Russia-Ukraine war update - Geopolitics and the impact on the APAC region

It’s been a turbulent time for markets following the invasion of Ukraine on 24th February and the resulting sanctions imposed by Western countries on Russia shortly thereafter. While there have been recent, hopeful signs of a possible ceasefire, the situation remains dynamic and fluid.

The outlook for global growth appears less certain - the EU economy is expected to take the brunt of the geo-economic impact, followed by the US and finally the APAC region. Overall, APAC economies remain relatively insulated due to the region’s limited trade links with Russia, low consumer price inflation and more dovish monetary policies.

Commodity prices and demand for Asian products

In my base case, I assume an ongoing geopolitical crisis for the next couple of quarters and that Russia does not disrupt energy supplies to Europe, which could mean that the price of oil trades around USD 110 /bbl. This is around 10% higher than where it started at the beginning of the year.

Real GDP growth in the region could be lowered by 40 - 50bps than prior estimates due to a near-term rise in commodity prices along with a possible dent in European demand for Asian products.

Source: GS Research. Data as of Feb 2022.

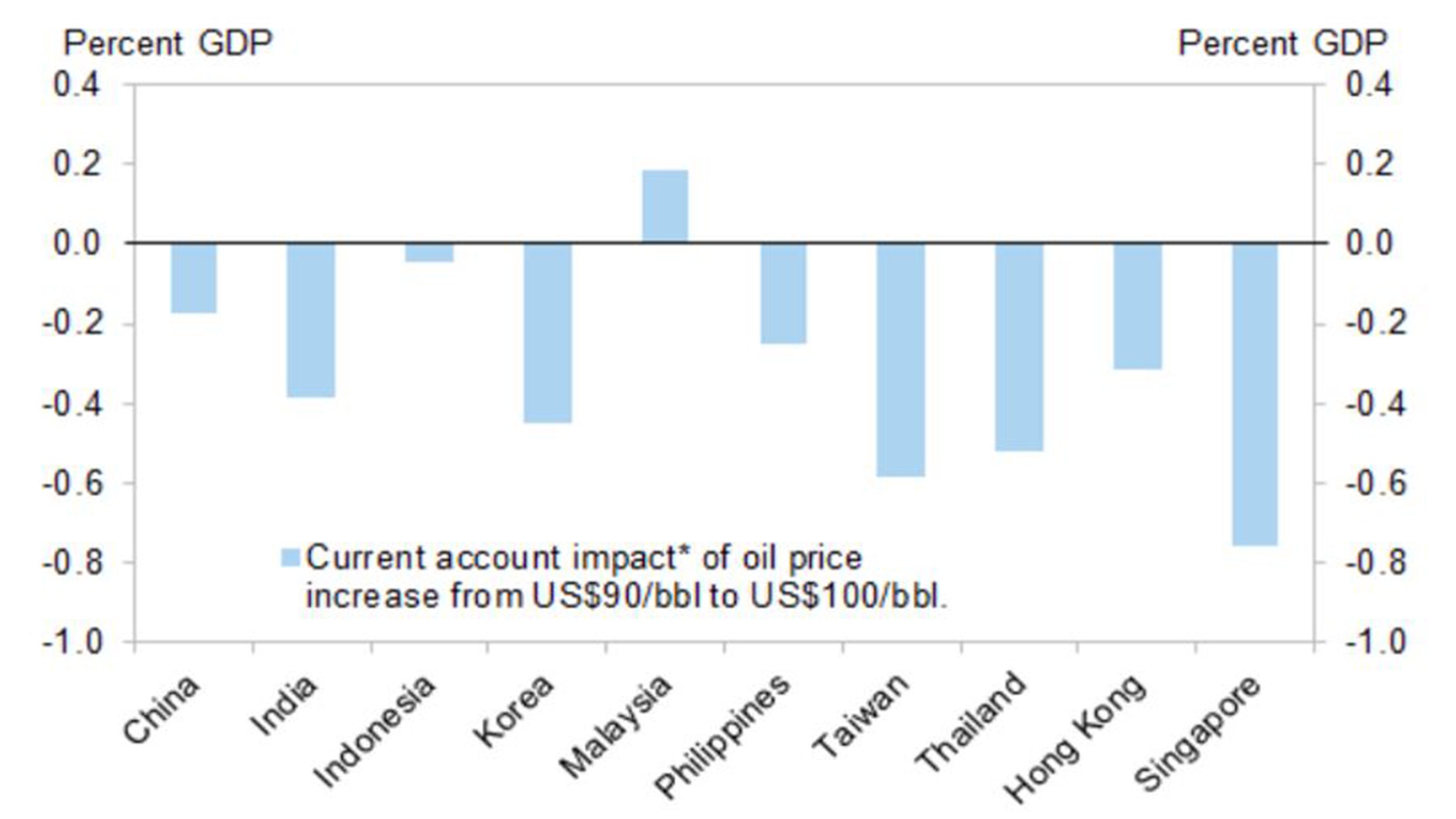

Historically, the price of Brent hasn’t had a meaningful impact on APAC’s growth forecast, currency or risk assets. Still, higher oil prices could start to encroach on each Asian economy’s current account deficits – except Malaysia which is a net crude oil exporter.

If oil prices remain elevated, the economies that should see the biggest current account impact are India, Korea, Taiwan and Thailand. This could then further translate into a real income hit for households – though policymakers are likely to partially blunt the impact through fuel subsidies and other fiscal stimulus schemes.

On the other hand, rice prices have more of an impact on the region’s inflation and economy – even with prices +18.99% y/y, this still pales in comparison to wheat prices which are +64.52% y/y.

