2026 Investment Outlook: Resilience and rebalancing

We believe the market can continue to rise in the new year, and we expect new opportunities to be unlocked as market leadership evolves.

Invesco fixed income capabilities are designed to capture market potential.

After a savage bond sell-off in 2022, fixed income markets are offering strong income opportunities at attractive valuations for the first time since the global financial crisis.

Now is a good time to extend duration and lock in these yields before markets change. Gain access to diversification benefits and risk mitigation with our flexible fixed income approaches.

Increased market and economic uncertainty warrants a greater focus on high quality assets and defensive investment strategies.

Even after the flight to quality that followed recent banking sector events, investment grade yields remain at their most attractive since the 2008 global financial crisis.

We think investment grade fixed income makes sense in this environment.

While rates look like they may be peaking, with markets rallying in January, now could still be an attractive entry point.

Figure 1 plots corporate bond returns during a period of over 50 years, detailing the highs and lows. The grey shading draws attention to the 12-month periods following major lows.

Historically, corporate bond returns have been strongly positive for a sustained period following major market selloffs.

Source: Macrobond as of 28 February 2023. Historical analysis reviews Bloomberg US Corporate Index annualised rolling 12-month return data dating back to index inception. Grey highlights signify the 12 months following the 12-month annualized low greater than -5%. An investment cannot be made in an index. Past performance is not a guide to future returns.

The global economy is not out of the woods just yet but yields remain very compelling. Against the impacts of recession and rate hikes, a more defensive asset class like investment grade (IG) fixed income could prove more attractive than higher yielding assets.

