Asset owner insights: Climate indexes and ETFs

Continuing with our Asset Owner Insights series, in this piece we examine how asset owners are utilizing climate indexes and ETFs in their portfolios while also providing an overview of the range of climate indexes and ETFs approaches available to investors.

Asset owner approaches to climate indexes and ETFs

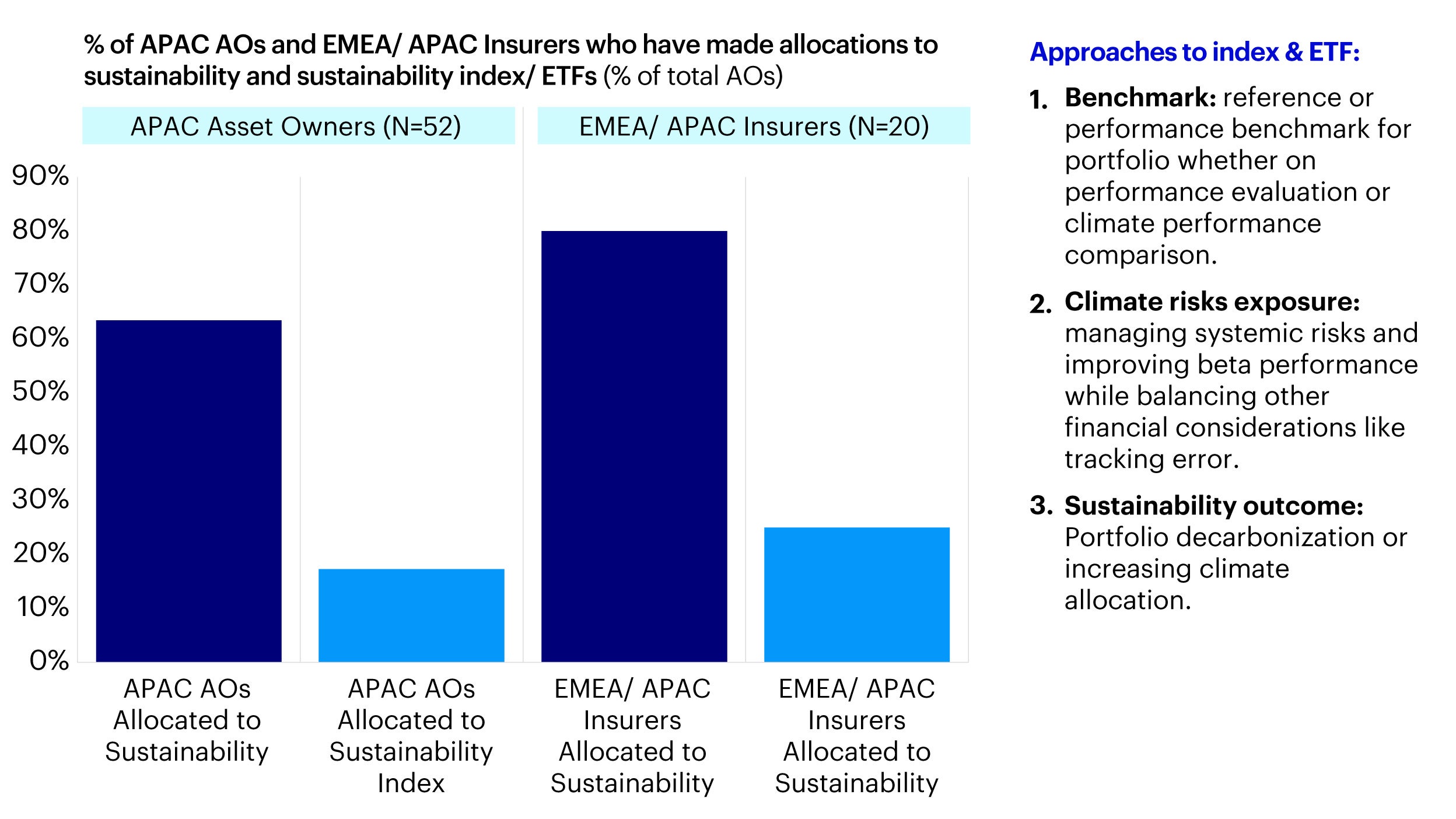

As part of our research on APAC asset owner approaches to ESG and climate investing, we found that among 52 APAC asset owners nearly 20% have invested in sustainability indexes and ETFs.1 Similarly, in a recent analysis of the 20 largest APAC/ EMEA insurers with over US $7 billion in assets under management, almost 25% have invested in sustainability indexes and ETFs.2

Source: Invesco Asia Pacific, APAC asset owner approaches to ESG and climate investing, Sep 2024, https://www.invesco.com/apac/en/institutional/insights/esg/apac-asset-owner-approaches-esg-climate-investing.html ; Invesco Asia Pacific, Asset owner insights: Insurers’ approaches to climate investing and asset allocation, Mar 2025, https://www.invesco.com/apac/en/institutional/insights/esg/asset-owner-insights-insurers-approaches-to-climate-investing-and-asset-allocation.html.

Broadly speaking, these asset owners utilize climate indexes and ETFs in three ways:

- Benchmark: Utilizing a climate index as a reference or performance benchmark allows asset owners to evaluate specific portfolios in relation to investment objectives, and determine if asset managers achieve the objectives set by asset owners in policy benchmarks. This can be both a direct policy benchmark where mandates with climate considerations (like emissions reduction) are suitably compared on performance and tracking error with a relevant climate benchmark, or at times asset owners might have a broad market index (for performance evaluation) and a separate climate index (for climate performance evaluation).

- Managing climate risks exposure: For investors investing through a climate index or ETF strategy, many are trying to reduce climate risks exposure in a portfolio. Such investors typically want their broad portfolio to mirror the market closely with the goal to improve beta performance, minimize high-risk holdings, and manage systemic risks.3 Investors would typically adjust weightage to companies based on their exposure to climate risks and opportunities while these indexes also allow investors to balance such exposure against traditional factors like market capitalization, liquidity, and tracking error.

- Sustainability outcomes: For other investors investing through a climate index or ETF strategy, they might have portfolio decarbonization objectives or other sustainability objectives as part of their investment strategy. These sustainability objectives and considerations which include emissions reduction or increasing allocation to climate solutions or transition finance are then embedded into the investment constraints and index construction. Climate ETFs are also a cost effective and efficient way to quickly deploy capital aligned with climate objectives. From an issuer perspective, their inclusion in (or exclusion from) an index becomes a way for asset owners to drive decarbonization progress to meet their sustainability objectives.

