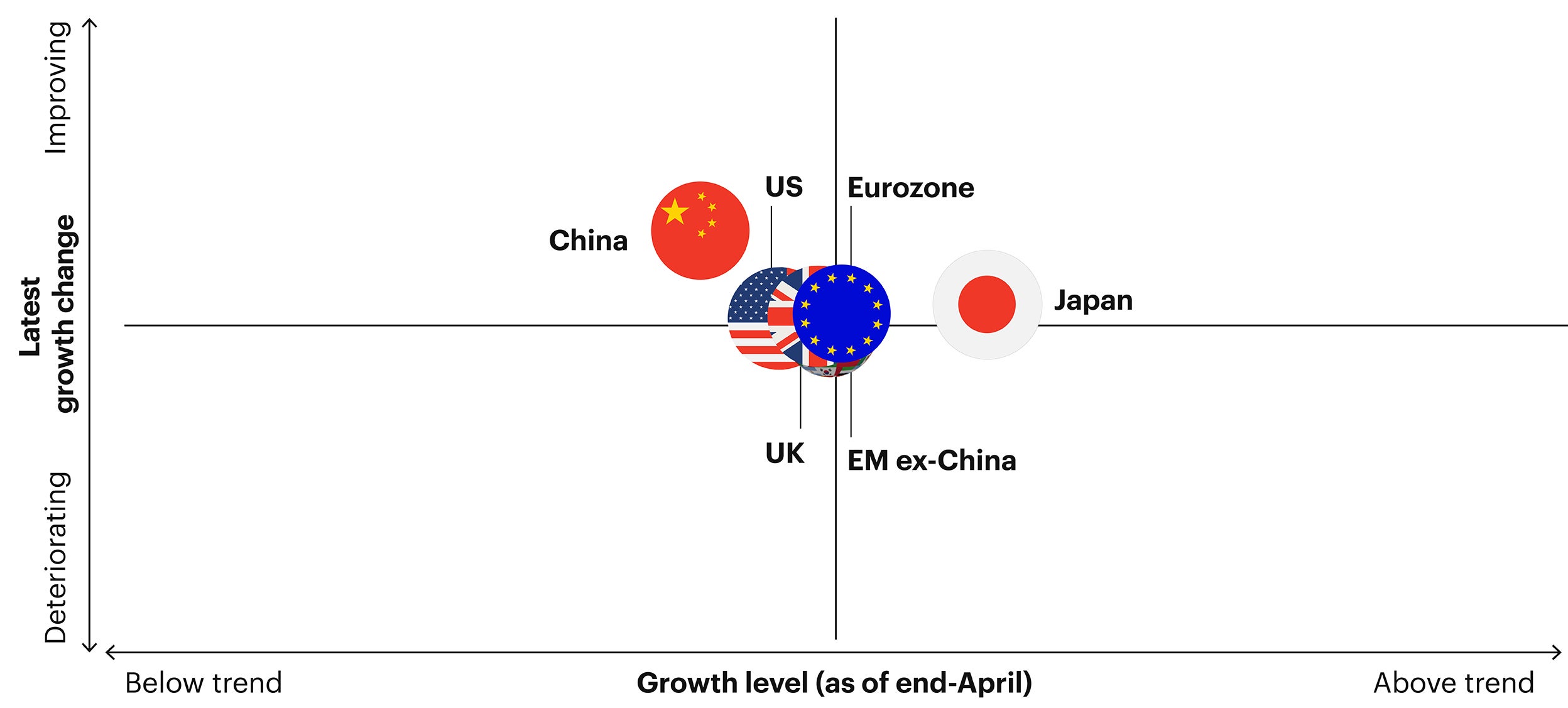

"The high degree of synchronicity brought about by pandemic-era policies is over. We are far from a globally synchronised cycle."

Kristina Hooper, Invesco Chief Global Market Strategist

We believe we’re at or near policy peak, that disinflation is underway, and that a relatively brief global economic slowdown is happening. But markets are likely to soon look past this episode and begin to discount a future economic recovery.

