Risk-appetite returns with investors’ eyes wide open

European ETF investors added US$28.7bn of net new assets in May, a significant improvement from April.

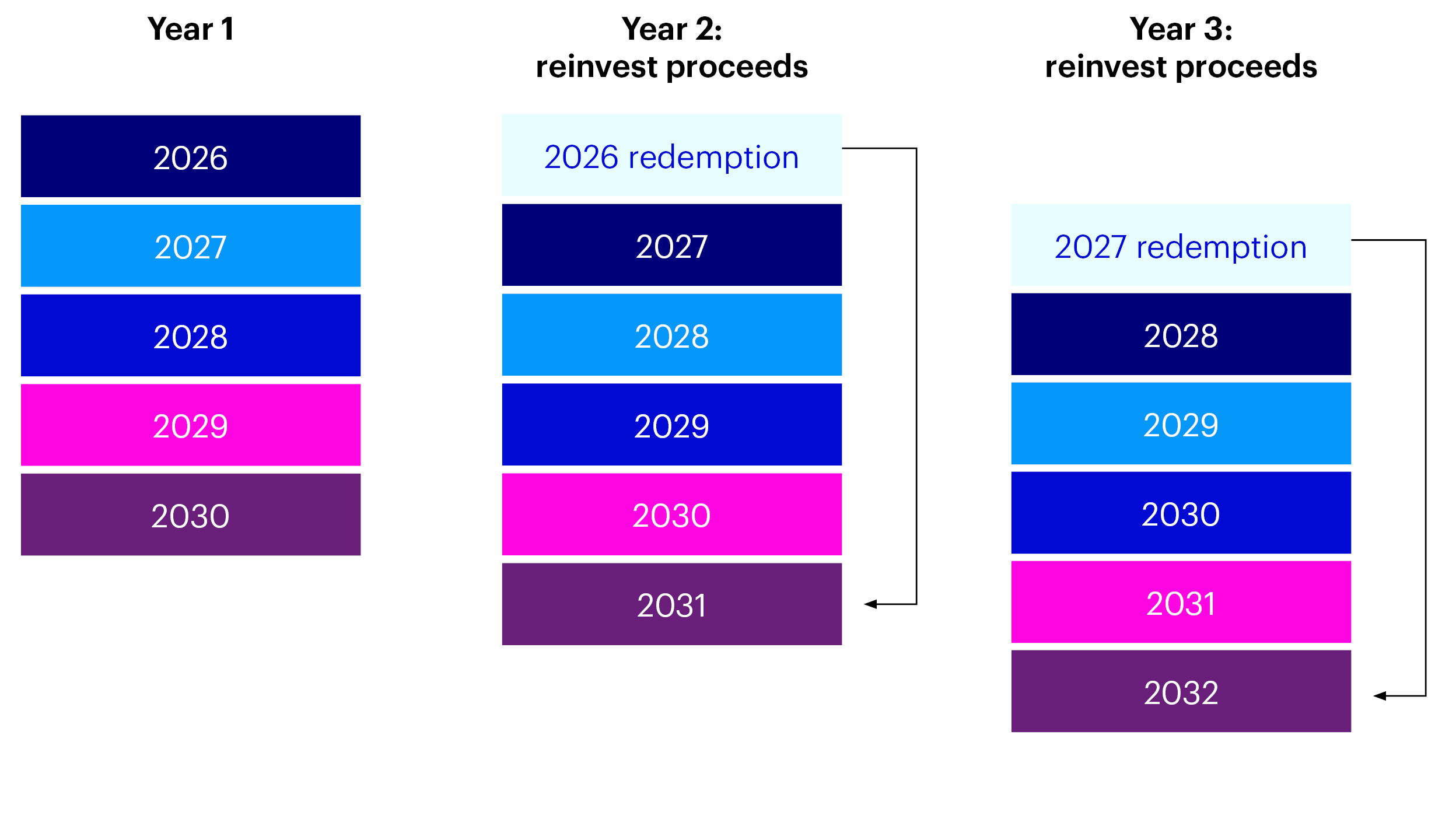

By staggering bond maturity dates, bond ladders can offer a measure of stability and adaptability (through regular cash flows), helping investors stay on course regardless of interest rate movements.

Investors can use defined maturity ETFs to build bond ladders that can help provide some stability regardless of where rates move.

Combining bond and ETF benefits, BulletShares UCITS ETFs make it easier to build cost-efficient, diversified ladders across timeframes.

As markets evolve, fixed-income investors are turning to strategies that offer both resilience and flexibility. Bond laddering, especially using defined maturity ETFs, has become an efficient way to manage interest rate risk, enhance diversification, and support long-term income goals.

Bond ladders, portfolios of bonds with staggered maturity dates, can enhance diversification, provide cash flow flexibility and help reduce exposure to interest rate volatility. As each bond matures, proceeds can be reinvested at current rates or used to meet certain financial goals, such as retirement or major purchases.

Bond investors have endured a whipsaw environment in interest rates that has introduced more unwanted volatility to portfolios. And with continued uncertainty over the US Federal Reserve rate policy, inflation, and geopolitical, fixed-income investors are looking for stability.

It’s therefore no surprise investors are turning to defined maturity ETFs, and how they can be used to build efficient bond ladders to introduce predictability into their income streams.

Defined maturity ETFs, such as our BulletShares UCITS ETF range, offer a streamlined way to construct bond ladders. Our ETFs hold a diversified basket of bonds that mature in a specific year, combining the benefits of individual bonds with the convenience, diversification, and liquidity of ETFs.

Unlike traditional fixed income funds, which typically maintain a constant duration and are more sensitive to interest rate changes, BulletShares ETFs allow investors to:

For illustrative purposes only.

Consider a bond ladder built with BulletShares ETFs maturing annually from 2026 to 2031. Each year, as an ETF matures, the proceeds can be reinvested into a new ETF with a later maturity, maintaining the ladder’s structure and adapting to the current rate environment.

With bond ladders, when interest rates are rising, investors can reinvest any proceeds from bonds maturing from the ladder into new bonds with higher rates. Meanwhile, if rates fall, investors may choose to reinvest less of the maturity proceeds into new bonds with lower rates, potentially anticipating attractive yields ahead. And, because bond ladders include bonds purchased at different times, investors may still benefit from holdings that were bought when rates were higher.

Investing across various BulletShares UCITS ETF maturities can enable investors to build a cost-effective, diversified laddered portfolio to manage interest rate risk and cash flows. Our range offers targeted exposure to USD (with GBP-hedged share classes available for those seeking to mitigate currency risk), and EUR investment grade corporate bonds, with maturity ranges from 2026 to 2030.

Whatever you’re looking to accomplish with your bond portfolio, Invesco’s range of BulletShares ETFs can offer convenient, cost-effective solutions to help meet your potential income goals.

European ETF investors added US$28.7bn of net new assets in May, a significant improvement from April.

We work hard to make sure our fixed income ETFs work hard for you. From leveraging our global resource and expertise to working on individual trade requirements, we aim to provide you with our best outcomes.

BulletShares® ETFs are a suite of fixed-term exchange-traded funds (ETFs) that enable investors to build customized portfolios tailored to specfic maturity profiles, risk preferences, and investment goals.