Key takeaways from US July CPI print - Disinflation forces continue to take hold

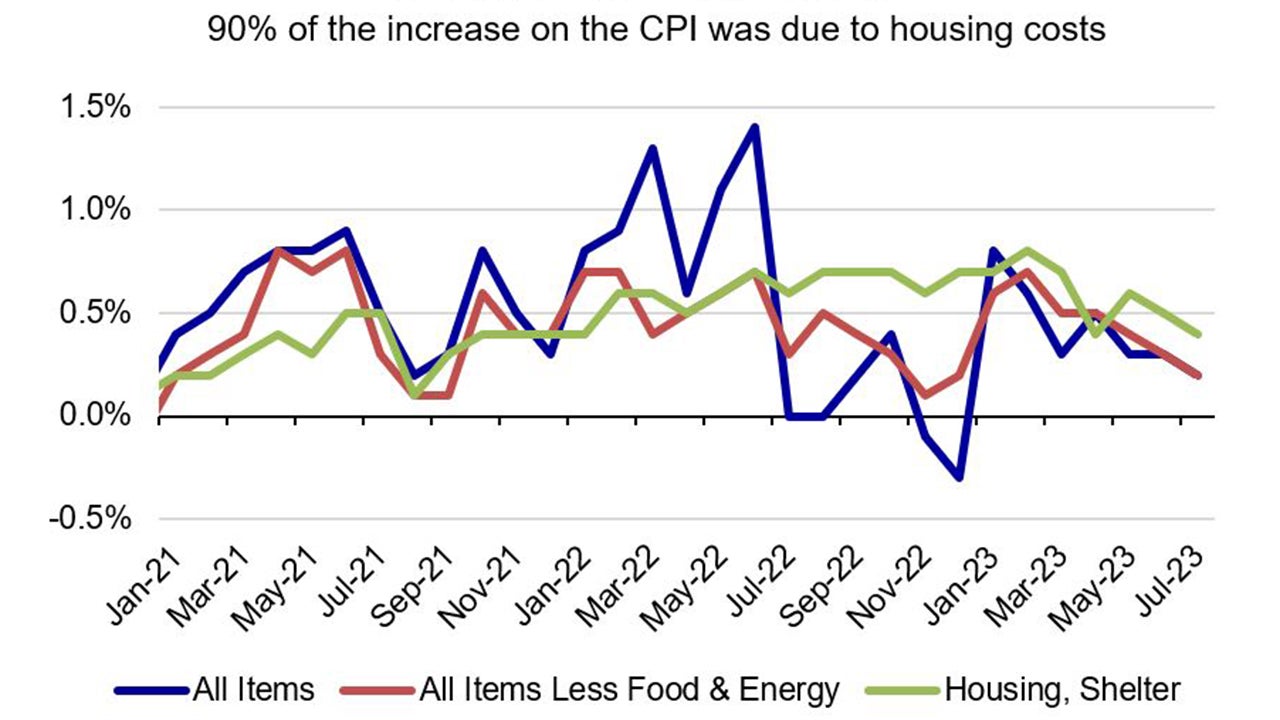

Disinflation forces continue to take hold in the US, as both headline and core CPI increased by a modest 0.2% m/m.1

Annual headline CPI edged up to 3.2% y/y from 3.0% in the prior month while core CPI fell to 4.7% y/y from 4.8% due to continued strong shelter price inflation.1

