Insight

Re-globalization (4) Chinese companies set to benefit from a second global supply chain

When we talk about China’s re-globalization, one of the key trends that investors should focus on is China’s active participation and contribution to the second global supply chain.

This helps China’s corporations to remain competitive in the global arena.

A win-win situation

- Chinese companies are establishing manufacturing hubs in various locations worldwide, a trend that sees clear signs of acceleration in the past few years - a win-win situation for both China and the rest of the world.

- This approach helps them to navigate trade restrictions, reduce costs, and maintain profit margins by diversifying their production bases.

- China's overall efficiency remains competitive due to its well-established production and logistics infrastructure, abundant labor force, engineers and strong entrepreneurship culture.

- Chinese companies possess a comparative advantage thanks to their access to a vast domestic market. This enables them to achieve significant economies of scale, resulting in substantially lower production costs.

- This will create a substantial win-win situation for the rest of the world, considering its lower costs, particularly when most economies are suffering from high inflation.

China’s competitive edge in securing a second global supply chain

- China’s manufacturing activities and products cover all 41 major categories, 207 medium categories, and 666 sub-categories in the UN classification. It is the only country in the world that has such complete supply chain and manufacturing capabilities1.

- China’s dominant position in the supply of key items certainly stand it at good stead in establishing manufacturing hubs in other locations. For example, China supplies globally 86% of batteries, 85-97% of solar products and 70%+ of air conditioners2.

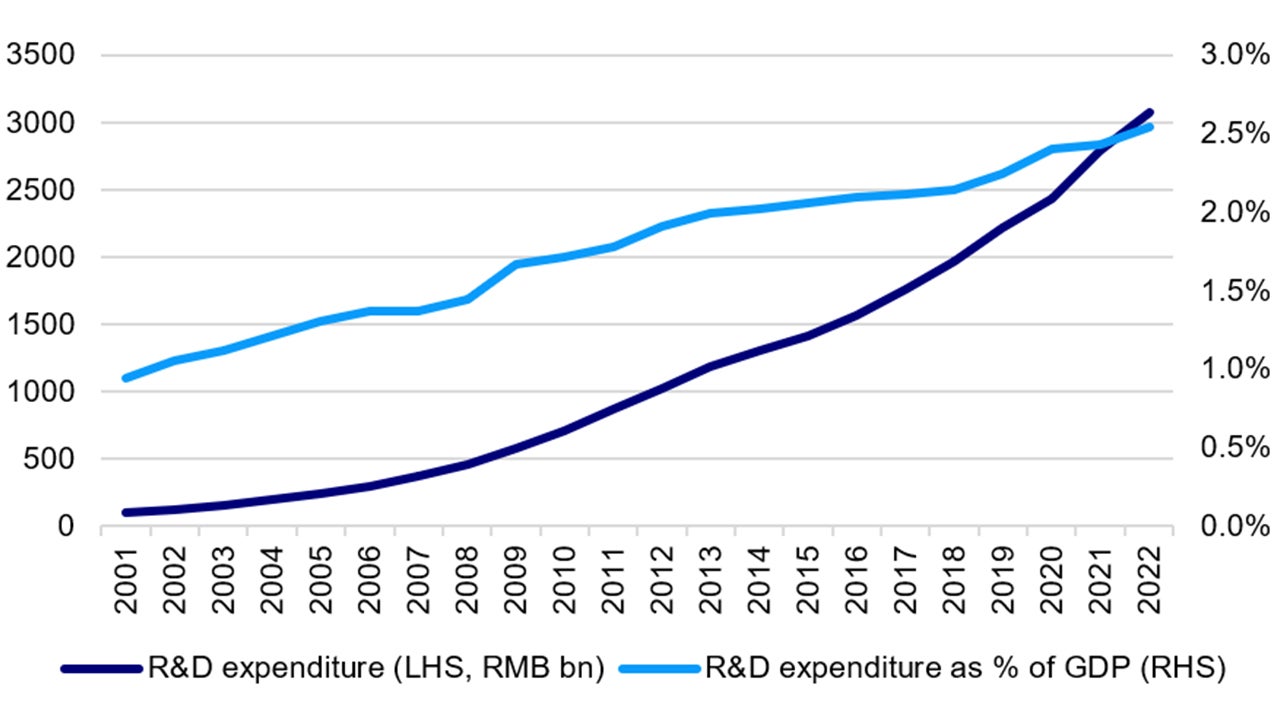

- On the other hand, China’s key competitive edges also include adequate engineers, and lower cost of production relative to developed countries. Chinese companies have been steadily boosting investment in research and development.

Chart: China R&D expenditure and as % of GDP

Source: National Bureau of Statistics of China. Data as of 2022.

Example – China’s auto industry

- Chinese auto companies have established factories worldwide as part of their strategy to expand and diversify their supply chain.

- A leading EV company in China has developed vertical supply chain, capable in manufacturing 70% of auto parts in-house3. This enables the company to maintain cost leadership and competitive advantage in the highly competitive EV market.

- The key areas of cost leadership are the battery and the electric powertrain, a result of in-house manufacturing depth, allowing for integrated solutions.

- The Chinese EV industry is undergoing a phase of consolidation, but the winners of this consolidation (which we believe will be those with a second global supply chain) are likely to pursue a global expansion strategy, taking market shares globally.

Investment implications

- As China’s re-globalization continues, it is important to identify key investment themes to tap the emerging opportunities.

- We believe that Chinese corporations, which are capable in contributing to the second global supply chain, will have the key competitiveness in terms of cost, technological advance and most important of all, be more resilient to any change in geopolitical relations. This will help drive the sustainable growth of their businesses - making them attractive investment opportunities for investors.