Q4 Investment Outlook

As we enter the final few months of the year, markets appear to trade with a notable sense of calm, seemingly discounting persistent policy uncertainty out of the US and unresolved geopolitical tensions.

The brief spike in volatility triggered by the April 2 announcement of reciprocal tariffs has since faded, perhaps reflecting the market’s tendency to fade policy shocks and return focus to underlying fundamental and growth dynamics.

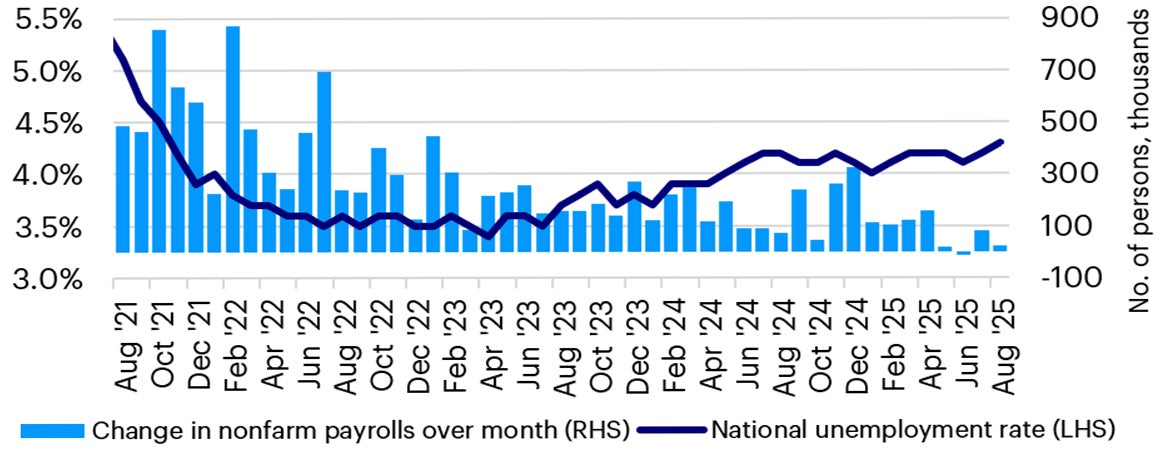

While the US economy is losing some momentum, the broader macro backdrop remains constructive with outright recession risks appearing limited. Labor market conditions are clearly cooling as hiring demand eases and payroll figures are revised lower.

Source: U.S. Bureau of Labor Statistics (BLS) and Invesco. Monthly data as of August 2025.

Against this backdrop, central bank policy signals point to a narrower path ahead. The Federal Reserve (Fed) cut rates for the first time this year at its September Federal Open Market Committee (FOMC) meeting even as inflation remains above target and financial conditions stay loose, supported by elevated equity markets and compressed credit spreads.

The Fed’s updated dot plot delivered a mildly dovish signal, indicating expectations for three rate cuts this year, albeit by a narrow margin.

Tariff‑related price pressures are expected to lift inflation in the near term, but these pressures seem to be more transitory in nature rather than the start of a sustained trend.

Investment Outlook

For investors, we believe that volatility in the weeks and months ahead may more likely present selective entry points than to mark a turn in the cycle.

We believe that markets are right to be more composed than during April’s “tariff tantrum”, primarily because the macro backdrop seems to be more accommodating this time.

Perhaps more importantly, the risk of a full‑blown trade war appears low. Countries facing the steepest duties, such as India and Brazil, account for only a small share of US imports.

Fixed Income

Yield curve steepening is likely to continue, as incremental cuts from the Fed brings the short end down but concerns over the US budget deficit and Fed governance may keep the long end more range bound.

Short‑duration assets continue to offer a relative yield advantage, while longer‑dated yields remain subdued versus historical norms.

In credit, spreads remain historically tight in both investment grade and high yield. While supported by solid fundamentals and earnings resilience, the current environment argues for a selective approach.

According to our observation, demand for credit remains robust, providing strong support for the market backdrop, likely reflecting that all-in yields remain attractive on both a real and nominal basis, particularly income-focused investors.1

We prefer corporate investment grade debt, which offers a similar risk‑return profile to government bonds, while corporate high yield spreads have tightened further. Within investment grade, we favor the UK and emerging markets over a neutral stance on the US and EU, supported by more attractive all‑in yields.

Equities

Equity valuations are high in the US but tech earnings growth remains resilient. Cyclicals may continue to outperform on the prospects for rate cuts. Bank stocks may benefit as yield curves steepen, and margins improve.

European stocks have outperformed the US this year but that has largely been driven by valuation multiples re-rating. Sustaining the rally will likely require an earnings pickup, which could be supported by incoming fiscal stimulus from large infrastructure and defense spending plans.

UK stocks also have more valuation appeal, alongside a sector profile that combines income rich defensives and economically sensitive cyclicals.

Hong Kong and China equities have taken off. Low rates in China are prompting domestic investors to buy equities, particularly those listed offshore in Hong Kong. Valuations still appear cheap relative to global peers, and the “anti-involution” campaign may help support margins and earnings growth by curbing excessive competition.

Overall, the current environment argues for a diversified approach, while taking a bit of market risk in anticipation of a global growth rebound next year.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.