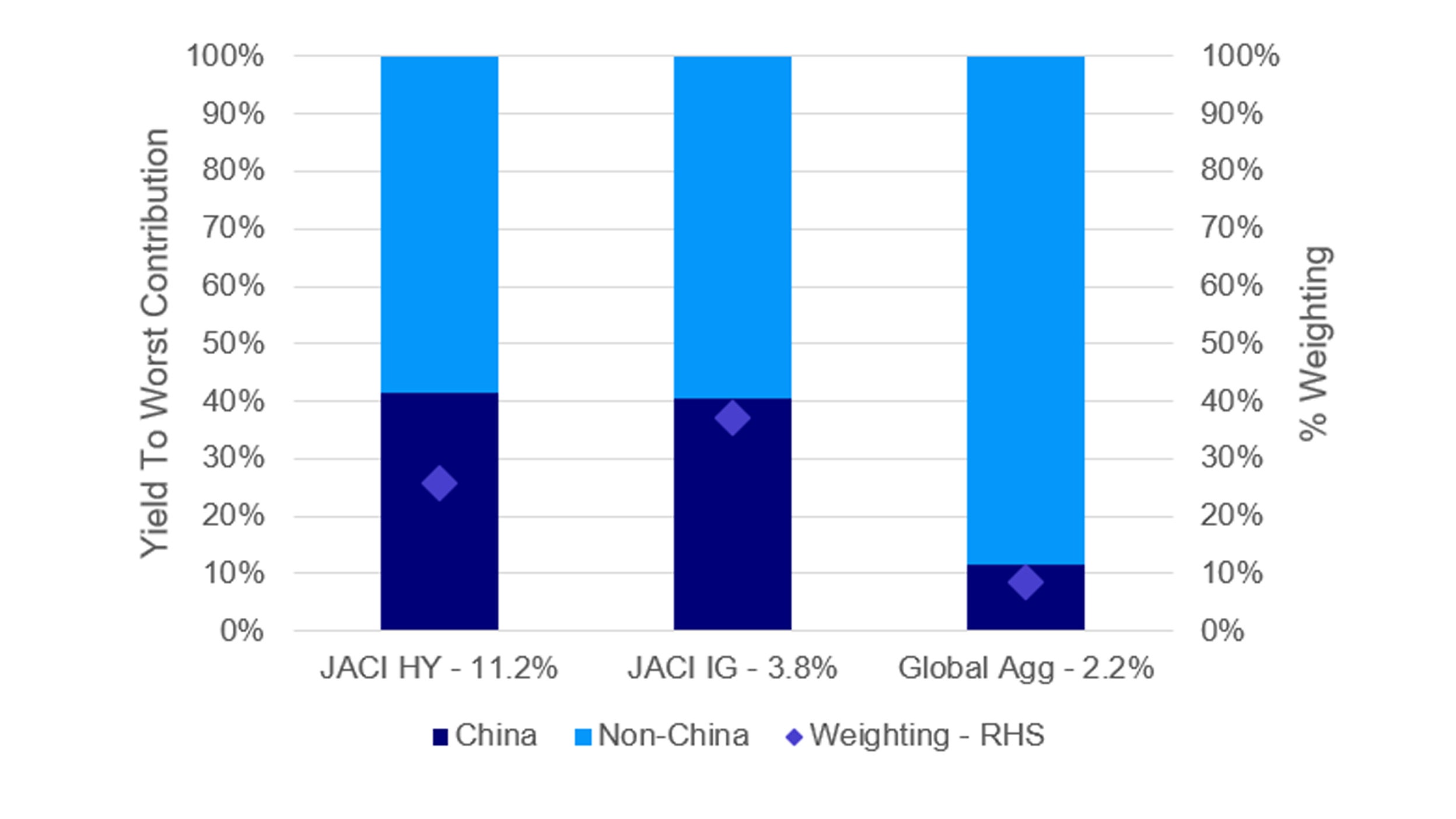

In Asia, rates have been the main driver for Asian IG bonds. Reduced rates volatility and faster recovery in China supported the rally in fixed income assets globally, with emerging markets (EM) and Asia leading the rebound.

We believe the market can continue to rise in the new year, and we expect new opportunities to be unlocked as market leadership evolves.

Invesco Solutions is proud to present our 2025 Capital Market Assumptions providing the long-term estimates for over 170 major asset classes to aid in strategic and tactical asset allocation decisions.

Uncovering the potential of Private Credit starts with gaining access to them. It’s a world of opportunity – and we have the expertise and the network you need to unlock it.

We believe emerging market (EM) local debt is set to outperform over the next several years after the asset class suffered one of the largest selloffs since the 1990s in 2022.

Global financial markets and economies endured a series of geopolitical shocks and market volatility. Now these negative shocks are abating and evolving global macro conditions are expected to favour EM countries. We believe global interest rates are set to stabilize and monetary policy will focus on fighting inflation. In the meantime, China has started to reopen its economy. With inflation peaking, we think EM yields in real terms are at especially attractive levels. EM local bond yields have been at a level not seen in more than a decade. (Invesco data as at 31.01.2023, unless otherwise stated.)

Hemant Baijal, Head of Multi-Sector Portfolio Management, Global Debt, InvescoWe believe that emerging markets local currency debt features differentiated alpha and income generation potential with meaningful client portfolio diversification benefits.

Periods where EM local debt yields are materially higher than US Treasuries have typically been followed by EM outperformance versus the broader US bond market. For example, after the yield differential widened to over 400 basis points in 2011, EM rates outperformed strongly over the next two years.

Similarly, when the yield differential widened to over 400 basis points in 2015, EM local debt outperformed in 2016 and 2017, peaking in early 2018. With the yield differential currently above 400 basis points, and absolute yields at a decade high, we expect EM local debt to mean revert again, especially as inflation slows in both emerging markets and the developed markets. When the asset class has faced major declines in the past, patient investors who have invested were ultimately rewarded with sharp increases in returns a year later. (Invesco data as at 31.01.2023, unless otherwise stated.)

Source: Bloomberg. As of December 31, 2022. “GBIEM” refers to J.P. Morgan GBI-EM Global Diversified lndex.

We believe that the time has come where ESG investing in China is increasingly a why not moment. As China is one of the largest carbon emitters globally, it has adopted one of the most ambitious climate change plan.

As a result, there is potential for fixed income investors to explore the opportunities to enjoy the China growth story in a sustainable way through investing in China fixed income, which has the potential to provide attractive risk-adjusted returns and diversification benefits.

Source: Aladdin, Invesco, Bloomberg, as of 31 December 2021.

Source: Aladdin, Invesco, Bloomberg, as of 31 December 2021.

Asia IG outlook for Q1 2026 remains positive, supported by US rate cut expectations, robust fundamentals and strong technicals, though rich valuations and macro risks call for defensive positioning.

Asia Emerging Markets fixed income faces shifting dynamics in 2026. Low inflation and easing policies support local bonds, while hard currency spreads stay tight. Selective positioning is key amid policy divergence.

ESG investing in Asia fixed income is here to stay and Asia has a unique role in driving climate transition to help the world hit the 1.5-degree scenario.

Connect with us for a tailored conversation on your investment needs.