Major DMs are in late-cycle, in our view.

China, in contrast, is in early cycle.

Other emerging markets mixed.

“Bumpy landing” in major developed markets and recovery to follow thereafter.

We believe we are at or near policy peak. European policy tightening set to continue.

Chinese policy likely to remain supportive.

To try to curtail the worst inflation in decades, Western developed central banks have moved aggressively to tighten monetary policy. This has helped exert downward pressure on inflation but has also brought about a meaningful slowdown in global growth and some financial accidents, including several US regional bank failures. However, against this backdrop we see resilient domestic demand in many economies, especially in services activity.

"The high degree of synchronicity brought about by pandemic-era policies is over. We are far from a globally synchronised cycle."

Kristina Hooper, Invesco Chief Global Market Strategist

We believe global growth is below trend and slowing. A broad-based recession is a risk, but not our base case.

After the pandemic boom and a sharp increase in interest rates, major Western economies are slowing. Goods consumption, which boomed in the post-pandemic period, is slowing while services consumption continues to expand.

The easing of supply chain pressures has facilitated the easing of goods' price pressures, and we expect price pressure in services to ease going forward. A disinflationary trend should provide a more positive overall backdrop for economies and markets.

Source: Invesco Investment Solutions, latest available data, as of April 30, 2023.

Demand is already slowing in many major economies, credit conditions are tightening, and in some economies—notably the US—inflation is already on a downward trajectory. The disinflationary process is underway.

While inflation momentum is weakening, so, too, is growth. We expect some weakness in the second half of this year as policymakers accomplish a bumpy landing, which may or may not precipitate a mild recession in the back half of 2023. While credit standards have tightened and the yield curve has been inverted for some time, activity has remained resilient and labour markets have remained tight.

Quarterly data from Q4 1999 to Q2 2023 (as of May 15, 2023). Data (including forecasts for 2023) provided by OECD. Data is net for all countries except UK, which is gross. Sources: OECD, Refinitiv Datastream and Invesco Global Market Strategy Office.

The relaxation of Covid restrictions has driven a meaningful though less rapid than expected recovery in Chinese growth. Services activity has seen the most pronounced pick-up, while slowing global growth has meant softer industrial production and exports.

Still, China’s near-term outlook remains favourable— the reopening still has legs, inflation is well-anchored and monetary policies remain accommodative. After 2023, the growth outlook for China appears less certain. Policymakers will need to set policies to reinvigorate the property market and counter demographic headwinds.

Policy rates are peaking across developed markets, in our view, with the US leading and Europe lagging. In contrast, China’s policy remains supportive.

After a rapid tightening cycle, we believe the Fed is at or near its terminal rate with inflation ending the year at a level above the Fed’s 2% target, likely closer to the 3% mark. Looking forward, we expect some marginal rate cuts starting later this year or early 2024, but policy rates are likely to remain elevated over the outlook horizon.

The Eurozone and UK are likely to follow a pattern similar to the US, but with a lag. We view European growth positively in the near-term, but with region-specific challenges re-emerging later in the year. Tightening financial conditions will likely weigh on credit growth over time, helping to reduce inflationary pressures. The ECB is likely to continue hiking but with a terminal rate lower than the in the US.

China is in a markedly different place in its cycle and, overall, we expect monetary policies to remain accommodative to support credit growth. More proactive measures from the PBOC could be expected, such as a cut to the reserve requirement ratio (RRR) to boost household and business sentiment.

Sources: Bloomberg L.P. and Macrobond, as of May 22, 2023. The peak policy rate in this chart is the highest rate across 30-day futures over all maturities 24 months out.

As central banks tighten, the risk of financial crisis is elevated. Indeed, this tightening cycle has already resulted in the failures of SVB, Signature Bank, Credit Suisse, and First Republic Bank.

Such financial crisis risks raise the probability that central banks will likely have to pivot to an easing regime more quickly, perhaps leading to an eventual transition to a recovery regime.

