Harvesting the “desynchronization” premium: A case for China equities

As global investors continue to navigate a more complicated landscape, it’s essential we examine the full investment opportunity set and consider new sources of improved portfolio risk-adjusted returns. An area that has received considerable attention but is still overlooked by many investors (even in Asia), is China. In a post-Covid environment, investors have reaped substantial benefits from developed equity markets, particularly the U.S., but going forward, as financial conditions tighten in the West, investors may need to reconsider asset classes that can help them achieve desired portfolio outcomes. Investors traditionally look to harvest a diversification premium and provide ballast to their portfolios when facing a volatile economic backdrop. We’ve discussed this matter in detail with respect to multi-asset approaches, such as through fixed income and private markets. However, we haven’t touched on methods to achieve growth and diversification within a global equity sleeve. This is where the opportunity in China equities becomes particularly compelling.

Investors often discuss the term “decoupling” with respect to China and the West, but the more appropriate term is “desynchronization”. Both economic systems are undoubtedly interdependent, and although the underlying business cycles within the two blocs has moved somewhat out of sync mostly due to the unique post-Covid environment, we do not believe this is a paradigm shift and the global forces that drive markets remain intact. In fact, this emerging phenomenon creates a unique space for investors to improve portfolio outcomes by enhancing returns and reducing risks, the primary objective of most of the investors we engage.

Analyzing this through a process-driven framework, we consider the efficacy of China equities using our long-term capital market assumptions (LTCMAs) and the Invesco Vision platform. It’s imperative we understand the fundamental return-drivers of equities and compare expectations in China versus developed markets such as the U.S. The construction process for our long-term CMAs involves a building block approach, where we decompose equity returns into observable and forecastable component parts.

Source: Invesco, for illustrative purposes only.

The three key underlying components of equity returns over a long-term time horizon are total yield, valuation change, and earnings growth. Additionally, we consider the impact of currency exposure using an interest rate parity approach, which we believe is effective over longer time periods. It’s important to note that in our view long-term earnings growth eventually reverts to nominal GDP per capita, which we use as an earnings proxy in our calculations. Given this, we can make a side-by-side 10-year LTCMA comparison of China and U.S. large cap equities (for a USD-denominated investor).

| Total Yield | Valuation Change | Earnings Growth | Currency Adjustment | Total Expected Returns | |

|---|---|---|---|---|---|

| China equities (Proxy - CSI 300) | 2.5% | 1.0% | 4.7% | 1.2% | 9.4% |

| U.S. equities (Proxy - S&P 500) | 2.7% | -0.3% | 3.6% | 0.0% | 6.0% |

Source: Q2 2023 Long-Term Capital Market Assumptions, data as of 30 June 2023. For illustrative purposes only. An investment cannot be made directly into an index. There can be no assurance that any estimated returns or projections can be realized. Past performance is not a guarantee of future results.

Looking at the sub-components of the CMA forecasts above, it’s important to unpack the key sources of divergence and consider additional factors when analyzing how to best integrate China equities into a diversified global portfolio. One interesting aspect that many global investors might not be actively considering as a return driver for China equities is a robust yield, driven by dividends, roughly on par with U.S. large caps. Another item worth considering is valuation, which is impactful over longer-term periods (over 7 years). Considering long-term, cyclically adjusted price-to-earnings (CAPE) ratios, U.S. equities are currently priced at 3x their Chinese counterparts.

Source: Barclays

An additional driver of returns is earnings growth, which as mentioned previously reverts to nominal GDP growth per capita over a long time period. Looking at the real GDP growth component of this figure, our expectations for China are 4.2%, as opposed to 1.9% for the U.S. Accounting for a deceleration in China’s real GDP per capita versus what we saw in the 2010 to 2019 period (pre-Covid), we still think growth will substantially outpace developed markets. In our view this excess real growth should benefit China equity investors. Finally, the interest rate differential between China and the U.S. is likely to provide a currency tailwind for CNY-based investments over a long horizon.

As seen above, investors can accrue meaningful benefits by allocating to China in a diversified portfolio, as valuations, earnings, growth, and currency tailwinds provide an attractive return proposition. However, as portfolio constructionists we know it’s imperative to consider additional factors such as volatility and correlation, to ensure asset classes benefit portfolios on a risk-adjusted basis. This is where we’ll further leverage the Invesco Vision platform to forecast the expected risk between China and U.S. equities.

| Expected risk(%) | Correlation | |

|---|---|---|

| China equities (Proxy - CSI 300) | 25.1 | 0.29 |

| U.S. equities (Proxy - S&P 500) | 16.9 |

Source: Invesco Vision, data as of 30 June 2023. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized. An investment cannot be made directly into an index.

While we can see an increased level of volatility exhibited by China equites, there is a substantially reduced level of correlation between the two markets. The combination of these factors leads to overall risk reductive effects on a portfolio, which we’ll discuss in the subsequent analysis. This diversification benefit, or perhaps better framed “desynchronization” premium in this unique construct, can provide substantial benefits to global investors. Overall, it is a sound assessment to view China equities as “riskier” than U.S. equities in a traditional context, however, given the ability to improve both growth and diversification when combined, we think the potential rewards outweigh the risk.

