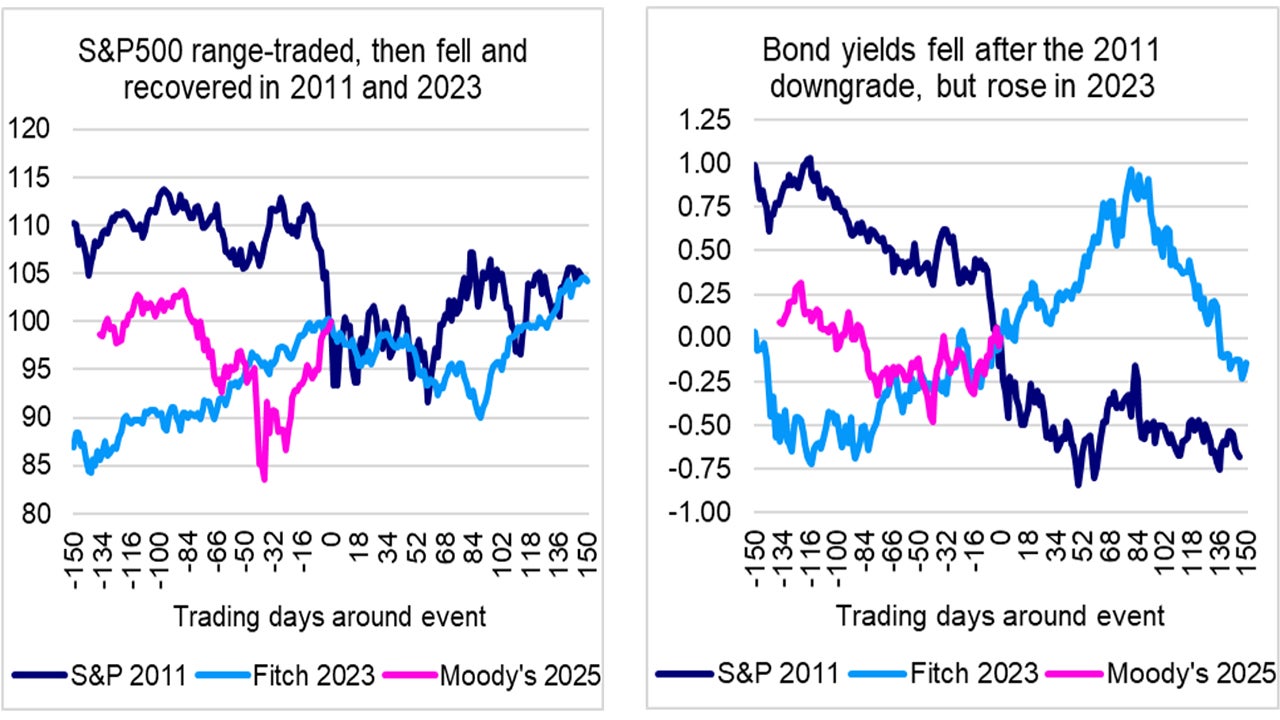

Moody’s is simply the last rating agency to move. While S&P’s US sovereign downgrade prompted a sharp selloff in US equity markets in 2011, Treasury yields fell – contrary to the S&P perception that they were now inherently riskier.

After the Fitch downgrade in 2023 Treasury yields rose but that was more likely driven by macro factors (especially inflation and Fed policy) in our view. (chart)

Following the Moody’s downgrade, yields on US Treasuries rose but subsequently fell again. The 30-year UST yield briefly hit 5%.1 Stocks were little changed.

The more muted reaction this time around may be reflecting that the downgrade has little outright effect after the initial shock value has worn off (which might be happening already).

Source: Bloomberg, Macrobond, Invesco. Daily data, +/-150 calendar days before and after each downgrade all as at 16 May 2025. Note: Left chart shows change in S&P500 index level. Right chart shows change in US 10-year Treasury yield vs. dates of downgrades. Each reindexed, dates of downgrades=100; S&P, 5 August 2011; Fitch, 1 August 2023; Moody’s, 16 May 2025.

After the 2013 downgrade most investment guidelines were rewritten to hold Treasuries as a class instead of a AAA rated bucket. This means there should be very limited forced selling.

Still, the reasons behind the downgrade (deficit) are likely to be important going forward, and this episode does highlight well-documented fiscal challenges facing the US – even if these issues may be integrated already into market expectations.

