Multiple Sources of Income Solutions

Invesco offers multiple sources of income which could potentially generate stable income for your portfolio.

Things to consider when positioning for a potential global easing cycle

Stocks and Bonds stand to benefit

With the fight against inflation bearing fruit – inflation has gradually come down towards central bank targets, investors may start to think about how to position for a global easing cycle.

Both the European Central Bank and Bank of England have cut interest rates earlier this year. The US Federal Reserve (Fed) is expected to cut interest rate before the end of Q3 2024.

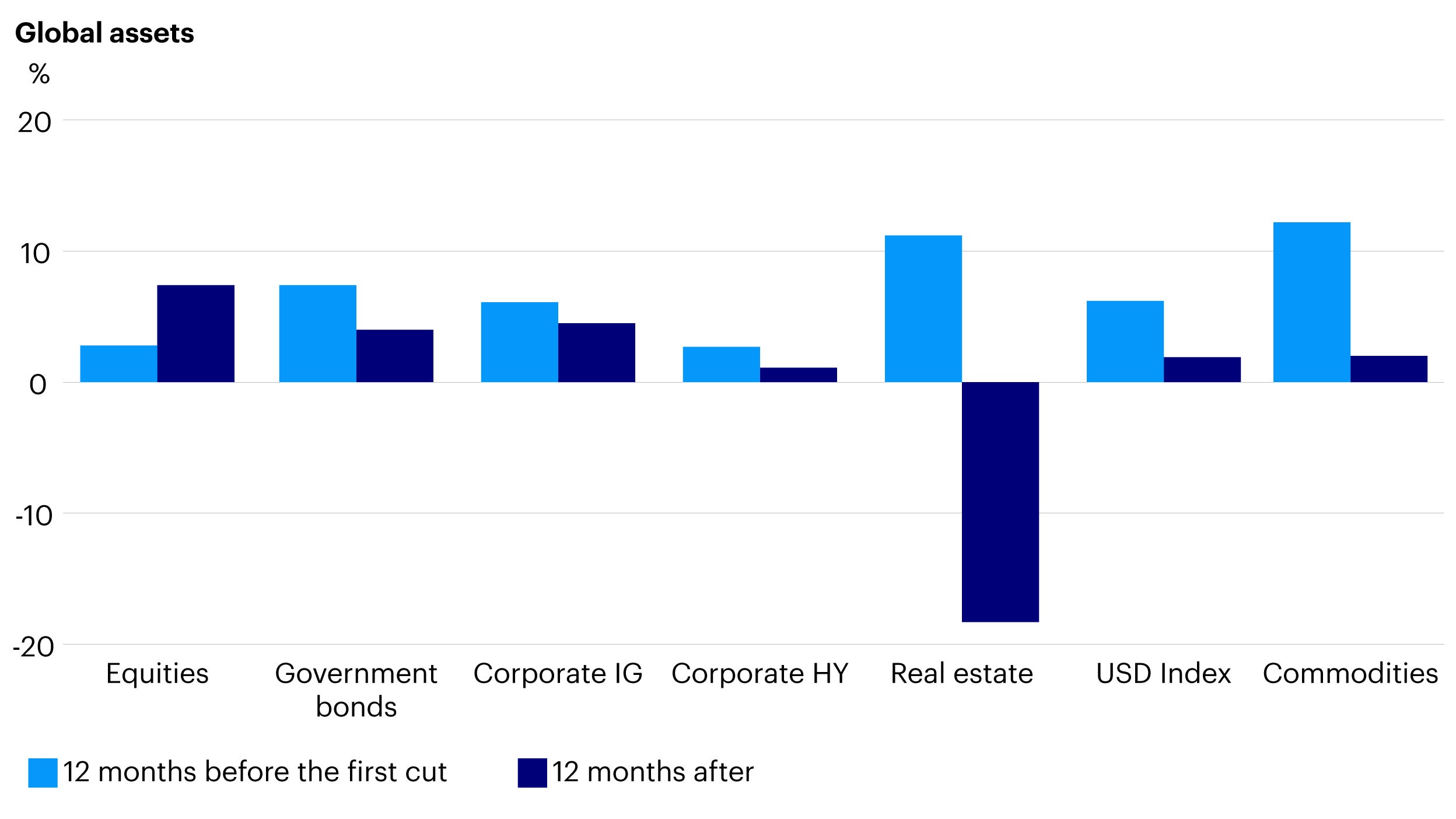

Historically, both stocks and bonds performed well following the first Fed rate cut as investors expect an easing cycle could lead to economic recovery. As such, this may be time for investors to explore the opportunities in global equities and fixed-income.

Notes: Past performance is no guarantee of future results. An investment cannot be made directly in an index. “Corporate IG” = investment grade; “Corporate HY” = high yield. Based on Federal Reserve interest rate cycles since 1974. Please see Appendix for methodology and index definitions. As of May 31, 2024. Sources: ICE, ICE BofA, FTSE Russell, MSCI, S&P GSCI, Refinitiv, LSEG Datastream, and Invesco. For illustrative purposes only.

Bond yields tend to go down along with central bank rate cuts. Investors looking for income may potentially take advantage to lock in the attractive yield in fixed income, e.g. investment grade bonds.

Source: BlackRock Aladdin, as of July 31, 2024 *Bloomberg Global Aggregate Corporate USD Hedged Total Return Index. Past performance is no guarantee of future results. For illustrative purposes only. An investment cannot be made directly in an index.

While historically, stocks and bonds stand to benefit from rate cuts, it is important to diversify geographically (i.e. a global exposure) as 1) The timing and depth of central bank rate cuts will vary by country, 2) Economic recovery may be uneven across the global, 3) Geopolitics and elections may trigger political uncertainties.

Economic recovery may be uneven across the global.

Geopolitics and elections may trigger political uncertainties.

#Diversification does not guarantee a profit or eliminate the risk of loss. There is no guarantee objectives and/or targets will be met.

Focus funds

