Episode 8 - Asset allocation, why does it matter?

Does asset allocation really matter?

- Asset allocation is often hailed as the cornerstone of long-term investing. It involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one.

- There is even a widely cited statistic that asset allocation really drive 90% of your investment returns, or is that just a myth? Are 60/40 portfolios still the winning formula? The truth is that there’s no one-size-fits-all formula.

The role of asset-classes

- Asset classes are the ‘building blocks’ of your portfolio.

- Market conditions that favor one asset category may not be favorable for another asset category. By investing in more than one asset category, you could potentially reduce risk and better achieve your long-term financial goals.

- We need to understand the characteristics of each asset class before we work out the allocation.

Different types of asset-classes

- Stocks, or equities represent ownership in companies and are typically used for long-term capital growth. They may seem like the star strikers – dynamic with high-potential, but could be volatile. On the other hand, while bonds may offer relatively lower returns, they provide liquidity and potentially capital preservation – like steady defenders.

- Cash or cash-equivalents are the most liquid asset-class and typically provide little to no returns especially in inflationary periods. But they serve its importance by being extremely liquid to quickly move in and out of a market correction as well as a buffer during an emergency.

- There are also other types of asset-classes including commodities, precious metals, or even alternative asset-classes such as real estate, private equity, cryptocurrency, and derivatives.

- Due to unique characteristics of each asset class, different combinations of equities, bonds, and alternatives over time could have different degree of diversification and risk-return profile.