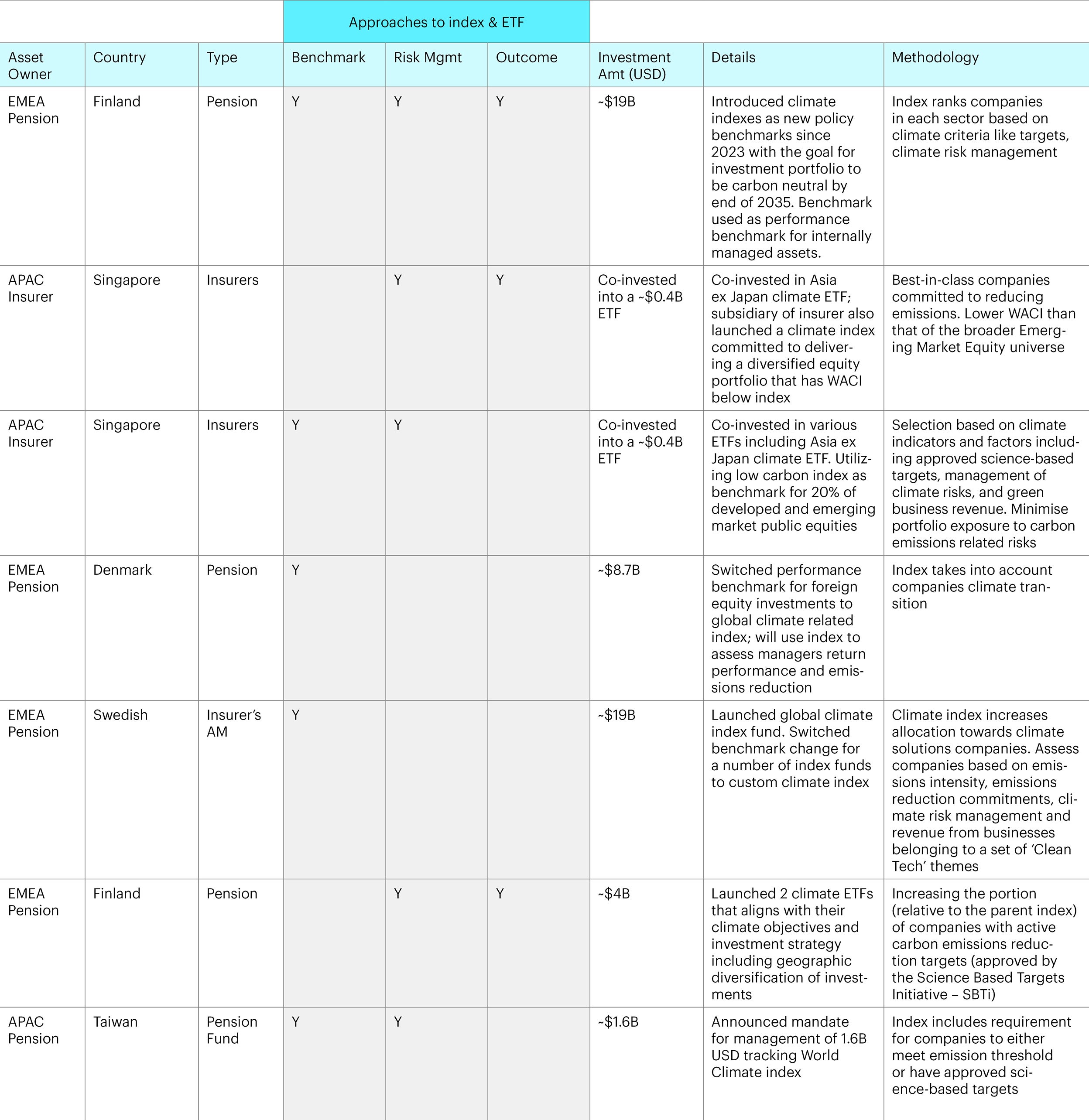

Many asset owners utilize and deploy climate indexes and ETFs based on a combination of the above approaches. Like our analysis of largest APAC/ EMEA insurers, the two strategic questions that asset owners face are in meeting portfolio decarbonization targets they have set, as well as capturing investment opportunities as they increase their allocation targets to climate. The following table summarizes examples of asset owners globally that have either used a climate index as a reference benchmark or have invested through a climate index or ETF strategy:

Source: SGX Analysis; 1. Ilmarinen, Ilmarinen adopts new climate benchmarks, Feb 2023, https://www.ilmarinen.fi/en/current-topics/news-and-articles/2023/ilmastoindeksi-kayttoon/ ; 2. Prudential, Sustainability Report 2023, Mar 2024, https://www.prudentialplc.com/~/media/Files/P/Prudential-V13/reports/2023/sustainability-report-2023.pdf ; 3. Singlife, Singlife invest in climate action ETF, Sep 2023; SingLife benchmarked against low carbon indexes; 4. ESG News, Denmarks Industriens Pension weaves MSCI Climate Action Indexes into foreign equities benchmark, Mar 2024, https://esgnews.com/denmarks-industriens-pension-weaves-msci-climate-action-indexes-into-foreign-equities-benchmark/ ; 5. ICMIF, Länsförsäkringar continues its journey to achieve climate-smart vision, Dec 2020, https://www.icmif.org/news_story/lansforsakringar-continues-its-journey-to-achieve-climate-smart-vision/ ; MSCI, MSCI Region ex Select Securities Climate Action 75% Custom Indexes* Methodology, Sep 2024, https://www.msci.com/documents/10199/83cd04dc-34f5-8a85-9f67-41bf19f2037f ; MSCI, MSCI World Select Climate Target Index*, Nov 2024, https://www.msci.com/documents/10199/6788f679-3010-5e2f-799b-28bf03412d0e ; 6. Varma, Varma makes record-breaking investment in a climate fund in the US market, Dec 2024, https://www.varma.fi/en/this-is-varma/current-issues/news-and-articles/news/2024-q4/varma-makes-record-breaking-investment-in-a-climate-fund-in-the-us-market/ ; 7. Asia Asset Management, Taiwan’s BLF opens tender for US$1.6 billion climate equity fund, Feb 2025, https://www.asiaasset.com/post/29336-blf-0220

