Lowest cost

We have the lowest cost S&P 500 ETF in Europe, for just 0.05% p.a.

We have the lowest cost S&P 500 ETF in Europe, for just 0.05% p.a.

Consistently low tracking error and strong out performance versus the index

$16 billion of assets under management*

US equities may account for anywhere between 30-50% of the overall asset allocation in a typical globally diversified portfolio. Therefore, you should be able to make a significant impact on your portfolio’s performance by the way you gain exposure to the asset class.

Unfortunately, history shows that US large caps (as represented by the S&P 500 index) has been one of the toughest markets for investors to beat in any one year, much less on a consistent basis.

If, instead of an actively managed fund, you are looking for passive exposure to the S&P 500, you have the choice of around 15 ETFs in Europe that simply aim to deliver the index performance.

Some are more successful than others.

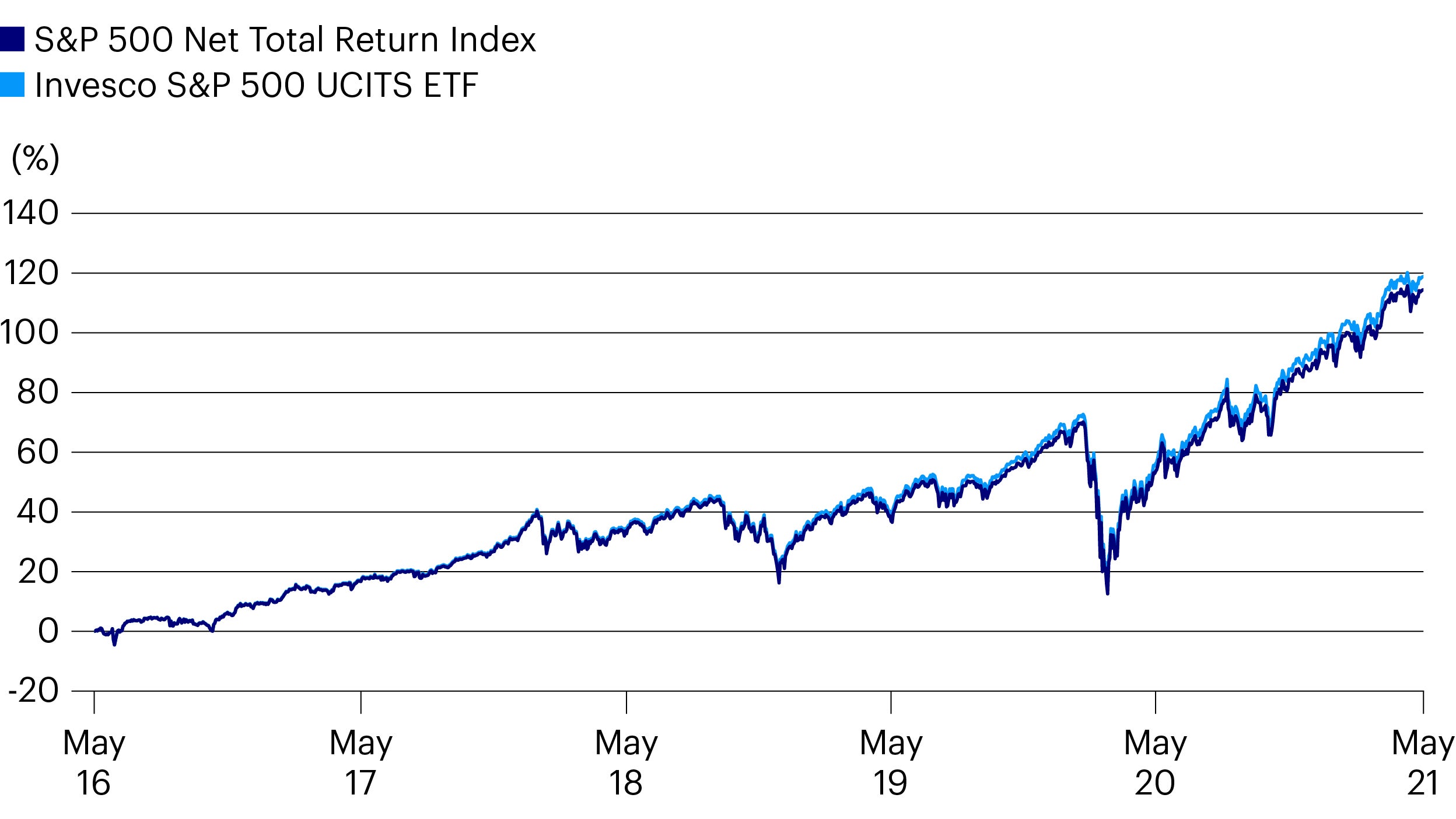

Our S&P 500 UCITS ETF has the lowest ongoing charge of any of its peers in Europe. However, that’s just part of this fund’s success story. What’s perhaps even more impressive – and possibly surprising – is that it’s outperformed the index consistently and with low tracking error.

Past performance does not predict future returns

Source: Bloomberg, to 31 May 2021, in USD.

When developing our ETFs, we look for a structure that offers the most efficient exposure to the underlying index. That could mean physical replication or, in other instances, synthetic replication.

To track the S&P 500, we use a synthetic replication model that allows the ETF to receive gross dividends, i.e. virtually 100% of the dividend with no withholding tax. This is a clear advantage versus ETFs that replicate the index physically, as they would be subject to at least a 15% withholding tax rate on dividends.

With our synthetically replicated ETFs, we hold a basket of high-quality securities (not necessarily those of the underlying index) and arrange total return swaps with multiple large financial institutions. The swap counterparties are contracted to pay / receive any difference between the return of the basket and that of the index.

The use of multiple counterparties is intended to reduce the impact on the ETF if any of them were to default on their obligations. The objective of our synthetic structure is to deliver the performance as closely and consistently as possible relative to the underlying index.

Sometimes this means our passive ETFs can even outperform the index.

The Invesco S&P 500 UCITS ETF is part of our core ETFs range, which are among the lowest cost products available in Europe for exposure to core equity, fixed income and commodity benchmarks. We design our ETFs to provide efficient and consistent tracking of their reference indices, net of charges including transaction costs.

Find out more about our Core ETFs

| May 20 – May 21 |

May 19 – May 20 |

May 18 – May 19 |

May 17 – May 18 |

May 16 – May 17 |

Dec 19 - Dec 20 |

Dec 17 - Dec 20 |

|

|---|---|---|---|---|---|---|---|

| S&P 500 NTR index | 39.65% |

12.17% |

3.16% |

13.71% |

16.73% |

17.75% |

46.29% |

| Invesco S&P 500 UCITS ETF |

40.23% |

12.74% |

3.69% |

14.11% |

17.04% |

18.30% |

48.46% |

| Outperformance |

0.41% |

0.51% |

0.51% |

0.35% |

0.27% |

0.47% |

1.48% |

Source: Bloomberg, showing 12-month periods to 31 May 2021, in USD.