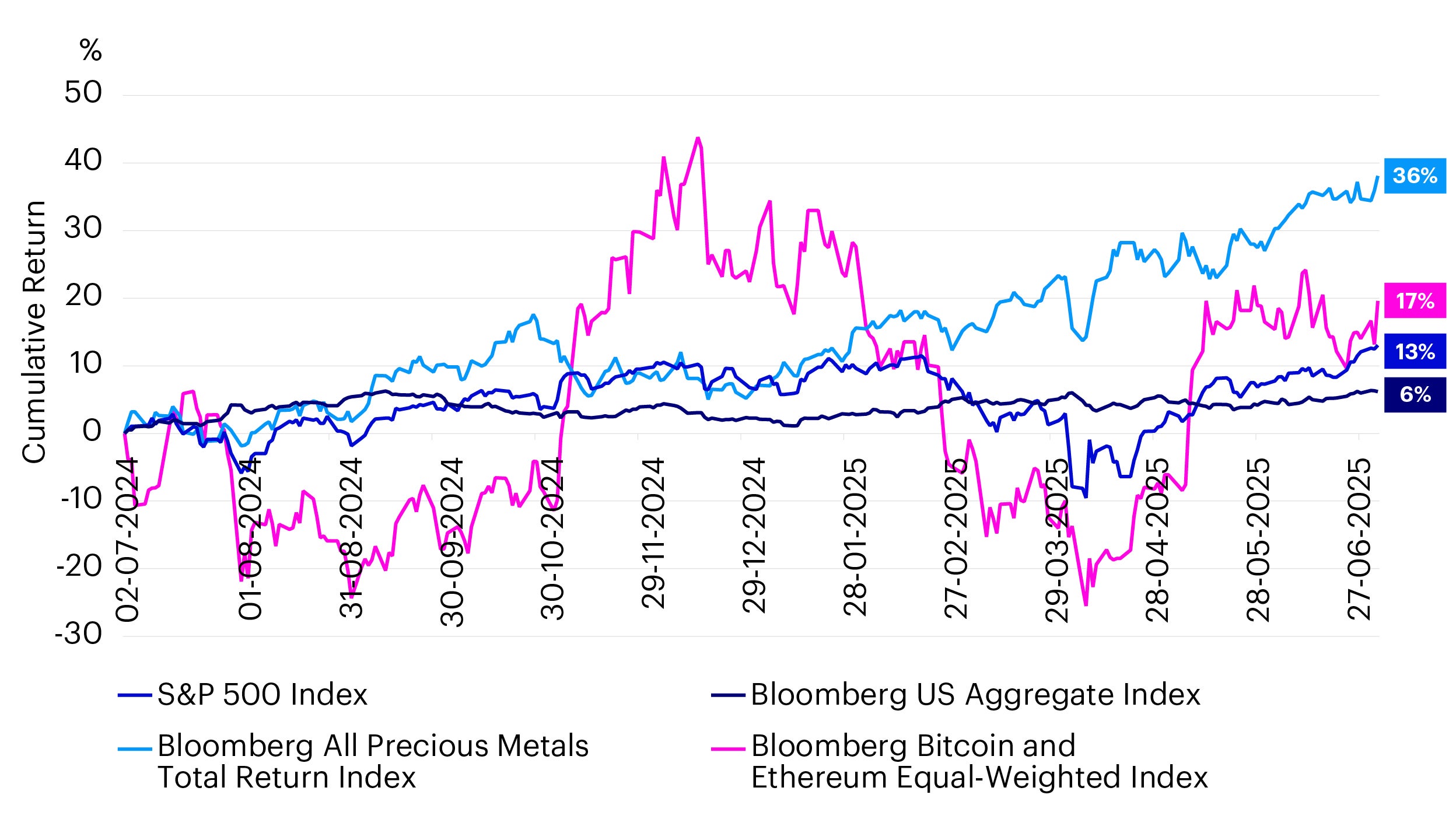

- For example, we can consider the historical performance of some asset classes, represented by indices below.

Asset class |

Represented by… |

|---|---|

US equities |

S&P 500 Index |

US investment-grade bonds |

Bloomberg US Aggregate Index |

Precious metals |

Bloomberg All Precious Metals Total Return Index |

Cryptocurrencies |

Bloomberg Bitcoin and Ethereum Equal-Weighted Index |

Asset class |

Historical Volatility (Higher = More volatile) |

|---|---|

US equities |

17.8 |

US investment-grade bonds |

5.2 |

Precious metals |

18.5 |

Cryptocurrencies |

58.4 |

Source: Bloomberg, as of Jul 2025. Used with permission of Bloomberg Finance L.P. For illustrative purposes only. It does not represent a recommendation to buy/hold/sell the assets. It must not be seen as investment advice. Indexes cannot be purchased directly by investors. Past performance does not predict future returns.

1: The Bloomberg US Aggregate Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

2: The Bloomberg Bitcoin and Ethereum Equal Weight Index tracks the performance of the two largest digital assets, Bitcoin and Ethereum, using an equal weighting scheme.

3: BBG All Precious Metals Index (Total Return) aims to track the performance of holding a long position of precious metal futures contracts; gold (66.7%), silver (11.1%), palladium (11.1), and platinum (11.1%), in combination with the cash collateral invested in 13 week (3 Month) U.S. Treasury Bills.

*: historical volatility is measured over a 365-day period using the Classical Volatility (CLV) model.

