Innovation The Nasdaq-100: More than meets the eye

Explore some of the biggest names in the Nasdaq-100 index. They span sectors to innovate in new ways and diverse businesses.

When investors think of the Nasdaq-100® Index, the word “technology” is often top of mind. That’s no surprise—many of the world’s most influential tech companies call the index home. But a closer look reveals something broader: the Nasdaq-100 isn’t just a tech index—it’s an innovation index.

Invesco QQQ ETF (QQQ), which tracks the Nasdaq-100, offers access to a portfolio of companies helping drive progress across multiple sectors, whether or not they’re officially labeled “tech.” And that distinction matters.

The Nasdaq-100 is composed of 100 of the largest non-financial companies listed on the Nasdaq Stock Market, a hotbed of tech and innovation. That one rule—to exclude financials—has had long-term implications for the index’s character. Rather than reflecting traditional sector weightings like broader benchmarks, the Nasdaq-100 has tilted toward industries powered by intellectual property, scalability, and digital transformation.

While the information technology sector remains the benchmark’s largest at about 57%, it’s not alone.1 The index also includes leaders in consumer discretionary, health care, communication services, and industrials. Many of these companies are pushing boundaries in ways that rival—or might even surpass—those in traditional tech.

Stock indices like the Nasdaq-100 typically use rules-based approaches like the Industry Classification Benchmark (ICB) or Global Industry Classification Standard (GICS) to determine which sector a particular company belongs in.

In today’s economy, though, it can be difficult to peg companies into a specific sector. In other words, there can be gray areas that could leave some investors scratching their heads.

For example:

These examples highlight why investors looking for innovation exposure may miss the mark by focusing only on sector labels.

Here are just a few examples of companies outside the information technology sector that are helping shape the future in their own domains:

These firms aren’t just adopting new tools—they’re hoping to build competitive advantages with them.

For investors, this matters because it means QQQ provides more than exposure to many sectors beyond the technology industry. That can be especially important in an environment where innovation is happening in unexpected places.

It also helps explain QQQ’s performance profile. While it may be compared to “tech ETFs,” QQQ includes a wider set of business models compared to strictly tech-focused funds. QQQ’s sector diversification has contributed to the fund’s ability to navigate a variety of market environments.

