As inflation continues to rise in many developed markets, central banks are hiking interest rates aggressively but with little success in containing inflation. Some countries are facing the risk of economic recession. With the uncertain macro-economic outlook, stock and bond markets are getting increasingly volatile. Investors are looking for investment choices with lower risk and volatility to garner a relatively stable return.

Record-high inflation in developed markets

US Consumer Price Index hit a 40-year high of 9.1% in June and hovered around high levels in July and August. Eurozone inflation hit new record of 9.1% in August. Elsewhere, inflation has become a bigger problem in the UK than other European nations. Inflation went up to 10.1% in July and is now forecast to hit 13.1% by the end of the year.

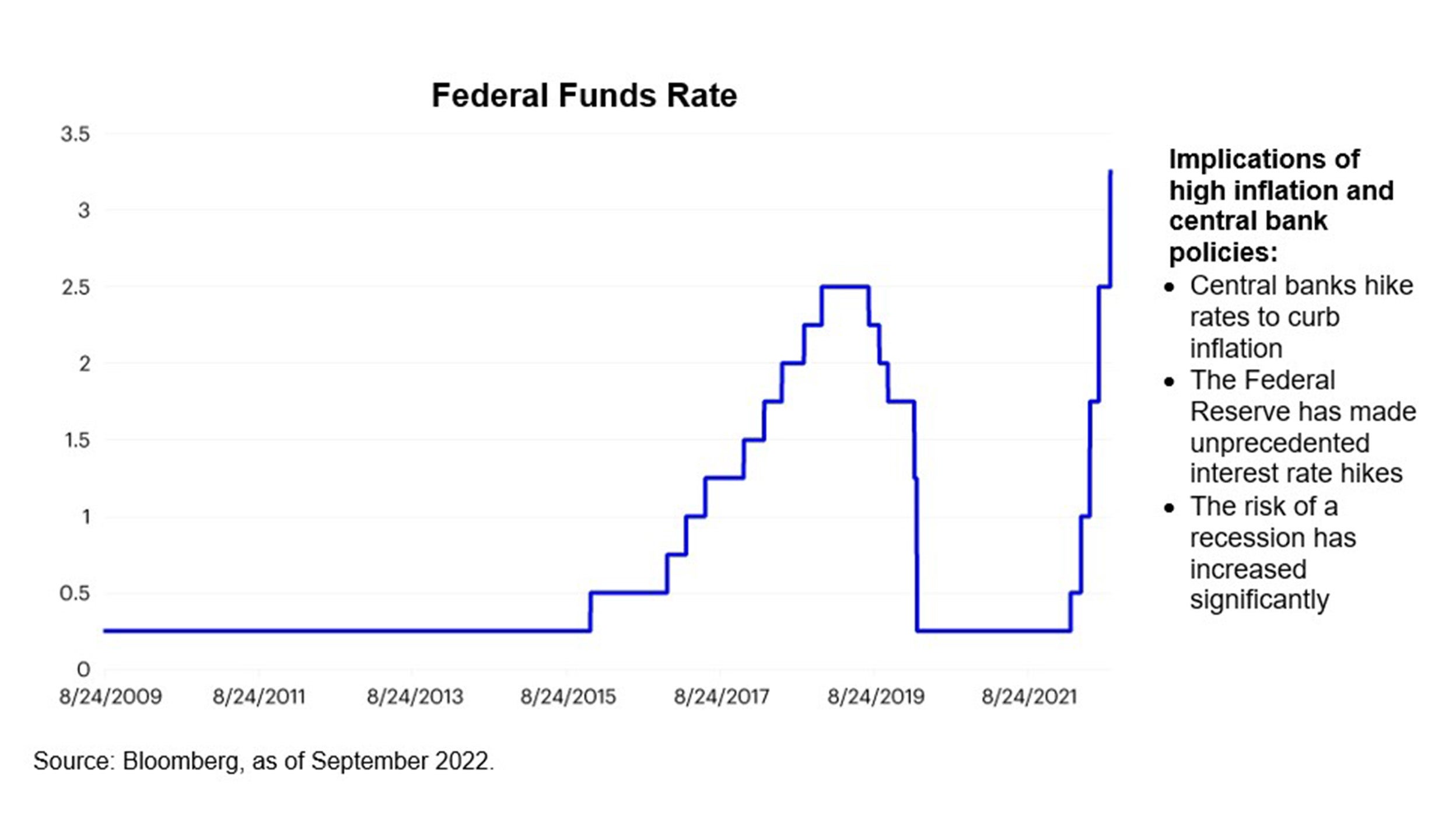

One of the reasons leading to high inflation in the US is monetary policy. Money supply has surged after the Federal Reserve rolled out “unlimited Quantitative Easing” and maintained interest rate at an ultra-low level of 0.25% which is far below inflation rate since March 2020.

John Taylor, Professor of Economics at Stanford University, says, “When monetary policy is too easy - either because the Federal Reserve sets the interest rate too low or because it increases money growth too rapidly - there will be an increase in inflation.” 1 Besides, geopolitical tension has put pressure on supply chain, coupled with a surge in post-pandemic demand and fiscal stimulus in some countries, also led to the high inflation globally.

Central banks hike interest rates aggressively to curb inflation

Central banks, led by the Federal Reserve, have been raising interest rates since early 2022. In particular, central banks in the US, Euro Zone and Canada announced rate hikes by 75 basis points in September. The latest Federal Funds Rate has reached 3.25%, the highest since 2008.

