NA4942874

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

These comments should not be construed as recommendations. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The Nasdaq-100 is a stock market index made up of equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. Investment cannot be made directly into an index.

The Industry Classification Benchmark (ICB) is a system for assigning all public companies to appropriate subsectors of specific industries.

The S&P 500® Index is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held stocks in the United States.

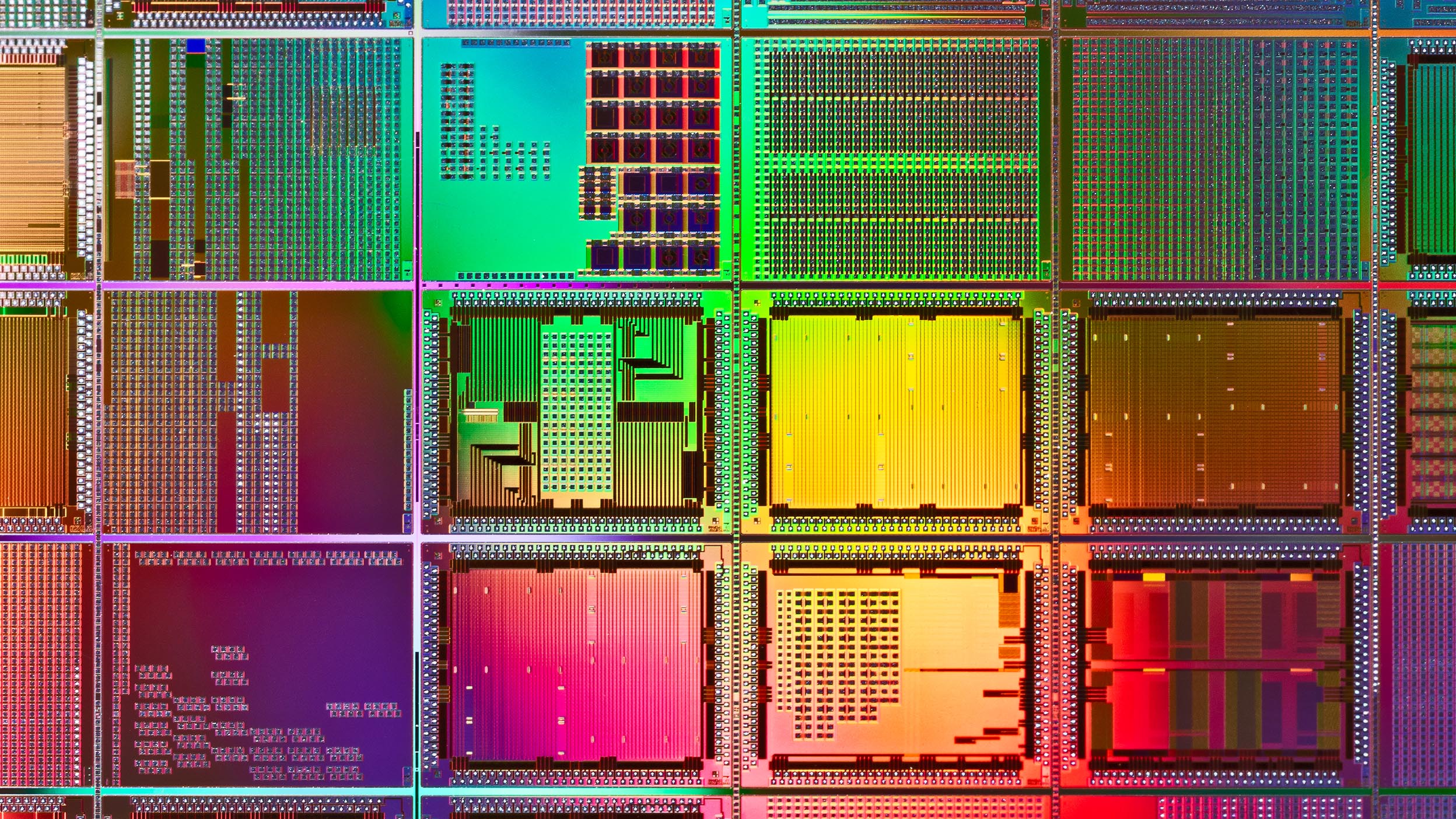

This content should not be construed as an endorsement for or recommendation to invest in NVIDIA, Microsoft, Alphabet, Amgen, Gilead, Moderna, Broadcom, Intel, Qualcomm, Amazon, Apple, or Netflix. None of the companies mentioned herein are affiliated with Invesco. Only 12 of 101 underlying Invesco QQQ ETF fund holdings are featured. The holdings are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings.

Incorporating alternative investments into a portfolio can lead to significant losses, including the total loss of your investment. Additionally, some alternative investments have experienced extreme volatility and are generally not suitable for all investors.