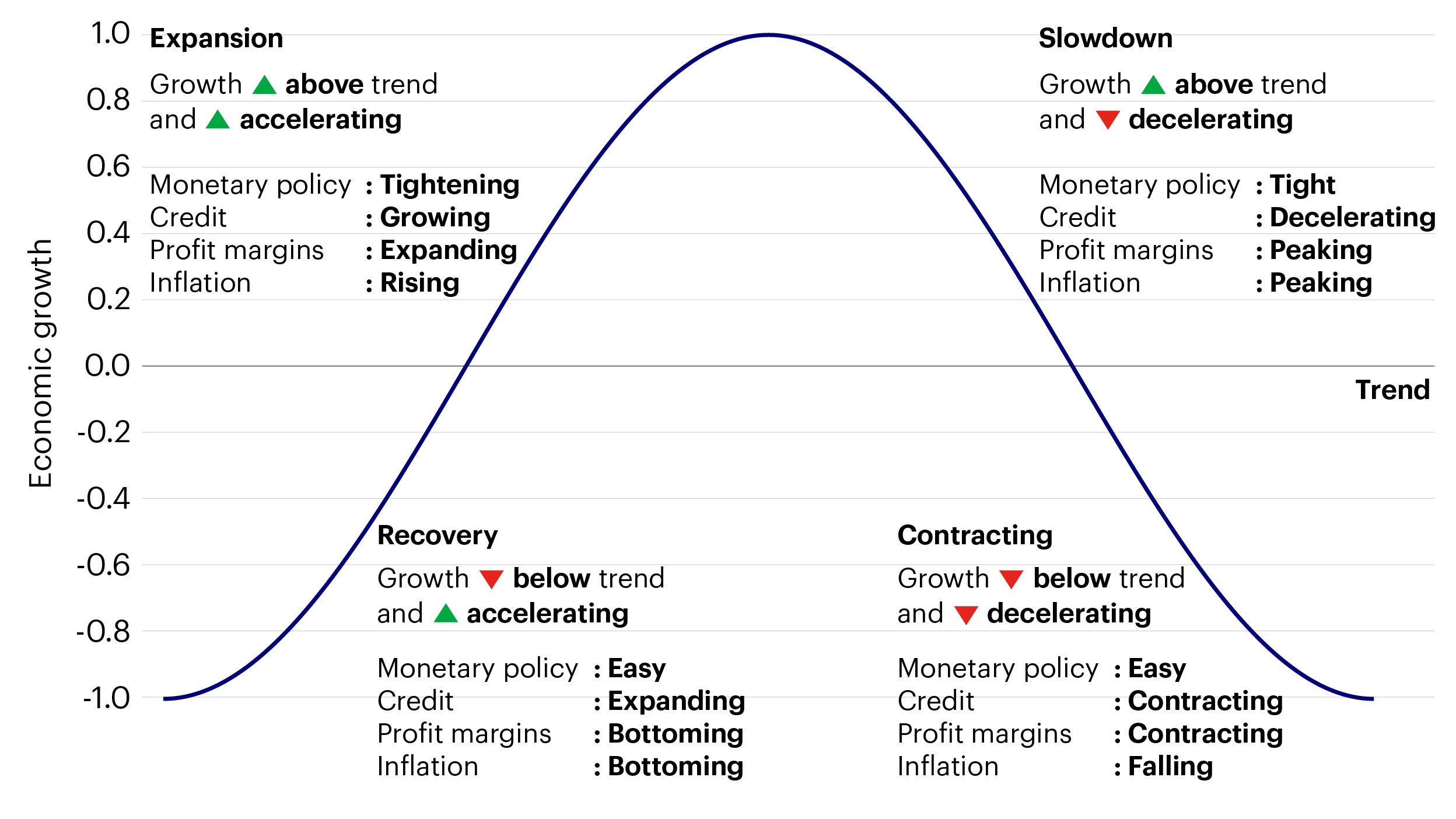

Episode 7 - Positioning bond and equity funds through different cycles

Financial markets, much like the broader economy, move in cycles. While the timing and duration of each cycle can vary, understanding the typical phases of a business cycle - and how to adapt your investment strategy accordingly - can help investors navigate uncertainty and make more informed, resilient decisions.