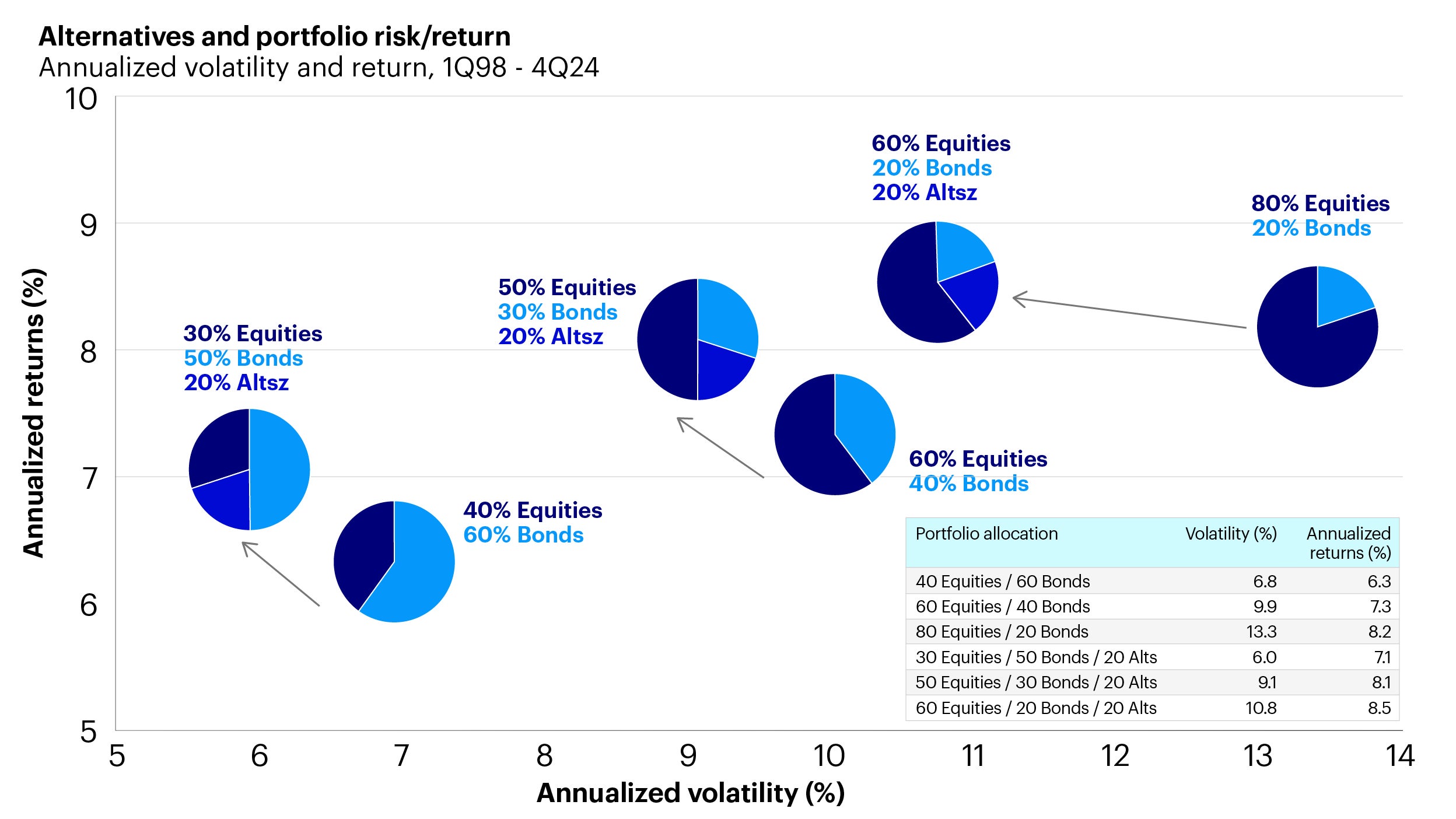

Source: Bloomberg, Burgiss, FactSet, NCREIF, PivotalPath, Standard & Poor’s, J.P. Morgan Asset Management, as of May 2025. For illustrative purposes only. Past performance does not predict future returns.

The alternatives allocation includes hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility is calculated as the annualized standard deviation of quarterly returns.

Factors to consider in Asset Allocation

Time horizon

Investment goal

- An investor with a longer time horizon may feel more comfortable taking on a riskier, or more volatile, investment because he or she can wait out slow economic cycles and the ups and downs of markets.

- Aggressive investors usually have a higher-risk tolerance. They are more likely to risk losing money in order to get better returns in the long run. A conservative investor, or one with a low-risk tolerance, might favor investments that are likely to preserve his or her original capital.

- For example, younger investors saving for retirement 30 years down the road might want a portfolio heavily weighted toward stocks because they believe it may provide greater long-term growth.

- But as you near retirement and then start living off your investments, you have less time to recoup losses if stock prices drop. Thus, you may decide to invest a greater percentage of your portfolio in bonds and cash.

How do investors build a portfolio

- Some investors prefer to do-it-yourself, picking individual stocks, bonds, or ETFs through a brokerage platform. There is full control over asset selection and allocation, and potentially lower fees if managed efficiently. However, this takes time and know-how.

