The importance of engagement

Tom Hemmant (Fixed Interest Fund Manager) stresses the importance of thorough ESG research and engagement processes, particularly in instances where publicly available data doesn’t tell you the full story. ‘It’s about attempting to tackle the difficult questions and financing those companies that are changing and making efforts’, he added.

Engagement is perhaps even more important when investee companies are privately owned – something our private credit team will attest to. Given the lack of third party ESG data available in this area – reliable or otherwise – the issue of accuracy becomes a moot point. The information simply doesn’t exist.

In a webinar held by Invesco last year, Kristofer Dreiman (Head of Responsible Investments at Swedish insurer Länsförsäkringar) drew attention to the fact that only about 10% of the companies he invests in actually have any outside information related to ESG. ‘That information simply isn’t available in the private credit space’, he added.

At Invesco, our private credit team has developed its own proprietary ratings system based on information collected through due diligence conversations and questionnaires. The team simply refuses to invest in companies that will not engage.

And, of course, it’s not just active fixed income solutions that can benefit from the power of engagement either. Many of the engagements led by our in-house ESG team at Invesco pertain to our entire physically invested solutions range. In other words, passive investors benefit from our active engagement processes.

Looking forwards

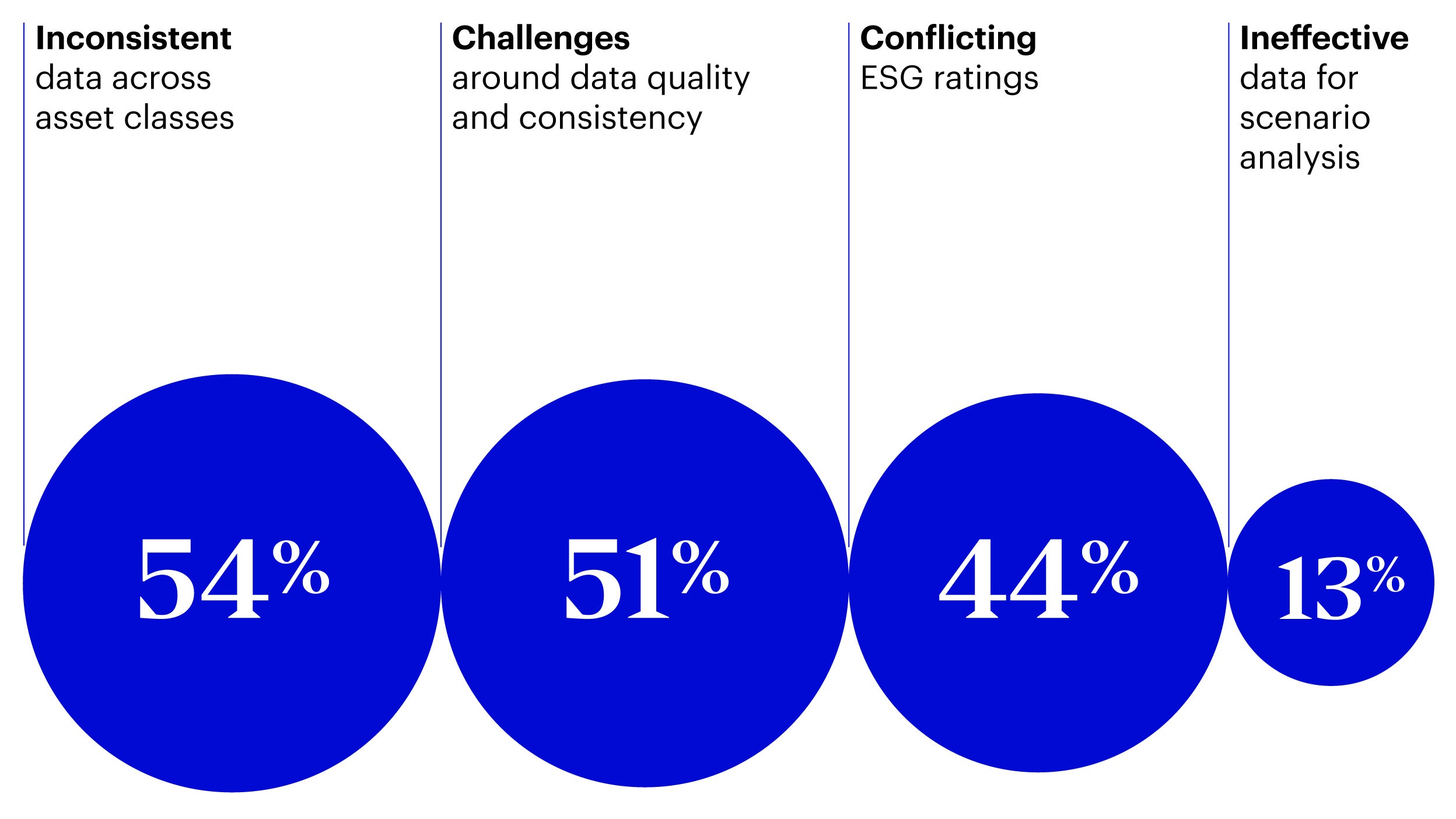

Improving data quality and transparency is a big objective for the industry – and we have had some progress.

In her 2022 outlook, Cathrine de Coninck-Lopez (Invesco’s Global Head of ESG) drew particular attention to the creation of the International Sustainability Standards Board, which ‘sets a line in the sand for global standards on ESG reporting […and] will go a long way in feeding more standardised metrics and data into our systems’.

However, until these developments are further along – and we suspect even then – inefficiencies in the data create opportunities that our teams can actively exploit.