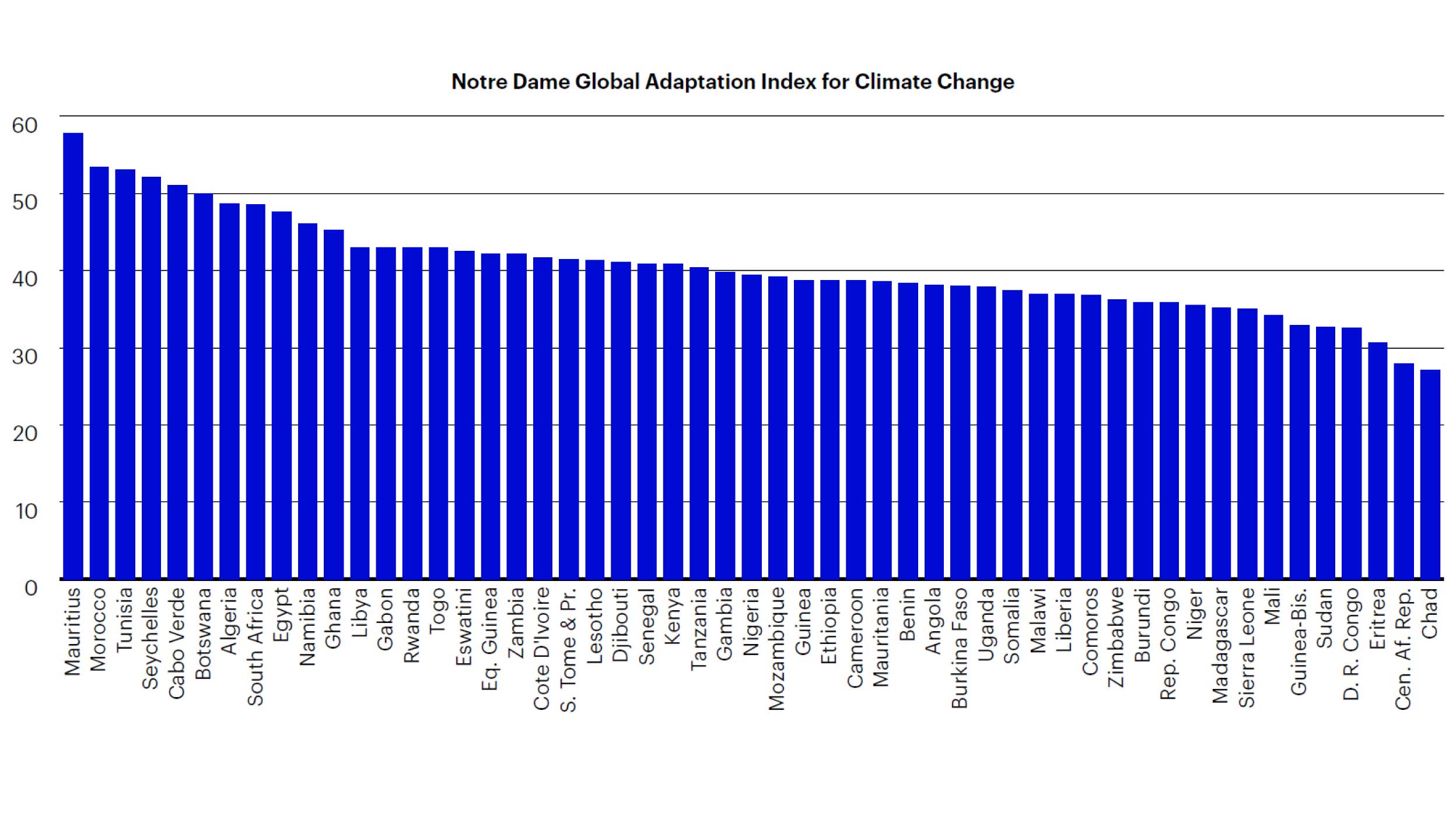

While Africa has contributed less than 3% of cumulative CO2 emissions as of 2022, it seems destined to suffer the worst consequences of global warming. The Notre Dame Global Adaptation Index for Climate Change measures a country’s vulnerability to, and preparedness for, climate change (lower scores indicate greater vulnerabilities). Out of the 185 countries in the index, 41 African countries dominate the most vulnerable third, 11 African countries are in the middle third, and only one African country, Mauritius, is in the top third. Chad faces the lowest score of any country in the world.

Additionally, the UN estimates that Africa will account for 41% of the world’s working age (15-64 years) population by 2100, compared to 15% in 2020. Today’s workers may already be seeking opportunities outside of the region, in advance of potential mass migration, as large parts of Africa could become uninhabitable.

However, it is not too late, and action now can limit future damage. Investors can participate in the solution, and climate change will likely become a dominant investment theme for the rest of the century at a minimum.

