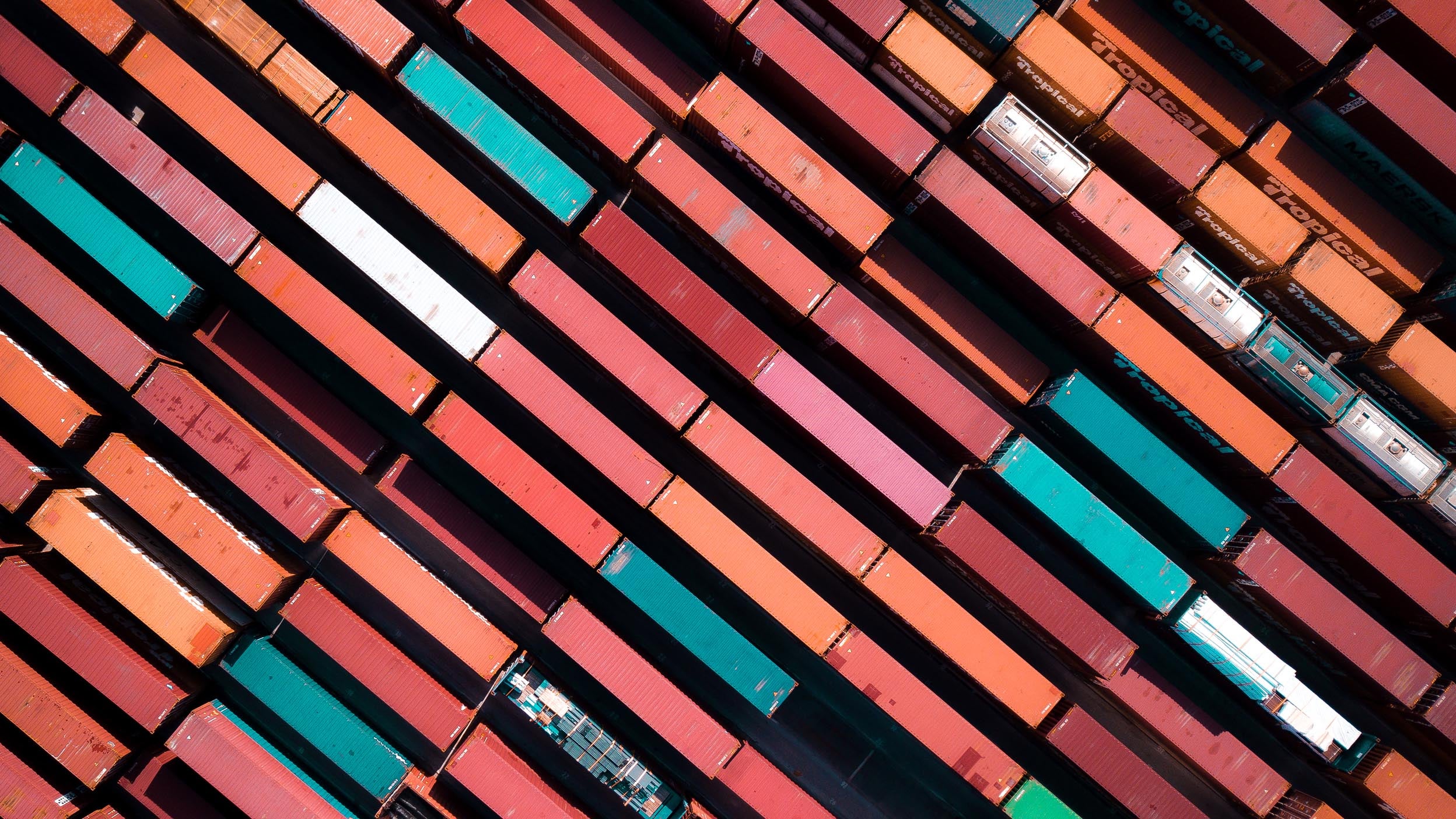

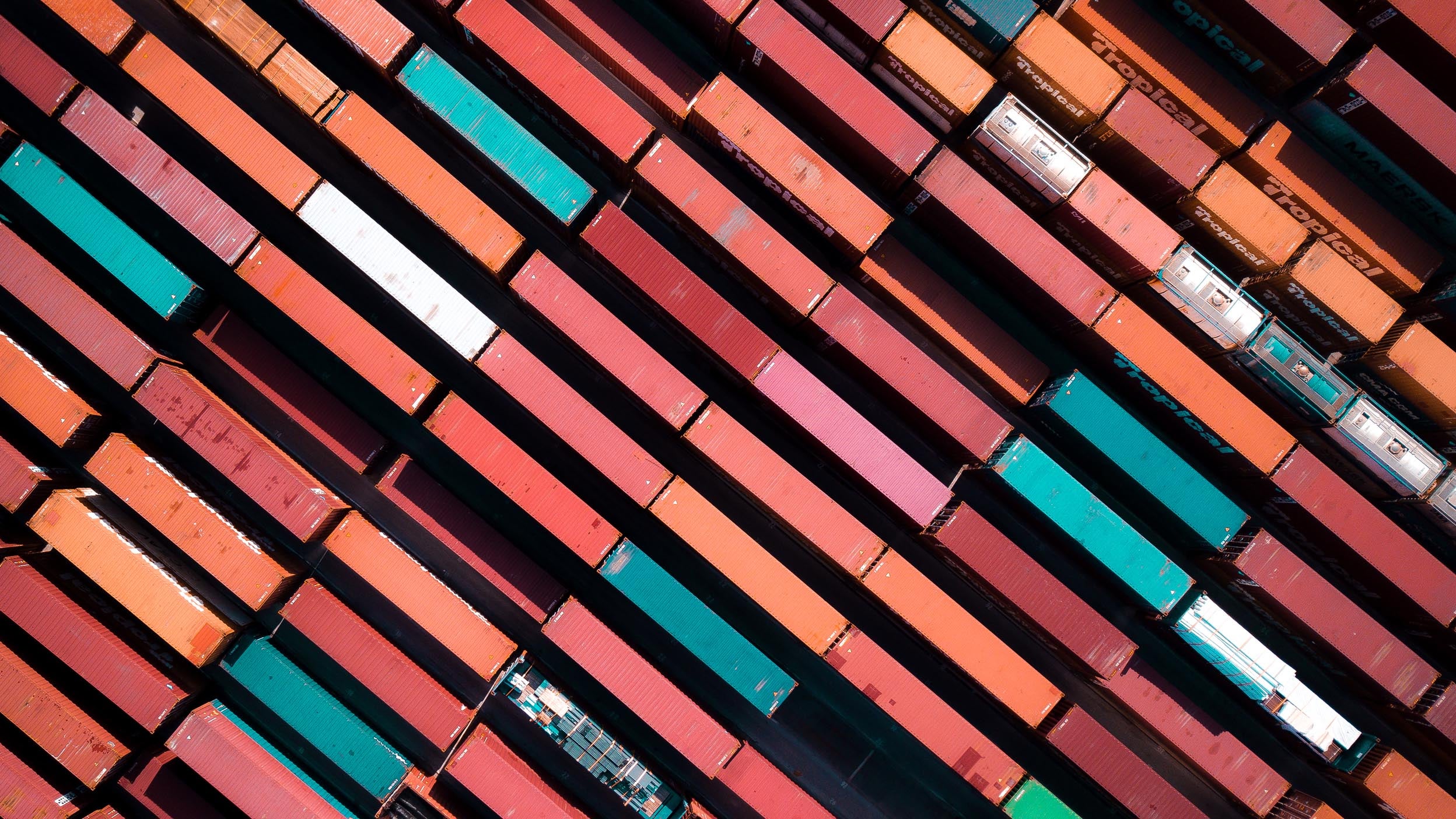

Markets and Economy The four Trump policies most likely to impact economic growth

Deregulation and tax cuts could potentially provide a boost to US economic and market growth, while tariffs and immigration restrictions could pose challenges.

The U.S. economy remains resilient, and inflation continues to moderate, but at a slower pace than we would like to see.

Our view remains that 2023 is a path to a sustained recovery for the market, but not necessarily a straight one.

For those who are more risk-averse, emphasizing income may help to tamp down volatility in a portfolio.

I’ve been on the road a lot in the last several weeks, presenting to various client groups, and I’m struck by the level of pessimism I’ve been hearing. There are certainly challenges ahead, but I don’t believe that pessimism should overshadow the potential for capital appreciation and income that I see ahead.

Investor pessimism seems to be focused on three main questions.