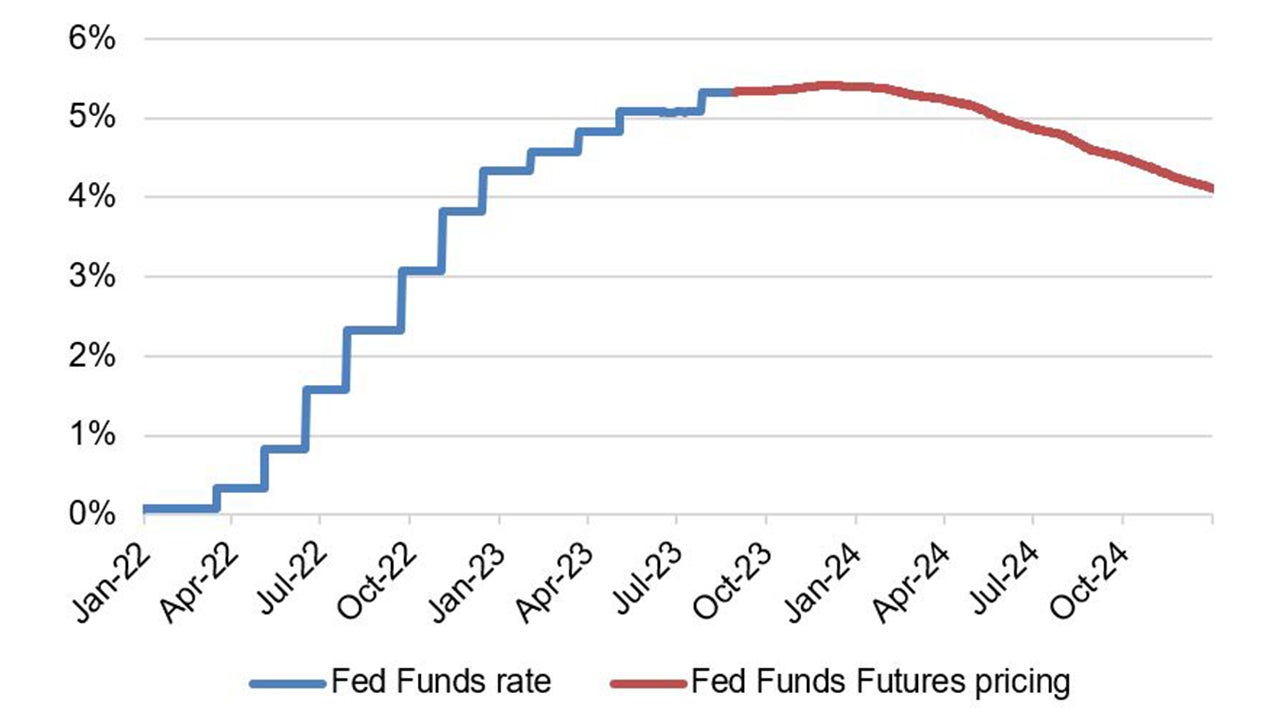

There’s nothing in the July data that leads me to believe that the Fed will raise rates in September.

Source: U.S. Bureau of Labor Statistics (BLS). Data as of 10 Aug 2023.

A deep dive on the CPI data

In the July print, core goods prices fell by -0.3% m/m though core services prices accelerated by 0.4% m/m driven almost entirely by shelter.1

It’s important to note that shelter is a lagging indicator and that new rent inflation has already fallen meaningfully.

This would suggest that over the coming quarters, shelter inflation is likely to trudge downwards to more normalized levels (perhaps even to below pre-COVID levels).

More so, if we strip out shelter for the month of July, then core inflation was closer to 2.5% y/y in the month1 – which corresponds to a 2.0% PCE reading (personal consumption expenditures).

PCE weighs the shelter category differently than CPI and is the Fed’s preferred inflation marker. In sum, there currently exists a pathway towards 2% inflation without further rate hikes.

Just as we have been saying, the disinflationary process is well underway. Some data points will be imperfect but the disinflationary trend is strengthening. I am very encouraged to see core CPI up just 0.2% for the month.

Outlook

I believe this increases the odds further that the Fed doesn’t hike in September. However, I don’t expect dovish rhetoric. I believe the Fed will maintain a hawkish tone to keep a lid on financial conditions, to prevent markets from getting ahead of themselves.

Source: Federal Reserve, CME Group, Macrobond and Invesco. Data as at 10 Aug 2023.

Going forward, we will want to watch consumer inflation expectations carefully – recall that that is an important part of the calculus for the Fed.

In June 2022, the CPI print and the Michigan inflation expectations survey prompted the Fed to hike 75 bps rather than the 50 bps that had been telegraphed to markets, so expectations matter to the Fed because the Fed believes they are predictive.

We will get the preliminary Michigan survey on Friday and the NY Fed survey on Monday. Higher than expected consumer inflation expectations could cause the Fed to think twice about not hiking in September.

With contribution from Kristina Hooper