ETF strategies

No matter what you or your clients are looking to achieve financially, our ETFs can help you reach your investing goals.

Forward-looking signals guide dynamic factor allocations given cyclical properties.

Rules-based investment process allows for transparency — no "black box" construction.

Complementary to passive and active management, delivering an innovative and cost-effective solution in the marketplace.

Invesco Dynamic-Multifactor Strategies seek to outperform the corresponding FTSE/Russell market-cap-weighted benchmark on a total-return and risk-adjusted basis while maintaining a comparable level of risk over a full market cycle.

| Ticker | Fund | Asset class | Vehicle | Download |

|---|---|---|---|---|

| IIMF |

Invesco International Developed Dynamic-Multifactor Index ETF | International and global equity | ETF | Fact sheet |

| IUMF |

Invesco Russell 1000® Dynamic-Multifactor Index ETF | US equity | ETF | Fact sheet |

Darim Abdullah, ETF Strategist, breaks down how Invesco's Dynamic-Multifactor approach works, how they're different from other factor-based strategies, and why investors should consider them for their portfolios.

00:00:07:24

In Canada, we have two Dynamic-Multifactor ETFs. One provides exposure to the broader U.S. equity market and comes with the ticker IUMF, and the other provides exposure to the broad developed international equity market and comes with the ticker IIMF.

00:00:23:24

Both ETFs are core diversified and broad-based strategies that employ a rules-based process to take advantage of their changing market environment.

00:00:33:29

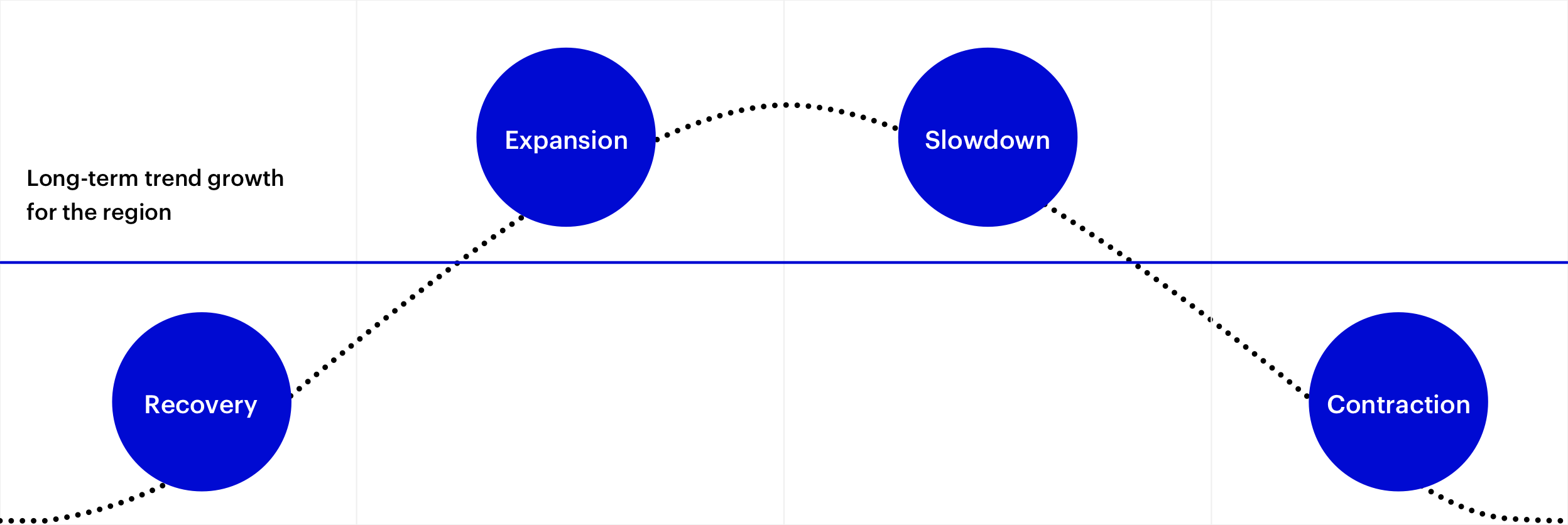

First, leveraging Invesco's macro-regime Framework, the first step of the process involves identifying the current economic regime. Or more simply put - the stage of the business cycle.