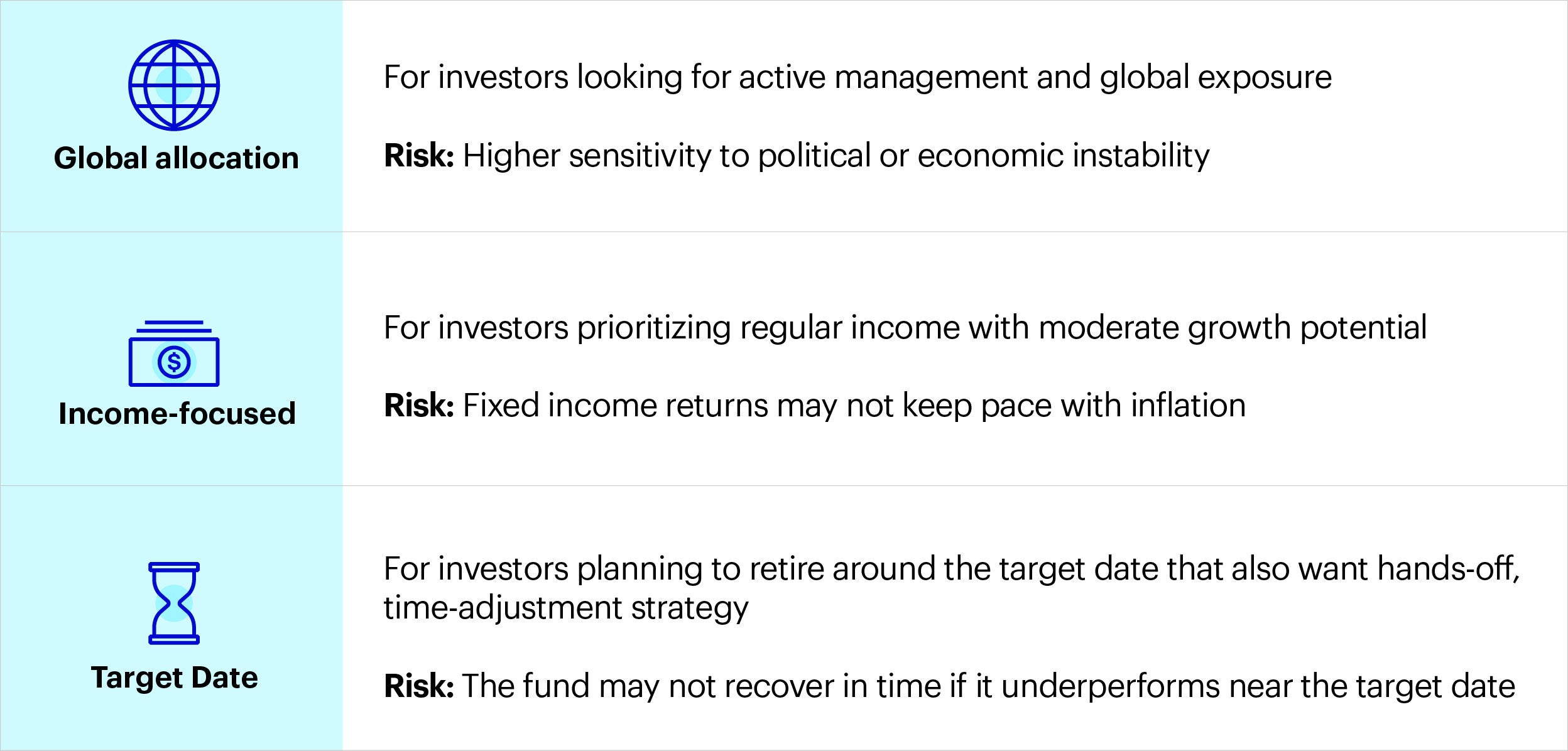

- Others may go for the convenience of multi-asset funds. These professionally managed funds combine different asset classes into a single investment product, while being professionally managed, diversified, and regularly rebalanced. They’re a great option if you want a hands-off approach.

^: There is no guarantee the objective/target could be achieved.

Example for illustration: Asset allocation according to risk appetite^

An example of an aggressive portfolio

Equities (Growth & Emerging Markets) 50%

Venture Capital 25%

Cryptocurrencies 15%

Commodities 10%

An example of a balanced portfolio

Equities (Global Diversified) 40%

Bonds (Corporate and Gov’t) 30%

Private Equity 20%

Cash 10%

An example of a conservative portfolio

Gold 40%

Bonds (Investment-grade) 40%

Cash and Money Market 10%

Equities (Defensive) 10%

^ For illustrative purposes only. There is no guarantee the objective/target could be achieved.

Periodic review of your portfolio

- When your portfolio is up and running, it's important to conduct a periodic review. This will help you see clearly if your portfolio is still in line with your risk appetite and ultimate financial goals, and allow you to make changes to your investments accordingly.

- That includes considering how your life and financial needs have changed and whether it's time to adjust the weighting of your assets. For example, if a moderately aggressive portfolio racked up a lot of gains from stocks recently, you might move some of that profit into safer money market investments.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.