Market outlook R&D: A long-term investment

See why long term investment strategies should factor in research and development. A company's R&D strategy may lead to durability and better returns.

Where can you go to find the world’s most iconic companies, enterprises that have become synonymous with growth and innovation? Where are the companies that are producing groundbreaking developments in areas such as electric vehicles, artificial intelligence, cloud computing, social media, and e-commerce?

You won’t find all these companies in Silicon Valley, Seattle, Austin, or any other tech hub. For access to the category-defining companies at the forefront of innovation, consider the Nasdaq-100® Index.

The Nasdaq-100 was created in 1985 as a gauge dedicated to the 100 largest non-financial companies by market capitalization listed on the Nasdaq. This group includes titans of technology and venerable brands such as Apple, Microsoft, Nvidia, Amazon, Alphabet (Google’s parent company), and Meta Platforms (the parent of Facebook). Given Nasdaq’s history as the first all-electronic exchange, it’s not surprising that some of the most widely known technology companies list there.

QQQ, which tracks the Nasdaq-100, provides efficient access to many companies driving innovation with the potential to transform the global economy.

Owning QQQ provides access to companies that are committed to research and development and to staying at the leading edge of innovation. These companies’ constant innovation has helped QQQ become the #1-ranked, best-performing large cap growth fund, based on total return over the past 15 years by Lipper (1/369) as of September 30, 2024.

QQQ’s legacy of being home to innovative companies is apparent in another way: The number of $1 trillion+ firms residing in the ETF. There are six U.S.-based corporations with market values of at least $1 trillion1 and all six are held by QQQ. These companies set the standard for industry adaptation, speed to market, and delivering world-class value for their customers. (Market capitalization, which equals a company’s current share price multiplied by the total shares outstanding, is an indication of how much investors think a company is worth, taking into account the company’s growth prospects.)

Lipper fund percentile rankings are based on total returns, excluding sales charges and including fees and expenses, and are versus mutual funds, ETFs and funds of funds in the category tracked by Lipper. Source: The Lipper one-year rank 80% (535 of 673), five-year rank 2% (10 of 600), 10-year rank 2% (5 of 477), 15-year rank 1% (1 of 369) as of September 30, 2024.

Rank |

Company |

Market cap (trillions) |

| 1 | Apple | $3.36 |

| 2 | Microsoft | $3.20 |

| 3 | Nvidia | $2.78 |

| 4 | Alphabet | $1.97 |

| 5 | Amazon | $1.96 |

| 6 | Meta Platforms | $1.36 |

Source: CompaniesMarketCap.com as of September 18, 2024.