Climate index and ETF toolkit

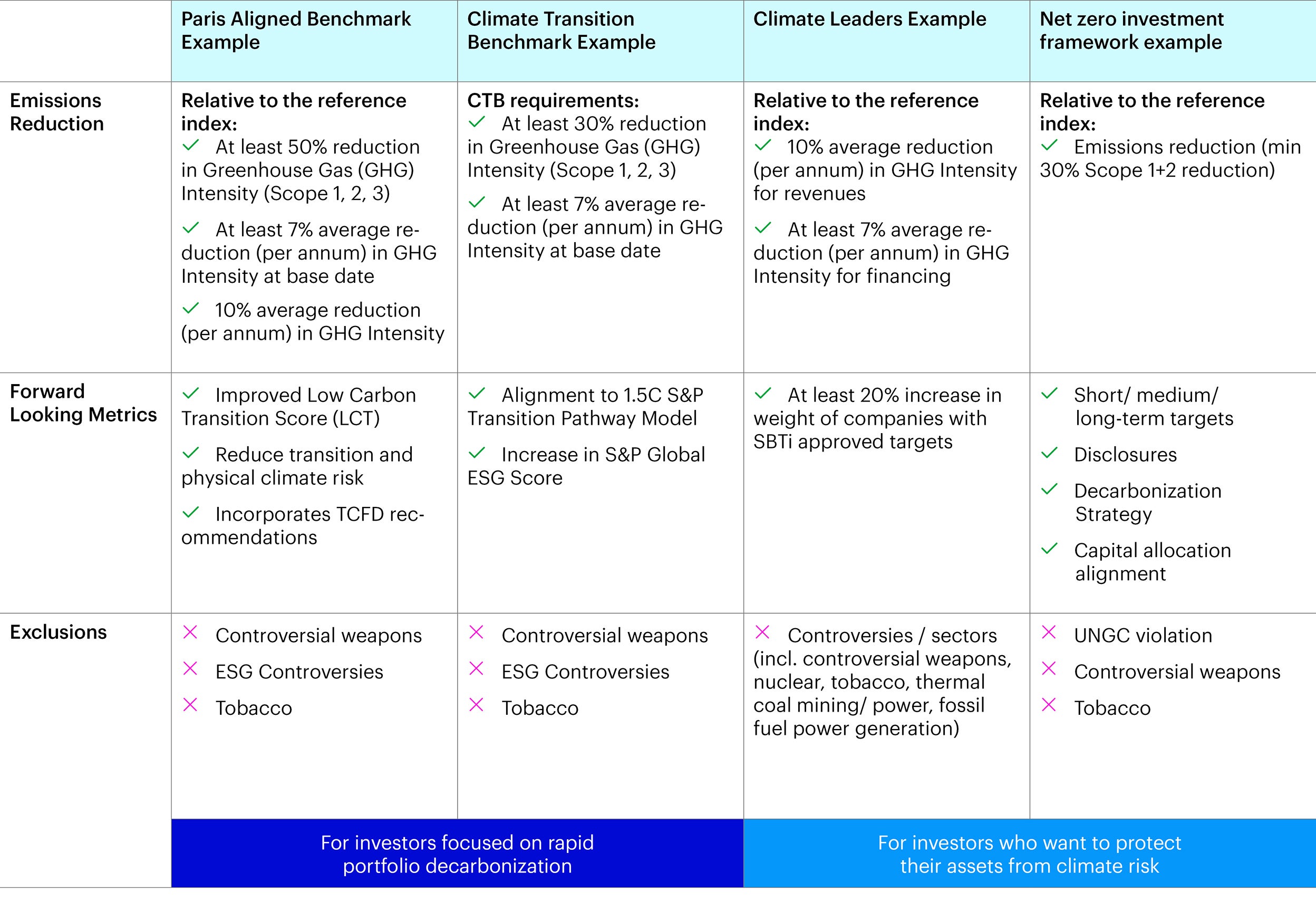

Directionally, most climate index and ETFs are created using three categories of criteria and screens:

- Emissions reduction: Screening is based on achieving a minimum level of emissions reduction such as a percentage reduction in greenhouse gas intensity (as compared to benchmark) or achieving a minimum percentage of average per annum reduction. Both Europe’s Climate Transition Benchmark and the Paris-Aligned Benchmarks have such minimum levels of emissions that are standardized as part of the benchmark requirements.

- Forward-looking metrics: Further screening is typically on the transition readiness of companies by utilizing forward-looking metrics such as having disclosures aligned to international standards like the Taskforce for Climate-related Financial Disclosures (TCFD), having validated Science-based targets or green revenues or capex investments.

- Exclusions: Typically to align with asset owners’ sustainable investing policies, these exclusionary criteria can include excluding issuers with higher ESG-rated risks and controversies or certain higher risk sectors like controversial weapons, tobacco, thermal coal mining or fossil fuel generation.

Given the above perimeters that indexes or ETFs can consider, we showcase four examples of the range of solutions that can be customized based on investors objectives.

Source: Invesco, for illustrative purposes only.

- Paris-aligned Benchmark: Aligned to the EU’s Paris-aligned Benchmarks (EU PAB), this strategy has a strong focus on emissions reduction (including at least 50% reduction in intensity versus benchmark) and incorporates a broader consideration of climate risks, disclosures, and sustainability exclusions.

- Climate-transition Benchmark: Aligned to the EU’s Climate Transition Benchmark (EU CTB), this strategy looks to both optimize towards a minimal percentage of emissions reduction while also considering transition progress and the management of sustainability risks.

- Climate Leaders: In addition to percentage reduction in intensity, this strategy tilts towards companies with approved science-based targets as that serves as forward-looking indicator on the credibility of a company’s transition plan and predictor of its transition progress ahead.

- Net Zero Investment Framework: Utilizing the Institutional Investors Group on Climate Change’s Net Zero Investment Framework that consists of six forward-looking indicators (long-term and short/medium term targets, emissions progress, disclosures, decarbonization strategy, capital allocation alignment) to assess transition progress of companies along an alignment spectrum. The index and strategy can then be customized based on investors’ preferred exposure to aligned or aligning companies while also factoring in constraints on universe exposure and tracking error.