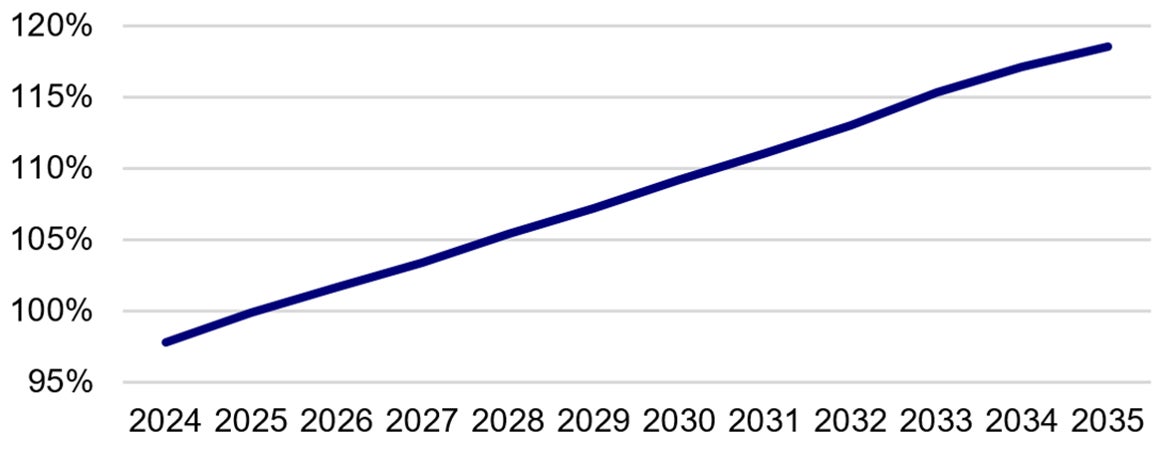

The federal budget deficit is running near $2 trillion a year, or more than 6% of gross domestic product2.

Source: Congressional Budget Office and Bloomberg. Note: The latest CBO projections don't incorporate an extension, or expansion, of the 2017 tax-cut package. Forecasts measure debt held by the public at year-end.

Cuts in government spending by the Department of Government Efficiency (DOGE) are unlikely to have any lasting change when it comes to the government’s overall deficit and there isn’t any verifiable evidence so far, that the organization has had any impact on federal spending.3

Notably, the Republican budget and tax bill was unsuccessful in the House last Friday, as a faction within President Trump's own party opposed the legislation, citing concerns that it would significantly increase the federal deficit.

The Trump administration could encounter challenges in shifting its policy focus from tariffs to more pro-growth initiatives, such as tax cuts, particularly if these measures exacerbate the fiscal deficit.

As the initial effects of the Moody’s downgrade fades, US assets will instead be driven by changing macro factors.

Rising inflation, fiscal and political risks could drive yields up over time. Additionally, in major liquid markets of “safe-haven countries” like the US, the TINA (there is no alternative) dilemma still holds.

Why have US Treasury yields remain elevated?

Higher US Treasury yields have reflected a complex mix of lower recession risks, higher inflation expectations, and US fiscal deficit worries as Congress proposes further tax cuts without matching offsets in spending.

Deficit concerns have shown up in higher credit default swap prices on US government debt, too. While the Treasury market may remain under some pressure from bond vigilantes, we are minded not to panic.

The US has many levers to pull when it comes to its debt and deficit.

We expect the debt ceiling will be lifted (just as it was in 2023 and many periods before), foreign investors haven’t dumped US Treasuries, and the Fed isn’t likely to buckle to pressure.

Republican budget and tax bill

Labeled the "Big Beautiful Bill" by the president, the proposed legislation seeks to prolong the 2017 tax cuts, which are scheduled to expire this year, potentially adding an estimated $4.2 trillion to the federal deficit over the next ten years.4

Additionally, the bill proposes $663 billion in new spending cuts and aims to raise about $1 trillion by removing certain tax credits and increasing specific taxes.5

Investment implications

We are monitoring closely how budget talks are progressing in the US. As mentioned above, any news suggesting a need to increase coupon issuance by the US Treasury is likely to drive yields higher and the curve steeper.

And the reverse is true too because it’s entirely feasible for the US deficit to contract this year, due to increased revenues from already in place tariffs and before the tax cuts to go into effect.

The picture for the US fiscal outlook is less clear longer-term, which is why real yields in the US are cheap and could likely stay cheap until we get more details.

Additionally, it’s unlikely the Moody’s downgrade will have any particular impact on the TIPS (Treasury Inflation-Protected Securities) market.

We continue to favor that investors remain broadly diversified and believe that right now could be an attractive entry point for the highest-grade sovereigns and credit in the APAC region.

With contribution from Invesco Fixed Income team.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.