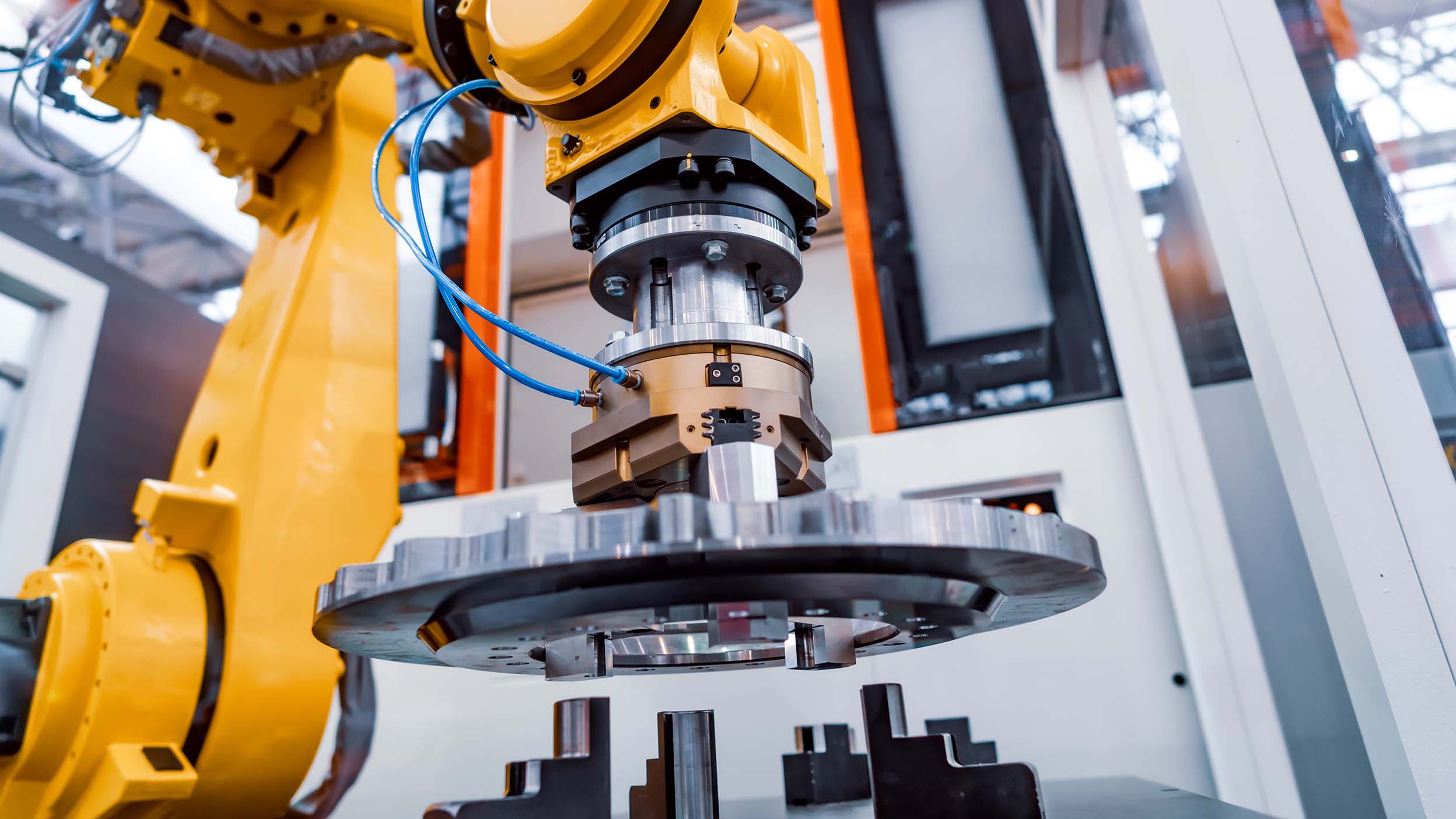

But the Nasdaq-100 is home to more than just the world’s leading technology companies. More than a third of the index is represented by companies outside the information technology or communication services sectors. This includes innovative healthcare companies such as Intuitive Surgical, whose da Vinci robotic surgical system helps doctors deploy innovative procedures and reduce risk in previously invasive surgeries. It also includes cutting-edge companies such as Netflix and Electronic Arts, as well as leading consumer companies Costco Wholesale, PepsiCo, Starbucks, Airbnb, and DoorDash.

The Nasdaq-100 has significantly outperformed the S&P 500 Index (a broad measure of the U.S. stock market) for more than a decade. From January 2, 2009, through September 30, 2024, the cumulative total return of the Nasdaq-100 was more than 2x that of the S&P 500.

Nasdaq-100 |

S&P 500 |

|

Cumulative Returns |

10351.81 | 446.70 |

Annualized Retun |

15.60 | 10.67 |

Annualized Volatility |

19.00 | 15.96 |

Bloomberg L.P. data as 9/30/24. Performance quoted is past performance and cannot guarantee of comparable future results. An investor cannot invest directly in an index. Index returns do not represent Fund returns.

Why has the Nasdaq-100 performed so well relative to the broader U.S. stock market? A major reason is because the Nasdaq-100 has been heavily allocated toward top-performing industries such as technology, communication services and consumer cyclical. It should be noted, however, that these high-growth industries tend to be more volatile than other sectors.

Learn more about how to access some of the world’s most innovative companies with Invesco QQQ ETF.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

See why long term investment strategies should factor in research and development. A company's R&D strategy may lead to durability and better returns.

Because the distinctions between these two similar passive indexing approaches are subtle, choosing either an index fund or an ETF often comes down to a matter of personal preference, comfort, and availability

NA3939576

Past performance is not a guarantee of future results. An investor cannot invest directly in an index.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

The Index and Fund use the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

This content should not be construed as an endorsement for or recommendation to invest in Apple, Microsoft, Nvidia, Alphabet, Amazon, or Meta Platforms. Neither Apple, Microsoft, Nvidia, Alphabet, Amazon, nor Meta Platforms are affiliated with Invesco. Only 6 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 10/14/2024, Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta Platforms made up 8.77%, 7.77%, 8.45%, 4.73%, 4.91%, and 5.12%, respectively, of Invesco QQQ ETF.