00:00:45:08

These stages can be identified as: recovery, expansion, slowdown or contraction. Once the current economic regime is determined, each regime is mapped to historically rewarded factors or investment styles. The portfolio construction then involves dynamically adjusting the ETFs underlying holdings’ targeting those highly exposed to the factors or investment styles favored by the current economic regime.

00:01:10:21

Let's provide an example. During an economic recovery, the ETFs would be tilted towards holdings that are relatively undervalued and smaller in size, targeting the value and size factors which have historically done well during an economic recovery.

00:01:26:20

And during an economic slowdown, The ETFs would adjust their holdings and be tilted towards holdings that exhibit strong defensive attributes, such as low volatility and quality factors.

00:01:40:05

In essense, the ETF is dynamic and making changes to its underlying holdings to better fit the economic regime we’re in and how to navigate the market, uncertainty.

00:01:54:14

We believe that our Dynamic-Multifactor ETFs are uniquely differentiated from other factor-based strategies via two angles. First, there will be at least two targeted factor exposures and sometimes three at any given point in time. This multifactor approach differentiates our ETFs from other single factor based strategies out there.

00:02:16:00

So this begs the question “Why is it important to think about factors together rather than on a standalone basis”? We believe this is important because many of these factors tend to have low to negative correlation to one another, and by using multiple factors, we can reap the potential diversification benefits of bringing them together.

00:02:37:06

The second way over ETFs our differentiated is that within the multifactor framework, the strategy is truly dynamic and moving from one set of factors to another depending on the economic regime we are in.

00:02:49:17

So, this sets it apart from other multifactor strategies that tend to be more static in nature. The dynamic overlay, driven by Invesco's macro regime framework, has been a key driver for returns for the strategies since their inception.

00:03:08:19

We believe that Invesco Dynamic-Multifactor Strategies provide cost-effective alpha, targeting, broad U.S. and international equity exposures. Since the inception of the underlying indices that have delivered excess returns on top of broad-based market indices such as the S&P 500 and the MSCI EAFE.

00:03:28:00

This was coupled with downside risk mitigation as evident, and they down-capture ratios. The ability of the strategy to position itself into more defensive holdings exhibiting low volatility and high-quality factors when markets are expected to be challenged has provided an attractive down-capture ratio.

00:03:47:04

This was particularly helpful for the US equity strategy in 2022, considered by many as one of the most challenging year for investors in recent history.

00:03:57:09

The US equity strategy delivered an excess return of 4.87% on top of the broad based S&P 500 index. Investors may seek to benefit from such an active and cost-effective approach in light of the uncertain market backdrop we've been experiencing.

00:04:14:18

Whether you are an investor who wants to capitalize on an economic recovery or reduce your investment risk associated with economic downturns, Invesco’s Dynamic-Multifactor ETFs can potentially help you alleviate the need to tactically make changes to your investments by providing you with a streamlined approach to navigating the U.S.

00:04:34:17

and international equity markets, regardless of their direction.

Factors exhibit cyclicality and different exposures to economic risk. The framework will navigate market cycles, depending on each regime, for a tactical factor allocation approach.

This graph demonstrates how the team defines the stages of the business cycle based on the expected level and change in economic growth and how we combine proprietary indicators to estimate one of four factor regimes: Recovery, expansion, slowdown, and contraction.

| Recovery | Expansion | Slowdown | Contraction | |

|---|---|---|---|---|

| Long-term economic growth trend | Growth is below trend and accelerating | Growth is above trend and accelerating | Growth is above trend and decelerating | Growth is below trend and decelerating |

| Size | x | x | ||

| Value | x | x | ||

| Momentum | x | x | ||

| Low volatility | x | x | ||

| Quality | x | x |

Factor cyclicality

Our Philosophy

No matter what you or your clients are looking to achieve financially, our ETFs can help you reach your investing goals.

Client-focused fixed income solutions that help you navigate the ever-changing world of bond investing.

Trust Invesco to access the world's largest economy and some of the most recognized companies.

NA 5010850