Markets and Economy Tariffs and trade wars: What do they mean for investors?

We assess what President Trump’s “Liberation Day” tariffs might mean for US and global markets, equities, and more.

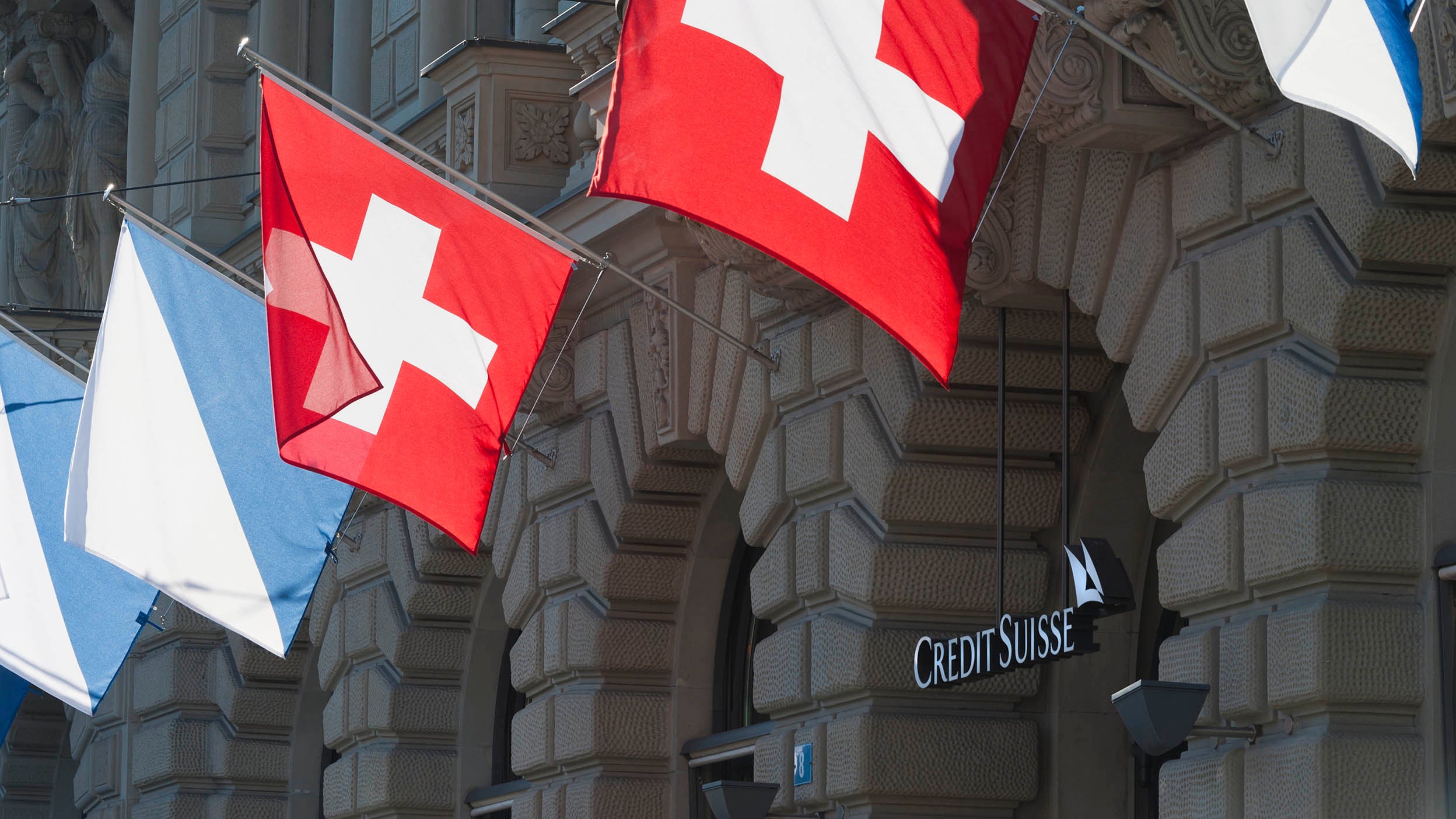

Unless a resolution is found, the large, systemically important bank’s difficulties have the potential to trigger concerns about the risk of another Global Financial Crisis.

We think that governments and central banks may have to step in to shore up confidence in the financials sector.

We expect volatility to remain high as investor sentiment remains fragile in the face of high interest rates.