I feel that realism is more appropriate than pessimism. U.S. inflation figures were released last week, with both the headline and core Consumer Price Index exceeding consensus expectations. However, this print still indicates that inflation is moderating, albeit more stubbornly than expected. That was also true for the U.S. Producer Price Index print released last week.

On the brighter side, some economic growth data is also exceeding expectations. January U.S. retail sales were far better than expected: 3% versus expectations for 1.7%.1 Ex-autos the figure was 2.3%, far higher than the consensus forecast of 0.7%.1

My key takeaway from last week’s data is that the U.S. economy remains very resilient, and inflation continues to moderate, but at a slower pace than we would like to see. The U.S. Federal Reserve (Fed) may have to hike slightly more before it hits the "pause" button — and I believe it’s very unlikely to cut rates later this year. Recent “Fedspeak” last week has supported this conclusion, although I believe it’s been overly hawkish:

It’s not just the Fed. We’re hearing hawkish language from other central banks. Last week we got data showing that UK inflation slowed by more than expected, to a six-month low, in January. That was greeted with this comment from UK Chancellor Jeremy Hunt, “While any fall in inflation is welcome, the fight is far from over.”4

And then there was the European Central Bank’s Valentine’s Day tweet:

“Roses are red

Violets are blue

We will stay the course

And return inflation to 2."

This is coming from a central bank whose Valentine’s Day tweet two years ago was:

“Roses are red

Violets are blue

We’ll keep financing conditions favourable

‘Til the crisis is through.”

My takeaway is that central banks will keep up their hawkish rhetoric until they are ready to hit the pause button. And that’s OK, so long as they don’t get too hawkish. I believe the Fed probably only needs two more rate hikes — unless upcoming data tells us otherwise.

I hold out the Bank of Canada as an example — its rather brave decision to hit the pause button on rate hikes has been confirmed by January inflation data, showing inflation moderating despite a very strong labour market. The Fed is talking tough right now because jawboning can be an effective tool in its toolbox, but I am not rattled by it and suspect the U.S. will be in Canada’s shoes in a couple of months. I’m realistic, but not overly pessimistic.

Another source of pessimism is earnings, as investors wait for the lagged effects of monetary policy to hit earnings at the same time inflation does damage to profit margins. I have heard the term “headwinds” on countless earnings calls for the fourth quarter. A UK medical device maker shared, “We will continue to face macroeconomic headwinds in 2023,”5 while a U.S. building products manufacturer shared, “Inflationary pressures continue to present headwinds.”6

The reality is that there should be macroeconomic headwinds created by a dramatic monetary policy tightening cycle, given that there have been significant headwinds created by inflation. But many companies are resilient and have been capably managing through these headwinds for some time already.

For example, S&P 500 earnings are expected to come under pressure, but not dramatically so. For first quarter 2023, analysts are projecting an earnings decline of -5.4% and revenue growth of 1.9%.7 For second quarter 2023, consensus expectations are for an earnings decline of -3.4% and a revenue decline of -0.1%.7 For third quarter 2023, earnings are expected to rebound with growth of 3.3% and revenue growth of 1.4%.7 For fourth quarter 2023, analysts expect earnings growth of 9.7% and revenue growth of 3.4%.7

I must give the caveat that of course these can be downwardly revised given that we haven’t seen the cumulative effects of rate hikes. However, I do believe much of the earnings deterioration has been priced into stocks already.

There is significant trepidation around this question. I’m no geopolitical expert, but geopolitical risks are always present. Sometimes they arrive with much anticipation, and other times we’re caught by surprise.

I’m struck by how, despite all the crises, conflicts, and tragedies we’ve experienced in the last 100 years, the stock market has been incredibly resilient over time.

As a concerned citizen, I’m closely watching today’s headlines and hoping that tensions all over the world will soon ease. As an investor, I can only look back to history and how markets have performed over the long term. I believe for long-term investors, it’s a mistake to get out of stocks and other risk assets to avoid a potential geopolitical threat, only to miss out on capital appreciation potential and income potential.

It strikes me that a big source of today’s investor pessimism is recency bias — last year was terrible for most asset classes, so many expect something bad this year too. Our view remains that 2023 is a path to a sustained recovery for the market, but not necessarily a straight one. Equity markets could potentially give back some of their recent gains as the economy weakens and earnings come under pressure. However, we would view that as a relatively temporary bump in the path that presents a potential buying opportunity.

