Invesco Global Real Estate Fund

Bringing daily liquidity to direct real estate. A unique strategy combining commercial real estate with liquid assets to provide access to a diversified global portfolio with daily pricing, and the potential for equity-like returns and bond-like income at potentially lower risk.

At a glance

The Invesco Global Real Estate Fund (GREF) is an Invesco Real Estate proprietary fund designed to provide investors with daily pricing and liquidity while accessing direct global real estate investments.

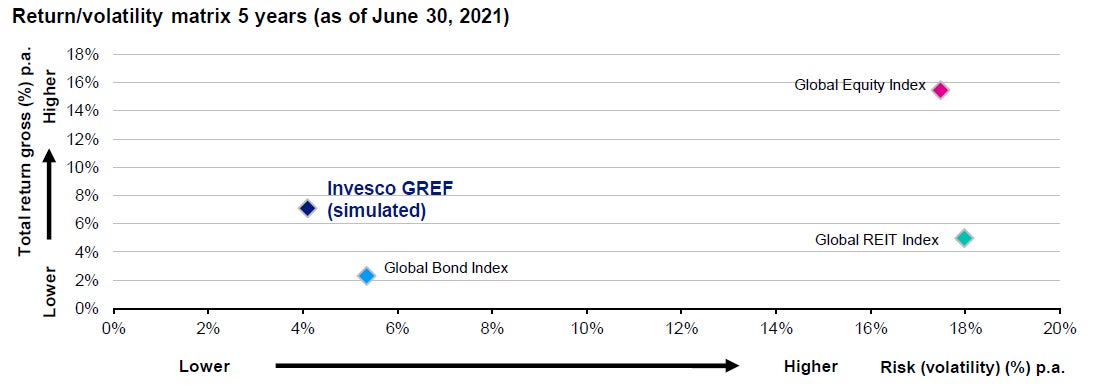

The strategy targets 70% direct, high quality real estate and 30% listed real estate and other liquid securities, cash and cash equivalents for liquidity. By adding a liquid component to the potential for stable income, diversification and strong relative performance (see chart below) offered by Global Real Estate investments, this strategy gives access to high quality, income-generating assets with daily pricing, making it particularly relevant for pension and insurance portfolios.

HIGH QUALITY DIRECT REAL ASSETS

FOCUS ON STABLE INCOME

STABLILITY AND DIVERSIFICATION

Goals

The fund aims to provide, over the long term, an average annual gross total return in line with that of a global core real estate portfolio. The expectation is that, on average, income will comprise 40-60% the total return expressed in USD.

Investment process

The Invesco Global Real Estate Fund allocates approximately 70% to direct access to high quality global real estate via our Global Direct Real Estate (GDRE) strategy, and approximately 30% to a liquidity sleeve comprising of our Global Real Estate Income Securities strategy and cash/cash equivalents.

By investing in these portfolios, GREF gains exposure to over USD $26bn of underlying portfolio assets, composed of 196 investments in 15 different countries (as of 30 June 2020).

The team

With over USD$79 billion in assets (as of 30 June 2020), Invesco Real Estate is one of the largest real estate investment management firms in the world.

Benefitting from the expertise of 571 real estate professionals in 21 offices, in 16 countries around the globe, we have an on-the-ground network of specialists who live-and-breath their local markets.

The team already holds approximately 400 institutional relationships globally, actively investing across the risk/return spectrum in core, value-add, and opportunistic strategies.

Rolling 12-month performance (net total return)

| 12 months period ending*) | July 2016 - June 2017 | July 2017 - June 2018 | July 2018 - June 2019 | July 2019 - June 2020 | July 2020 - June 2021 |

|---|---|---|---|---|---|

| Invesco GREF (actual) |

N/A | N/A | N/A | -0.9% | 8.1% |

| Invesco GREF (simulated) | 6.1% | 7.0% | 6.4% | -1.2% | 13.3% |

| Global REIT Index | 0.2% | 5.6% | 7.7% | -16.3% | 33.6% |

| Global Equity Index | 18.2% | 11.1% | 6.3% | 2.8% | 39.2% |

| Global Bond Index | -2.2% | 1.4% | 5.8% | 4.2% | 2.6% |

Past performance does not predict future returns. Source: Invesco Real Estate, MSCI, Barclays, FTSE EPRA/NAREIT, Lipper and Morningstar as of June 30, 2021. Invesco Global Real Estate Fund simulated performance represents the weighted average of quarterly gross total returns of theunderlying strategies set at the strategic allocation of: 70% in underlying core direct real estate strategies (of which strategic allocation to US core, US Income, Euro core and Asia Core is 25%, 15%, 35%, 25% until Q4 2019 and 25%, 15%, 30%, 30% from Q1 2020, 15%, 25%, 30%, 30% from Q3 20 and assuming 0.2% of operational expenses at GDRE Luxlevel), 26.5% in Global Income Real Estate Securities Composite and 3.5% cash. Portfolio hedging is applied on EUR, AUD and JPY exposure GREF holds through underlying regional direct real estate fund. Based upon a hypothetical investment into GREF. The performance data is for illustrative purposes only and should not be taken as actual returns. This data does not indicate that if the Invesco Global Real Estate Fund had, in fact, existed during the shown time periods that it would have achieved the hypothetical results shown and is not indicative of future results. Actual results would have differed. In each case, we are assuming an investment in Invesco Global Real Estate Fund is made on 1 January, the underlying strategies for the GDRE Lux call the capital immediately, and that there are no distributions during that time (or that distributions are reinvested), and the rebalancingofthe portfolio among the underlying strategies of GDRE Lux would have occurred quarterly at the strategic allocation. Global Equity Index: MSCI World Index, Global Bond Index: BarclaysGlobal Aggregate Bond Index, Global REIT Index: FTSE EPRA/NAREIT Developed Index.