Rising US debt ceiling anxiety

The Treasury department recently warned that the government could reach a moment when it will no longer be able to meet its financial obligations as early as 1st of June if Congress does not raise or suspend the debt limit, putting pressure on lawmakers and the president to hasten a deal in order to avoid a default.

Ultimately, Congress is likely to raise the debt successfully though it won’t be without a period of anxiety. Policy uncertainty typically leads to market volatility.

A recent nonpartisan Congressional Budget Office report confirms the earlier than expected default date, which can be attributed to weaker capital gains tax receipts from the prior months.

The Treasury has around $100bn of Medicare and Social Security payments during the first few days of June and would run out of funds before it could get to 15th June, when a slew of corporate tax receipt are expected to come in.1

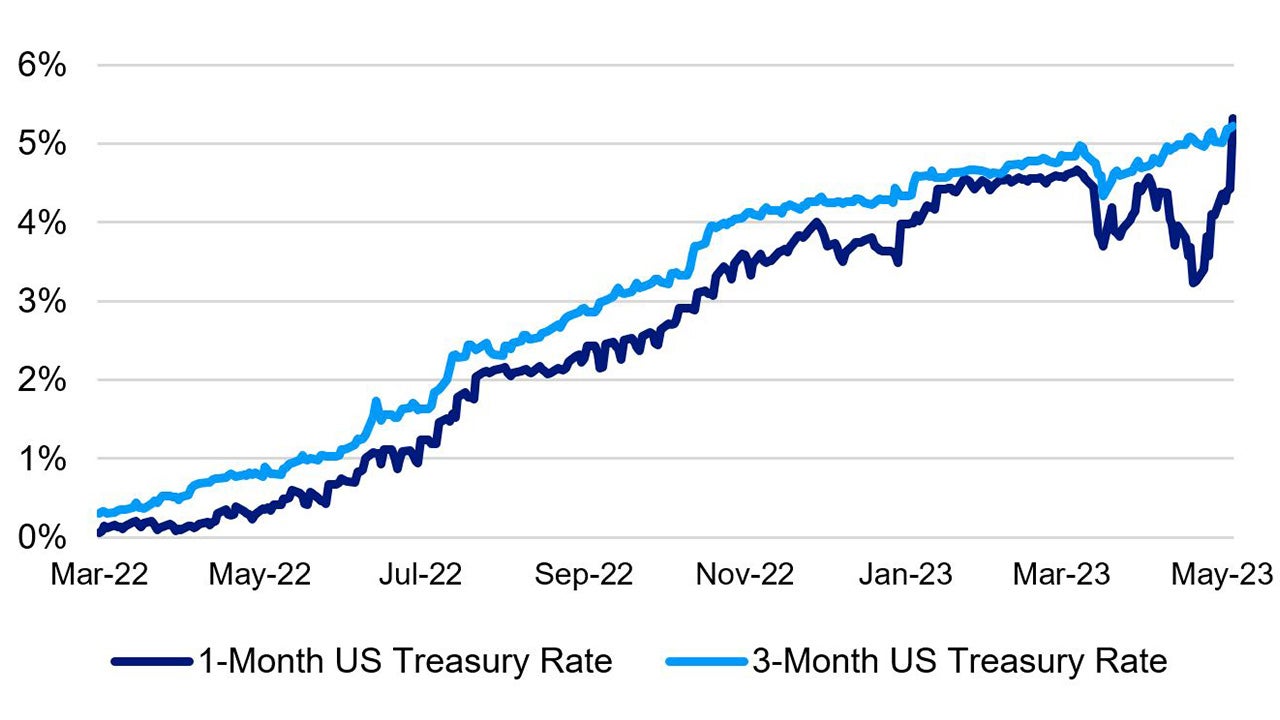

It’s no wonder that 4-week T-bill yields has surged 70bps from the prior week and went from trading rich relative to the overnight benchmark rate to trading 40-50bps cheap.2 Investors are less willing to invest in instruments which mature when the debate may be most intense.

Source: Bloomberg, data as of May 5, 2023.

Our take

This debt ceiling “game of chicken” presents heightened risks to the financial markets as they hope for a quick resolution and brace for a potential default. It brings back memories of 2011, when Congress refused to pass a debt ceiling bill until the last possible minute.

While it was ultimately resolved after Congress agreed to a multi-year set of spending cuts, financial markets experienced significant volatility as a potential Treasury market default loomed.

What makes this debt ceiling saga interesting is the economic backdrop. The Federal Reserve increased interest rates aggressively in 2022 to bring inflation under control, but the full effect of these rate hikes is still filtering its way through the economy as we wait for Congress to resolve the debt ceiling issue.

The confluence of factors - the potential for a slowdown in economic growth, recent banking crisis and the perceived risk of default - could cause investor risk sentiment to deteriorate.

The possibility that one or more of the rating agencies could downgrade the US has also increased, similar to when Standard and Poor’s downgraded the US in 2011 from AAA to AA+.

I believe that Congress will ultimately raise or suspend the debt ceiling, allowing the US government to resume normal debt issuance and financing activities. But this resolution will likely go down to the wire, as the Biden administration is asking for a clean, no-strings-attached debt ceiling bill.