Sources: Bloomberg L.P. and Macrobond, as of April 30, 2023.

Aggressive Fed rate hikes caused a rapid rise in mortgage rates, which exerted downward pressure on commercial real estate prices. This has been exacerbated by the US regional bank mini-crisis and a further tightening of credit conditions. This has raised concerns about the risks facing US commercial real estate going forward.

We anticipate continued downward pressure on real estate prices in the near term. However, commercial mortgage rates may actually be lower, and credit conditions may have improved by later in 2024 — by the time a significant portion of commercial real estate loans mature and need to be refinanced. We will remain vigilant about financial stresses that could emerge from continued bank stress.

Includes multifamily and non-residential loans; estimate as of Q3 2022. LTCM = Long-Term Capital Management. Source: Invesco Real Estate using data from Trepp as of March 2023.

Geopolitics remain a key concern. One indicator of recent tensions may have been the jump in central bank purchases of gold during 2022 (which may explain the resilience of gold in the face of a rising bond yields and a stronger dollar).

Inflation may have encouraged those central bank purchases. However, we suspect the desire to diversify away from USD holdings was deepened by the sanctions imposed upon Russia after its invasion of Ukraine.

Annual data from 2010 to 2022. Sources: World Gold Council and Invesco Global Market Strategy.

In turbulent times, investors typically flee for the safety of US high quality, large-cap growth stocks, which has been the case in recent months (left chart). By contrast, persistent global value stock outperformance depends on the end of Fed interest rate hikes, a falling US dollar, and rising worldwide output (right chart).

Looking past near-term volatility, the good news is that global manufacturing activity has improved, the US dollar has fallen, and broader financial conditions have eased – all since the end of last year.

While the Fed delivered an interest rate hike at its last meeting, we think policymakers are nearing the end of policy tightening. Eventually, we expect the global value trade to regain investor interest amidst an improving operating climate.

Sources: Bloomberg L.P., Invesco, April 30, 2023. Notes: EM = MSCI Emerging Markets Index. DM ex-USA = MSCI ACWI ex USA Index. Europe = MSCI Europe Index. US small = Russell 2000. US value = Russell 1000 Value. US large = S&P 500. US growth = Russell 1000 Growth. Price returns in US dollars. See page 21 for index definitions. An investment cannot be made into an index. Past performance does not guarantee future results.

We believe valuations are an important determinant of long-term returns, which we think shines a favourable light on Chinese stocks, especially compared to India and the US.

However, in the shorter term, economic momentum may be more important. The Chinese central bank (PBOC) has been easing over recent years, while the Fed has been tightening aggressively. One outcome has been the divergent paths of money supply growth in both countries. We believe this points to better economic (and profit) momentum in China.

"The macro backdrop is increasingly supportive of global markets, but bond yields are likely stuck in a range."

Rob Waldner, CFA, Invesco Chief Strategist

The current environment is uncertain for investors. Growth has been stronger than expected, and the US labour market has been more resilient to rising rates. Worries about energy availability have eased, allowing better economic performance in Europe and across the global economy.

While not booming, global economic momentum has remained solidly in positive territory, and so far, the major economies have skirted a recession. The outlook for US inflation is steadily improving as we see housing price weakness work its way into price indices and as wage pressure shows signs of easing.

