Introducing the Invesco Metaverse and AI Fund

Shape the future. Invest in undervalued companies that help facilitate, create, or benefit from, immersive virtual worlds for both consumers and enterprises.

More than just hype

Technology plays an ever-growing role in our everyday lives. It has brought us significant economic growth in what some have classed as the start of the ‘fourth’ industrial revolution.

In our view, the metaverse is the next phase of this revolution – the next step in the evolution of the internet, a megatrend that we are only in the first innings of.

What are the opportunities in the metaverse?

Trillion-dollar market

Every year, USD 54 billion is spent on buying digital goods, which is almost double of money being spent on buying music.¹ Estimates suggest that the total addressable market for the metaverse could be USD 8-13 trillion by 2030.²

Immersive experiences

The Metaverse brings together all the elements of our digital age in immersive experiences that seamlessly integrate our digital lives and physical lives. This innovation has the potential to transform the way people interact with organisations, with use cases such as gaming, manufacturing, digital museums, and more.

Already making an impact

Real-world use cases for the Metaverse already exist today. Many companies are building virtual offices to support remote collaboration, for example, while manufacturers create digital twins of their factories that simulate the physical ones in real-time.

Three reasons to choose the Invesco Metaverse and AI Fund

We want to capture the growth of the Metaverse by investing in 30-50 stocks with exposure to the theme. We take a disciplined approach to valuation, with a focus on cash flow, balance sheet strength and business model sustainability.