Credit Suisse shares fell 30% intraday on March 15 to a record low dragging the whole European financials sector lower.1 It has been involved in a series of scandals over recent decades, the latest of which were risky exposures to Archegos Capital Management and Greensill Capital.2

However, what triggered the latest incident was a comment by the Saudi National Bank, their biggest shareholder, that they will not raise their investment in Credit Suisse citing regulatory limits.3 (They want to avoid the regulatory burdens that come when a shareholding reaches 10%.) This followed the delayed release of the bank’s annual report on March 14, which showed an increase in customer outflows to 110 billion Swiss francs (CHF). PricewaterhouseCoopers, their auditor, has also included an “adverse opinion” on the effectiveness of the bank's internal controls over its reporting. In the current environment of heightened sensitivity to loss of deposits after the collapse of Silicon Valley Bank (SVB), it drove a significant negative response from investors.

Credit Suisse is a systemically important financial institution globally with CHF 531 billion of total assets — approximately twice the size of SVB in terms of total assets — and CHF 1,294 billion of assets under management as of the end of 2022.4

We think the size of Credit Suisse’s assets indicates larger counterparty exposures — an uncomfortably close equivalent to Lehman Brothers, which had about $600 billion USD of total assets in 2008. The incident raises echoes of the 2008-2009 Global Financial Crisis and has triggered a flight to safety within equity markets and across all asset classes.

Falling equity markets were accompanied by lower sovereign yields and higher gold prices, while volatility indicators spiked. Rate futures indicated lower probability of rate increases for the next meetings of the U.S. Federal Reserve (Fed) and the Bank of England. Expectations for the most likely outcome of tomorrow’s European Central Bank meeting moved to a 25 basis points hike from 50 points previously.5

We still think the financials sector will find it hard to outperform in the face of increasing macro headwinds, regardless of a resolution of the Credit Suisse incident. Deposit rates will have to increase to stem outflows and that should put pressure on margins.

Although the events of the past week seem isolated and specific to certain business models, we think the more widespread issue of a higher interest rate environment revealing further weaknesses remains. There have been only eight bank failures in the last five years (out of 563 total since 2000), partly due to interest rates staying historically low since the Global Financial Crisis.6

In our view, however, there’s a high probability of regulators and central banks acting in concert to backstop the financial system, which should prevent a repeat of the Global Financial Crisis. For example, the Swiss National Bank indicated late on March 15 that, if necessary, it will provide liquidity to Credit Suisse. Nevertheless, we expect investor sentiment to remain fragile in the short term, and events like this can nip a nascent market recovery in the bud. More broadly, we expect the financials sector and risk assets to stay weak until there’s a strong commitment from governments and central banks to prevent these issues from spiralling further.

We anticipate volatility in the near term, helped by uncertainty around Fed policy, and fears of whether banking issues are more systemic. Our macro framework shifted to contraction at the end of February as market sentiment deteriorated. In the near term, we favour a more defensive posture in portfolios — fixed income over stocks, higher quality credit over risk credit, as well as defensive sectors and factors. We would anticipate, however, an improving global risk appetite once the Fed hits the pause button.

The risk is that the banking sector issues are more widespread than just Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse. We’ll be following the banking sector closely to see how it’s faring in the face of significant headwinds, especially credit default swaps, for potential contagion to other large financial institutions.

Another risk is if inflation moderation isn’t satisfactory for the Fed to hit the “pause button” soon, and that rate hikes continue for some time. A prolonged or renewed tightening cycle could increase pressure on the banking sector, increasing recession risks, and delaying the time before a sustainable economic recovery could start.

With contributions from Paul Jackson

Source: Refinitiv, as of March 2023.

Source: Makortoff, K. and Pegg, D., Crooks, kleptocrats and crises: a timeline of Credit Suisse scandals, The Guardian, February 21, 2002.

Source: Refinitiv

Source: Credit Suisse Annual Report

Source: Refinitiv as of March 15, 2023

Source: Federal Deposit Insurance Corporation

We assess what President Trump’s “Liberation Day” tariffs might mean for US and global markets, equities, and more.

With policy uncertainty rattling markets and consumer sentiment, it’s important to remember the market's long-term growth throughout its history.

While the setup for markets was good coming into 2025, they’ve struggled as investors assess ongoing changes to the US policy approach.

NA2794794

Important information:

Image credit: EThamPhoto / Getty

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

Past performance does not guarantee future results.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Investments focused in a particular sector, such as financials, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

CHF is the abbreviation for the Swiss franc, which is the official currency of Switzerland.

A basis point is one hundredth of a percentage point.

A credit default swap (CDS) is a financial derivative that allows an investor to swap or offset their credit risk with that of another investor.

USD is the abbreviation for the U.S. Dollar.

Rate futures is a financial derivative that allows exposure to changes in interest rates.

Sovereign yield is the interest rate paid to the buyer of the bond by the government, or sovereign entity, issuing the debt.

Contagion is the likelihood that significant economic changes in one country will spread to other countries.

Inflation is the rate at which the general price level for goods and services is increasing.

Quantitative tightening (QT) is a monetary policy used by central banks to normalize balance sheets.

The opinions referenced above are those of the author(s) as of March 15, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.