Innovation Wearable tech: Where style meets innovation

Wearable technology is rapidly expanding while providing new technology to user’s everyday lives

Machine learning, the development of algorithms that learn from data and perform tasks without explicit instructions, is no longer confined to labs or future forecasts—it’s driving real-time innovation across nearly every industry. In the past year alone, advances in generative Artificial Intelligence (AI), large language models (LLMs), and cloud-powered infrastructure have modified the way that businesses operate and consumers engage with technology. And many of the companies leading this shift are part of the Nasdaq-100 Index, tracked by Invesco QQQ.

The global machine learning market size was estimated at about $51.5 billion in 2023 and it is projected to rise to over $1.4 trillion by 2034.1

Source: Precedence Research, October 2024. Projections may differ significantly from actual results, and there is no guarantee that estimates will be accurate.

From virtual assistants and autonomous vehicles to fraud detection and AI copilots, machine learning has become one of the most dynamic and widely adopted technologies of the modern era. Let’s take a closer look at where ML is headed, and how investors are gaining exposure through QQQ.

While machine learning has long been associated with the tech sector, its impact now stretches across industries:

These use cases aren’t projections—they’re active applications helping to shape some of today’s growing industries.

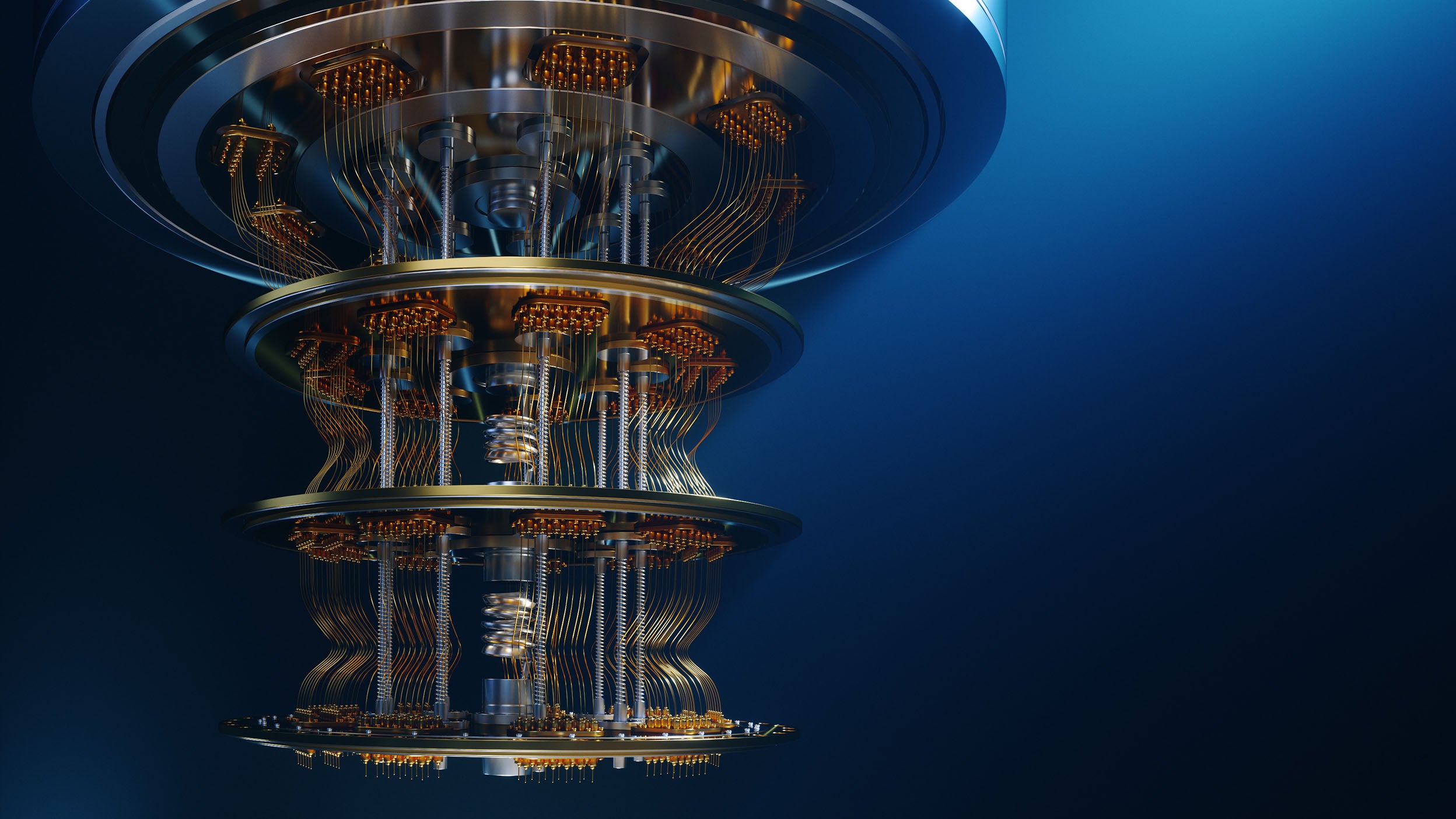

Behind every ML model lies a complex web of infrastructure—cloud platforms, graphics processing units (GPUs), high-speed memory, and vast storage capacity. These technologies help make it possible to train, scale, and deploy AI across organizations of every size.

Companies in the Nasdaq-100 are providing the tools and architecture that helped fuel this growth:

Even companies like Tesla and Palantir are deploying machine learning at scale, whether in autonomous driving or large-scale enterprise analytics.

The machine learning market has grown at a rapid clip. Global AI investment exceeded $200 billion in 2024, with enterprise adoption reaching all-time highs across sectors.2 At the same time, monetization strategies are becoming clearer: companies are embedding ML directly into consumer products, enterprise software, and digital platforms—working to hopefully turn innovation into revenue.

As adoption expands, so do opportunities for investors. ML innovation isn’t just coming from pure-play AI firms—it’s being driven by established leaders with deep R&D pipelines, platform ecosystems, and the scale to turn breakthroughs into real-world impact.

Invesco QQQ provides access to the Nasdaq-100 Index, which includes many of the companies powering and applying machine learning at scale. From hardware and infrastructure to cloud platforms and enterprise AI tools, QQQ investors are gaining exposure to the backbone of tomorrow’s technology—today.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

Wearable technology is rapidly expanding while providing new technology to user’s everyday lives

The rise of artificial intelligence (AI) is impacting big tech. Learn more about how industries, from hardware manufactures to software developers, are utilizing AI.

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

NA4480047

Past performance is not a guarantee of future results.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

This content should not be construed as an endorsement for or recommendation to invest in NVIDIA, Microsoft, Amazon, Alphabet, or Meta Platforms. Neither NVIDIA, Microsoft, Amazon, Alphabet, nor Meta Platforms are affiliated with Invesco. Only 5 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 5/6/2025, NVIDIA, Microsoft, Amazon, Alphabet, and Meta Platforms made up 7.59%, 8.83%, 5.37%, 5.10%, 3.53%, respectively, of Invesco QQQ ETF.