Innovation Beyond passwords: The future of biometrics

The evolution of biometric technology benefits almost every industry and has many business and personal use cases.

There was a time when intelligent robots were possible only in movies. Now they’re very much part of our everyday lives. Industrial robots serve many functions today, including automobile assembly lines, loading delivery trucks, and even automated vacuum cleaning.

Those are the familiar avenues through which robots are deployed, but there’s more to the story. Automation and robots are receiving renewed attention from corporate customers and businesses alike looking to avoid supply chain disruptions.

That’s one reason why industrial robotics revenue is forecast to grow 5% to 7% annually over the next four years. Additionally, the cost of those robots is expected to decline 3% per year over that same period, indicating barriers to adoption are falling.1

*Projected

Source: World Robotics 2023 Report, International Federation of Robotics

Invesco QQQ ETF, which tracks the Nasdaq-100 Index, is home to several companies that are purveyors of automation and robotics services and technologies. QQQ also holds companies that produce components and gear needed to drive those offerings as well as firms that are potential beneficiaries of increased automation and robotics adoption.

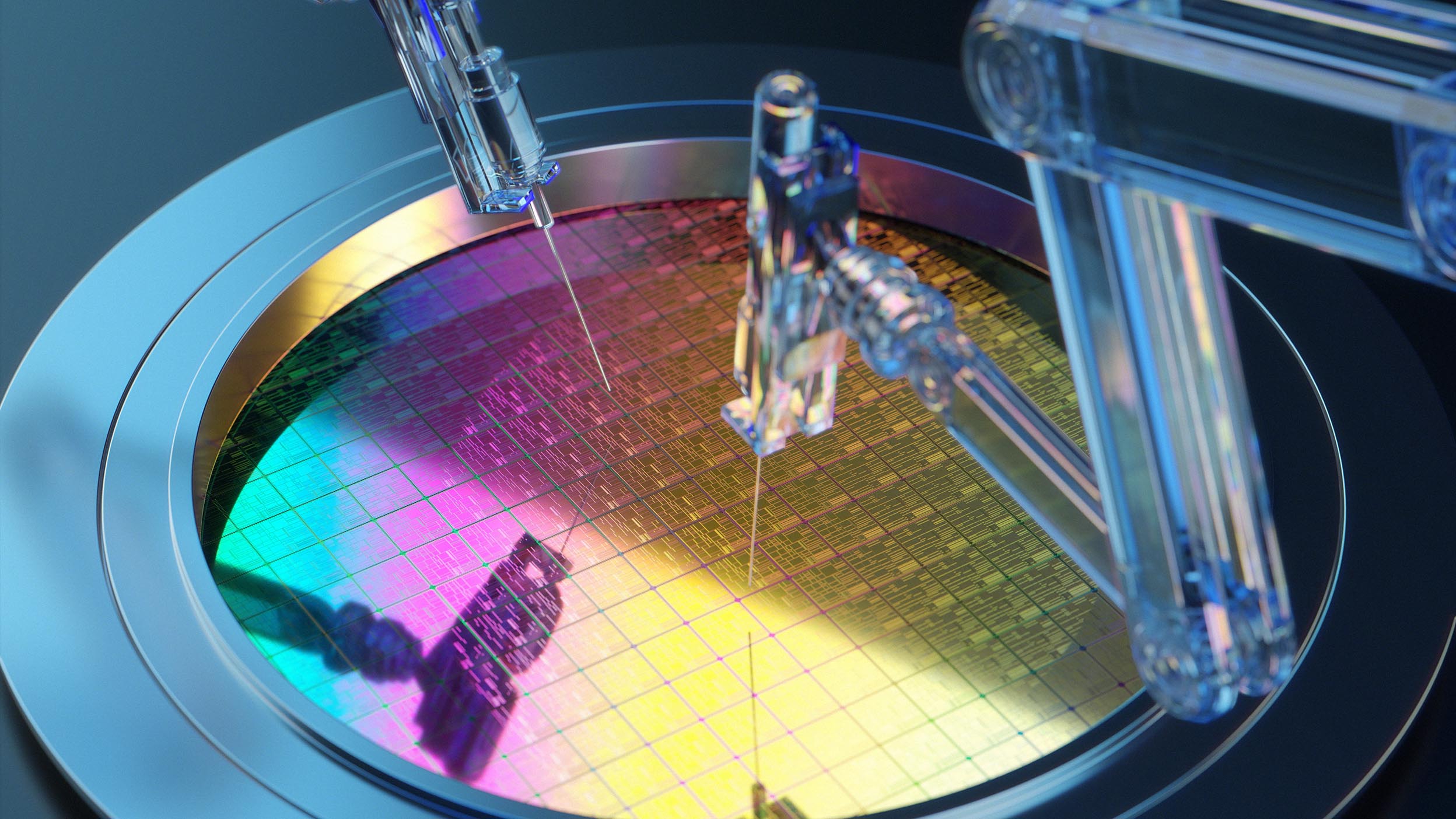

As is the case with so many disruptive technologies, automation and robotics are semiconductor intensive. Robots require cutting-edge computing power so they can process their environment and execute complex tasks. Semiconductors are to robots what brains are to humans.