Overall, consumer price inflation in the region remains largely under control and most Asian central banks have the luxury to take a much more dovish monetary policy stance that could make cause their local currencies to underperform the USD as rates and yields quickly rise due to high inflation.

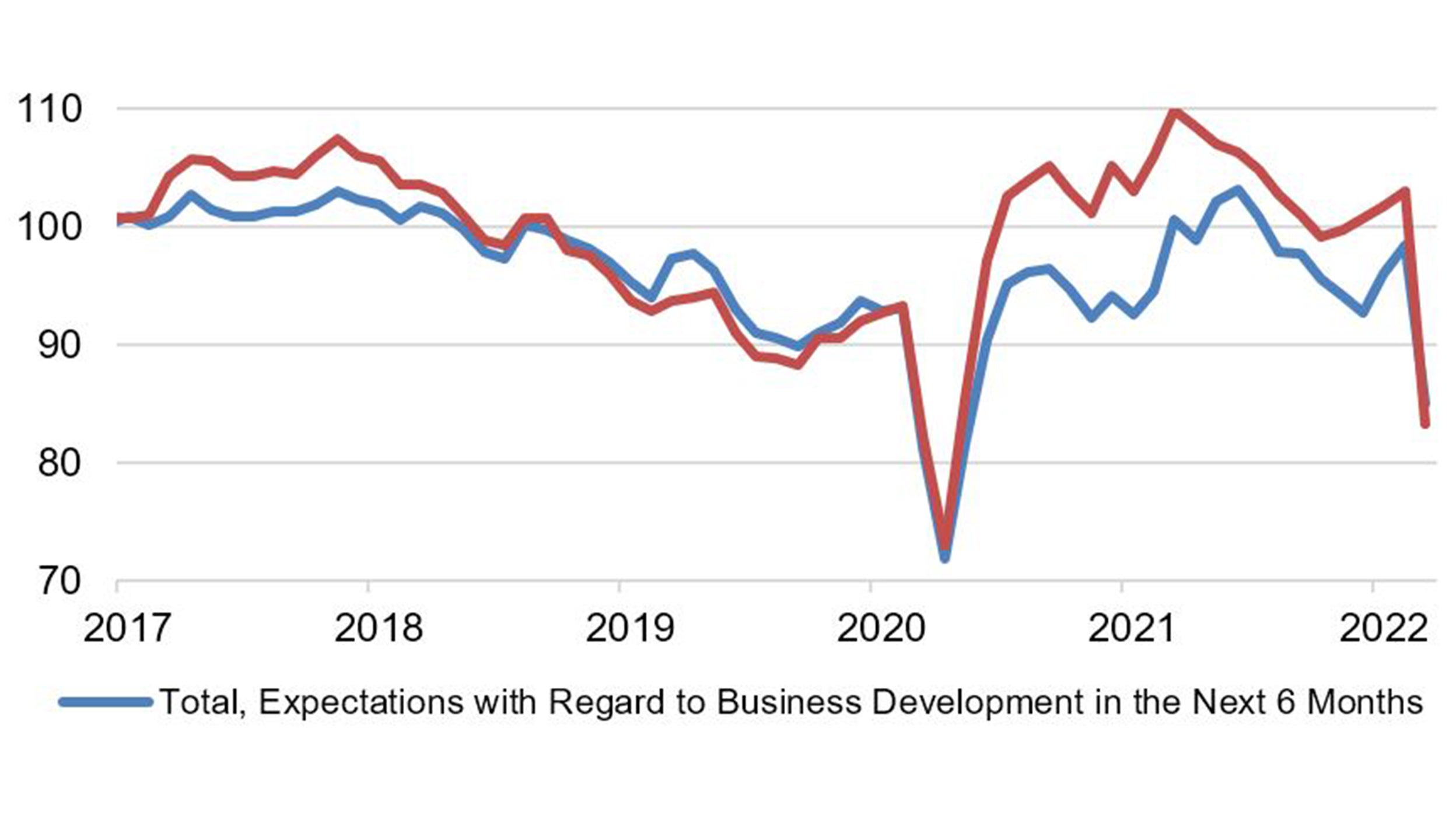

Where I’m keeping a closer eye on is external demand. German business sentiment, as measured by the IFO German Business Expectations Index, dropped 13.3 points in March. This was driven by extreme uncertainty and that makes sense given how close Germany is to the epicenter of the crisis.

Faltering European demand is challenging – as there tends to be a correlation with weaker Asian export volumes. It’s possible that trade-oriented economies in the region could start to see creeping export volume headwinds in the March monthly data.

Source: Ifo Institute. Data as of March 2022.

The APAC region may see a mini-consumption boom

Still, weaker export volumes could be largely offset by the region’s opening-up rebound. Policymakers around the region appear to be racing each other to ease COVID restrictions, much more quickly than I anticipated.

In addition to a relaxation of most social distancing restrictions, quarantine-free international travel is possible starting in April in many APAC countries. This could be the start of a mini-consumption boom in the region that mimics the one most Western countries experienced a year ago, that drives greater credit impulse and bank lending and gives a shot of adrenaline to the region’s capex cycle.

Investment Implications

Overall, I continue to remain overweight on the APAC region, neutral on the US and underweight Europe.

I believe that bonds have been oversold recently due to fears that central banks won’t be able to tackle high inflation and facilitate a soft economic landing.

As rates and yields rise, within equities, I believe that there will continue to be a rotation from growth to value and defensives to cyclicals.