Key Takeaways from the FOMC June Meeting

The Fed hiked rates by 75 basis points (for the first time since November 1994) inline with market expectations for a higher hike given the recent higher-than-expected CPI print and the increase in longer-term inflation expectations.1

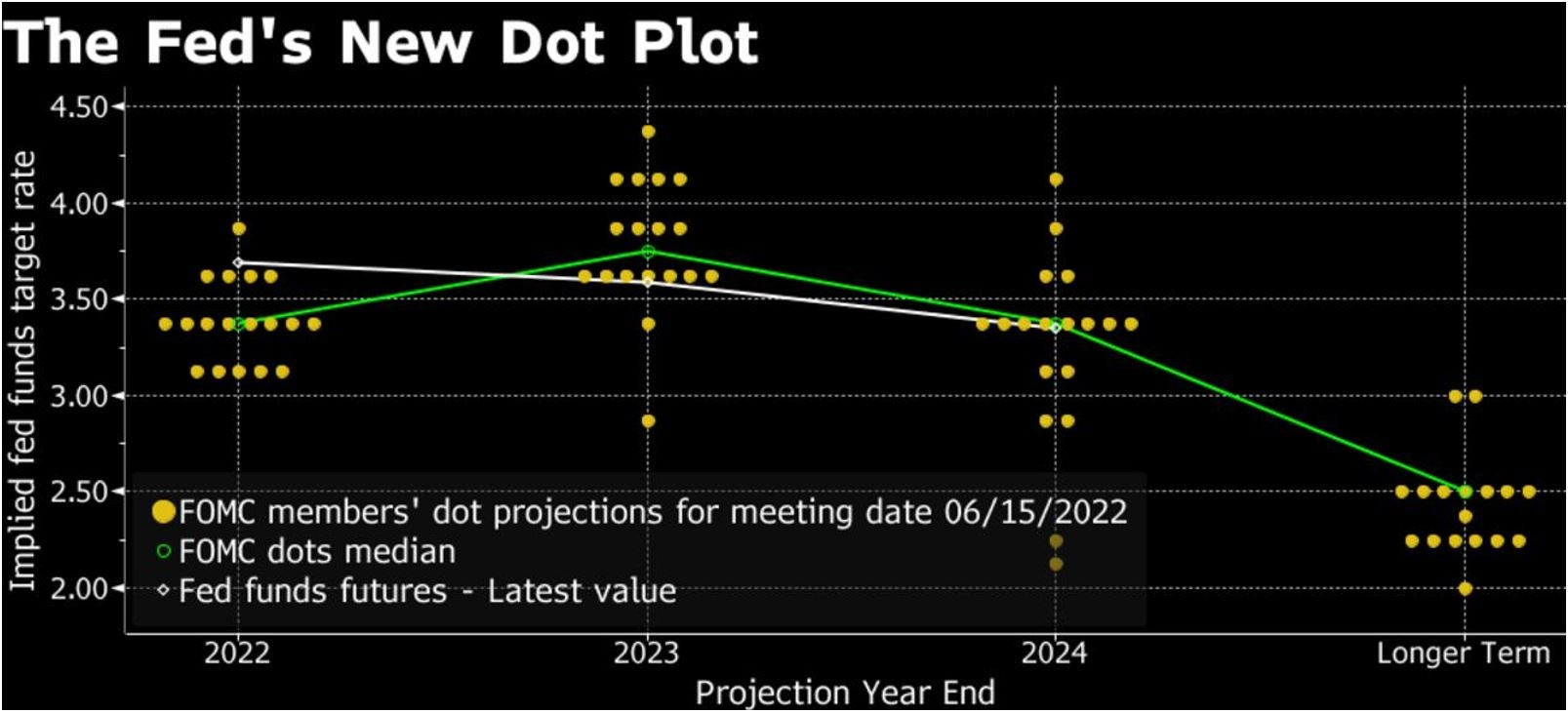

- The Fed also released its new dot plot (which the Fed uses to signal its outlook for the path of interest rates):

- Median Fed funds rate projected to be 3.4% at end of 2022. (Back in December, Fed funds rate at end of 2022 was projected to be 0.9%)

- Fed funds rate projected to be 3.8% at end of 2023

- Fed Chair Powell thinks that a 3.8% Fed funds rate could be enough to return inflation to target, but of course will react if that’s not the case.

Source: Bloomberg. Data as of 15 June 2022.

I believe that the Fed was sufficiently hawkish in its decision and its language. The Fed is clearly trying to gain credibility with its strong wording: in its statement, it used the language that it is “strongly committed to returning inflation to 2%” - which is a significant change from it “expects” inflation to return to its 2%. Powell has made it clear the focus is on the price stability mandate, not the full employment mandate, since the labor market is so tight.

Not to expect moves of 75 basis points to be common

Powell also stressed the Fed is “moving expeditiously to do so” and expects either a 50 or 75 basis point hike at the July meeting but he said not to expect moves of 75 basis points to be common.

I think markets should take this forward guidance in stride – that we could be currently experiencing peak hawkishness and that the Fed is not going to aggressively tighten policy at all costs.

US equities have reacted positively, at least initially, given the rate hikes had been priced in over the last several days and tech stocks outperformed on the day.

The 10-year and 30-year US Treasury yields dropped very significantly today, indicating expectations of much lower growth. At one point in the afternoon, they inverted but have since reversed. There is a narrow spread between the 2s and 10s but it is not inverted.

Outlook

The Fed has regained some credibility today. Admittedly, it is getting harder to achieve a soft landing but it is possible. The Fed is committed to being nimble and data dependent – it will make decisions meeting by meeting, and be responsive to incoming data just as it was today - which should help its ability to achieve a soft landing.

The Fed wants to see a series of declining monthly inflation readings to know they are controlling inflation. I am keeping a close eye on headline and core inflation readings, as well as consumer inflation expectations for the longer term. At the same time, investors will want to follow data closely that could indicate a faster slowing of the economy than the Fed expects, which could trigger a recession.

Our Invesco mid-year outlook continues to believe that inflation will peak soon in the US, and slowly moderate. Still, I recognize that the only factor the Fed can control is demand; there are external factors, such as geopolitical conflicts and remnants of COVID that could have a significant impact around the world.

The global economy is slowing down, as would be expected given developed economies’ tightening monetary policy. From a relative asset allocation perspective, our base case expectations lead us to a reduced risk posture with a slight overweighting of equities. It makes sense to be broadly diversified across and within equities, fixed income and alternatives.