Applied philosophy: Where do we find value in Emerging Market equities in 2025?

Emerging Market equities kept pace with their global benchmark for most of the last 12 months except for the rally led by mostly the US after the US Presidential election. I expect economic growth to reaccelerate towards trend despite the higher levels of US policy uncertainty. This should be a hospitable environment for EM equities, in my view, especially if developed market central banks continue easing. In such a diverse asset class, I think it is worth digging deeper into which countries I would favour for the long term based on their valuations.

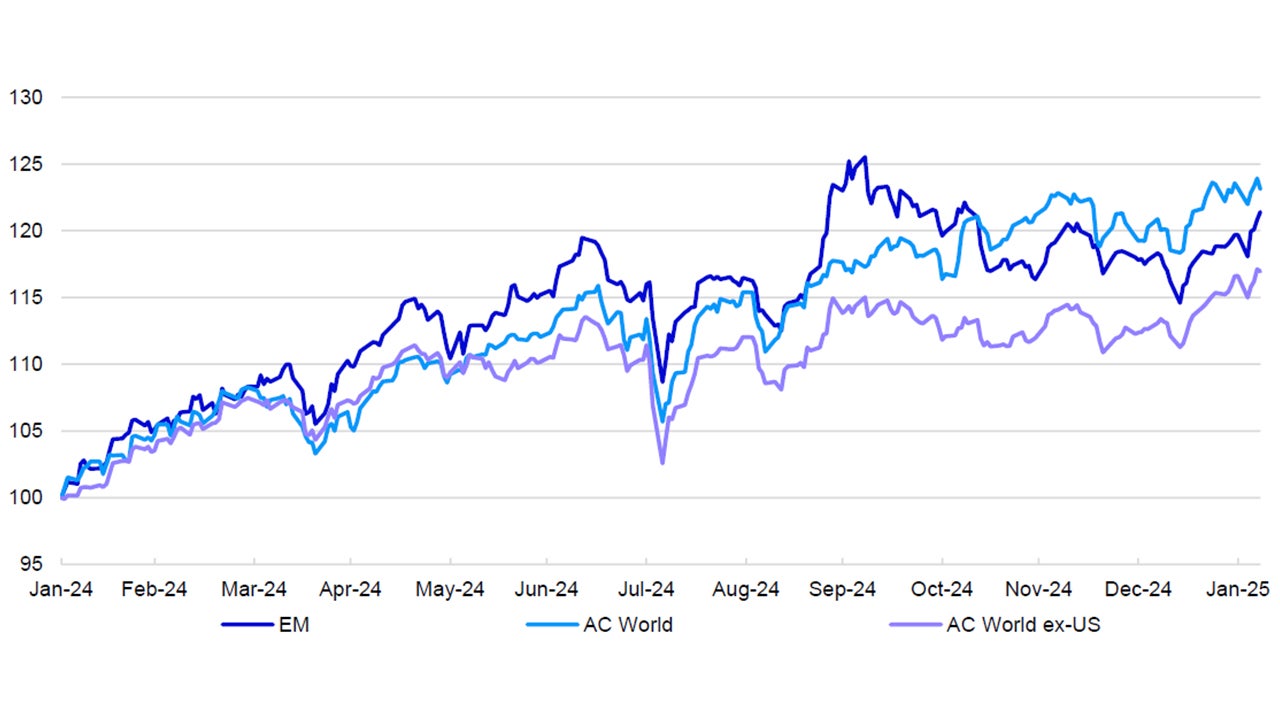

January usually feels like the longest month as we trudge through the dark and the cold without the excitement of holidays to distract us. However, this year it has flown by with the news cycle being extra eventful. Equity markets have had a lot to contend with, from the inauguration and the first flurry of executive orders by President Trump, through benign inflation reports to a mini-wobble in technology stocks. Developed Markets (DM) have had a strong start to 2025, especially Europe, with Emerging Market (EM) equities broadly in line with the MSCI All-Country World index (Figure 5). Will EM be able to keep up with global equities in the next 12 months?

