Markets and Economy The four Trump policies most likely to impact economic growth

Deregulation and tax cuts could potentially provide a boost to US economic and market growth, while tariffs and immigration restrictions could pose challenges.

Just days into the new year, Omicron continues to spread and the U.S. Federal Reserve has turned hawkish. So does this change our 2022 outlook? Not dramatically, but we offer a few notable updates.

At Invesco, constructing our annual outlook is an important endeavour. We begin the process in early September, bringing together some of our most experienced investment professionals and thought leaders, representing different regions and asset classes, to undergo a multi-step process.

We first develop gross domestic product projections and inflation projections based on a variety of inputs. We also factor in fiscal and monetary policy in various countries and regions to help form our view. We then determine where in the economic cycle we are, which informs our asset class preferences. To address the breadth of possibilities that lie ahead in the environment, we not only provide a base case scenario that we believe is highly probable, but we also provide two additional tail risk scenarios and contemplate the investment implications of each.

When we released the 2022 outlook in early December, we gave the caveat that we had formed these views largely prior to the emergence of the Omicron variant and the possibility of an accelerated taper timeline from the U.S. Federal Reserve (Fed). We recognized that there may be a need to revisit the outlook if we were to experience an event significant enough to potentially alter the macroeconomic landscape and investment implications. And so we recently reconvened to assess the impacts of the spread of the Omicron variant and the Fed’s hawkish pivot.

The result is that our outlook remains largely intact, with a few notable exceptions:

The two asset preferences in our base case scenario that we thought might be altered by the Omicron spread and a more hawkish Fed were emerging markets and longer duration. However, we continue to support both of those preferences:

Even with the impacts of the Omicron variant, our key hypothesis remains: We expect a convergence of returns across asset classes as economic growth approaches trend growth rates. As we wrote in December, we view 2022 as a year of transition.

Deregulation and tax cuts could potentially provide a boost to US economic and market growth, while tariffs and immigration restrictions could pose challenges.

The potential for significant deregulation and tax cuts has excited many investors, leading US stocks to “climb the wall of worry” despite immigration and tariff risks.

Donald Trump’s red wave victory was the decisive end to a historic election. Will we see tax cuts and deregulation fuel growth? Or do trade wars and higher spending quash it?