Selecting and evaluating indexes and ETFs

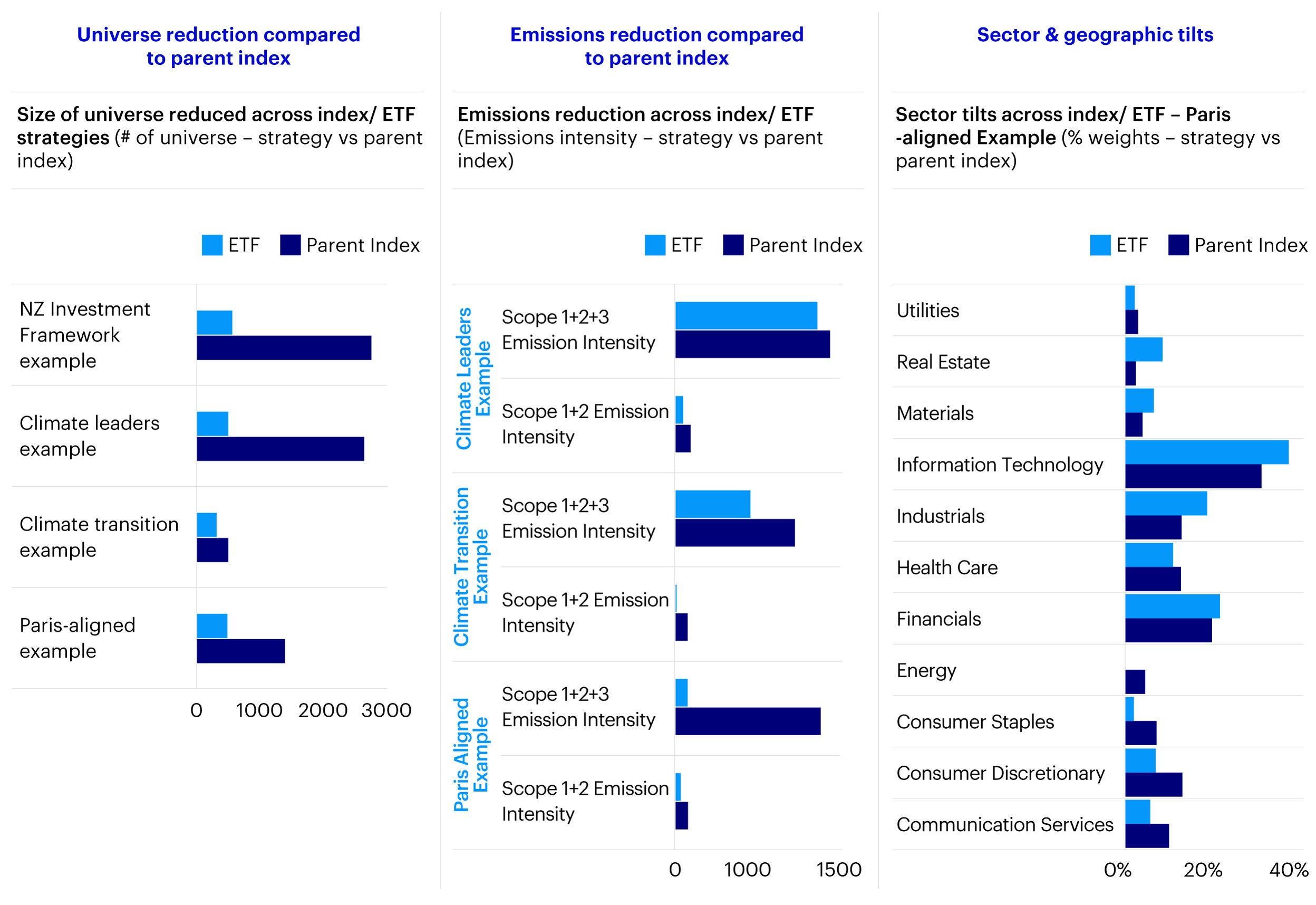

Given the range of approaches and strategies above, one common question is which index and strategy should an investor select. A key starting point goes back to the investment objective of the investor, for example having a priority objective in portfolio emissions reduction will differ from wanting to better manage climate risks while balancing against tracking error and performance.

