Things to consider when positioning for an end of tightening cycle

Both equities and bonds stand to benefit

Since March of last year, Federal Reserve has hiked interest rate 10 times in a row. The recent banking crisis indicates that the rate hikes might have been too aggressive. This has sparked market expectations for an end of the tightening cycle.

Peaking interest rate could be a positive catalyst for both equities and bonds. Historical data show that US stock market tends to perform well in the one-year, two-year, and three-year periods following an end of a rate hike cycle (with a few exceptions).

S&P 500® Index: returns following the end of previous tightening cycles

End of Fed hiking cycle |

Fed funds rate |

1 year after |

2 years after (annualized) |

3 years after (annualized) |

|---|---|---|---|---|

Aug 1984 |

11.75% |

18.2% |

28.3% |

30.3% |

Feb 1989 |

9.75% |

18.9% |

16.72% |

16.5% |

Feb 1995 |

6.00% |

35.6% |

30.3% |

31.9% |

May 2000 |

6.50% |

-10.6% |

-12.2% |

-10.9% |

July 2006 |

5.25% |

16.1% |

1.6% |

-6.1% |

Dec 2018 |

2.50% |

31.5% |

24.7% |

26.0% |

Source: US Federal Reserve, as of April 30, 2023. The S&P 500® Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. An investment cannot be made directly into an index. Past performance does not guarantee future results.

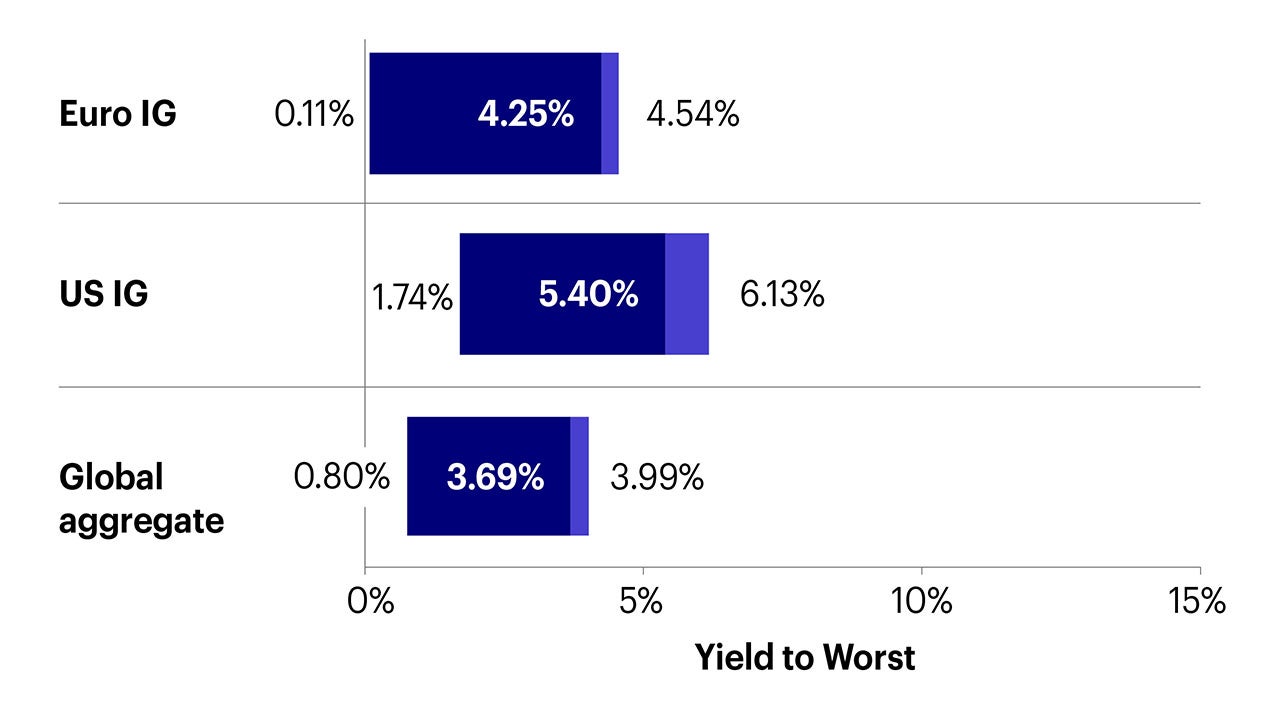

Yields surged substantially last year following the rate hikes, with global and euro investment grade bonds’ yields nearing all-time highs. As market anticipates an end to the rate hike cycle, US Treasury yields have begun to recede over the past three months. This downward trend is expected to continue as rates peak, which may mean that now could be a relatively attractive entry point for bond investments.

