Invesco Global Equity Income Fund

A core global fund with a focus on dividends and capital growth.

Find Out More

Why Invesco Global Equity Income Fund?

Source: Invesco as at 31 August 2025.

^Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time. Performance is sourced from ©2025 Morningstar, data as of 31 August 2025, based on A (USD)-Acc share class. †Peer group: EAA OE Global Equity Income.

#Weightings and allocations are subject to change without notice.

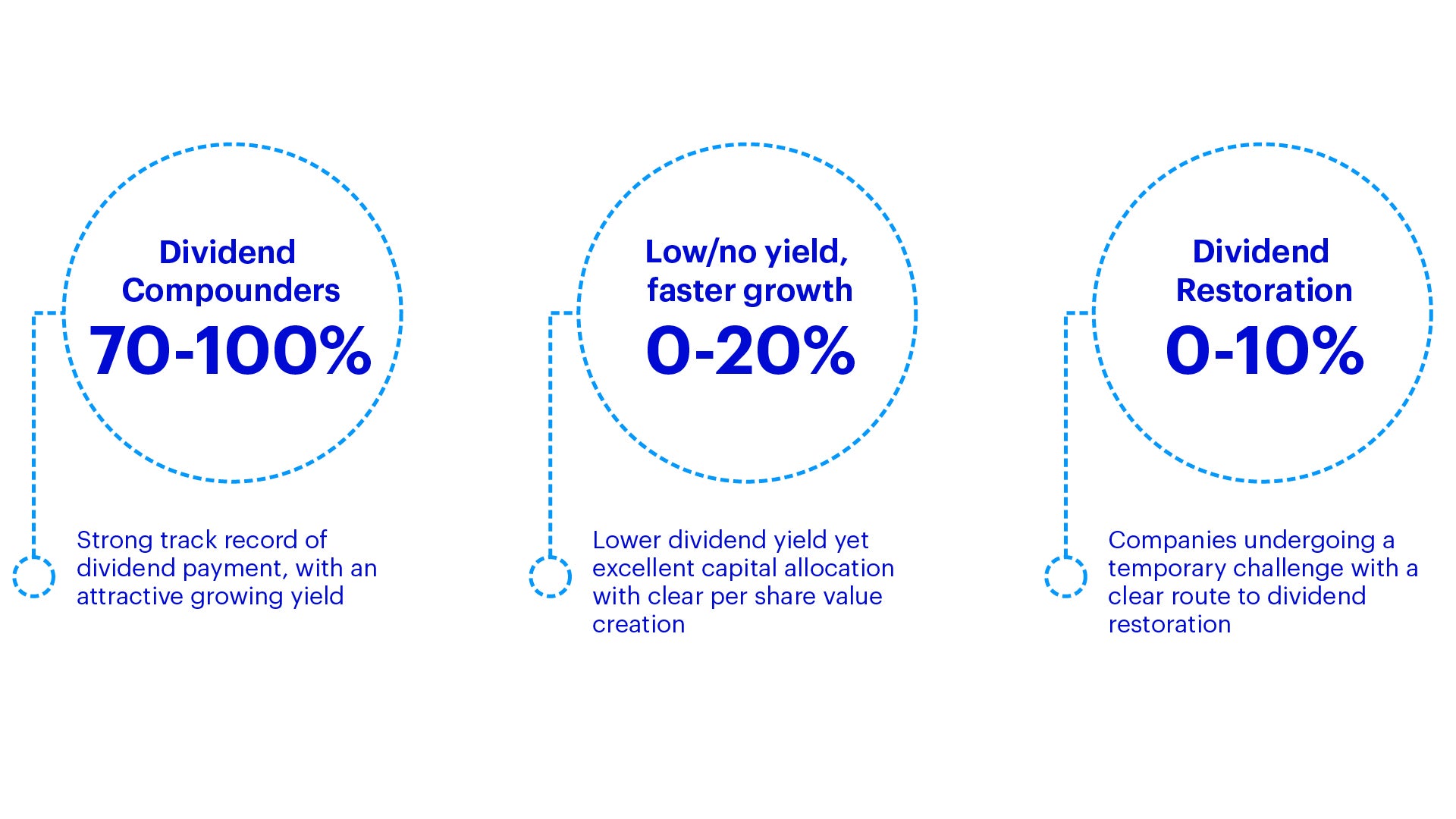

Active stock selection that focuses on both income and growth

A strategy that purely focuses on high dividend has historically underperformed the broader global equity market. This highlights the importance of balancing income and growth.

We believe that investing in dividend growers and companies with lower dividend yield yet excellent capital allocation with clear per share value creation can potentially enhance total returns. Diversification remains key when considering valuation, revenue growth and fundamentals.

Source: Bloomberg, as at 27 June 2025. Investments cannot be made directly into an index. Past performance does not guarantee future results.

Source: FactSet, I/B/E/S, MSCI, Goldman Sachs Global Investment Research, as at 1 August 2025. 2026 figures are estimates and for illustrative purposes only.

Source: Invesco as at 31 August 2025. For illustrative purposes only.

Source: Invesco as at 31 August 2025. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice. The weightings for each breakdown are rounded to the nearest tenth or hundredth of a percent; therefore, the aggregate weights for each breakdown may not equal 100%.

Top 10 holdings

1. Rolls-Royce 2. 3i 3. Canadian Pacific Kansas City 4. Microsoft 5. Texas Instruments

Total holdings: 41 |

5.7% 5.6% 5.5% 4.8% 4.6% |

6. AIA 7. Coca-Cola Europacific Partners 8. ASML 9. East West Bancorp 10. London Stock Exchange |

4.0% 4.0% 3.9% 3.4% 2.7% |