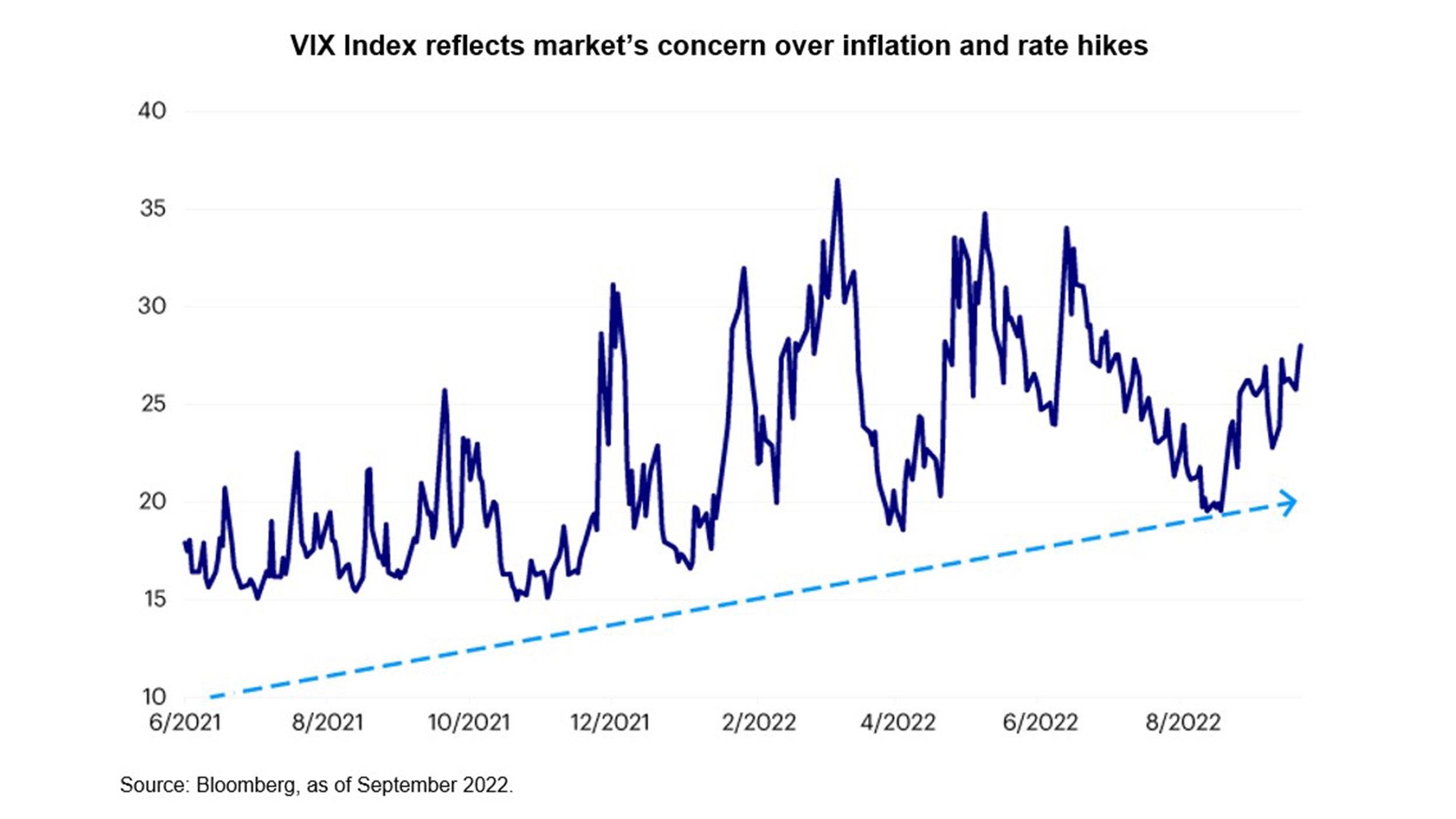

However, the consecutive rate hikes have created market uncertainties. The VIX Index, which measures the volatility of S&P 500, has trended upward since last year, reflecting higher volatility in the stock market. As inflation intensifies, investors are looking for investment choices with relatively stable returns, less risky and lower volatility.

What to look for when investing amid an inflationary backdrop

High quality and more defensive assets

Relatively lower correlation with risk assets

Potentially consistent and stable income

Four investment choices in high inflationary environment and their advantages

Senior loans

Senior loans are underwritten by banks and used by corporations to finance acquisitions, refinance existing debt or for other business purposes.

👍 Floating rate feature adjusts to changes in interest rates

👍 Asset class resiliency with positive returns in 28 of the last 30 years2

👍 First to be repaid in case of a default

Real estate

Real estate encompasses residential, offices, shopping malls, logistics centers and warehouses.

👍 Inflation could be passed on to tenants in the form of rent rises

👍 Stable rental income

👍 Typically higher yields than traditional equities and bonds3

👍 The real estate market has relatively lower volatility

Investment grade bonds

Investment grade bonds are rated Baa3 or higher by Moody’s; or BBB- or higher by Standard & Poor’s and Fitch.

👍 Financial stability and ability to repay debt, higher credit rating and lower risk of default

👍 More defensive amid market volatility

👍 Medium to long term total return potential. Relatively stable.

Real assets

Real assets include commodities, agriculture, timber, infrastructure, and real estate.

👍 Positive returns over the last 20 years4

👍 Typically higher yields than traditional equities and bonds4

👍 Inflation may bring on higher income for certain infrastructure projects, such as toll roads and rental income for real estate

Past performance is not indicative of future results.