Equities 2024 investment outlook

The 2025 equities outlook is improving. Balance sheets look healthy, and many stocks are attractively valued, though geopolitical risks remain. Find out more.

On average, US equity returns have tended to be strongest in January, compared to the other 11 months of the year.

When the S&P 500 Index rises in January, full year returns have tended to be positive, leading some to call January a performance predictor.

Over time, a buy and hold approach would have outperformed a strategy that times the market based simply on the direction of January returns.

The rally in US stocks slowed last month as the S&P 500 Index ended January up a modest 1.6%, following a whopping 8.9% gain this past November and 4.4% gain in December.1 With US equities off to a more tempered start in 2024, discerning investors are left to wonder about two well-known phenomena regarding the first month of the year: the January effect and the January barometer.

What have equity returns the first month of the year historically looked like? Is stock performance in January indicative of what performance will be for the full year? The January effect and January barometer shed light on these questions. But do they create investment opportunities? Probably not.

On average, US equity returns have tended to be strongest in January, compared to the other 11 months. The trend has been especially prevalent among small-cap stocks.2 Several theories attempt to explain why, including the impact of year-end tax loss harvesting, the flow of funds in the new year, and investor psychology. Interestingly, although the January effect was seen throughout the 20th century, it has weakened substantially in recent decades.

Source: Bloomberg, as of 12/31/23. Based on monthly S&P 500 Price Index (1928 through 2023) and Russell 2000 Price Index (1979 through 2023). Past performance is not a guarantee of future results. An investment cannot be made directly in an index.

The January barometer refers to the fact that the S&P 500’s calendar year performance has matched the direction of January returns nearly 77% of the time.3 In other words, when the index rises in January full year returns tend to be positive, and when the index falls in January full year returns tend to be negative. This has led some to believe that when it comes to stock market performance, “as goes January, so goes the year.”

Regardless of January’s historically strong returns and supposed predictive power, investors should reconsider before making investment decisions based on market patterns. Here are three things to keep in mind about the January effect and barometer.

Source: Bloomberg, as of12/31/23. Based on monthly S&P 500 Total Return Index (1989 to 2024). Past performance is not a guarantee of future results. An investment cannot be made directly in an index. This is a hypothetical example and for illustrative purposes only.

The beginning of the year is often full of anticipation. By the end of the year, we usually find reality was different from our expectations. As in life – investors should not lose sight of the long term, regardless of what January brings.

The 2025 equities outlook is improving. Balance sheets look healthy, and many stocks are attractively valued, though geopolitical risks remain. Find out more.

Thematics funds provide diversified exposure to specific themes or trends, regardless of traditional sector classifications. Discover more in our latest article.

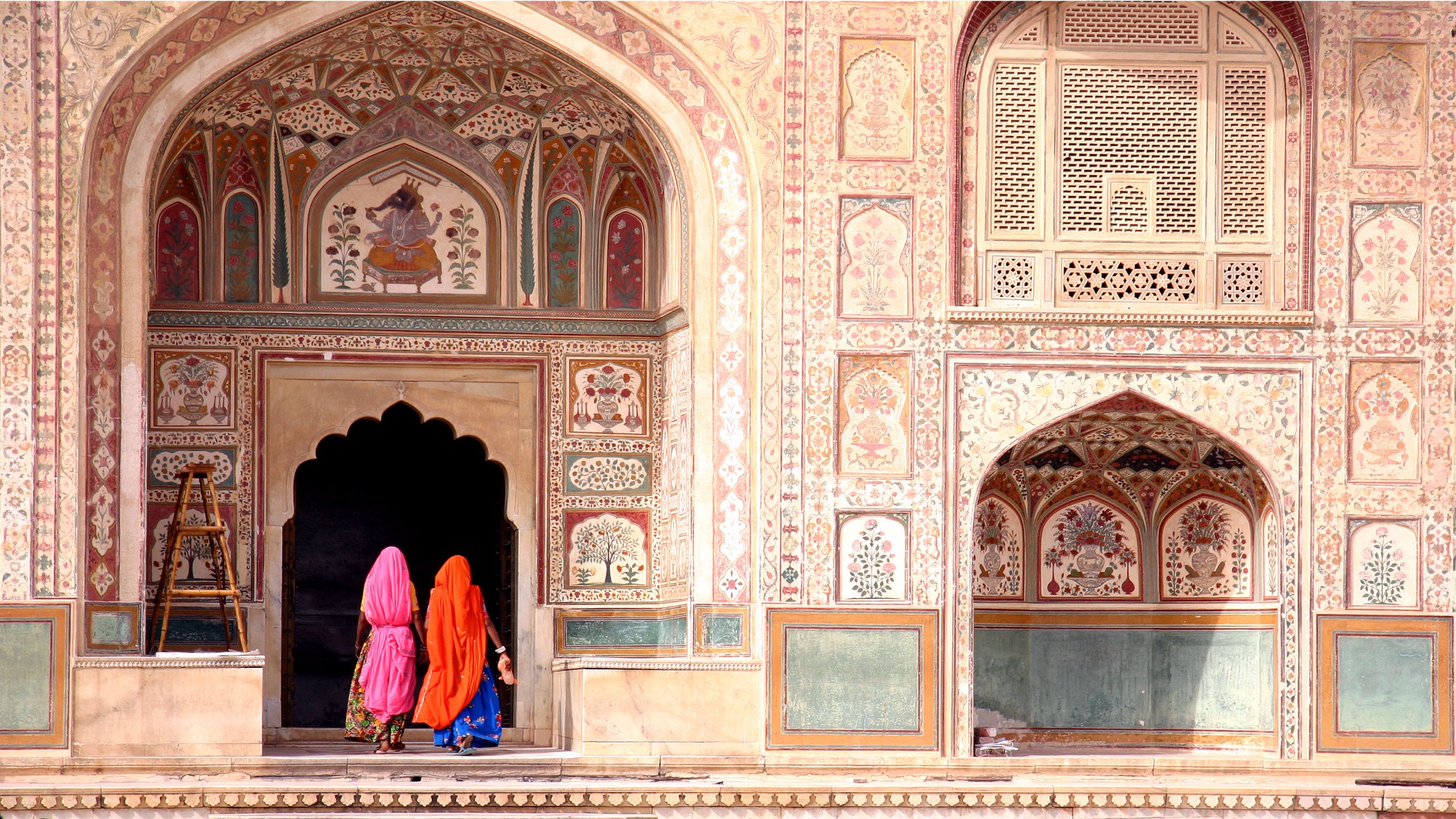

The Indian equity market is poised for significant growth, and we believe performance will be supported by strong corporate earnings and GDP figures. Find out more.

1Bloomberg, 1/31/24. Based on monthly S&P 500 Price Index data from 10/31/23 to 1/31/24.

2Bloomberg, 12/31/23. Based on monthly S&P 500 Price Index (1928 to 2024) and Russell 2000 Price Index (1979 to 2024) data since inception.

3Bloomberg, 12/31/23. Based on monthly S&P 500 Price Index data from 1928 to 2024.

4Bloomberg, 12/31/23. Based on monthly S&P 500 Price Index (1928 to 2024) and Russell 2000 Price Index (1979 to 2024) data since inception

5Bloomberg, 12/31/23. Based on yearly S&P 500 Price Index data from 1928 to 2024.

6Bloomberg, 12/31/23. Based on monthly S&P 500 Price Index data from 1928 to 2024.

7Bloomberg, 12/31/23. Based on monthly S&P 500 Total Return Index (1989 to 2024) data since inception.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.