The first signs are not encouraging. The US dollar has been strengthening since the end of Q3 2024 (as of 7 February 2025 based on the DXY index) mainly driven by an increase in US rate expectations, which tends to coincide with EM underperformance (although that trend has partially reversed since mid-January 2025). Recent US announcements on tariffs may add to USD strength unless other countries retaliate. Also, if “trade wars” escalate this raises the prospect of higher global inflation and could suppress growth and investment, all of which may disproportionately impact EM economies.

As Figure 1 shows, until the end of Q3 2024, EM equities were on course to outperform the MSCI All-Country World index on a local currency basis since the last time I published my deep dive into EM equity valuations (see here for more detail). A range-bound US dollar and the anticipation of Fed easing played a part alongside resilient global growth. That reversed in Q4 2024 as investors increasingly priced in the impacts of a Trump presidency including potentially higher inflation, interest rates and a stronger USD.

The relatively strong total returns in EM in the last 12 months were mostly driven by China, while DM equities were boosted by strong US returns. Interestingly, the two largest economies in the world had similar nominal GDP growth rates at around 5% in 2024. Although there was a roughly even split between real growth and inflation in the US, inflation was close to 0% in China. The main drivers of growth were different, too, with consumer spending driving most of US GDP growth and investment and exports in China.

Nevertheless, there has been a growing concern that the world may be split into the US and the rest, especially if President Trump increases tariffs, or uses them as leverage in negotiations. In my view, financial markets have at least partially priced in higher levels of uncertainty about the likely path of inflation and growth. I think this could lead to a more “risk-off” environment than implied by economic fundamentals, which remain robust for now.

Notes: Past performance is no guarantee of future results. Data as of 7 February 2025. We show daily data from 31 January 2024 rebased to 100 on that date. We use the local currency versions of total return indices for the MSCI Emerging Markets Index, the MSCI All-Country World Index and the MSCI All-Country World ex-US Index.