Source: Invesco as at 31 August 2025. Geographical weightings, sector weightings and portfolio holdings are subject to change without notice. For illustrative purposes only. It does not represent a recommendation to buy/hold/sell the securities. It must not be seen as investment advice.

Distribution information*

*Aims to pay dividend on monthly basis. Dividend is not guaranteed; For MD-1 shares, dividend may be paid out of capital. (Please refer to Note 1 and/or Note 2 of the "Important information")

| Intended frequency | Record date | Amount/Share | Annualized dividend (%) | |

| A (AUD Hgd)-MD1 Shares | Monthly | 29/08/25 | 0.0640 | 6.60% |

| A (USD)-MD1 Shares | Monthly | 29/08/25 | 0.0760 | 6.63% |

| A (HKD)-MD1 Shares | Monthly | 29/08/25 | 0.7000 | 6.71% |

| A (RMB Hgd)-MD1 Shares | Monthly | 29/08/25 | 0.4800 | 5.10% |

Source: Invesco as at 31 August 2025.

Annualized dividend (%) = (Amount/Share X Frequency) ÷ Price on record date. Upon dividend distribution, the Fund's net asset value may fall on the ex-dividend date. For Frequency, Monthly = 12; Quarterly = 4; Semi-Annually = 2; Annually =1. All distributions below USD 50/AUD 50/HKD 400/RMB 400 will be automatically applied in the purchase of further shares of the same class. Positive distribution yield does not imply a positive return.

Explore Funds

Invesco Global Investment Grade Corporate Bond Fund

A unique thematic approach to invest in high quality fixed income.

Transcript

Invesco Global Income Fund

A balanced fund with active asset allocation in search of income opportunities and capital growth globally.

Transcript

Invesco Pan European High Income Fund

The largest European-focused multi-asset balanced fund* using active asset allocation to achieve income and capital growth.

*Source: ©2025 Morningstar as of 30 June 2025. The largest fund in Morningstar Category - EAA Fund EUR Cautious Allocation.

Transcript

How can we help?

Invesco Funds Hotline:

(852) 3191 8282

Mon – Fri: 9:00am to 6:00pm