Key takeaways from January FOMC meeting

The Fed kept its benchmark rate the same today, as it has for the past three meetings. This meeting was all about reading the tea leaves to glean any signs of what’s in store for America’s monetary path forward.

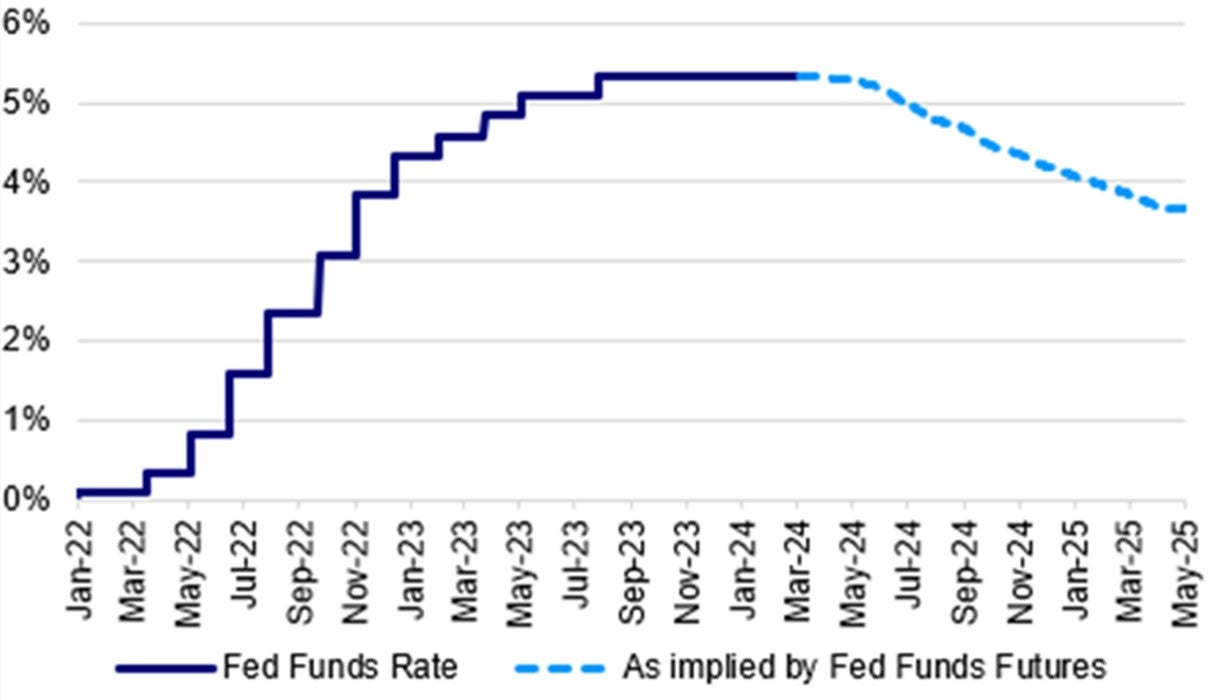

The biggest takeaway is that Fed Chair Powell intimated that a March rate cut is not likely even though markets have recently started to price one.

Still, I believe that it’s not about when the Fed starts to cut rates but how many and how much is cut in the coming year.

I continue to believe that the rate cuts start in Q2 and that the cuts will be material and more than what the Fed anticipated in December.

Source: Federal Reserve and CME group. Data as at 1 Feb 2024.

The Fed seems comfortable with the strength of the economy

It’s clear that the Fed wants to prevent financial conditions from easing too much and Chair Jay Powell has guided the market from blindly expecting a rate cut during the next FOMC meeting in March.

Still, Powell admitted during the press conference that the US economy is a “pretty good picture” and that the labor market has been strong, though inflation is coming down.

He acknowledged that a year ago, the Fed thought it needed to see a softening of economic data to cause inflation to adequately ease.

But now, the Fed is comfortable with the strength of the economy and it doesn’t believe the economy needs to weaken to see inflation be tamed.

To me, Powell seems somewhat surprised that the Fed’s rapid interest rate hikes last year haven’t wreaked havoc on the economy though he still expects activity to slow in the near-term.

The initial report of US fourth-quarter GDP was better than expected — an annualized rate of 3.3% versus expectations of 2% — although down from the third quarter print of 4.9% annualized.1

The December reading of the core Personal Consumption Expenditures price index, the Fed’s preferred measure of US inflation, fell below 3% year over year — the lowest level since March 2021.2

This underscores the very significant progress made in taming US inflation and that the march towards the Fed’s 2% inflation target continues.

Investment Implications

When taking into account the market movements so far and how to position a portfolio for the rest of the year, I still expect small caps and stocks outside the US, along with tech, to perform well in coming months — in addition to investment grade bonds — to name a few areas of opportunity.

However, I believe it’s critical to be well diversified across and within the three major asset classes — stocks, bonds and alternatives.

With contribution from Kristina Hooper