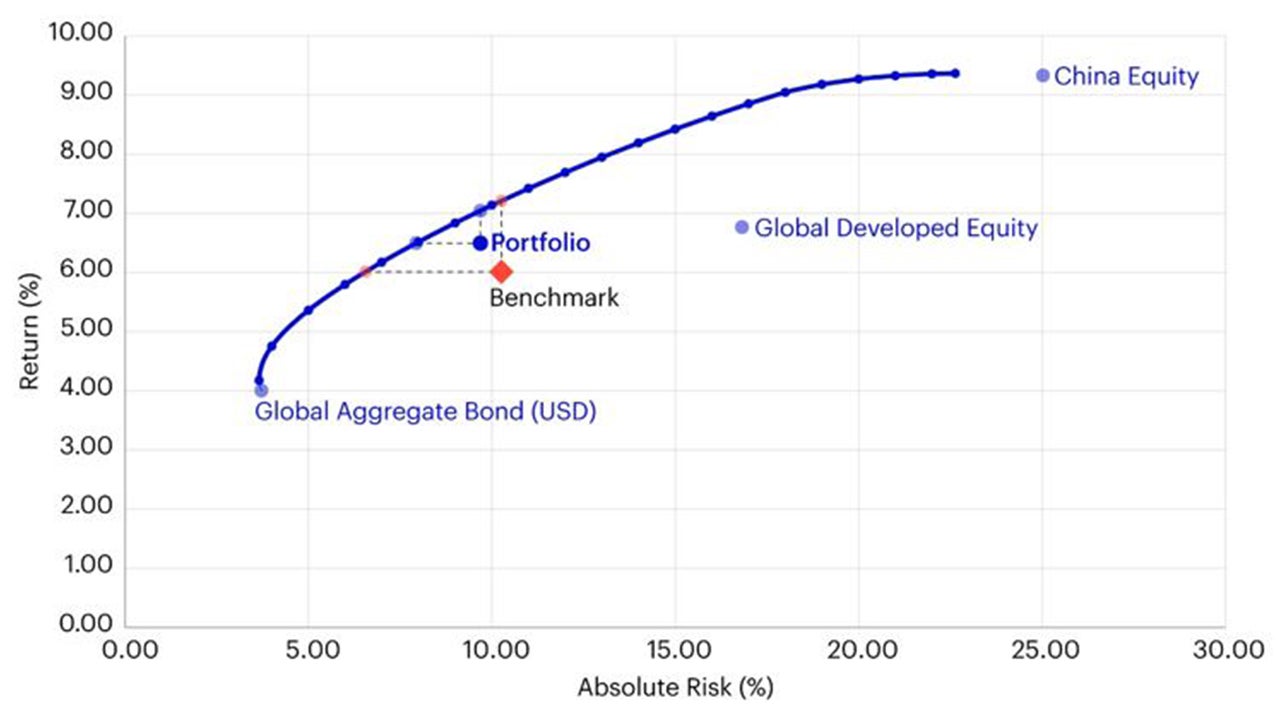

While comparing the unique nuances of the China and U.S. equity markets is a helpful guidepost, we also wanted to consider integration of China equities in the context of a global balanced portfolio, since this is most common starting point for investors.

We begin the analysis with a straightforward implementation of 10% exposure to China in a portfolio of developed global equities and core bonds.

Source: Invesco Vision, data as of 30 June 2023. Return estimates are based on the Q2 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

| Portfolio 1 | Portfolio 2 | |

|---|---|---|

| Portfolio Composition | Global Developed Equities -60% Global Bonds - 40% |

Global Developed Equities -60% China Equity - 10% Global Bonds - 40% |

| Expected Returns (%) | 6.0 | 10.3 |

| Expected Risk (%) | 6.5 | 9.7 |

As discussed in our prior examples, implementing China equity can increase expected return and reduce portfolio risk. In this instance, the 10% allocation to China equities increases expected portfolio return by nearly 50 bps, while at the same time reducing portfolio volatility by 60 bps. This is a meaningful improvement in risk-adjusted returns, and one which isn’t realistically possible with any other global equity asset, providing investors with benefits via the “desynchronization” premium we see playing out in global markets.

It is important to reinforce another unique aspect of China equity markets, which is very different from the developed space – the ability to generate steady outperformance through active management, often times achievable through low to moderate tracking error approaches (e.g., 1-3%). Median range China A active quantitative managers frequently generate information ratios above 1, which is typically only achieved by the very top tier of active managers in developed markets. This market dynamic further increases the attractiveness of China equity exposure and augments the asset class-based analysis shown above, providing global investors with strong rationale to consider this opportunity. It is worth noting that there are even ways to harvest an outperformance premium using passive-based approaches.

Thinking through a more tactical lens, the recent Politburo meeting indicated the Chinese government is pursuing a more dovish monetary policy stance going forward which has already improved risk sentiment. From a global perspective, using our Tactical Asset Allocation (TAA) framework we shifted to a recovery regime (i.e., risk-on) stance in July, so the opportunity in emerging market equities such as China is expected to be strong in the short to intermediate term in addition to the strategic attractiveness we’ve highlighted above.

In sum, being able to increase both growth and diversification within the equity sleeve by investing in China equities is unique amid the current backdrop. We believe this emerging “desynchronization” premium is compelling for global investors.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Diversification and asset allocation do not guarantee a profit or eliminate the risk of loss.