India’s growth drivers bolster investment appeal

Summary

- India continues to demonstrate strong and resilient economic momentum, supported by a series of positive developments that reinforce its long-term growth story, particularly driven by domestic strength.

- S&P’s first sovereign rating upgrade for India in 18 years marks a vote of confidence in the country’s macroeconomic stability and reform progress.

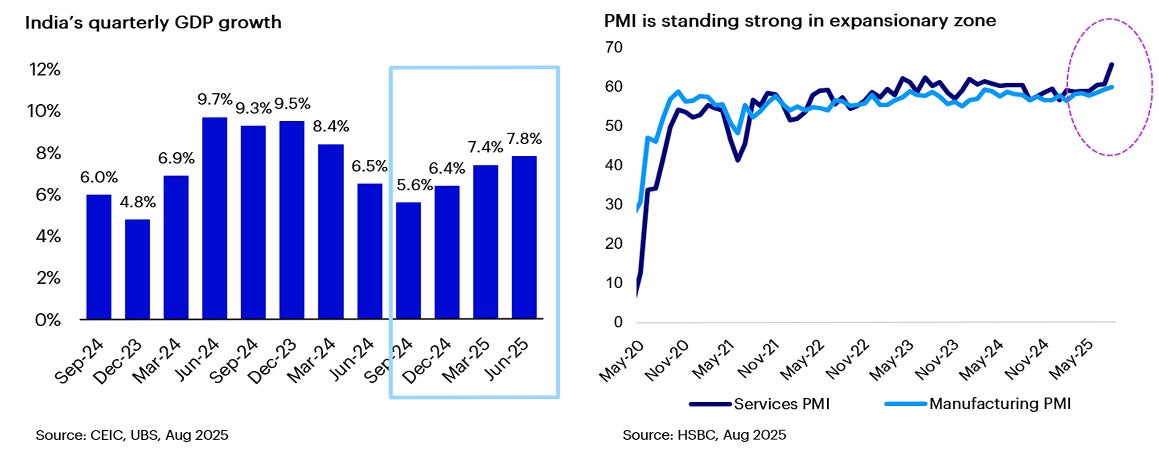

- Strong high frequency data include Q2 GDP growth and manufacturing Purchasing Managers' Index (PMI) are robust.

- Consumer Price Index (CPI) inflation data has come to 8-year low and steadily on a downtrend trend.

- The proposed goods & services tax (GST) rationalisation could boost consumption.

- The upcoming wedding season will be another potential consumption boom in India.

The first sovereign rating upgrade by S&P for India in 18 years

Standard & Poor’s upgraded India’s long-term sovereign credit rating to ‘BBB’ from ‘BBB-’ earlier this month, marking the country’s first sovereign upgrade by S&P in 18 years.1

The upgrade reflects positive factors, including India’s buoyant economic growth, the government’s commitment to fiscal consolidation, improved quality of public spending, and strong corporate, financial, and external balance sheets.

India is expected to attract stronger foreign fund flows after the ratings upgrade, which could potentially enhance investor confidence and lower borrowing costs.

Strong domestic growth

India’s real GDP growth for Q2 came in at 7.8% year-on-year2, exceeding market expectations. The strong performance was primarily driven by robust private consumption and growth in the services sector. A notable revival in mass consumption also contributed to the growth momentum.

Additionally, India’s manufacturing PMI rose to a 17-year high of 59.3 in August 20253, supported by the underlying strong output sub-index - reflecting the resilience of domestic demand.

Benign CPI paving the way for rate cuts

July CPI inflation softened to an 8-year low at 1.55%4. Indeed, inflation in India has been steadily on a downtrend due to easing of food and commodity prices. This certainly opens the door for more central bank rate cuts. We expect 25-50bps repo rate cut in rest of FY26.

We believe that the front-loading of rate cuts (100bps Calendar Year to Date (CYTD)), softer inflation (boosting purchasing power), together with GST reform along with personal income tax relief (US$15bn) help buoy household consumption in the long run5.

Proposed GST rationalisation to boost consumption

Prime Minister Modi announced GST rate rationalisation last month, which could get implemented by Diwali (Indian festival which is due in October-2025). The proposed reform includes lowering GST rates on mass-market items and aspirational goods.

Currently, India has five GST slabs: 0%, 5%, 12%, 18%, and 28%.6 Among these, the 12% and 18% rates are considered standard. Reports suggest that the government is proposing to simplify the structure by retaining only two primary slabs- 5% and 18% - along with a 40% rate for select goods.6

The removal of the 12% GST slab would be particularly beneficial for sectors such as processed foods, garments, footwear, tractors, farm equipment, construction materials and hospitality.

We view this as a positive development. It could stimulate consumption, especially benefiting both consumer discretionary and consumer staples sectors. A more streamlined GST structure may also help ease inflationary pressures.

Upcoming wedding season – a potential consumption boom

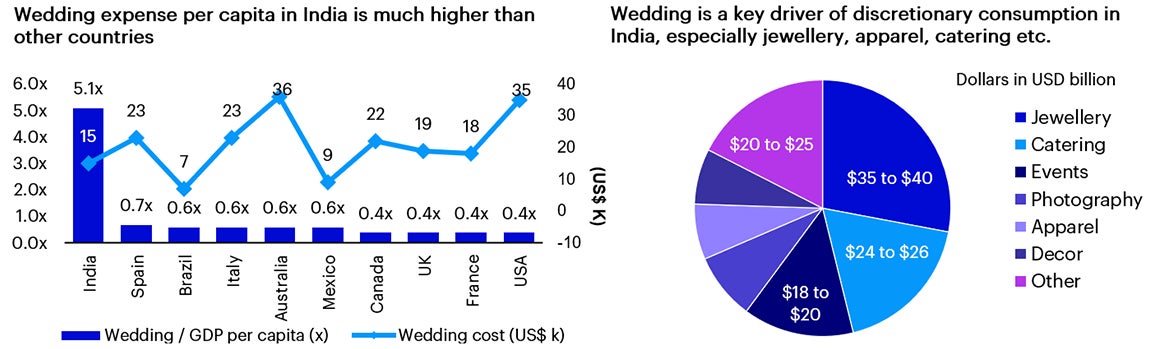

Talking about consumption, the upcoming wedding season in India, which will take place between October and December, will be in focus. Around 8-10 million weddings take place in India.7 An Indian will likely spend one-fifth of his lifetime wealth on a wedding. The cost of an Indian wedding is around US$15,000 on average. 7

Most of the wedding budget goes to jewellery, catering & events. The Indian wedding industry is estimated to be worth ~US$ 130 billion.7 We expect the industry to grow as people will be more willing to spend on their wedding on wealth effect & optimism on employment prospects in the country.

Source: RBZ Jewellers DRHP, Jefferies, June 2024 (latest available). CRISIL Research, December 2022 (latest available).

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.