Evolving tariff landscape and implications for regional credit

Trade-related uncertainty has moderated since our previous outlook. While specific implications for individual Asian countries and sectors remain to be clarified, market participants are increasingly focused on assessing the real economic impact of tariffs beyond headline rates. Although peak tariff uncertainty appears to be behind us, the next phase will likely emerge as the economic consequences begin to materialize. Countries facing disproportionate negative effects from tariffs remain most vulnerable. Despite the easing immediate tariff-related concerns, we anticipate continued uncertainty, particularly in light of a recent US appellate court ruling that deemed most reciprocal tariffs unlawful.

US monetary policy outlook and implication for global financial conditions

The recent deterioration in the US labor market prompted the Federal Reserve (Fed) to implement an interest rate cut in September. A soft jobs report in early September, coupled with significant downward revisions to August data, signaled heightened downside risks to the US labor market. This trend reflects a deceleration in hiring activity, as evidenced by the July employment report, and a shift in the Fed’s policy focus toward mitigating labor market risks while monitoring inflation, which remained elevated at 2.7% in June, above the Fed’s 2% target. Following the anticipated September cut, two additional 25-basis-point cuts are projected by year-end. This trajectory reflects a data-dependent approach, with labor market deterioration and moderating inflation as key drivers, although tariff-induced inflationary pressures could influence the pace of easing. Overall, these cuts are expected to improve global financial conditions, supporting Asian credit markets by reducing borrowing costs and enhancing Asian currency stability.

Central bank independence risk: Increased politicization of US monetary policy

The Trump administration’s efforts to exert greater influence over the Fed have raised concerns about the central bank’s independence. Markets appear to be in the early stages of pricing in the implications of increased politicization of monetary policy. Should concerns over the Fed’s independence gain traction, potential risks including higher inflation premia, a pronounced steepening of the US yield curve, and a weaker dollar could be anticipated.

Regional credit outlook: Cautious optimism and country-specific dynamics across Asia

