Dynamic Multifactor Strategies- A Macro Regime Approach

We believe dynamic factor strategies have the potential to outperform both market cap benchmarks and static multifactor implementations. Learn why here

+ Factor portfolios based on quantitative characteristics such as value, momentum, quality, size and low volatility have historically generated attractive excess returns, outperforming market cap benchmarks on a risk-adjusted basis.

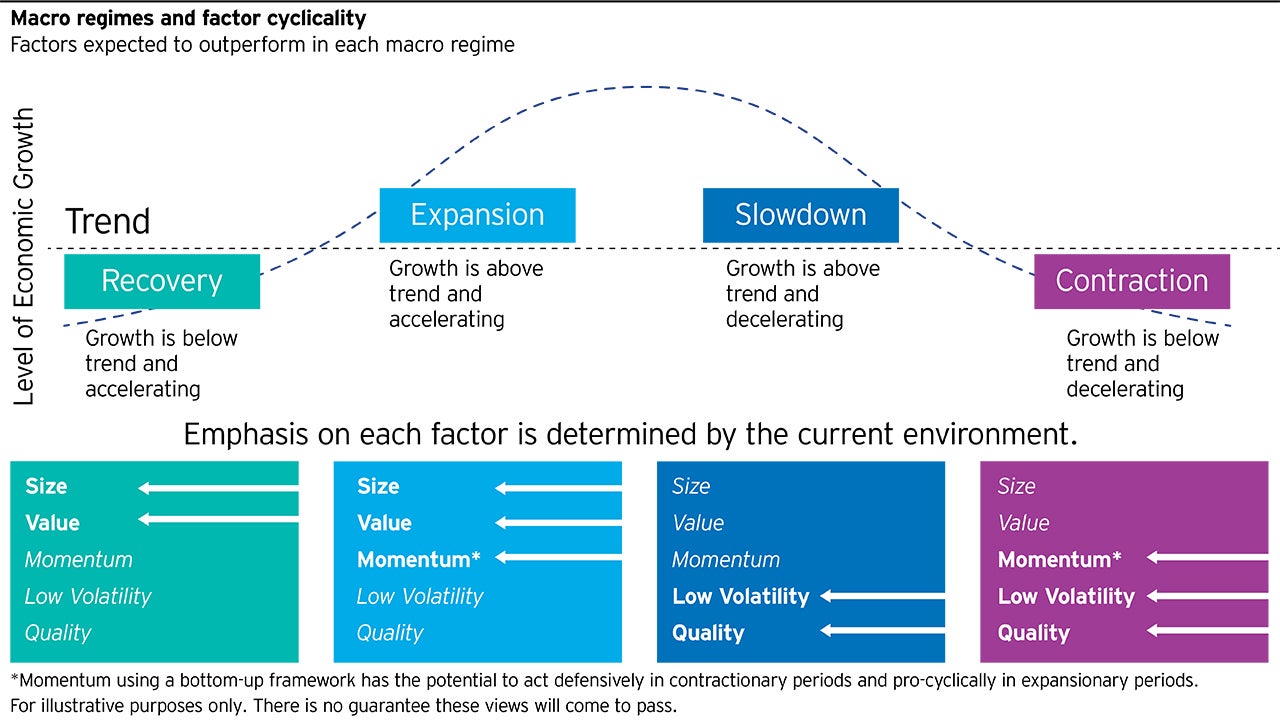

+ While single factors have outperformed over the long-term, they have also experienced strong cyclicality, occasionally leading to extended periods of underperformance driven by changing market environments.

+ Factor cyclicality can be understood in the context of factor fundamentals and their sensitivity to macroeconomic risks. While size and value tend to be pro-cyclical factors, low volatility and quality tend to be defensive factors. Momentum, a more transient factor, tends to outperform during late cyclical stages.

+ We believe investors can exploit these distinct macro sensitivities among factors, developing dynamic rotation strategies driven by forward-looking macro regime frameworks, with the potential to outperform static multifactor portfolios while maintaining diversification to multiple factors.

Download the whitepaper