Blended finance provides green shoots of hope

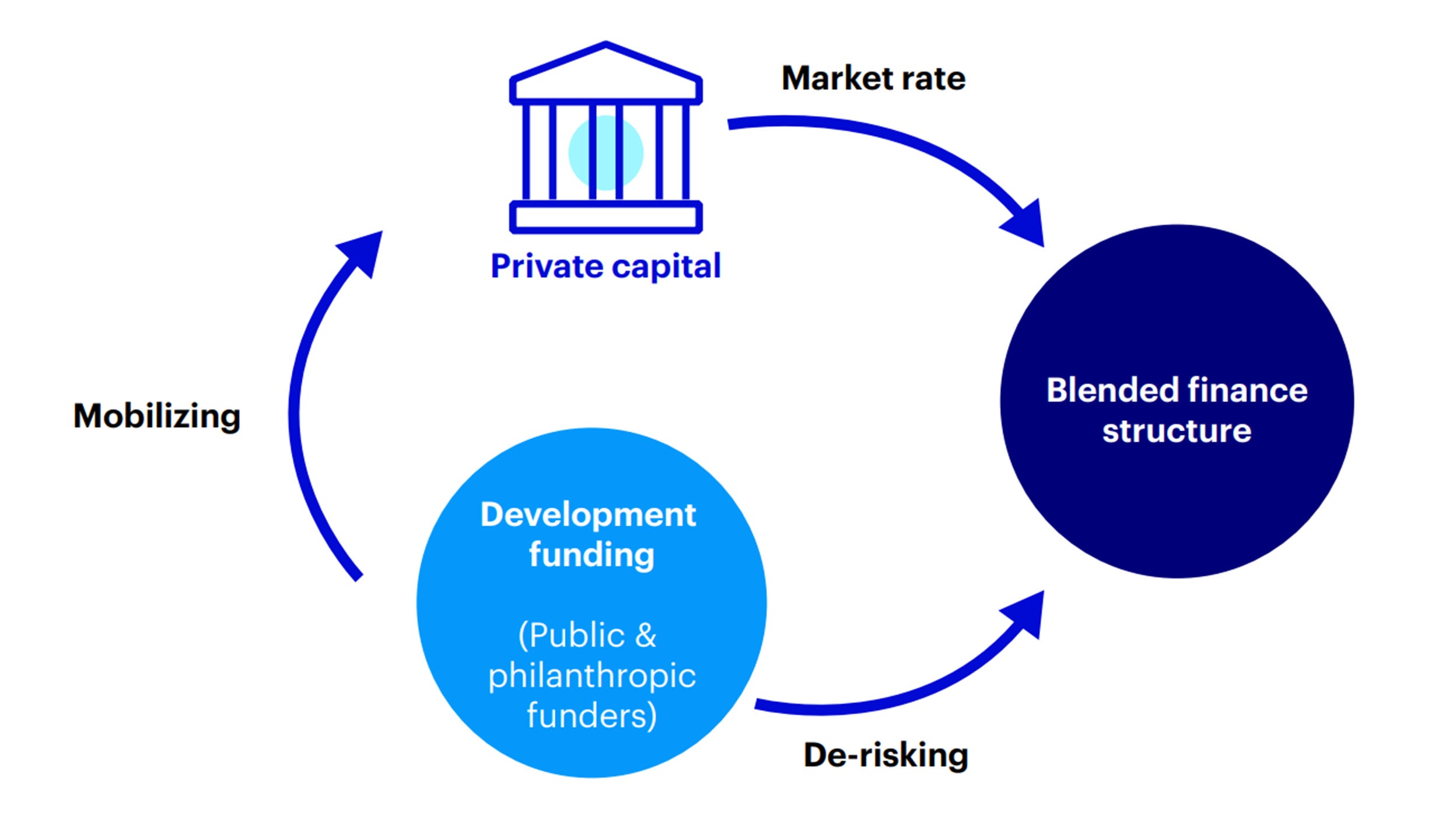

The enormous vulnerability of the Least Developed Countries and Small Island Development States to climate change means they require significant and rapid deployment of capital at scale for climate adaptation. Their vulnerability to economic distress and limited public budgets, combined with the rapid increase in temperatures and sea level rise, call for urgent support to deploy capital. However, private sector and institutional investors tend to be risk averse, making it difficult to mobilise sufficient capital to meet climate mitigation needs and particularly climate adaptation solutions. Harnessing sufficient capital requires innovative commercial structures to close the gap between the climate objectives of vulnerable countries and the risk-return profile that investors typically seek.

Sufficient investment capital and technical assistance for adaptation and mitigation could empower project developers and developing countries to implement climate-resilient infrastructure, technology access and sustainable practices across sectors. These investments could fund impactful projects that enhance climate resilience and contribute to the reduction of greenhouse gas emissions, which could create a favourable environment for attracting additional investment and mobilising financial resources at a reasonable cost. This dynamic could strengthen the capacity of communities and countries to address the challenges of climate change, promote sustainable development and achieve countries’ adaptation and mitigation goals.