However, some members of Congress are seeking spending cuts before they agree to any increase, which will likely raise the negotiating stakes and make a quick resolution unlikely.

Investment implications

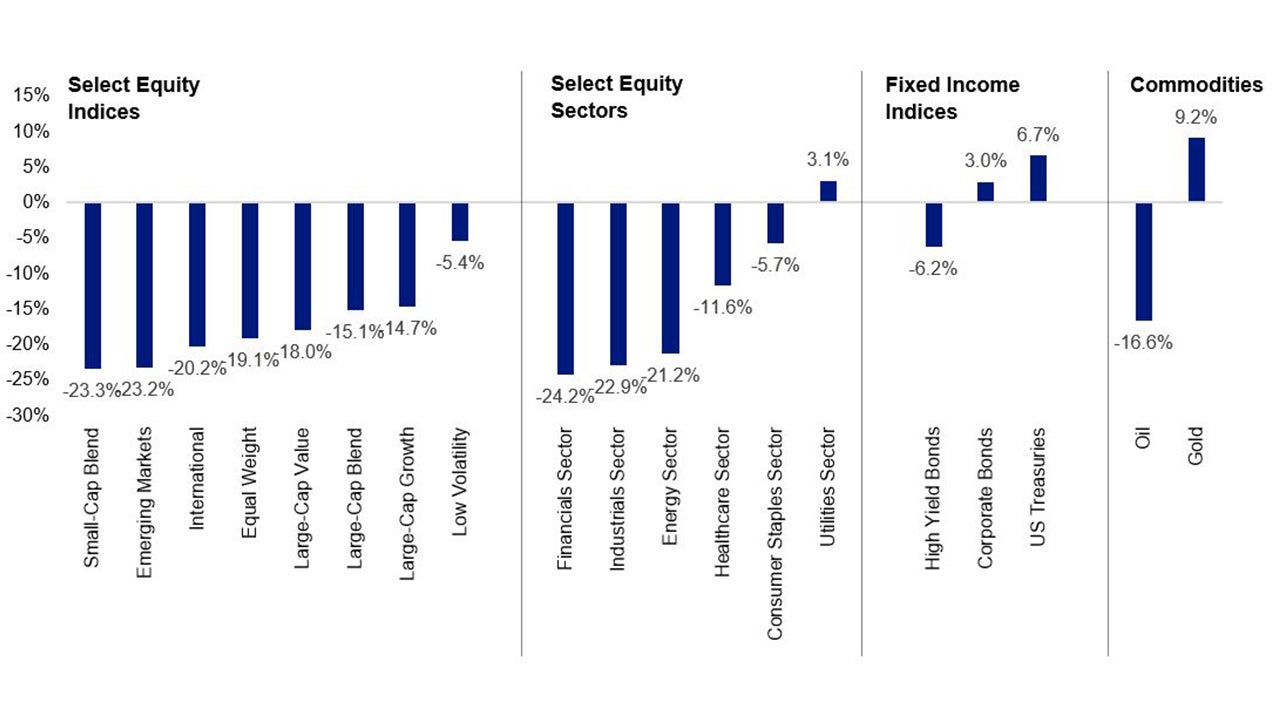

The debt ceiling debates of 2011 resulted in a risk-off environment that ultimately created a buying opportunity for investors. From July 2011 to September 2011, equities sold off with higher quality stocks and defensive sectors outperforming.

MSCI EM unperformed -23.2% Treasuries (ironically) and gold rallied.3 APAC market participants should prepare for liquidity conditions in the US to tighten as the debate plays out.

In the near term, I don’t believe there’s any rush to go risk-on as investors await the Fed’s rate guidance and for the never-ending debt ceiling drama to play out.

Similar to 2011, I believe more risky assets are likely to experience the brunt of market volatility. I believe it would make sense for investors to store up a bit of dry powder to take advantage of some buying opportunities that could arise from the debt ceiling volatility, especially emerging market and US small cap stocks.

Source: Bloomberg, data as of March 31, 2023. Small-Cap Blend is representative by the Russell 2000 Index. Emerging Markets is represented by the MSCI EM Index. International is represented by the MSCI ACWI ex-US Index. Equal Weight is represented by the S&P 500 Equal Weight Index. Large-Cap Value is represented by the Russell 1000 Value Index. Large-Cap Blend is represented by the S&P 500 Index. Large-Cap Growth is represented by the Russell 1000 Growth Index. Low Volatility is represented by the S&P 500 Low Volatility Index. The equity sector returns are represented by the Global Industry Classification Standard (GICS) Level 1 sector groups of the S&P 500 Index. High Yield Bonds represented by the Bloomberg US Corporate High Yield Bond Index. Corporate Bonds represented by the Bloomberg US Corporate Bond Index. US Treasuries represented by the Bloomberg US Treasury Index. Oil is represented by the price per barrel of US West Texas Intermediate Crude. Gold is based on the spot price in US dollar per troy ounce. Indices cannot be purchased directly by investors.

With contributions from Brian Levitt and Kristina Hooper.