Source: LSEG Datastream, MSCI, Invesco Global Market Strategy Office

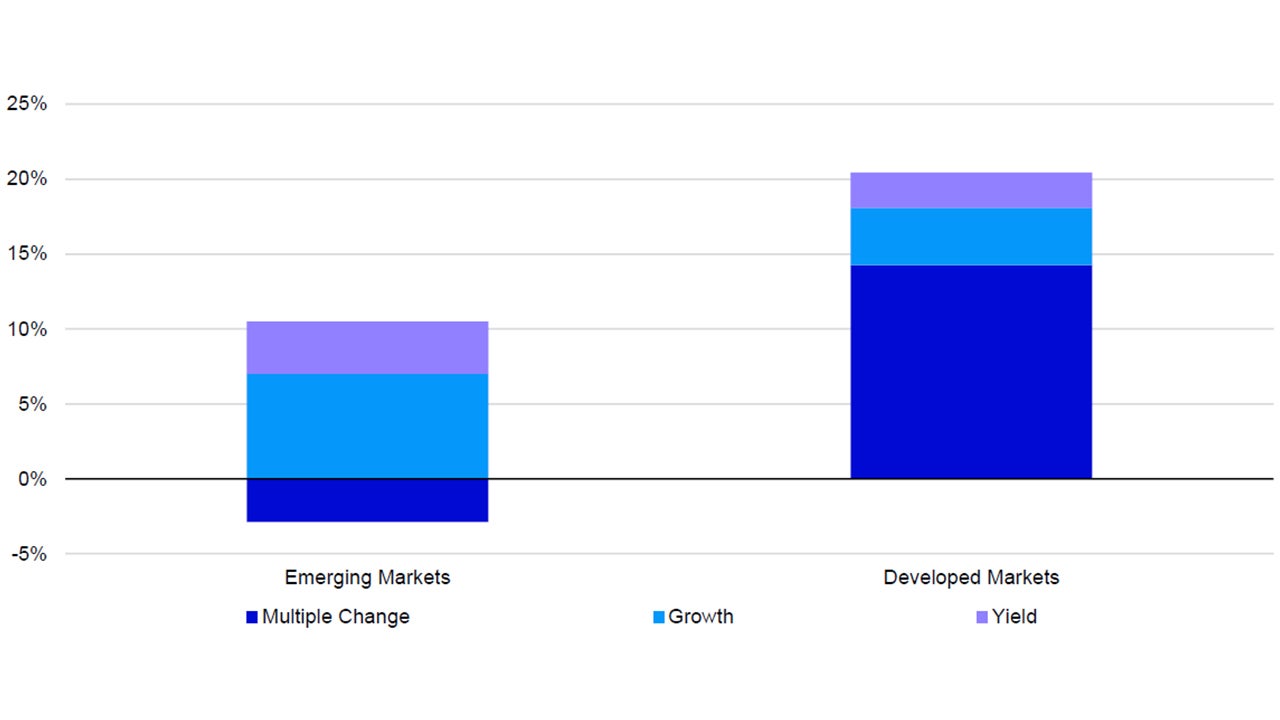

A good way to start, in my opinion, is to examine what drove this performance differential. If we decompose returns into the change in valuations (using dividend yields), dividend growth and income, it becomes evident that developed market outperformance was mainly driven by multiple expansion between 31 January 2024 and 7 February 2025. Both dividend growth and dividend yield were higher for EM, but multiples contracted in the same period.

I can think of at least three reasons why that might have happened: 1) a fading belief in the power of EM economies to catch-up with DM (especially the US), 2) the widening gap between the two groups of countries in terms of technological progress (most of the multiple expansion was driven by the technology sector), 3) the expectation that the policies of a Trump-led United States will keep interest rates higher than previously expected and the US dollar strong.

Policy uncertainty may eventually favour relatively “safer” assets, such as DM equities and government bonds, especially in Europe where monetary policy looks the most favourable. Nevertheless, a widening valuation differential makes a strong case for EM equities for a contrarian like me. Whether the main drivers of that are structural or cyclical could be up for debate, although I suspect cyclical factors will have a bigger impact in the next 12 months (structural change takes a longer time to unfold, in my view).

Indeed, our base case for 2025 implies a positive environment for EM (see here for the full detail). In my view, the global economy could reaccelerate after uneven growth in 2024, while monetary policy easing is likely to continue. This includes the Fed, which implies a weakening US dollar that would boost commodity prices (many EM economies are commodity exporters). On top of that, valuations may have priced in a lot of bad news. The dividend yield of 3.3% is higher than that of all other regions apart from the UK’s that is on the same level. At the same time, its cyclically-adjusted price/earnings ratio (CAPE) of 16.7x is the lowest (all valuation ratios are as of 7 February 2025). EM equity valuations also look favourable compared to historical averages: they trade at a 22% discount based on dividend yield and a 7% discount on CAPE.

The current disinflationary process may have stalled and partially reversed recently, but in my view inflation rates will stay within the “comfort zone” of within one percentage point of central bank targets in most countries. I think this will allow monetary policy easing to continue, which could remove some of the headwinds to growth, even if it may be more gradual than previously expected. The main risk for EM economies is a further weakening of their currencies especially against the US dollar, which could add to inflationary pressures prompting local central banks to raise rates as in Brazil, for example. However, some of those pressures may have been priced in opening up the opportunity for strong returns.

Notes: Data as of 7 February 2025. Past performance is no guarantee of future results. Returns are calculated between 31 January 2024 and 7 February 2025. “Yield” shows the income investors received from dividends paid during the period concerned. “Growth” shows the rate of dividend growth, calculated using the percentage change in dividend per share (DPS) values for the sector indices. DPS is calculated as dividend yield times the price index. “Multiple Change” refers to the change in dividend yield, plus the change in dividend yield times dividend growth. We use the Datastream Total Market Emerging Market and Developed Market indices.