To facilitate investors with their selection, a couple of helpful evaluation and consideration factors include:

- Universe reduction and tracking error: Compared to parent benchmark, how significant is the reduction in the investable universe of companies and correspondingly what is the tracking error.

- Emissions reduction: Comparison of emissions reduction between strategy in question versus relevant parent benchmark. This is vital particularly for investors looking to achieve significant portfolio decarbonization.

- Sector and geographic tilts: If the strategy creates significant tilts or underweights in its sector and geographic allocation what would the corresponding performance implications be.

Source: Invesco analysis.

Analyzing how a strategy compares on the above dimensions with the parent benchmark allows investors to better understand the value or impact of the strategy alongside what the potential trade-offs and constraints may be.

Looking ahead: Future opportunities

Between 2014 and 2023, the number of asset owners using ETFs nearly doubled, ETF use increased more than 3.5x and asset owner ETF assets under management increased by 22%4, particularly amongst government pension and sovereign wealth funds. For asset owners with sustainability and climate as priorities, we believe climate indexes and ETFs will increase in importance as both a benchmark and investment approach.

Looking ahead, some other future trends that asset owners can keep in mind include:

- Fixed income indexes: Cambridge University research highlighted that 33% of asset owners report facing barriers in gaining access to investment grade corporate bond products (indices, benchmarks, funds) that align with their fixed income climate strategies5. Yet this is an important asset class allocation for global asset owners, as we have highlighted in our recent whitepaper on insurers approaches to climate investing, where most insurers have a predominantly fixed income allocation. While there are complexities to index construction in fixed income, particularly for sovereign exposures, we believe this to be an area of innovation that asset owners can keep an eye out for.

- New themes – transition and adaptation: As laid out in our approach to climate mitigation, adaptation and transition, we believe in addition to climate mitigation, the assessment of transition risks and opportunities alongside investing into climate adaptation needs and solutions can present new opportunities for investors. For example, research suggests that global annual revenues from climate adaptation solutions could grow from US $1 trillion to US $4 trillion by 2050 while the investment opportunity set could grow from US $2 trillion to US $9 trillion by 2050.6 Identifying the right metrics and screening criteria to assess transition and adaptation activities could create new climate index and ETF opportunities.

- Applications in active ETFs: Active ETFs are expected to be significant driver of growth for the ETF market, for example in 2024 half of the US’s net ETF inflows came from active ETFs.7 Such strategies benefit from the efficiency and transparency of ETFs while also allowing for the combination of systematic screening of companies on climate perimeters alongside fundamental research and stewardship for portfolio construction.

- Commodities and carbon tilt: For investors interested in commodities investing, one other area of innovation is having a carbon tilted commodity strategy. Through Life Cycle Assessment (LCA) models to assess emissions across all stages of commodity production process, one can underweight commodity sectors with higher emissions and overweight those with lower emissions. At the same time investors can also target a percentage reduction in portfolio emissions relative to the commodity benchmark in question.

These trends can continue to provide investors with a range of solutions that can be customized to asset owners’ unique objectives and constraints.

With research contributions from Invesco’s Sustainable Investing Analytics team (Himanshu Agarwal and Niraj Desai).

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

There are risks involved with investing in Exchange-traded Funds (“ETFs”), including possible loss of money. Index-based ETFs are not actively managed, and the return of index-based ETFs may not match the return of the Underlying index. Actively managed ETFs do not necessarily seek to replicate the performance of a specific index. Both index-based and actively managed ETFs are subject to risks similar to those of stocks, including those related to short selling and margin maintenance requirements. Ordinary brokerage commissions apply. Equity risk is the risk that the value of equity securities, including common stocks, may fail due to both changes in general economic and political conditions that impact the market as a whole, as well as factors that directly related to a specific company or its industry.