In my view, the key to combating pessimism is to remain well diversified and focused on long-term goals. We could see a significant retracing of the advances the stock market has made in recent months, but I would expect it to be relatively temporary — and therefore a potential buying opportunity for those with longer time horizons.

In a period of volatility with the potential for relatively low returns, I believe investors are likely to benefit from an emphasis on income potential. Income should also be diversified, in my opinion, and can include investment grade credit, emerging market debt, municipal bonds, high yield bonds, dividend-paying stocks, and real estate investment trusts.

After all, the pain we went through last year with aggressive tightening has already produced some benefits in 2023: Most fixed income sub-asset classes have experienced a major increase in yields in the past 13 months. For example, the ICE BofA AAA U.S. Corporate Index had an effective yield of 2.06% at the end of 2021, but as of Feb. 16, 2023, that effective yield was a more robust 4.68%.8 I don’t believe investors should abandon equities, but for those who are more risk-averse, emphasizing income may help to tamp down volatility in a portfolio.

Given my focus on pessimism this week, my commute this morning seemed right in line with the theme. As I was walking to the subway, I noticed a woman stopping people to share what seemed like extremely important information. As I approached, I realized she was whispering, “The end of the world is near!” My first thought was “Wow – people are getting even more pessimistic than I expected.” My second thought was “No wonder some genius made a lot of money creating ‘Keep calm and carry on’ T-shirts and mugs.” And while my instinct was to tell her that everything is going to be OK, she seemed to enjoy sharing this information with unsuspecting, half-awake commuters. So, as I ran for the subway, I took this as one more reminder that resilience and patience are important attributes for investing as well as life.

Deregulation and tax cuts could potentially provide a boost to US economic and market growth, while tariffs and immigration restrictions could pose challenges.

The potential for significant deregulation and tax cuts has excited many investors, leading US stocks to “climb the wall of worry” despite immigration and tariff risks.

We expect significant monetary policy easing to push global growth higher in 2025, fostering an attractive environment for risk assets as central banks achieve a “soft landing.”

Source: U.S. Census Bureau, as of Feb. 15, 2023

Source: St. Louis Fed, Feb. 16, 2023

Source: Reuters, “More Fed policymakers point to higher rates in inflation fight,” Feb. 17, 2023

Source: Reuters, “Slowdown in UK inflation eases pressure on Bank of England,” Feb. 15, 2023

Source: Smith & Nephew Earnings Call, Feb. 21, 2023

Source: Louisiana Pacific Earnings Call, Feb. 21, 2023

Source: FactSet Earnings Insight, as of Feb. 17, 2023

Source: Bank of America Merrill Lynch

NA2750930

Important information

Header image: Eldad Carin / Stocksy

Some references are U.S. centric and may not apply to Canada.

Diversification does not guarantee a profit or eliminate the risk of loss.

Past performance is not a guarantee of future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

An investment cannot be made directly into an index.

There is no guarantee that estimates/forecasts will come to pass.

The Consumer Price Index (CPI) measures change in consumer prices as determined by the U.S. Bureau of Labor Statistics. Core CPI excludes food and energy prices while headline CPI includes them.

The Producer Price Index (PPI) is compiled by the U.S. Bureau of Labor Statistics and measures the average change over time in the selling prices received by domestic producers for their output.

Disinflation, a slowing in the rate of price inflation, describes instances when the inflation rate has reduced marginally over the short term.

The federal funds rate is the rate at which banks lend balances to each other overnight.

Tightening is a monetary policy used by central banks to normalize balance sheets.

The effective yield is the return on a bond that has its interest payments (or coupons) reinvested at the same rate by the bondholder.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer’s ability to make payments of principal and/ or interest.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Securities that pay high dividends as a group can fall out of favour with the market, causing such companies to underperform companies that do not pay high dividends. Also changes in the dividend policies of the companies and the capital resources available for such companies’ dividend payments may affect the Fund.

Investments in real estate related instruments may be affected by economic, legal, or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid.

ICE BofA AAA U.S. Corporate Index, a subset of the ICE BofA U.S. Corporate Master Index tracking the performance of U.S. dollar denominated investment grade rated corporate debt publicly issued in the U.S. domestic market.

The opinions referenced above are those of the author as of Feb. 21, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.