Therefore, it’s no surprise that semiconductor leader and QQQ holding Nvidia provides some exposure to robotics through its dominating presence in graphics processing units (GPUs) and AI technology. Nvidia also has the Jetson computing boards designed for embedded AI computing in autonomous machines, including robots. Users of the Jetson platform include Nvidia customers like Amazon, Cisco, and Pepsico – all of which are QQQ holdings.

Qualcomm is another example of a semiconductor manufacturer with an increasing robotics footprint. The company’s Robotics RB6 platform powers next-gen robots in defense and sophisticated industrial manufacturing applications.

Other semiconductor names currently in QQQ’s portfolio include Broadcom, Advanced Micro Devices, and Applied Materials.

Automation and robotics end markets such as AI, cloud computing, defense, and electric vehicles seemingly overshadow the healthcare opportunity set, but that sector is a potential epicenter of robotics adoption.

Robots produced by companies including QQQ holding Intuitive Surgical are already performing complex surgeries, often reducing patient risk and improving outcomes in the process. In 2020 it was estimated that only 3% of surgeries performed around the world were executed by robots,2 indicating there’s significant runway for growth.

Then there’s the administrative side of healthcare. It’s estimated that administrative tasks represent 25% of all healthcare spending, but improved automation could reduce that by as much as 30%.3 The potential savings by way of increased automation could be massive for clinicians, healthcare systems, and patients alike.

Healthcare robots represent opportunity on another front. These robots can alleviate nurses of some of the more mundane though time-consuming tasks, such as medicine delivery and sample collection, associated with the job. The ability of nursing robots to pick up the slack is pivotal at a time when the U.S. is facing a steep nursing shortage – one that’s been fostered in part by burnout and tedious tasks.4

Invesco QQQ ETF provides access to a broad swath of cutting-edge companies and features an extensive list of robotics-related names.

In addition to the companies mentioned here, Facebook parent Meta Platforms is developing AI robotics based on human interactions. Honeywell International, another QQQ holding, has been a leader for more than two decades, developing AI-powered robots for logistics and transportation customers. Humanoid robots like Tesla’s Optimus are already performing surprisingly complex human tasks and movements.

QQQ’s exposure to the automation and robotics investing theme is just another example of how the ETF holds many companies pushing the boundaries of fast-growing, disruptive technologies.

Select the option that best describes you, or view the QQQ Product Details to take a deeper dive.

The evolution of biometric technology benefits almost every industry and has many business and personal use cases.

The rise of artificial intelligence (AI) is impacting big tech. Learn more about how industries, from hardware manufactures to software developers, are utilizing AI.

As blockchain, cryptocurrency, and other digital assets grow into a major industry, we examine this burgeoning asset class for investors.

NA3457105

Past performance is not a guarantee of future results.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional/financial consultant before making any investment decisions.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

This information is provided for informational purposes and does not constitute an endorsement or recommendation of any companies referenced.

This content should not be construed as an endorsement for or recommendation to invest in NVIDIA Corp, Amazon.com Inc, Cisco Systems Inc, PepsiCo Inc, Broadcom Inc, Advanced Micro Devices Inc, Applied Materials Inc, Intuitive Surgical Inc, Meta Platforms Inc Class A, Honeywell International Inc, or Tesla Inc. Neither NVIDIA Corp, Amazon.com Inc, Cisco Systems Inc, PepsiCo Inc, Broadcom Inc, Advanced Micro Devices Inc, Applied Materials Inc, Intuitive Surgical Inc, Meta Platforms Inc Class A, Honeywell International Inc, nor Tesla Inc are affiliated with Invesco. Only 11 of 101 underlying Invesco QQQ ETF fund holdings are featured. The companies referenced are meant to help illustrate representative innovative themes, not serve as a recommendation of individual securities. Holdings are subject to change and are not buy/sell recommendations. See invesco.com/qqq for current holdings. As of 3/18/2024, NVIDIA Corp, Amazon.com Inc, Cisco Systems Inc, PepsiCo Inc, Broadcom Inc, Advanced Micro Devices Inc, Applied Materials Inc, Intuitive Surgical Inc, Meta Platforms Inc Class A, Honeywell International Inc, and Tesla Inc made up 6.28%, 5.14%, 1.46%, 1.73%, 4.20%, 2.26%, 1.22%, 1.01%, 4.94%, 0.94%, 2.38%, respectively, of Invesco QQQ ETF.