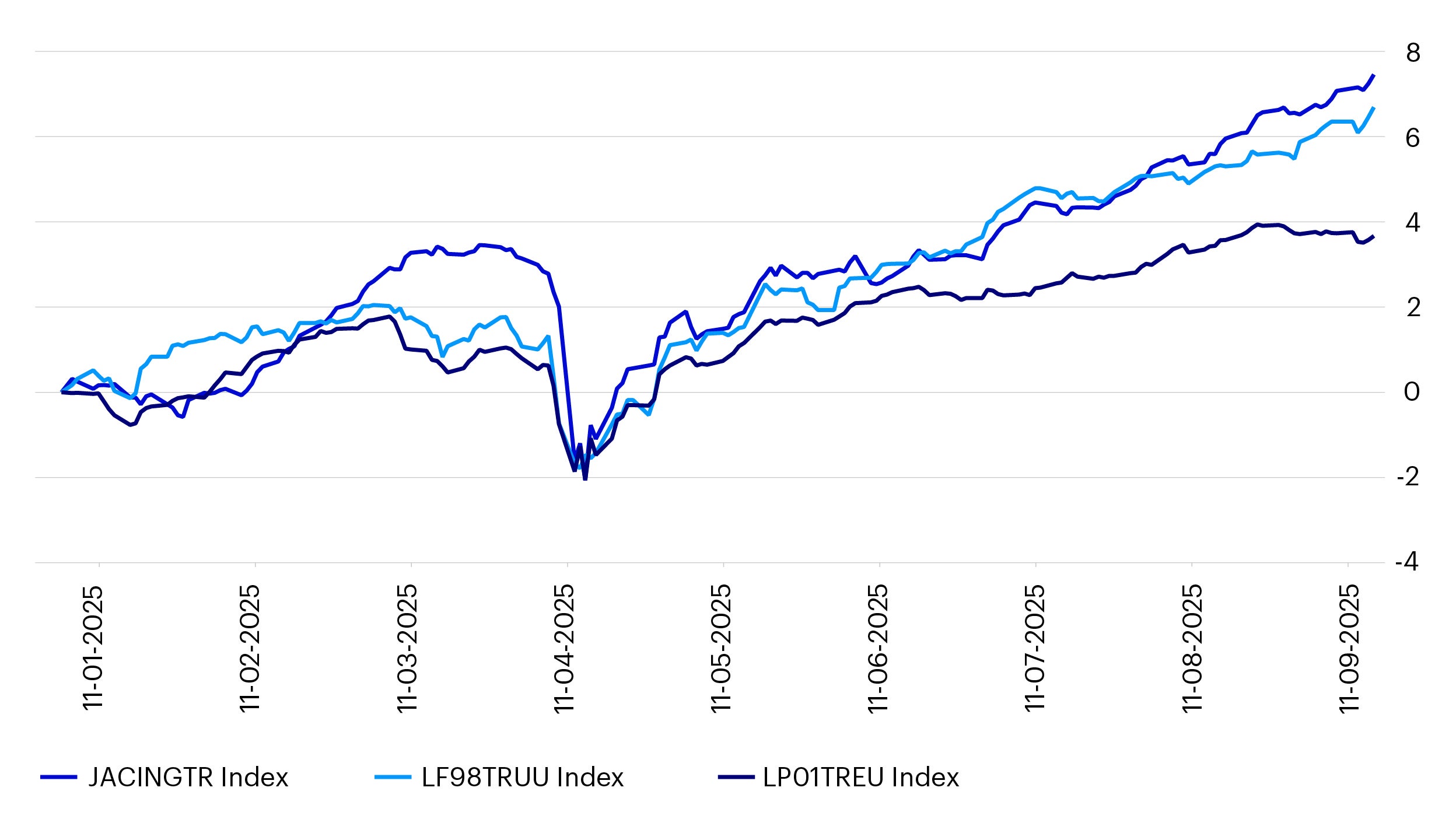

Asian credit markets enter Q4 2025 with a cautiously optimistic outlook, supported by resilient regional fundamentals and constructive technicals. However, IG valuations have become less compelling following strong rallies earlier in the year. External risks—particularly those stemmed from US monetary policy, trade tensions, and regional geopolitical developments—continue to weigh on sentiment.

Against this backdrop, country-specific dynamics will play a critical role in shaping credit performance across the region. The outlooks for key markets are outlined below:

China remains a key driver of regional market dynamics. Continued policy support and monetary easing are expected to stabilize credit conditions, although persistent weakness in the property sector and export vulnerability to US tariffs pose downside risks IG issuers with strong government backing remain well-supported, attracting demand from banks and cross-border investors.

India benefits from robust domestic demand and an accommodative policy stance, with further rate cuts anticipated. Credit spreads are anticipated by solid fundamentals, though the imposition of 50% tariffs by the US poses a drag on growth. Potential US sanctions related to Russian oil imports could further dampen investor sentiment. IG issuers in infrastructure and financials continue to offer attractive opportunities.

Korea provides relative stability, with limited exposure to trade disruptions and strong corporate balance sheets. IG credits have been generally well-positioned, supported by both monetary and fiscal stimulus as the Bank of Korea prioritizes growth recovery.

ASEAN markets exhibited mixed resilience. Indonesia faces political unrest and fiscal challenges, while Thailand contends with ongoing political instability. However, regional diversification and selective IG exposure—particularly in Singapore and Malaysia—could offer defensive positioning.

Supply-demand dynamics and central bank flexibility in Asia

Technical conditions remain supportive across Asia. Net supply in the IG segment is negative, driven by maturities and coupon payments. The ongoing shift by issuers toward local currency funding—seeking lower financing costs—continues to dampen Asian US dollar bond supply. This supply-demand imbalance has helped sustain spread levels, although further compression is likely limited.

Central banks across Asia retain flexibility for further monetary easing, with two to three rate cuts expected in 2025. Declining inflation and subdued global growth support accommodative stances. However, foreign exchange sensitivity and reserve adequacy may constrain divergence from US monetary policy.

Macro and geopolitical factors to monitor in Q4 2025

As Asian credit markets continue to navigate a global landscape marked by potential disruptions, several macroeconomic and geopolitical risks warrant close monitoring, given their potential to materially influence portfolio performance in the coming quarter.

Key risks include:

- Re-escalation of US-China tariffs

- Volatility in US interest rates amid fiscal uncertainty

- Regional geopolitical tensions (e.g., Middle East, South-East Asia)

Portfolio strategy: Defensive positioning and selective opportunities

Given rich valuations, a defensive approach is warranted. Recommended strategies include:

- Diversifying allocations within IG for stability, and selectively adding high-beta Japanese, Australian names for incremental returns

- Modestly extending duration to capture carry

- Prioritizing quality issuers—industry leaders with sound fundamentals and limited exposure to trade disruptions

Conclusion: Disciplined risk management for Q4 positioning

While Asia credit remains resilient and has offered attractive yields and diversification benefits, navigating Q4 requires disciplined risk management and country-specific positioning to mitigate external shocks and capitalize on selective opportunities.