The Fed’s renewed easing and impact to markets

The Federal Reserve (Fed) delivered a widely anticipated 25-basis-point rate cut, leading the policy rate at 4.0% – 4.25%1 and signaled that further easing is likely.

Notably, there was one dissent favoring a more aggressive 50bp cut in September. However, Chair Powell’s remarks leaned slightly hawkish - he stopped short of committing to a neutral rate, instead describing the current stance as “more neutral” and noting that policy is moving “in the direction of neutral.”

The accompanying press release statement highlighted a slowdown in job growth, a rise in the unemployment rate, and persistently elevated inflation. It also underscored increasing downside risks to the labor market.

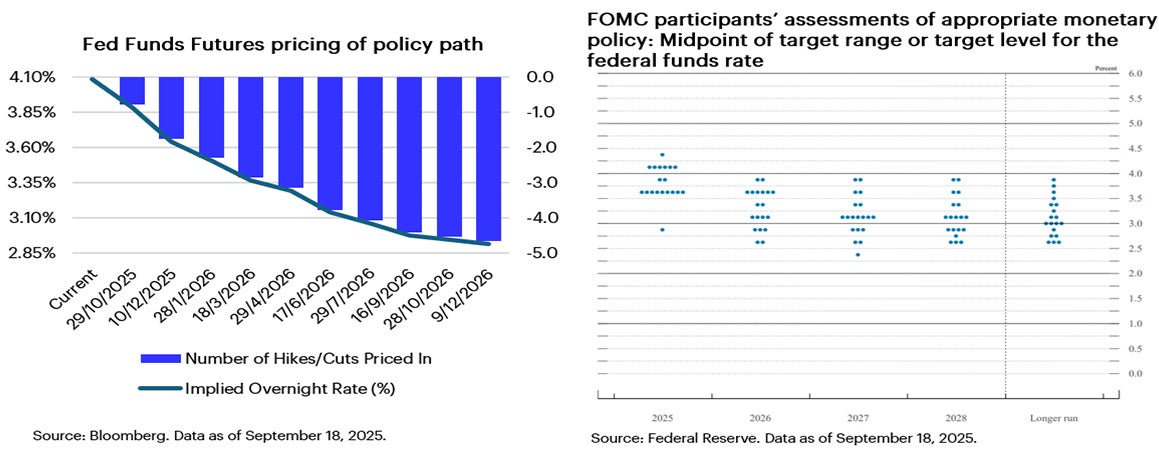

Still, the Fed’s updated dot plot delivered a mildly dovish signal, indicating expectations for three rate cuts this year to 3.625%1, albeit by a narrow 10-9 margin.

For 2026, the dot plot was lowered to 3.375% which implies only one further 25bp rate cut for next year, which is notably above the market’s implied rate of 2.911%.1

We continue to expect two additional 25bp rate cuts by year-end and a further cut in the beginning of next year.

Investment Implications

US equity index futures advanced in early Asian trading following the rate cut while the decline in US Treasuries signals disappointment from market participants who had bet on a more dovish Fed and aggressive series of rate cuts.

The performance of US stocks during easing cycles is dependent on the state of the economy. The US stock market has historically posted strong returns after the start of an easing cycle when the economy didn’t fall into a recession within the subsequent 12 to 18 months.

For this cycle, we do believe that US stocks have priced-in a lot of the rate cuts.

So in this new Fed easing cycle, we believe investors may maintain a well-diversified portfolio while selectively increasing exposure to Emerging Markets (EM) equities and EM local currency bonds.

Additionally, we see potential for real estate to outperform in a falling interest rate environment.

Fed rate cuts throughout the remainder of the year are likely to weaken the USD while also opening the door for Asian central banks to cut rates further.

A weakening USD, easing monetary policies around the APAC region and retreating oil prices have historically been a good environment for EM to out-perform Developed Markets (DM).

And with EM equities currently trading at a one-third discount to their DM counterparts, we believe there is good value to be had.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.