Market outlook QQQ quarterly outlook report

Read about the latest Invesco QQQ ETF fund performance and what our strategist expects next quarter.

Bitcoin and cryptocurrencies get a lot of attention for their volatility but within the broader crypto ecosystem, blockchain technology is projected to grow rapidly in coming years.

The blockchain ecosystem includes crypto miners, exchanges, investors, merchants, cybersecurity firms, and other innovative companies.

Investors in QQQ can gain exposure to many of the engines of blockchain technology, while also accessing a diversified set of industry leaders.

Cryptocurrency has the potential to revolutionize how we think about money. Like many other potentially industry-changing technologies, though, crypto has experienced some bumps along the way. For many long-term investors in cryptocurrencies, price volatility is simply the price of admission. However, investors have other ways to participate in the ecosystem that powers Bitcoin, Ethereum, and many other cryptocurrencies.

While crypto prices dominate the headlines, blockchain technology — which underpins cryptocurrencies and other applications across a wide range of industries—may be an interesting and attractive space for investors.

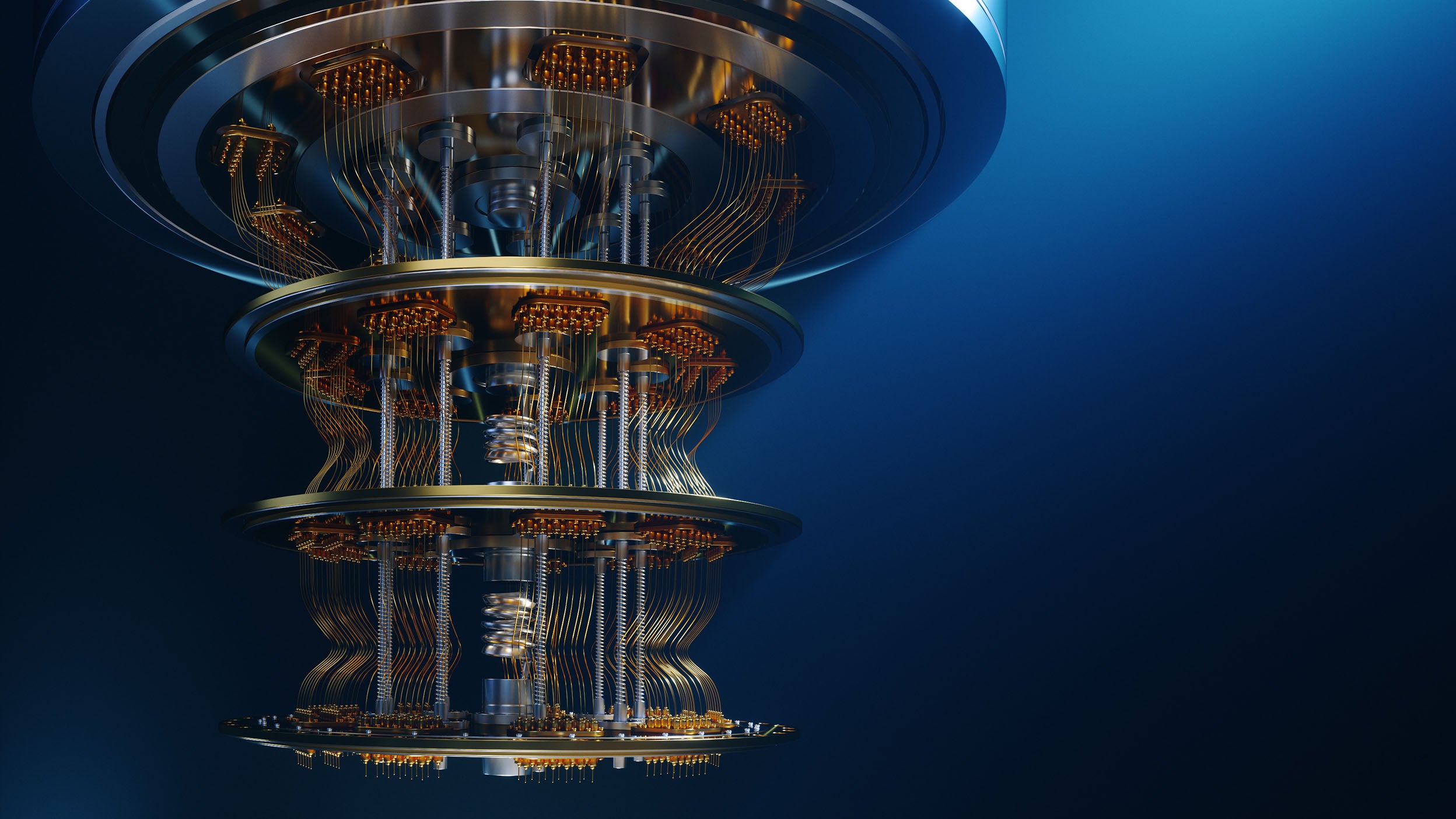

Most investors at some point or another have probably seen quotes for Bitcoin and other cryptocurrencies flash across their screens. They may be less familiar with blockchain technology, the code and systems that power cryptocurrencies and other applications. Many innovative companies are using blockchain to change how data is stored and how transactions are verified.

