Fixed Income: A strong case for bonds

As economies show resilience, selectivity and care remain critical for bond investors figuring out where to take duration risk and how to think about returns.

Easing monetary policy and financial conditions are expected to support global economic growth close to potential. Though a recession scenario is not expected, it remains a 15% risk case.

A benign growth and inflation outlook implies that further restrictive monetary policy is not necessary, and central banks should seek to get rates closer to neutral. We expect central banks to deliver a series of rate cuts over the next year across the major global economies.

We are underweight equities relative to fixed income, favouring US equities and defensive sectors, and overweight duration in investment-grade credit and sovereign fixed income in our strategies. We also may see opportunities in Private credit and commercial real estate debt.

Following a year in which disagreements surfaced between Government ministers and the Prudential Regulation Authority over the extent of reforms to UK Solvency II, 2024 should be the year in which the final technical details of the reform package are ironed out and brought into force.

The UK authorities plan to finalise the reform package in three tranches:

Tranche one: HM Treasury will legislate to reduce the Risk Margin. Draft regulations published1 in June 2023 proposed to cut the risk margin for long-term life insurance by approximately 65%, and for non-life insurance by approximately 30%. The final legislation is expected by the beginning of 2024.

Tranche two: the PRA will publish final rules on the Matching Adjustment (MA). In September 2023, the PRA published a consultation paper setting out draft plans to “enable broader and quicker investment by insurers in their MA portfolios”2, as well as an attestation process for the amount of MA benefit being claimed. The PRA expects to publish final policy and rules on the MA during Q2 2024, with the changes coming into force on 30 June 2024.

Tranche three: all other Solvency II reforms on which the PRA has consulted will take effect on 31 December 2024. These include the draft proposals consulted on in June 2023, which the PRA predicts “will allow a meaningful reduction to the existing administrative and reporting requirements for the UK insurance sector”3.

Once the reforms are in force, pressure is likely to build on the insurance industry to demonstrate that the benefits – which the City Minister has predicted could be up to £100bn of capital freed-up for investment – are delivered.4 MPs have already questioned the PRA on whether its remit extends to monitoring whether capital released under the reforms is invested in the UK economy rather than transferred to shareholders via higher dividends.5 Given the constrained state of the public finances, the next government (of whichever colour) is likely to look to the private sector – and to the insurance sector in particular – as a source of significant new investment capital.

UK Solvency II (to become Solvency UK) |

|---|

|

The UK registered zero growth in Q3, and few expect much, if any, for 2024 overall. Inflation remains uncomfortably high and has been slower to recede than in the US and Eurozone. Although the inflation outlook remains uncertain, recent data have shown a moderating trend and the labour market is showing signs of loosening, which should feed into slower wage growth going forward.

Source: Bloomberg, October 2023

The BoE decision to pause at its September meeting suggests that the bar for near-term rate hikes is relatively high. We think short-term rates should remain capped in the context of relatively weak macro fundamentals and tighter financial conditions. Market pricing suggests that the Bank Rate will stay around its current level throughout most of 2024. However, heavy supply and the lack of liability-driven investment demand continues to put upward pressure on longer-dated yields.

The cycle is relatively advanced in the UK and Europe with credit events picking up among weaker rating categories. We expect these to continue rising in 2024 given more challenging refinancing conditions. We have seen an uptick in disappointments during the Q3 2023 earnings season, but we still view these as idiosyncratic rather than systemic.

Overall fundamentals are still reasonable, however. Leverage in sterling investment grade is low by historical standards and earnings margins are still elevated. Interest coverage has come down with rising yields and we are expecting it to continue deteriorating gradually, but this is not an immediate concern given well-spread maturity profiles.

Source: Bloomberg Intelligence, Q2 2023

In the US, the credit cycle shows signs of maturing. Leverage has trended higher while margins, interest coverage, and revenue growth have fallen. We expect that corporates will prioritize debt paydowns to control borrowing expenses and defend balance sheets. Downgrade activity escalated in 2023, albeit from a low base, and upgrades still outweigh downgrades.

We think spreads on investment grade look reasonable given the macro environment and corporate fundamentals. While the growth outlook is anaemic, Sterling issues are trading substantially outside of their long-term medians. Looking overseas, Euro corporates are also wide of their longer-term averages while US ones are slightly inside – likely due to the stronger growth dynamics in the US.