Important information

NA 1994689

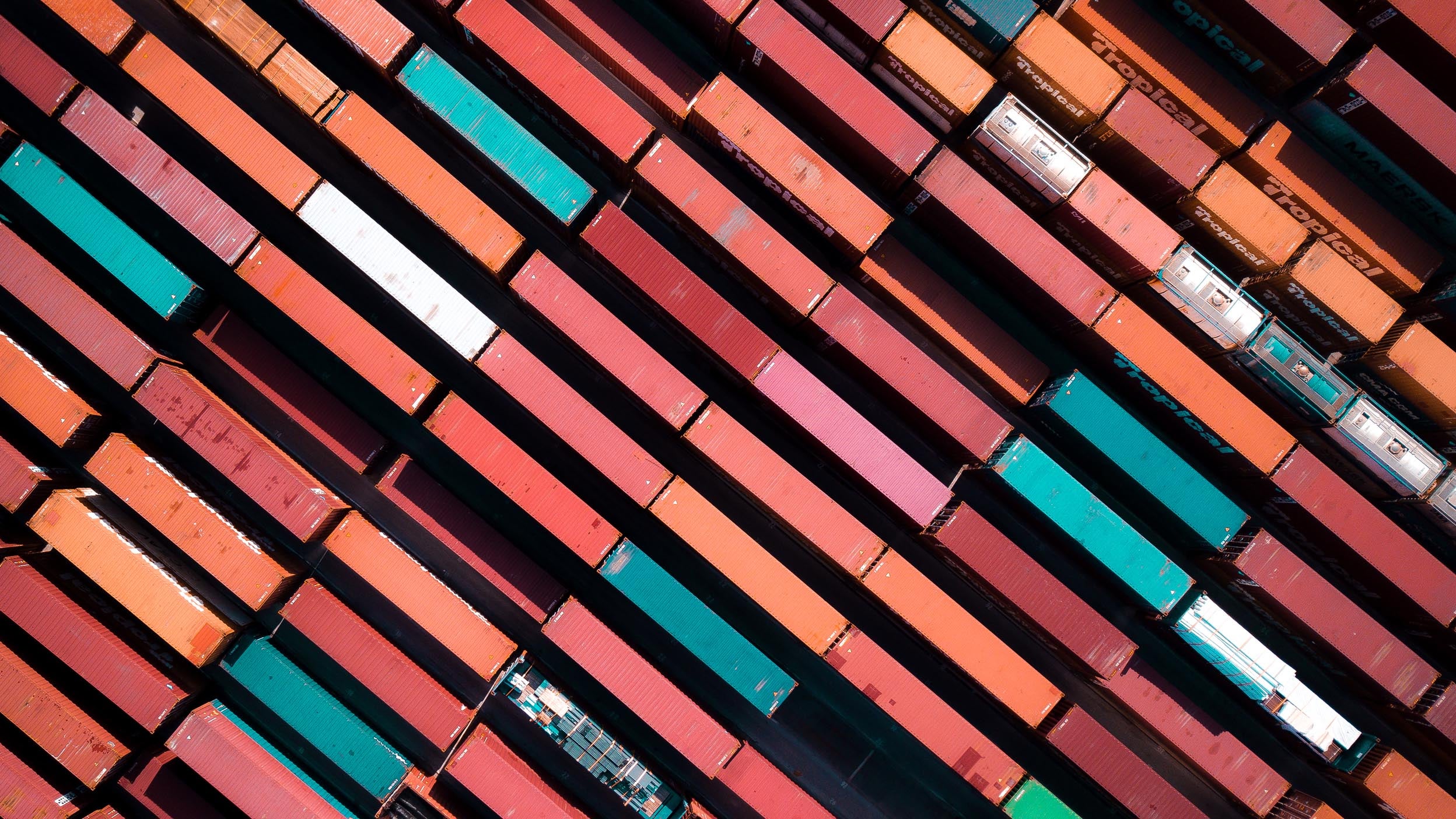

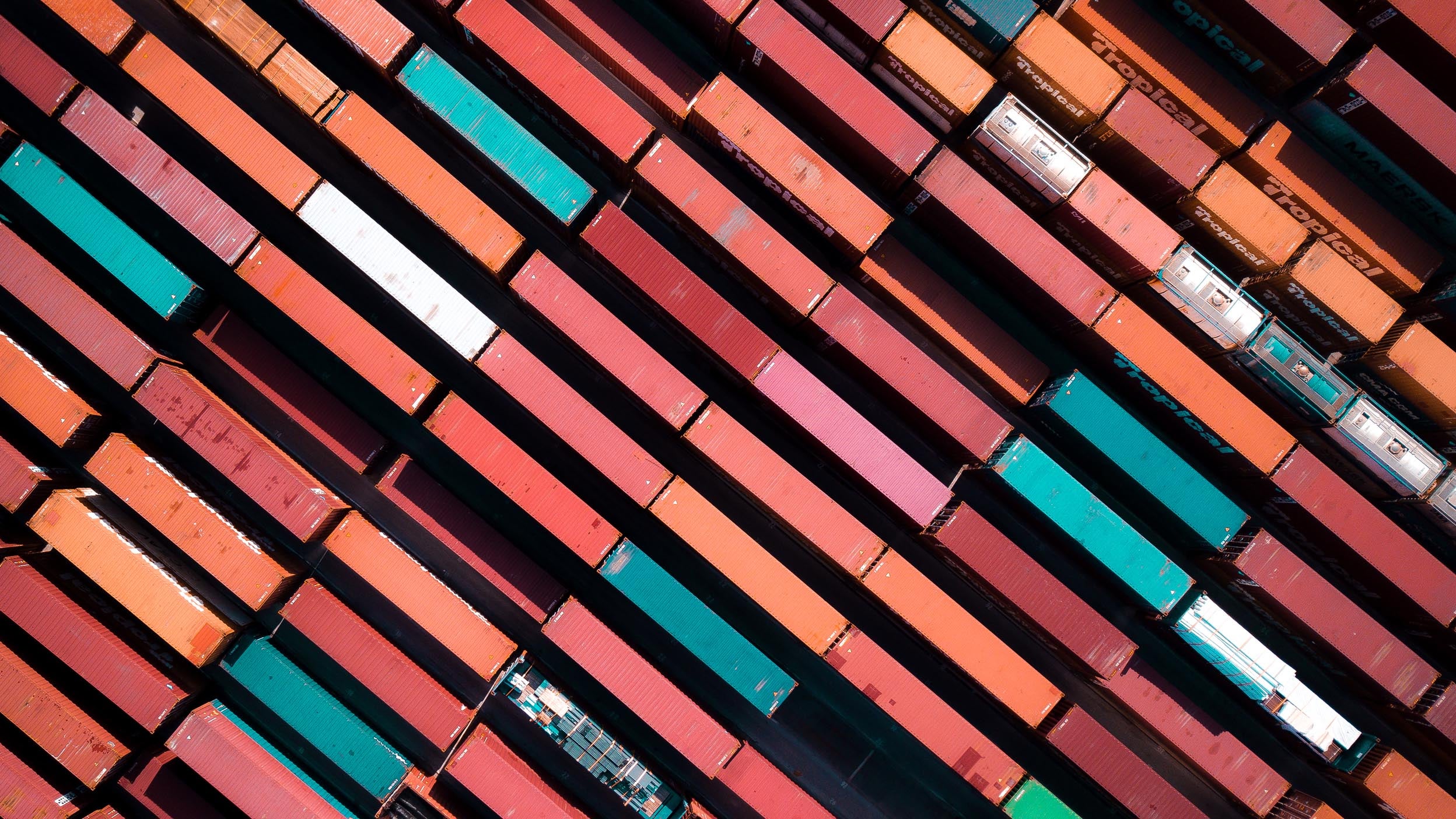

Header image: d3sign / Getty

Some references are U.S. centric and may not apply to Canada.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Gross domestic product is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

Tapering is the gradual winding down of central bank activities that aimed to reverse poor economic conditions.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates. Duration is expressed as a number of years.

The opinions referenced above are those of the author as of Jan. 18, 2022. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.