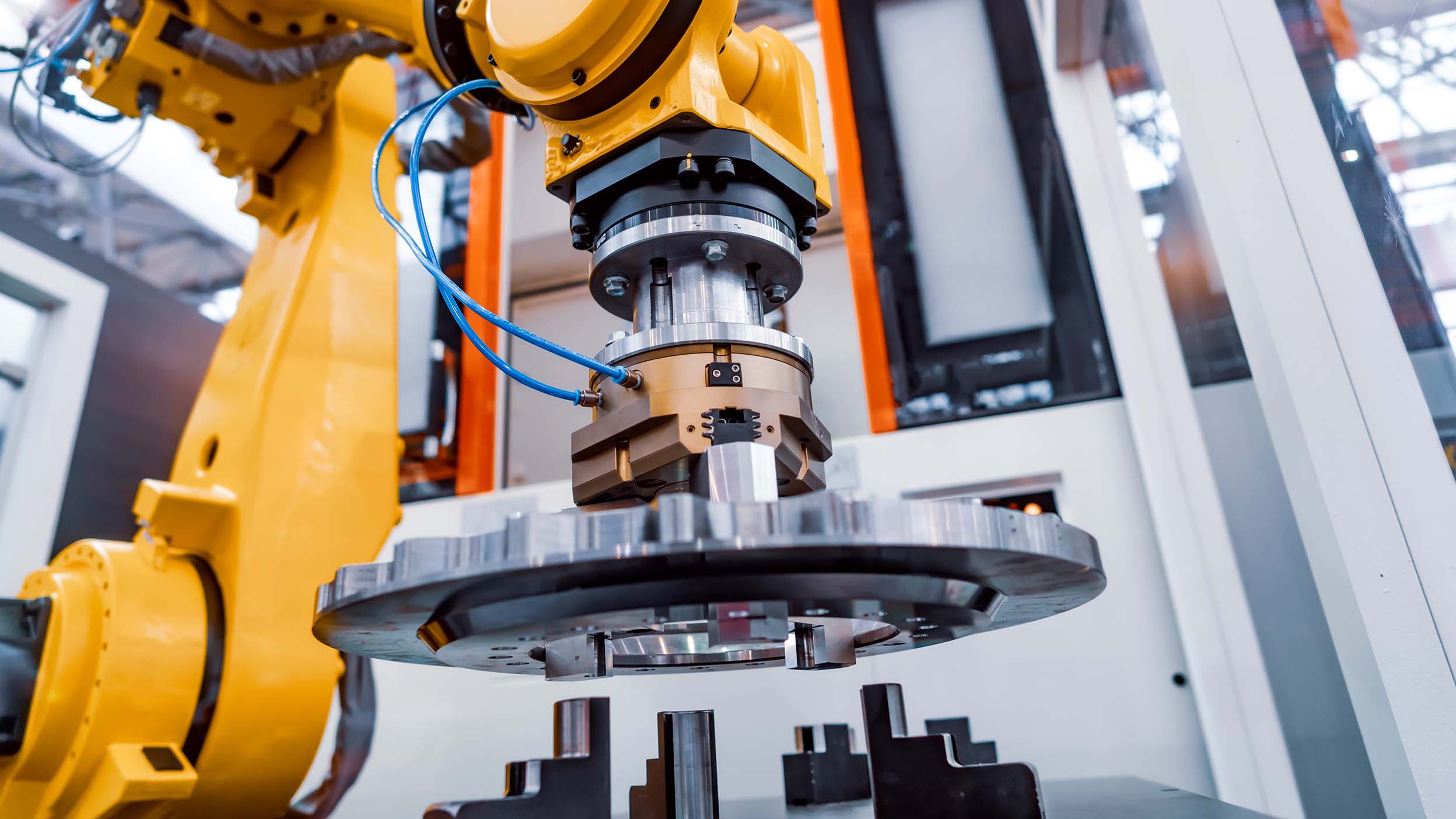

The Nasdaq-100 isn’t just a snapshot of the technology sector—it’s a lens on the innovation economy. From AI-powered logistics to robotic surgery, some of the companies in QQQ represent the leading edge of progress, no matter what sector they are in.

For investors looking to capture that momentum, understanding what’s inside the Nasdaq-100—and why it’s built the way it is—may make all the difference.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Explore some of the biggest names in the Nasdaq-100 index. They span sectors to innovate in new ways and diverse businesses.

GPUs are playing a large role in the technological revolution that is powering AI and supporting the growth of many technology companies.

Learn how the Nasdaq-100 index and Invesco QQQ ETF give investors access to companies that are driving innovation across the global economy.

NA4550631

All data sourced from Bloomberg L.P. as of 5/31/2025 unless otherwise noted. An investor cannot invest directly in an index.

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

Diversification does not guarantee a profit or eliminate the risk of loss.

The Index and Fund use the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

The Global Industry Classification Standard was developed by and is the exclusive property and a service mark of MSCI, Inc. and Standard & Poor's.

This content should not be construed as an endorsement for or recommendation to invest in Amazon.com Inc, Meta Platforms Inc, Intuitive Surgical Inc, PepsiCo Inc, Netflix Inc, and Amgen Inc. Neither Amazon.com Inc, Meta Platforms Inc, Intuitive Surgical Inc, PepsiCo Inc, Netflix Inc, nor Amgen Inc are affiliated with Invesco. Only 6 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of June 3, 2025, Amazon.com Inc, Meta Platforms Inc, Intuitive Surgical Inc, PepsiCo Inc, Netflix Inc, and Amgen Inc made up 5.48%, 3.58%, 1.22%, 1.12%, 3.21%, and 0.96%, respectively, of Invesco QQQ ETF.