Source: Bloomberg, as of June 3, 2023. Bold data represent current yields.

Asian market relatively attractive

Peaking interest rates could benefit the stock market in general. Within this, Asian equity market appear more attractive compared with the global equity market in terms of both valuation and dividend yield. The current estimated P/E ratio of Asian market is 14.11x, lower than global market’s 16.65x. In terms of dividend yield, Asian market offers a yield of 2.77%, higher than the global 2.22%.1

Source: Bloomberg, as of June 6, 2023.

Multiple sources of income

An inverted yield curve is often seen as a sign of recession. Currently, the 3-month/18-month US Treasury yield curve has inverted to a level not seen since 1981.2 This heightens concerns that aggressive tightening may precipitate a US economic recession. With the risks of recession expected to continue into Q3, asset allocation with multiple sources of income could be a more preferable approach.

Source: Bloomberg, as of June 6, 2023.

References:

1 Bloomberg, as of June 6, 2023.

2 Bloomberg, as of May 5, 2023.

Focus funds

Fixed income

- Invest in high quality assets - Around 89% of investment grade corporate bonds with an average credit rating of BBB+.

- Ten selected themes - Use thematic approach to identify global investment opportunities, such as the credit cycle difference between Europe and US, diversification of supply chains and energy independence.

- Aims at distribution on a monthly basis## - MD-1 share classes in USD, HKD, RMB-hedged, AUD-hedged, EUR-hedged and GBP-hedged are available.##

Dividend income

- A Morningstar 4-star rated fund^ - Good performance with 1st quartile peer group ranking^ over 3,5 years and since inception.^^

- Valuation driven - A selection of around 58 companies from the APAC region which are trading at a significant discount. Up to 50% of cyclicals to position for the Asian economic recovery.

- Aims at distribution on a monthly basis## - MD-1 share classes in USD, HKD and RMB-hedged are available.##

- A combination of income and growth - A balanced portfolio with no excessive style or factor bias. It takes both yields and growth potential into consideration.

- Morningstar 4-star rated fund^ - Good performance with 1st decile performance over 1 year and 3 years.^

- Aims at distribution on a monthly basis## - MD-1 share class in USD, HKD, RMB-hedged and AUD-hedged are available.##

Options income

- A combination of dividends and options income - The breakdown of income is roughly 20-35% from dividends and 65-80% from options. This approach aims for high income with less volatility.

- Aim for monthly high income - In December, MD-1 share classes in USD, HKD and RMB-hedged yielded 7.69%, 7.74% and 8.02% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

- A less volatile portfolio - A highly diversified portfolio of 659 holdings with an aim to reduce volatility.

*Annualized dividend (%) = (Amount/Share X Frequency) ÷ Price on record date. Upon dividend distribution, the Fund's net asset value may fall on the ex-dividend date. For Frequency, Monthly = 12; Quarterly = 4; Semi-Annually = 2; Annually =1. All distributions below USD 50/AUD 50/HKD 400/RMB 400 will be automatically applied in the purchase of further shares of the same class. Positive distribution yield does not imply a positive return.

^Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time. Source: ©2024 Morningstar, data as of January 19, 2024.

^^The inception date of A (USD)-AD Shares is September 10, 2018. Peer group: EAA Fund Asia ex-Japan Equity. The historical performance shown above up to September 7, 2018 relates to the historical performance of the Irish domiciled fund, which was merged into the Luxembourg-domiciled fund on that date. This change has no impact on the investment objective, strategies, risk profile or fee structures of the fund. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time. Source: © Morningstar 2024 (see disclaimer at end of document). Quartile rankings shown are for the A (USD)-AD share class. Past performance is not a guide to future returns.

##Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. (Please refer to Note 1 of the "Important information") All distributions below USD 50/EUR 50/AUD 50/HKD 400/RMB 400/GBP 40 will be automatically applied in the purchase of further shares of the same class. Positive distribution yield does not imply a positive return.

Source: Invesco, as of December 31, 2023. For illustrative purposes only. There is no guarantee that the securities/industries/regions mentioned above are currently held or will be held by Invesco funds in the future. It does not represent a recommendation to buy/hold/sell the securities/industries/regions.

Investment involves risks. Past performance is not indicative of future performance. Investors should read the relevant prospectus for details, including the risk factors and product features.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is provided for reference purposes only. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Asset allocation data is derived by Morningstar using full holdings data provided by Invesco. Morningstar Licensed Tools and Content powered by Interactive Data Managed Solutions.

How can we help?

Invesco Funds Hotline:

(852) 3191 8282

Mon – Fri: 9:00am to 6:00pm