Invesco offers multiple sources of income which could potentially generate stable income for your portfolio.

Understand Investment Grade Corporate Bonds in 3 Minutes

FED has begun a cycle of interest rate cuts. What is the outlook for the bond market? Which industries or regions are particularly attractive? Lyndon Man, Senior Portfolio Manager, shared his views on the outlook for investment grade corporate bonds.

There will be fund highlights after the Important Information.

Fixed income

- Invest in high quality assets - Around 89% of investment grade corporate bonds with an average credit rating of A-.^

- The selected themes - Use thematic approach to identify global investment opportunities, such as the credit cycle difference between Europe and US, financial deleveraging and energy independence.

- Opportunities for monthly income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 8.00% and 7.98% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

Multi-asset

- Active asset allocation: Active allocation based on portfolio manager's asset allocation framework in different economic conditions. A diversified global portfolio of income producing securities, mainly bonds and equities.

- Opportunities for monthly income - In November, A (USD Hgd)-MD1 Shares yielded 7.76%; A (HKD Hgd)-MD-1 Shares yielded 7.76%.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

- Morningstar 5-star rating: Invesco Global Income Fund A (USD Hgd)-MD1 Shares is Morningstar 5-star rated^^.

Dividend income

- A combination of income and growth - A balanced portfolio with no excessive style or factor bias. It takes both yields and growth potential into consideration.

- Morningstar 4-star rated fund^^ - Good performance with 1st quartile peer group ranking over 1 year, 3 years and 5 years.***

- Opportunities for monthly high income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 5.35% and 5.37% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

Options income

- A combination of dividends and options income - The breakdown of income is roughly 20% from dividends and 80% from options.# This approach aims for high income with less volatility.

- Opportunities for monthly income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 7.01% and 7.08% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

- A less volatile portfolio - A highly diversified portfolio of 620 holdings with an aim to reduce volatility. #

How can we help?

Invesco Funds Hotline:

(852) 3191 8282

Mon – Fri: 9:00am to 6:00pm