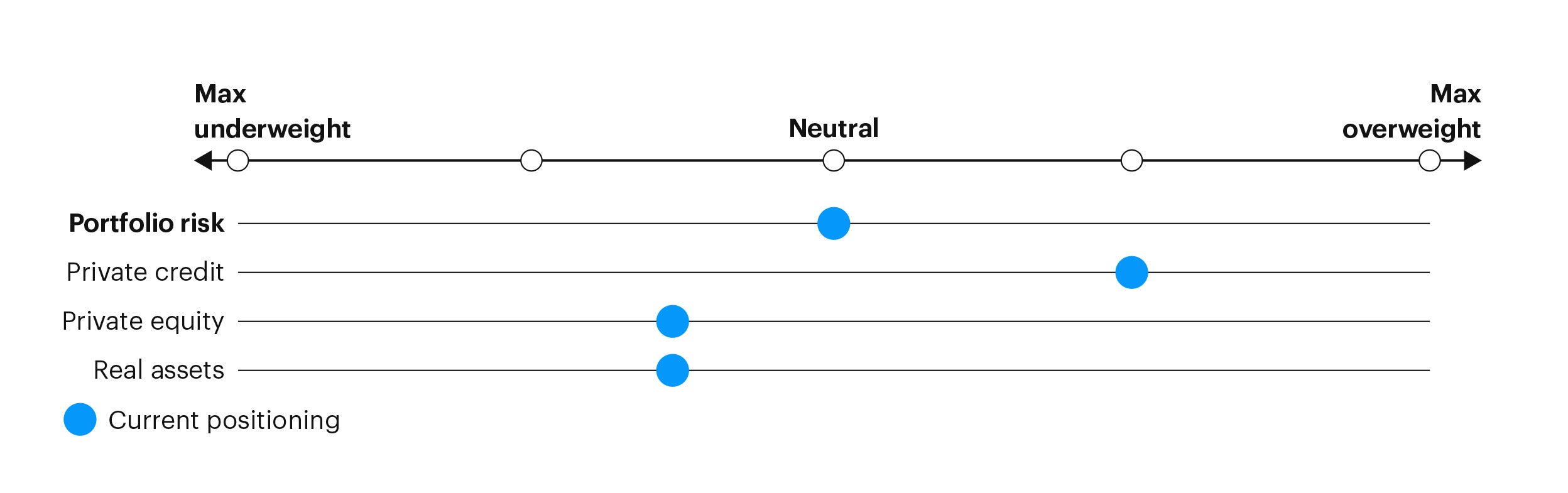

As we consider direct lending going forward, we expect the opportunity set to remain robust and attractive due to higher yields, record levels of PE dry powder, and strong balance sheets. While we do expect default activity to increase modestly, we believe investors are more than compensated for the risks given the senior protections from the asset class. As dislocations arise, distressed and special situations are beginning to appear more attractive. Finally, real asset credit remains our preferred way of gaining exposure to the asset class, as pressure on the regional banking sector should create avenues for alternative lending.

We downgrade our rating on private equity to a slight underweight as valuations are moderating amid higher borrowing costs. Pockets of opportunity appear in private-to-private transactions. At a high level, this is an environment that favours dry powder and new investments relative to investments made over the last several years, which in general, have yet to be marked down. There are opportunities for growth equity firms to provide capital for private companies that would have looked to access the IPO market.

Expect cap rates to stabilise in the second half of the year after the current correction. The impact of the repricing will vary by region, market, and real estate sector. Given valuation concerns, we have slightly reduced our positioning on real estate. Infrastructure remains an area of interest due to attractive fundamentals as projects are expected to be well funded from recent legislation.

Source: Invesco Investment Solutions, views as of April 30, 2023.

Real effective exchange rates suggest that the US dollar is more expensive than usual, with the Japanese yen at the other extreme (because the BOJ is one of the few central banks that did not tighten over the last 18 months). This doesn’t seem sustainable, given that the US is running a sizeable current account deficit.

Currencies are often thought to overshoot what is considered to be long-term fair value and to remain away from fair value for some time. Those over shootings are often explained by the fact that financial flows adapt to new circumstances more rapidly than flows of goods and services. Financial flows are often driven by interest rate differentials, which are now moving against the dollar.

Tactical asset allocation

Welcome to our Tactical Asset Allocation hub. Here you’ll find a selection of the most recent research from Invesco Solutions. Read our latest analysis that covers market strategy and opportunities across various asset classes.

2023 Mid-year global policy outlook

A lot has happened in the first half of 2023. But not much has changed in the macro geopolitical front since January. The same issues remain prevalent – the Ukraine-Russia war, US-China tensions, and the post-COVID-19 supply chain realignment all continue.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

All data as of May 31, 2023, unless otherwise stated.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.