A blockchain is a decentralized database that stores information and transactions digitally in a peer-to-peer network. Cryptocurrencies like Bitcoin are made possible by blockchains, which create a secure, decentralized ledger of transactions. This system removes the need for intermediaries, such as banks or central clearinghouses, to validate or process exchanges.1

Many industries are adopting technology to streamline their operations and manage data and supply chains. Sectors that are modernizing their operations with blockchain technology include healthcare, manufacturing, and financial companies.2

As adoption increases, the blockchain market appears poised for growth. The global blockchain technology market size was estimated to be around $4.8 billion in 2021 and is expected to reach $69 billion by 2030, representing a projected compound annual growth rate of roughly 68% between 2022 and 2030.3

Companies have also invested in driving innovations in blockchain technology. As of October 2023, the U.S. Patent and Trademark Office (USPTO) recorded 13,854 blockchain patent applications, with 9,442 patents granted.4 This suggests that more breakthroughs in blockchain technology may be on the horizon, particularly as patent applications in the space continue to grow.

The crypto and blockchain ecosystem includes crypto miners, exchanges, investors, merchants and cybersecurity firms. The Nasdaq-100® Index, which Invesco QQQ tracks, contains many companies that are helping build and transform the blockchain ecosystem. All of the companies mentioned below are currently held in QQQ.

Semiconductor companies — Just like in the California Gold Rush, the suppliers of “pick and shovels” to miners have the potential to build lasting profits. Semiconductor giant Nvidia is the leader in providing graphics processing units (GPUs) and specialized hardware for crypto mining. Advanced Micro Devices, another QQQ holding, is active in blockchain technology and produces the high-octane processing units used by many crypto miners. Chipmaker Intel also produces hardware to help power blockchain networks.

Payment processors — PayPal, the provider of electronic transactions for merchants and consumers, allows its customers to trade several cryptocurrencies, and also enables payments in crypto. PayPal, which has more than 400 million users, is a good example of a more traditional financial company getting involved in the crypto ecosystem.

Modern registry, retailers, and manufacturers — Honeywell International is using blockchain to digitize airplane records and parts.5 Retail juggernaut Amazon offers Amazon Managed Blockchain, which is designed to help users create scalable blockchain networks. Tesla CEO Elon Musk has been a vocal supporter of cryptocurrencies, and the company holds Bitcoin on its balance sheet.6

Web3 and the metaverse — Many QQQ companies are at the forefront of building the metaverse and all the potential applications of blockchain and crypto. The many companies that fall into this category include Alphabet (Google’s parent), Meta Platforms (Facebook’s parent), and Microsoft.

It’s safe to say we are still in the early stages of crypto and blockchain, and the list above only scratches the surface of the companies involved in this transformation. It’s going to be challenging to pick the winners among individual cryptocurrencies and individual companies involved in blockchain. QQQ may allow you to potentially benefit from the innovation that blockchain brings to the world, while also providing access to many other industry-leading innovators in one holding.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Read about the latest Invesco QQQ ETF fund performance and what our strategist expects next quarter.

Machine learning and quantum computing technologies are impacting many industries, streamlining many processes and attracting long-term growth

As blockchain, cryptocurrency, and other digital assets grow into a major industry, we examine this burgeoning asset class for investors.

NA3821694

Cryptocurrencies such as bitcoin are considered a highly speculative investment due to their lack of guaranteed value and limited track record. Because of their digital nature, they pose risk from hackers, malware, fraud, and operational glitches. Bitcoins and other cryptocurrencies are not legal tender and are operated by a decentralized authority, unlike government-issued currencies. Cryptocurrency exchanges and cryptocurrency accounts are not backed or insured by any type of federal or government program or bank.

Companies engaged in the development, enablement and acquisition of blockchain technologies are subject to a number of risks. Blockchain technology is new and many of its uses may be untested. There is no assurance that widespread adoption will occur. The extent to which companies held by the Fund utilize blockchain technology may vary.

As blockchain technology is new, there is a risk that companies developing applications of this technology may be subject to additional risks including, but not limited to, intellectual property claims and legal action. Furthermore, blockchain technology may be subject to future law and regulation that may adversely impact adoption.

Cryptocurrencies trade on exchanges, which are largely unregulated and, therefore, are more exposed to fraud and failure than established, regulated exchanges for securities, derivatives and other currencies.

Compound annual growth rate, or CAGR, is the mean annual growth rate of an investment over a specified period of time longer than one year.

This content should not be construed as an endorsement for or recommendation to invest in NVIDIA, Advanced Micro Dynamics, Intel, PayPal, Honeywell, Amazon, Tesla, Alphabet, Meta, or Microsoft. Neither NVIDIA, Advanced Micro Dynamics, Intel, PayPal, Honeywell, Amazon, Tesla, Alphabet, Meta, nor Microsoft are affiliated with Invesco. Only 10 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 8/26/2024, NVIDIA, Advanced Micro Dynamics, Intel, PayPal, Honeywell, Amazon, Tesla, Alphabet, Meta, and Microsoft, make up 8.13%, 1.64%, 0.58%, 0.51%, 0.90%, 4.78%, 2.69%, 5.02%, 4.75%, 8.04% of Invesco QQQ ETF.