Source: LSEG Datastream and Invesco Global Market Strategy Office

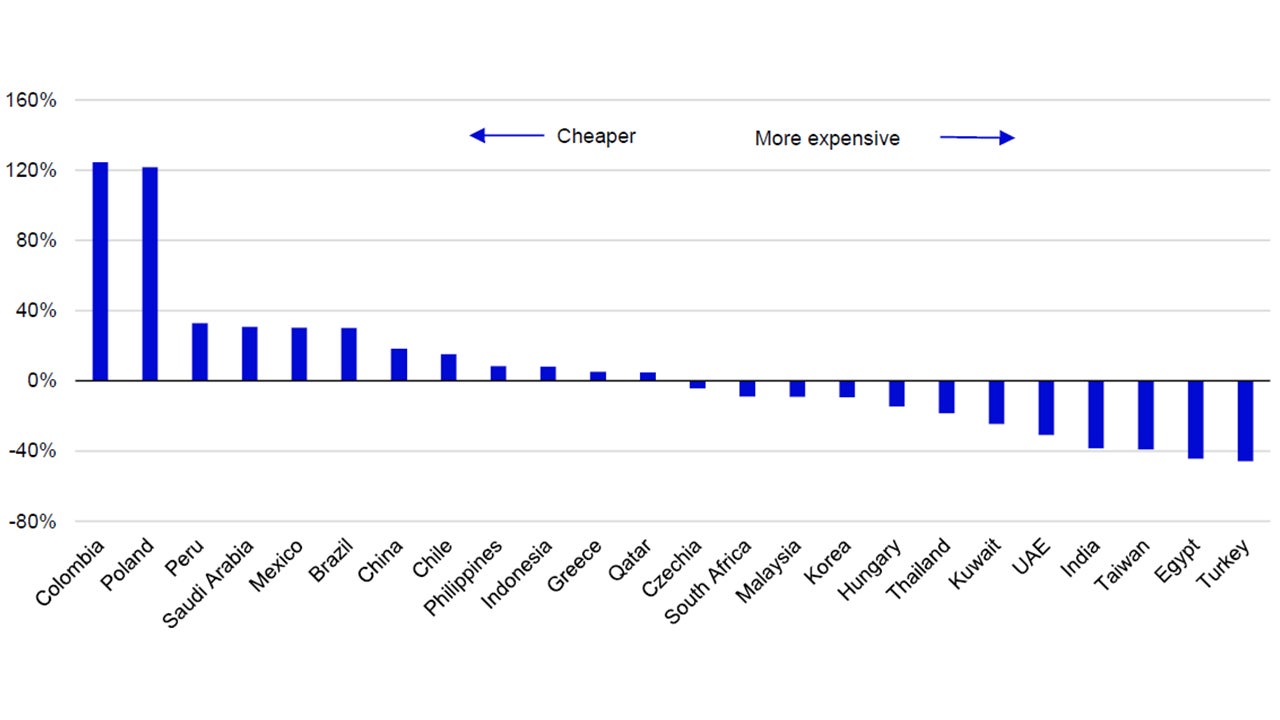

Notes: Data as of 7 February 2025. We use dividend yields from Datastream Total Market indices. The regional benchmark is the Datastream Total Market Emerging Markets (EM) index. The chart shows the ratio of the dividend yield on each market to that of the EM index, compared to the historical average for that ratio. We consider markets with positive values to be cheap, and those with negative values expensive.

Source: LSEG Datastream and Invesco

I am also positive about the long-term prospects of EM despite short term challenges. I think valuations should support EM equities especially if we avoid a global recession, which remains a tail risk for now. Eventually (I think) the current period of uncertainty will pass and improving risk appetite could boost EM returns.

Even if I am positive on EM equities overall, I think it is important to differentiate between such a diverse group of markets. Therefore, I examine the valuations of each constituent of the MSCI EM index using dividend yields relative to the EM benchmark versus their respective historical averages (Figure 3). Despite their recent underperformance (see Figure 4), Egypt, India and Korea continue to look overvalued alongside stronger performers, such as Hungary, Taiwan, Thailand, Turkey and the United Arab Emirates.

Most of the rest of the Asia-Pacific region (Indonesia, the Philippines and Malaysia) look close to historical averages joined by South Africa, Czechia, Qatar and Greece. I would consider these countries to be close to “fair value” at this point.

Latin American markets seem to be the most attractive with relative dividend yields higher than historical norms. I think that a lot of bad news is priced in making these countries the most attractive despite lingering uncertainty about how much of these high yields can be attributed to high payouts in the past (these markets tend to be dominated by resource-related stocks). Saudi Arabia is the most similar to these countries where extractive industries account for most of dividends paid. On the other hand, Poland is a more diversified market, albeit one dominated by banks.

Finally, China appears to be one of the most attractive large stock market within EM. Its relative dividend yield is well above its historical average suggesting attractive returns over the long term. After recent strong returns, valuations point to a less extreme undervaluation, but they still imply a good potential for outperformance.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.