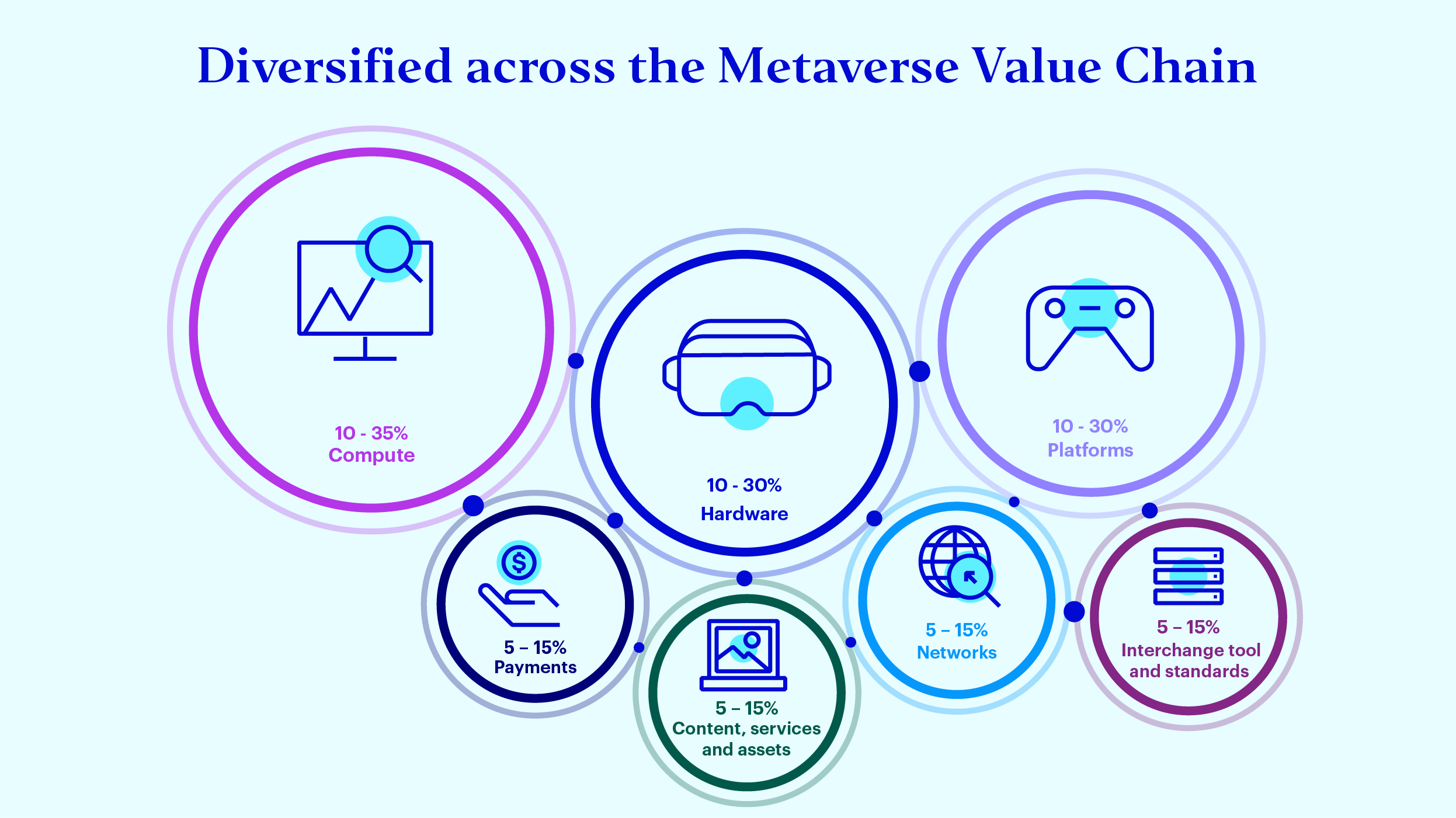

We aim to be diversified across the different segments of the Metaverse value chain. At this early stage, opportunities are greater in those companies developing the supportive technologies and infrastructure required to enable Metaverse capabilities. However, investing in the Metaverse isn’t just about investing in tech and internet companies. It’s also about things such as network infrastructure, digital payments, or content.

The investment team have broad experience in multiple sectors and a deep understanding of enabling technologies and requirements for building and operating the Metaverse. They also cover multiple investment regions, which helps to bring a global approach to Metaverse investing compared to their typically US-focused competitors.

Access the Invesco Metaverse and AI Fund product page to view KIDs/KIIDs and factsheets.

The investment concerns the acquisition of units in an actively managed fund and not in a given underlying asset.

Meet the team

The primary drivers of the fund’s positioning and performance are its named fund managers: Tony Roberts and James McDermottroe. However, collaboration is a key element of our investment culture, and they can source ideas and market insights from a wider group of regional experts.

Tony Roberts, Fund managerWe believe the Metaverse represents a major economic opportunity for a wide range of innovative companies that can help facilitate, create, or benefit from the growth of immersive virtual worlds.

Fund facts

The fund managers take a fundamental approach to investing and seek to find undervalued companies across the Metaverse value chain. They focus on the long term, and believe that share prices reflect fundamentals over time.

FAQ

Generally, the Metaverse is a virtual world accessible through advanced technology, where users can interact with computer-generated environments and characters as if they were in a physical world. It’s a concept that was popularized by Neal Stephenson’s novel ‘Snow Crash’, and has gained attention from companies and organizations working to create social platforms, virtual economies, and gaming worlds. The Metaverse offers the potential for users to engage in various activities, from socializing and gaming to buying and selling goods and services using virtual currencies and is seen as a potentially revolutionary development in technology and communication.

The most direct way to invest in the Metaverse is through stocks of companies that are developing or utilizing Metaverse-related technology. Additionally, investing in cryptocurrencies such as Bitcoin, Ethereum, and Decentraland's MANA token can provide exposure to the virtual economy aspect of the Metaverse. These cryptocurrencies are used as payment and investment vehicles within virtual worlds, and their value can fluctuate based on the popularity and growth of the Metaverse.

Investors should keep in mind that the Metaverse is still a speculative and emerging market, and as such, investments in this space can be risky.

The Metaverse is a ground-breaking concept that has the potential to revolutionise the way we interact with the world and with each other. Imagine a future where physical distance is no longer a barrier to socialising, working, or learning. A world where immersive experiences and virtual economies provide endless opportunities for entertainment and economic growth. The Metaverse could even revolutionise healthcare by offering innovative and accessible treatments for mental and physical illnesses. It could expand our horizons and open possibilities that we can only dream of.

The Metaverse faces several challenges that need to be addressed before it can become a fully functional virtual world, such as:

· Technological limitations: The Metaverse requires advanced technologies, such as high-speed internet, powerful computing, and sophisticated virtual reality hardware, to create an immersive and responsive virtual environment. Current technology still has limitations that need to be addressed.

· Interoperability: The Metaverse must be able to seamlessly integrate different virtual environments, platforms, and devices to provide a seamless user experience. Currently, there are no industry-wide standards for interoperability, which can lead to fragmentation and hinder the development of a truly universal Metaverse.

· User safety and privacy: The Metaverse must ensure user safety, privacy, and security in a virtual environment, where harmful behaviour and content can be more difficult to regulate. The Metaverse must be equipped with the necessary safeguards and tools to prevent cyberbullying, harassment, and other forms of abuse.

· Legal and financial regulation: The Metaverse’s virtual economy raises new legal and financial issues that need to be addressed. There must be regulations in place to protect users and prevent fraudulent activity.

· Social and ethical concerns: The Metaverse must also address social and ethical concerns, such as the potential impact on physical world interactions, privacy, and surveillance. It must promote diversity, equity, and inclusion to ensure that everyone can benefit from the Metaverse’s potential.

The Metaverse's development will require collaboration and innovation across industries, government, and civil society to address these challenges. However, the potential benefits of the Metaverse are significant, and it remains an exciting development that could transform the way we interact with each other and the world around us.