Key takeaways from US January CPI data

The US January CPI print came in slightly higher than expected - all but extinguishing the chances for a Fed rate cut anytime soon.

Despite the strong market reaction, we are not rattled by the latest print.

The disinflation process remains, though it could take a little longer than originally anticipated.

What’s important here is that virtually all components are moving in the right direction - the upshift in one month’s inflation report does not call for a trend.

We are not forecasting any changes to our future core inflation expectations.

A deep dive into the CPI data

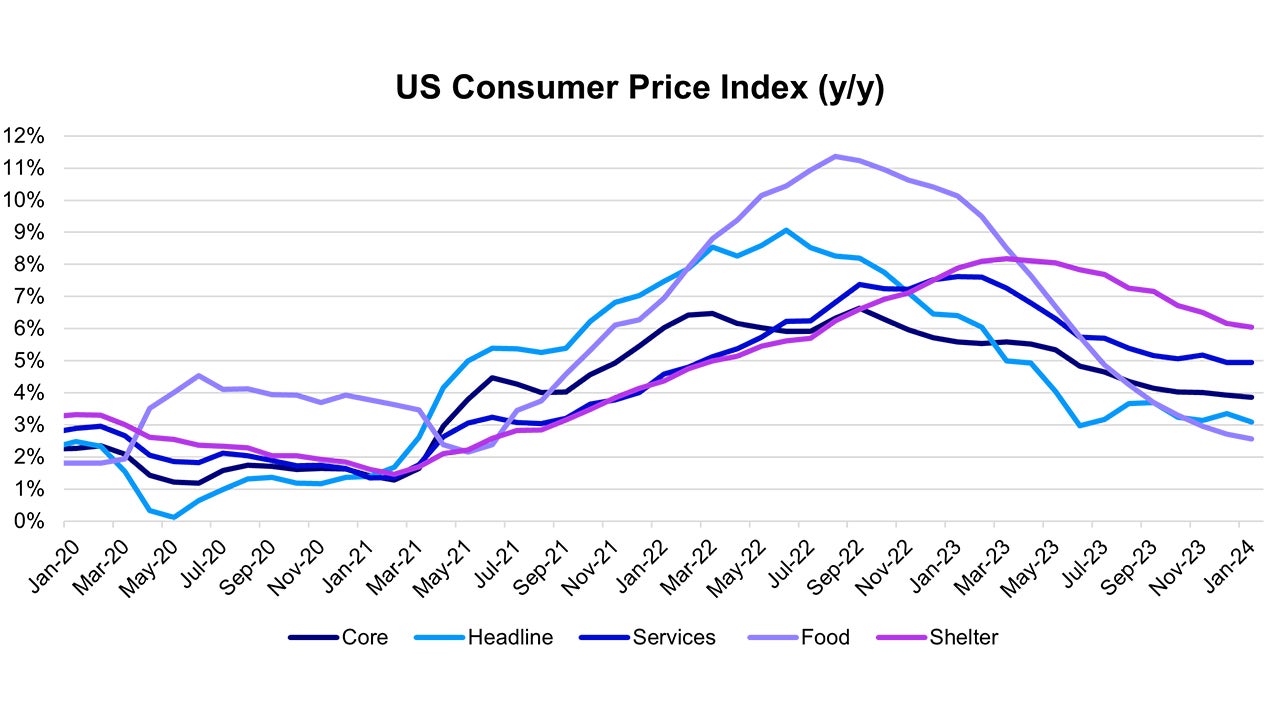

For the month of January, headline CPI accelerated to +0.31% m/m (vs median forecast +0.2%, prior month +0.23%) and core CPI rose +0.39% m/m (vs median forecast +0.3%, prior +0.28%).1

On a y/y basis, core CPI rose +3.86% (vs median forecast +3.7%, prior +3.93%).1

Most of last month’s upside surprise was driven by the strong rental / shelter component, though core services inflation such as medical, personal care and childcare also came in strong.

The shelter component remains high (at 6.0% y/y) but is falling (it is around 45% of the core CPI index).1

Source: US Bureau of Labor Statistics (BLS). Data as at 13 February 2024.

There tends to be a lag of around 18 months between house prices and the shelter component, so this component should continue downward until at least the end of this year.

Let us point out that core CPI ex-shelter was 2.0% over the past 6 months, annualized.1

Core PCE supports the overall disinflation narrative

Also noteworthy is that the Fed’s preferred inflation gauge is Personal Consumption Expenditure (PCE) – specifically core PCE, which has been relatively tamer when compared to CPI and thus more strongly supports the overall disinflation narrative.

Core CPI has not been a good predictor of core PCE over the past few months since the rental / shelter component has a much smaller weight in the PCE basket. Core PCE on a 6-month annualized basis, is currently running just under 2.0% y/y.2

Investment Implications

We are not surprised by the visceral market reaction although we believe it is an overreaction.

We had a big run up in stocks over the last few months, and that was at least partially due to expectations around fed rate cuts.

Those expectations seem to have been dashed by this print, so a sell-off makes sense, as does rising yields & a strengthening dollar.

While the odds have decreased for a May rate cut, we don’t believe that it’s completely off the table.

While the January inflation data suggests that the Fed is not too tight, it’s unclear how quickly the disinflationary process will transpire over the coming months – the Fed is unlikely to sound dovish while inflation lurks around the corner.

EM markets have recently started to price in the benefits of Fed easing after a challenging 2023.

We still prefer EM equities and local currency debt. We don’t believe that actual Fed easing from here is a prerequisite for EM outperformance.

We prefer to be broadly diversified within EM – since we see most EM economies benefitting from lower inflation and easing monetary policies this year and supported by a recovering North Asia tech cycle.

With contribution from Kristina Hooper, Thomas Wu