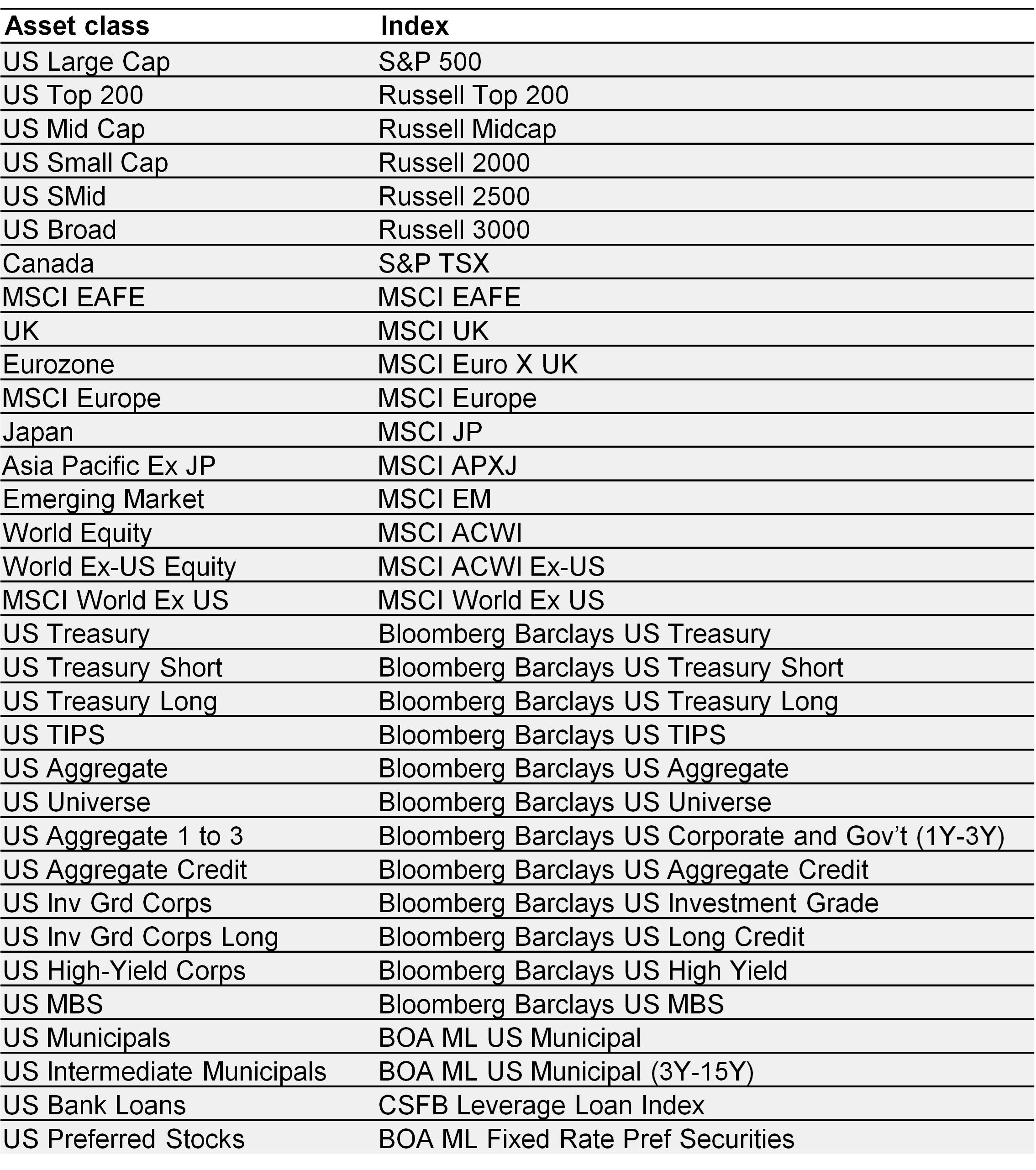

Source: Bloomberg, October 2023. An investment cannot be made in an index.

As always, the spread levels for an overall index conceal wide variations therein – and there are many relative value opportunities for investors who can pick and choose securities with a global viewpoint.

In the current risk-averse environment, insurers are naturally over-allocating to high quality bonds which exhibit much better spread than during the last decade and which could withstand a potential recession. The relative attractiveness of private debt is decreasing since highly rated credit assets are scarce on the private side, they need to be manufactured which induces a complexity cost.

Amongst the other factors of the asset allocation change of annuities writers, we can quote the increasing need of matching adjustment assets following the fall in the equity release production as a response to the increased interest rates resulting from the mini budget and the increasing activity on the BPA side.

On the other sides of the insurance business, private assets perfectly played their role of shock absorbers over the last few years but their relative importance in the balance sheet increased and neared the liquidity risk limits. Though the denominator effect slowed down the allocation to private assets over the last 18 months.

We expect a repricing of the private assets at year-end and a stabilization of the liabilities’ cost which will leave more room for diversification in 2024.

Source: Invesco. Data as of 30/09/2023.

Public markets, Fixed income remains the story of the year.

On the private markets side, we over allocate to debt over equity to cushion the volatility and refinancing risk and benefit from opportunities which are a good fit for insurers’ risk appetite & ALM: low LTVs and strong covenants.

The focus on diversification and the increasing appetite for inflation linked assets will probably attract new investors in the real estate debt space since higher interest rates and lower inflation have resulted in an attractive entry point thanks to repricing. Besides reduced bank lending creates a compelling opportunity for alternative real estate lenders.

Private Credit quality has also improved since 2022 via lender-friendly documentations and lower leverage profiles notably on the middle market side. Considering loans offer some of the best yields in fixed income despite their senior secured status, we believe their low correlation with traditional asset classes of the insurance balance sheet make them an attractive way to reinforce asset allocation in 2024.

As economies show resilience, selectivity and care remain critical for bond investors figuring out where to take duration risk and how to think about returns.

To optimise income yield and growth, we look for opportunities that are supported by long-term structural demand drivers, or where active management can enhance cash flows.

While 2025 brought uncertainty, the aftermath also brings new opportunities for the year ahead. Our experts discuss the potential this new landscape may bring in 2026.